Back to Journals » Psychology Research and Behavior Management » Volume 16

Self-Other(s) Risk Decision Differences in Different Domains in the Chinese Context: A Social Value Theory Perspective

Authors Wang D, Han D, Sun L, Zhou M, Hao L, Hu Y

Received 3 June 2023

Accepted for publication 7 October 2023

Published 12 October 2023 Volume 2023:16 Pages 4117—4132

DOI https://doi.org/10.2147/PRBM.S421482

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 4

Editor who approved publication: Professor Mei-Chun Cheung

Dawei Wang,* Dong Han,* Lingchao Sun,* Mengmeng Zhou, Leilei Hao, Yixin Hu

School of Psychology, Shandong Normal University, Jinan, Shandong, People’s Republic of China

*These authors contributed equally to this work

Correspondence: Yixin Hu, School of Psychology, Shandong Normal University, Jinan, Shandong, People’s Republic of China, Email [email protected]

Purpose: The core question explored in this study was whether social value theory, which can explain the domain specificity of self-other differences, still was applicable when choice recipients change.

Methods: A pre-experiment and three formal experiments were conducted to explore the differences in self-other risk decision-making in different domains and different recipients from the perspective of social value theory. Experiment 1 involved 152 participants who were asked to make decisions for themselves and a single other in three risk domains. In Experiment 2, 178 participants were recruited, with money loss domain added and the “others” divided into “intimate others” to explore the effect of social distance on self-others risk decision-making in four domains. In Experiment 3, 233 participants were involved, and the number of “others” was expanded to explore the differences between “individual decision-making” and “group decision-making”.

Results: In the relationship domain, individuals were more risk-averse when making decisions for themselves, while in the money gain domain and personal safety domain, individuals’ risk-taking tendencies when making decisions for themselves were significantly higher than that for new friends. In the money loss domain, no significant difference was found among the three decision-maker roles. When making decisions for a group (including the decision-maker), individuals exhibit a “compromise effect” in the non-monetary domain, where their risk appetite falls between making decisions for themselves and for the group.

Conclusion: The domain differences in self-other risk decision-making can be explained by the social value theory.

Keywords: self-other difference, risk decision-making, domain specificity, decision-maker role, social value theory

Introduction

In recent years, self-other decision-making has gained increasing attention in both research and practice, which has generated a diversity of research accounts and results.1–3 Some studies have found that making decisions for oneself is more risk-seeking than making decisions for others,1 while other studies have found that making decisions for others is more risk-seeking than making decisions for oneself.2,3 These conflicting results have prompted researchers to raise the question “Are people more risk-seeking or more risk-averse when they make decisions for others than when they do so for themselves?” To shed light on this question, several meta-analyses have been conducted in the literature on self-other decision-making. Although research has shown that whether people are more risk-seeking in making decisions for others than for themselves may vary across domains (such as financial, health and social), frames (gain or loss), recipients (such as friends, relatives or strangers) and other moderating factors,4,5 no empirical study has integrately investigated how these factors specifically affect self-other risk decisions.

In this study, a pre-experiment and three experiments are conducted to answer the following questions: How do people make decisions for themselves versus for others in different domains of self-other risk decision-making? Do self-other differences change in different domains when “others”, the recipients, are divided into “intimate others” and “stranger others”? Do self-other differences change in different domains when the number of “others” increases to two or more (ie, decision-making for a group)? Can these results be explained by a unifying theory?

Domain Differences in Self-Other Risk Decision-Making

Since the self-other differences in risk decision-making has been identified as a concern, a number of related studies in different domains, such as the money domain, the health domain, the investment domain, and the social interaction domain, have emerged.6–8 The self-other differences in risk decision-making have demonstrated domain specificity. Previous studies in the health domain have found that doctors (at least in their role as doctors) make more conservative decisions for their patients than for themselves.6 In the personal safety domain, regardless of decision-maker roles (such as those of driver, friend, or parent), they have been found to show the same difference in self-other risk decision-making; that is, they are more risk-averse for others than for themselves.7 In the relationship domain, however, researchers have found an opposite phenomenon, with people generally taking more risks when making decisions for others than for themselves.8 However, this effect only appears in low-impact relationship decisions instead of high-impact relationship decisions with serious potential consequences.9

Although many studies regarding self-other decision differences in the monetary domain have been conducted, their results are mixed. Researchers have found that self-other differences in the money domain are moderated by a gain or loss frame.4 Specifically, in the loss frame, people are more risk averse when they make decisions for others than for themselves,10,11 whereas with regard to the gain frame, previous studies have shown inconsistent results. Some researchers have found that people are more risk-seeking when making decisions for others than for themselves.12 However, other studies have not found a significant difference.11

In summary, whether making decisions for others is more risk-taking than for oneself varies by domain. When making decisions for others, individuals are more conservative than when making decisions for themselves in the health domain, the personal safety domain and the money loss domain. In the relationship domain, when making decisions for others, individuals may be more risk-taking than when making decisions for themselves; however, the self-other difference in the money gain domain is controversial. What are the mechanisms that produce domain differences in self-other risk decision?

Theoretical Explanations of Domain Differences in the Self-Other Risk Decision

Since the 21st century, empirical studies on self-other decision-making have flourished, and related theories explaining the self-other difference in risky decision-making have gradually developed. The existing theories can be divided into three perspectives: cognitive, emotion and socio-situational theories.5

Cognitive theories hold that people have different cognitive processes between making decisions for themselves and for others.13,14 Construal-level theory is one of the most representative theories. According to this theory, when making decisions for others, individuals tend to use high-level construal and pay more attention to the desirability of the results due to psychological distance, so they are more likely to prefer low-probability and high-risk options. When making decisions for oneself, the opposite is true.15,16 Cognitive theories focus on choice information and can cognitively explain the self-other difference in the risk decision in the money domain across gain and loss frames,17,18 but cannot explain the self-other difference in risk preference between different domains.

Emotion theory attributes people’s behaviour in making risky decisions to emotional responses, and the risk-as-feelings hypothesis is one of the representative theories.19 It argues that people are more emotionally numb to factors that affect risk when deciding for others. Therefore, decisions made for others in the gain frame show less risk aversion, while decisions made under the loss frame show less risk-seeking.10 However, several studies in the health and safety domain have found results that contradict the risk-as-feelings hypothesis, with individuals expressing higher perceptions of emotional risk (such as worry or anxiety) and experiential risk for those with whom they are close.20,21 Thus, the risk-as-feelings hypothesis may not be able to explain the self-other difference in the safety domain, and its applicable domains are limited.

Socio-situational theory is represented by social value theory, which was proposed by Stone and Allgaier.9 According to this theory, individuals make decisions for others mainly in accordance with the social value of perceived risks (the social norms recognized by the vast majority of people), while when making decisions for themselves, they are more influenced by factors other than social value. The study found that in low-impact interpersonal tasks, individuals chose more risk choices, which were perceived as valuable, when making decisions for those other than themselves. In high-impact interpersonal tasks and money tasks, there was no significant difference between making decisions for oneself and for others due to risk-seeking having no social value.9 Thus, when social value theory was first proposed, it was used only to show that people take more risks for others than for themselves in decision-making situations where risk-seeking is considered to have social value. Subsequently, Stone et al22 extend the scope of social value theory by examining the reversal of the direction of self-other differences when risk aversion is valued (eg, personal safety domain). The above research indicates that the self-other difference in a domain is closely related to its social value. Therefore, the domain differences in self-other risk decisions can be explained by the social value of the available options in those domains.

In summary, among all the theories to explain self-other differences, cognitive theories and emotion theories have a very limited ability to explain the domain differences of self-other decision-making, while social value theory not only explains self-other differences in the money domain but can also explain self-other differences in the broader decision-making domain, which contains social risk. Therefore, social value theory has a wide range of applications and comparative advantages in explaining the domain difference in self-other risk decisions. However, only a few domains have been addressed in the previous empirical studies, and no research has integrated the domains. To address these gaps, the current study capitalizes on social value theory to integrate and compare self-other differences in multiple domains of risk decision-making and to systematically explain the universality of the application of social value theory in self-other risk decision-making.

The “Others” in the Study of Self-Other Risk Decision-Making

Based on the studies mentioned above, in addition to the decision-making domains, the identity of the choice receiver, that is, the type of “other”, is also one of the key factors influencing the difference between self-other risk decision-making.5 “Others” can be divided into different types by two factors: nature and number.

From the perspective of the nature of “others”, there are many ways to divide people, such as general others and specific others, familiar others and unfamiliar others, as well as similar others and dissimilar others.8 The related research has indicated that people have different risk preferences when making decisions for different types of others.23 Generally, making decisions for others (such as friends or family members) with closer social distance to the decision maker is more similar to making decisions for oneself. For example, Beisswanger et al8 found that making decisions for strangers is more risk-taking than making decisions for oneself in interpersonal tasks, but the differences disappear when making decisions for intimate others. In the money gain domain, it has been found to be more risk-taking for individuals to make decisions for strangers than for themselves, but the above differences have not been found for decision-making for friends.2

In addition to the nature of “others”, the number of “others” is also an important factor.24,25 In the money domain, it has been proven that making decisions for multiple others is more risk-averse than making decisions for oneself.24 However, other studies have shown that there is no significant difference between joint decision-making (decision results shared by oneself and others) and decision-making for oneself.25 That is, decision-making for others involving the decision-maker’s own interests is different from decision-making for others with purely no interest alignment. However, there has been no research on the difference between decision-making for self-others in different situations, and no relevant theoretical explanation has been put forward.4 From the perspective of social value theory, the questions of whether decision-making for multiple others pays more attention to social value and whether the social value standard of decision-making for others is the same require further study.

Pre-Experiment

The goal of this experiment is to evaluate the social value of three domains. To determine the extent to which choice is valued, the pre-experiment employed the paradigm for investigating social value in risk decision-making from the present literature.8,9

Method

Participants

A power analysis using G*Power 3.126 suggested that 34 participants would provide a power of 0.80 to detect a two-way t-test with an effect size of 0.5. 92 (26 males and 66 females, Mage = 23.39, SDage = 2.95) university students participated in the pre-experiment. The participants in this study were students who were randomly selected from Shandong Normal University in Jinan, Shandong Province. They completed the experiment on a questionnaire website.

Materials

Three domains were selected from the existing literature (ie, the monetary domain, the personal safety domain and the relationship domain, See Appendix 1), and 4 scenarios were modified for every domain.8,22 To reduce the influence of the order effect, the order of scenarios was adjusted to ensure that two scenarios in any domain were not adjacent. The participants were required to evaluate the extent of Xiaoming and Xiaohua’s behaviour in each situation in line with the social public support on a 6-point Likert scale in which one means complete support and six means complete unsupport. Then, the participants were asked to choose which of Xiaoming and Xiaohua’s behaviours was riskier. For example, the scenario for relationship decision-making was as follows:

In a club activity, Xiaoming and Xiaohua (gender of Xiaoming and Xiaohua is same as the participant) see a very attractive person of the opposite sex. They want to take the initiative to talk to that person and obtain their contact information. After much consideration, Xiaoming decides to take the initiative to chat up the person, while Xiaohua decides not to. Please assess the social support for their behaviour according to your understanding.

- To what extent do you think there is social support for Xiaoming’s behaviour?

- To what extent do you think there is social support for Xiaohua’s behaviour?

- Whose behaviour do you think is more risky in the above scenario?

Result

Taking the extent of social support as the dependent variable, we conducted an independent sample t-test and found that there were no significant gender difference in the relationship domain, t (90)= 0.542, p = 0.589, personal safety domain, t (90)= −0.896, p = 0.373, and monetary domain, t (90)= −0.661, p = 0.511.

First, referring to the research of Stone et al,22 the social support extent of 12 scenarios in three decision-making domains was analysed. Taking the extent of social support as the dependent variable, a paired-samples t-test was carried out for the tasks of three domains. Specifically, in the relationship domain, the score of support for risk-taking (M = 4.57) was significantly higher than that of support for risk-avoiding (M = 3.72), t (91) = 6.26, p < 0.001, Cohen’s d = 0.65. In the personal safety domain, we found the opposite result. The score in support of the risk-avoiding option (M = 4.78) was significantly higher than that for the risk-taking option (M = 2.88), t (91) = –13.69, p < 0.001, Cohen’s d = 1.42. In the monetary domain, the score of support for risk-avoiding (M = 4.57) was significantly higher than that for risk-taking options (M = 3.89), t (91) = –5.96, p < 0.001, Cohen’s d = 0.62.

Second, the risk of the option was evaluated with reference to the study of Beisswanger et al.8 In the 12 decision-making situations, Xiaohua’s behaviour is considered to be more conservative, while Xiaoming’s behaviour is considered to be riskier. To exclude the subjective judgement of situation material producers with regard to risk, the participants were asked to choose one option that they thought was more risky from two given options in each decision-making situation. If the proportion of people who choose an option as a risk option was significantly different from that of 50% (p < 0.01), it was considered that the option was indeed risky.8 The analysis shows that all 12 situations met the above criteria.

Experiment 1

To explore how people make decisions for themselves versus for a single other person in different domains of risk decision-making, the difference between making decisions for self and for a same-sex friend was compared in three domains (ie, the monetary domain, the personal safety domain, and the relationship domain) in Experiment 1. According to social value theory, we predict that participants will choose more socially valued options in any domain when they make decisions for others.

Method

Participants

Conducted by G*Power 3.1,26 power analysis based on a two-way within-between interaction with a power of 0.90 and an effect size of 0.25 indicated a sample of 52 participants. In this experiment, to avoid potential missing data collected by questionnaire and ensure the experimental effect, a total of 160 participants were included and 152 valid participants (77 males and 75 females, Mage = 18.35, SDage = 1.68) were analysed in the experiment. The participants in this study were students who were randomly selected from Shandong Jianzhu University in Jinan, Shandong Province. All participants took part in a similar experiment for the first time.

In this study, all procedures involving human participants met with the ethical standards of Academic Board of Shandong Normal University, as well as the 1964 Declaration of Helsinki and subsequent amendments. Before proceeding, participants signed the informed consent and were informed that they could withdraw participation at any time. In addition, participants were told that their participation was voluntary and anonymous.

Experiment Design

In experiment 1, a mixed design of 2 (Gender: male, female) × 2 (Decision-maker Role: decision-making for “me”, decision-making for a same-sex friend) × 3 (Domain: monetary, relationship, personal safety) was used. Gender and decision-maker role were between-subject variables, and decision-making domain was within-subject variable. The dependent variable is the risk score of the subjects in the risk preference situation. In each scenario, participants were given 0 points for choosing the conservative option and 1 point for choosing the risky option. The lower the score, the more risk-averse participants were.

Materials

The scenario materials included 12 pre-experiment scenarios and were separated into 4 versions: a) deciding for self by women, b) deciding for self by men, c) deciding for others by women, d) deciding for others by men. This experiment adjusted the order of scenarios in each version. First, it was ensured that the two scenarios in the same domain were not adjacent. Each of the three scenarios in different situations was a group, and 12 scenarios were divided into four groups. Second, in each version, half of the scenario had the conservative option in front of the risk option, and the other half had the opposite.

The Inclusion of Other in Self Scale (IOS) was used to test the intimate relationship between self and a same-sex friend.27 There were 7 pairs of circles with different degrees of coincidence on the IOS scale, and the degree of coincidence increased from 1 to 7. The larger the overlapping area was, the closer the relationship was (see Figure 1). In the version deciding for others, the participants were asked to first imagine a same-sex friend, write down that person’s name and age, and then select the intimacy with him or her on the IOS scale.

|

Figure 1 The IOS scale. |

Procedure

The experiment was conducted in a quiet classroom. First, the participants read through the instructions. When the participants had no further questions, the experimenter randomly distributed the questionnaire. Half of the participants completed the task of making decisions for themselves, and the other half completed the task of making decisions for others. The participants had enough time to complete the questionnaire. After they completed their questionnaires, the experimenter collected these questionnaires. Finally, thank the participants for participating in the experiment and giving them gifts (like a pen, a book).

Results and Discussion

Descriptive statistical results are shown in Table 1.

|

Table 1 Self-Other Risk Preference Scores in Various Domains in Experiment 1 |

First, in analysing the scores of the IOS scale, we found that the average intimacy of the subjects with single same-sex friends was 3.18 ± 2.34, which shows that the intimacy of the subjects and the same-sex friends was moderate.

The results of a 2 × 2 × 3 repeated measurement analysis showed that the main effect of gender was significant, F(1, 148) = 5.84, p = 0.017, ηp2 = 0.04. Males were more risk-seeking (M = 1.40) than females (M = 1.17). The main effect of the decision-maker role was not significant, F(1, 148) = 0.05, p = 0.820. The main effect of the decision domain was significant, F(2, 296) = 18.01, p < 0.001, ηp2 = 0.11. The participants had the highest risk-taking tendency in the relationship domain (M = 1.63), the middle in the monetary domain (M = 1.24), and the lowest in the personal safety domain (M = 0.97).

The interaction between the decision-maker role and the decision domain was significant, F(2, 296) = 38.53, p < 0.001, ηp2 = 0.21. The simple effect analysis showed that in the relationship domain, the participants were more risk-averse when deciding for self (M = 1.08) and more risk-seeking when deciding for the same-sex friend (M = 2.18), p < 0.001. In the monetary domain, the participants were more risk-seeking when deciding for self (M = 1.51) and more risk-averse when deciding for the same-sex friend (M = 0.98), p < 0.01. In the personal safety domain, the participants were more risk-seeking when deciding for self (M = 1.29) and more risk aversion when deciding for the same-sex friend (M = 0.65), p < 0.001. The other two-factor interactions and the three-factor interaction were not significant.

This experiment indicated that individuals show different risk preferences between different domains, proves that there are domain differences in self-other decision-making. In the personal safety and money-gain domains, when making decisions for others, individuals are more risk-averse than when making decisions for self. In regard to the relationship domain, when making decisions for others, individuals are more risk-seeking than when making decisions for self. This is consistent with the results of the social value theory evaluation in the preliminary experiment. In the personal safety and money-gain domains, the risk aversion option has higher social value, while in the relationship domain, the risk-seeking option has higher social value. This experiment shows that people make decisions for others based on social values.

Experiment 2

The results of Experiment 1 were interesting: Although there was no significant main effect of the decision-maker role, when it was specific to the three different domains, there were differences in the decision-maker roles. If the decision-maker role with regard to “others” is subdivided into intimate friends and new friends according to the degree of intimacy, will there be a main effect of the decision-maker role? Does adding the money loss domain affect the main effect of the domain? How does the decision maker role interact with the decision domain? To explore how the nature of the choice recipient and the decision-making domain influence an individual’s risk decisions, the differences in how decision makers make decisions in different domains for themselves, for a close friend, and for a new friend were compared in Experiment 2.

Method

Participants

Conducted by G*Power 3.1,26 power analysis based on a two-way within-between interaction with a power of 0.90 and an effect size of 0.25 indicated a sample of 54 participants. In this experiment, to avoid potential missing data collected by questionnaire and ensure the experimental effect, a total of 186 participants were included and 175 valid participants (80 males and 95 females, Mage = 18.55, SDage = 0.99) were analysed in the experiment. The participants in this study were students who were randomly selected from Shandong Jianzhu University in Jinan, Shandong Province. All the participants took part in a similar experiment for the first time.

Experiment Design

In experiment 2, a mixed design of 2 (Gender: male, female) × 3 (Decision-maker Role: decision-making for “me”, decision-making for a close friend, decision-making for a new friend) × 4 (Domain: money gain, money loss, relationship, personal safety) was used. Gender and decision-maker role were between-subject variables, and decision-making domain was within-subject variable. The dependent variable is the risk score of the subjects in the risk preference situation. In each scenario, participants were given 0 points for choosing the conservative option and 1 point for choosing the risky option. The lower the score, the more risk-averse participants were.

Materials

First, according to the research paradigm of the pre-experiment, the social value of four new situations in the money loss domain was analysed. The results showed that in the situation of money loss, there was no significant difference between the score of support for the risky option and that of the conservative option, t (49) = –0.15, p > 0.05. Second, to exclude the subjective judgement of the situation material compilers on the risk, the participants were asked to choose one option that they thought was more risky from two given options of the four scenarios. The results were analysed using a two-tailed binomial test. If there was a significant difference between the proportion of people who regarded an option as a risk option and 50% (p < 0.01), then it was considered that the option was indeed risky.8 The analysis shows that the four scenarios meet the above criteria.

These four money loss scenarios and the 12 scenarios in Experiment 1 were recombined to form the risk preference situation of this experiment. The male version and female version were distributed separately. Each version of the situation was divided into decision-making for a self version, decision-making for a close friend version and decision-making for a new friend version. This study adjusted the order of situations in each version. First, every four situations formed a group, and it was ensured that two situations in the same domain were not adjacent. In addition, the risk options and conservative options in each version were arranged in the order of ABBA.

Procedure

Same as Experiment 1, excluded the manipulation of decision making role. In this experiment, the decision-maker roles were manipulated through the IOS scale combined with guidance.27 Participants should make decision for a close friend whose relationship corresponded to a degree of 7 intimacy and a person whose relationship corresponded to a degree of 1 intimacy on the IOS scale.

Results and Discussion

Descriptive statistical results are shown in Table 2.

|

Table 2 Self-Other Risk Preference Scores in Various Domains in Experiment 2 |

The results of a 2×3 × 4 repeated measurement analysis showed that the main effect of the decision-maker role was significant, F(2, 169) = 7.42, p = 0.001, ηp2 = 0.08. When making decisions for close friends (M = 1.87), the participants’ risk-taking tendency was significantly higher than that for themselves (M = 1.48) and new friends (M = 1.60), while there was no significant difference between the latter two. The main effect of the decision domain was significant, F(3, 507) = 93.15, p < 0.001, ηp2 = 0.36. The participants had the highest risk-taking tendency in the money loss domain (M = 2.35), which was not significantly different from that in the relationship domain (M = 2.15), but both were significantly higher than those in the money gain domain (M = 1.25) and personal safety domain (M = 0.85). The main effect of gender was significant, F(1, 169) = 13.80, p < 0.001, ηp2 = 0.08. Compared with females (M = 1.49), males were more likely to take risks (M = 1.81).

The interaction between the decision-maker role and the decision domain was significant, F(6, 507) = 29.68, p < 0.001, ηp2 = 0.26, as was the interaction between gender and the decision-making domain, F(3, 507) = 8.94, p < 0.001, ηp2 = 0.05.

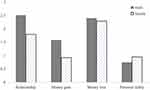

Further simple effect analysis of the interaction between the decision-maker role and the decision-making domain showed the following: In the relationship domain, individuals were more risk-averse (M = 0.80) when making decisions for themselves, while they were more risk-seeking for close friends (M = 2.98) and new friends (M = 2.66), but there was no significant difference between them. In the money gain domain, individuals’ risk-taking tendency (M = 1.50) when making decisions for themselves was significantly higher than that for new friends (M = 1.00), but there was no significant difference between the former two and that for close friends (M = 1.25). In the money loss domain, no significant difference was found among the three decision-maker roles (p > 0.05). In the personal safety domain, when making decisions for themselves, the participants’ risk-taking tendency (M = 1.14) was significantly higher than that of close friends (M = 0.78) and new friends (M = 0.63), but there was no significant difference between the latter two (see Figure 2).

|

Figure 2 The interaction effect between decision-maker roles and decision-making domains. |

Further simple effect analysis of the interaction between gender and the decision-making domain showed the following: In the relationship domain, males (M = 2.51) were more risk-seeking than females (M = 1.79); in the money gain domain, males (M = 1.58) were also more risk-seeking than females (M = 0.92), and the difference was significant, while in the fields of money loss and personal safety, there was no significant difference between males and females (see Figure 3).

|

Figure 3 The interaction effect between gender and decision-making domains. |

Experiment 2, in which “other” was divided into “intimate friend” and “new friend (stranger)” according to social distance, found that individuals making decisions for an intimate friend are more risk-seeking than for themselves and for a new friend. Further analysis of the interactions between decision-maker roles and the domains showed that self-other differences were found in the relationship domain, money gain domain and personal safety domain, which was consistent with the results of Experiment 1. However, in four domains, no differences in risk appetite were found for decisions made for a close friend and a new friend. According to the social value evaluation in the pre-experiment, we found that when the social value of the two options in a risk situation is quite different, there is no difference when individuals make decisions for others with different social distances.

Experiment 3

To explore how the number of the choice recipient and the decision-making domain influence individuals’ risk decisions, the number of “others” was expanded in Experiment 3. Experiment 3a aimed to evaluate the social value of the situation of deciding for individuals and for groups, and it examined the extent to which the public supports individuals and groups in risk-avoiding or risk-seeking behaviours. Experiment 3b compared how participants make decisions for themselves, for a same-sex friend, for a group (not including the decision-maker) and for a group (including the decision-maker) in different domains.

Experiment 3a

Method

Participants

Conducted by G*Power 3.1,26 power analysis based on a two-way within-between interaction with a power of 0.90 and an effect size of 0.25 indicated a sample of 54 participants. A total of 199 (52 males and 147 females, Mage = 18.48, SDage = 1.21) university students participated in Experiment 3a. A total of 104 subjects were assigned to the individual behaviour assessment group (Mage = 18.66, SDage = 1.43, 26 males and 78 female), and 95 subjects were assigned to the group behaviour assessment group (Mage = 18.27, SDage = 0.87, 26 male and 69 female). The participants in this study were students who were randomly selected from Shandong Normal University in Jinan, Shandong Province.

Materials

Four domains (ie, the money gain domain, the money loss domain, the personal safety domain and the relationship domain; See Appendix 1) were selected from the existing literature on the basis of the materials of the pre-experiment, and there were 4 scenarios for every domain. In addition, the individuals (Xiaoming and Xiaohua) in the situation were adapted into a group (Dormitory A and Dormitory B, each of which housed 4 to 6 people), which constituted new material for the social value evaluation of group decision-making. To reduce the influence of the order effect, the order of the scenarios was adjusted to ensure that two scenarios in any domain were not adjacent. The participants were required to evaluate the extent of Xiaoming and Xiaohua’s (Dormitory A and Dormitory B’s) behaviour in each situation in line with the social public support on a 6 point Likert scale, in which one means complete support and six means complete unsupport. Then, the participants were asked to choose which of Xiaoming and Xiaohua’s (Dormitory A and Dormitory B’s) behaviours was more risky.

Results and Discussion

Taking the extent of social support as the dependent variable, a paired-samples t-test was carried out for the tasks of four domains. The results of the individual social value evaluation were the same as the pre-experiment’s results. Specifically, in the relationship domain, the risk-taking score (M = 4.18) was significantly higher than the conservative score (M = 3.71), t (71) = 3.89, p < 0.001, Cohen’s d = 0.46. In the personal safety domain, the score of support for the conservative option (M = 4.91) was significantly higher than that for the risky option (M = 2.62), t (71) = –22.75, p < 0.001, Cohen’s d = 2.68. In the money gain domain, the score of support for conservative options (M = 4.31) was significantly higher than that for risk-taking options (M = 4.07), t (71) = –3.94, p < 0.001, Cohen’s d = 0.48. However, in the money loss domain, there was no significant difference in the support score between the conservative option and the risky option, t (71) = –1.21, p = 0.23.

The trend of social value assessment of group decision-making was consistent with that of individual decision-making. In the relationship domain, the risk-taking score (M = 4.41) was significantly higher than the conservative score (M = 3.98), t (79) = 3.84, p < 0.001, Cohen’s d = 0.43. In the personal safety domain, the score of support for the conservative option (M = 5.15) was significantly higher than that for the risky option (M = 2.49), t (79) = –24.77, p < 0.001, Cohen’s d = 2.75. In the money gain domain, the score of support for conservative options (M = 4.60) was also significantly higher than that for risk-taking options (M = 4.13), t (79) = –5.66, p < 0.001, Cohen’s d = 0.64. In the money loss domain, there was no significant difference in the support score between the conservative option and the risky option, t (79) = –1.41, p = 0.16.

Taking the relative support score (ie, the difference between the support rating score of the risk-taking option and that of the risk-averse option) as the dependent variable, a 4 × 2×2 repeated measurement analysis was carried out. The results showed that the main effect of domain was significant, F(3, 585) = 161.01, p < 0.001, ηp2 = 0.45. The relative support score was the highest in the relationship domain (M = 0.45), followed by the money gain domain (M = –0.35) and the money loss domain (M = –0.10), and it was the lowest in the personal safety domain (M = –1.71). The main effect of evaluation object was significant, F(1, 195) = 5.22, p = 0.023, ηp2 = 0.03. The relative support score of individuals (M = –0.34) was higher than that of groups (M = –0.52). The main effect of gender was significant, F(1, 195) = 8.54, p = 0.004, ηp2 = 0.04. The relative support score of males (M = –0.31) was significantly higher than that of females (M = –0.55). There was a significant interaction between domain and gender, F(3, 585) = 10.69, p < 0.001, ηp2 = 0.05. In the personal safety domain, the relative support score of males (M = –1.24) was higher than that of females (M = –2.19). The rest of the interactions were not significant.

In Experiment 3a, the social value of making decisions for a single person or for multiple persons (ie, a group) was evaluated. The results showed that risk aversion had more social value when making decisions for a group (compared with for a single person). In addition, this experiment showed that there were gender differences in social value in different domains, and the risk-seeking option of males had more social value than that of females, which was consistent with the results in Experiments 1 and 2. According to the above results, we speculated that when individuals make decisions for single others and multiple others, there will be differences due to the different social value standards adopted. To verify this hypothesis, Experiment 3b was carried out.

Experiment 3b

Method

Participants

Conducted by G*Power 3.1,26 power analysis based on a two-way within-between interaction with a power of 0.90 and an effect size of 0.25 indicated a sample of 64 participants. In this experiment, to avoid potential missing data collected by questionnaire and ensure the experimental effect, a total of 250 participants were included and 233 valid participants (112 males and 121 females, Mage = 18.59, SDage = 0.83) were analysed in the experiment. The participants in this study were students who were randomly selected from Shandong Jianzhu University and Shandong Normal University in Jinan, Shandong Province. All the participants took part in a similar experiment for the first time.

Experiment Design

In experiment 3b, a mixed design of 2 (Gender: male, female) × 4 (Decision-maker Role: decision-making for “me”, decision-making for a same-sex friend, decision-making for a group (including decision-maker), decision-making for a group (not including decision-maker)) × 4 (Domain: money gain, money loss, relationship, personal safety) was used. Gender and decision-maker role were between-subject variables, and decision-making domain was within-subject variable. The dependent variable is the risk score of the subjects in the risk preference situation. In each scenario, participants were given 0 points for choosing the conservative option and 1 point for choosing the risky option. The lower the score, the more risk-averse participants were.

Materials

The scenario materials were composed of 16 scenarios in Experiment 3a and were separated into 8 versions: a) deciding for self by female, b) deciding for self by male, c) deciding for same-sex friend by female, d) deciding for same-sex friend by male, e) deciding for group (not including decision-maker) by male, f) deciding for group (not including decision-maker) by female, g) deciding for group (including decision-maker) by male, h) deciding for group (including decision-maker) by female. This experiment adjusted the order of the scenarios in each version. First, it was ensured that the two scenarios in any domain were not adjacent. Each of the four scenarios in the different situations was a group, and 16 scenarios were divided into four groups. Second, as in Experiment 1 and 2, the order of risk and the conservative options in each version of Experiment 3b were balanced.

Procedure

Same as Experiment 1, excluded the manipulation of decision making role. In this experiment, participants should made decision for a same-sex friend and a group (including decision-maker/not including decision-maker) including five same-sex friends.

Results and Discussion

Descriptive statistical results are shown in Table 3.

|

Table 3 Self-Other Risk Preference Scores in Various Domains in Experiment 3b |

The results of a 2×4 × 4 repeated measurement analysis showed that the main effect of gender was significant, F(1, 224) = 7.62, p = 0.006, ηp2 = 0.03. Males were more risk-seeking (M = 1.84) than females (M = 1.66). The main effect of the decision-maker role was significant, F(3, 224) = 6.95, p < 0.001, ηp2 = 0.09. The participants were more risk-taking when making decisions for a group (including the decision-maker; M = 1.98) than for self (M = 1.66), for a same-sex friend (M = 1.78) and for a group (not including the decision-maker; M = 1.58). The participants were more risk-taking when making decisions for a same-sex friend than for a group (not including the decision-maker). The main effect of the decision domain was significant, F(3, 672) = 111.90, p < 0.001, ηp2 = 0.33. The results showed that the risk-taking tendency of the participants in the four domains from high to low was the money loss domain (M = 2.58), the relationship domain (M = 2.07), the money gain domain (M = 1.41) and the personal safety domain (M = 0.95). All four domain levels differed significantly from one another. However, there was no significant interaction among gender, decision-making domain and decision-maker role, F(9, 672) = 1.09, p = 0.372.

The interaction between the decision-maker role and the decision domain was significant, F(9, 672) = 14.14, p < 0.001, ηp2 = 0.16. Furthermore, the simple effect analysis showed the following: In the relationship domain, the participants were the most risk-averse when deciding for self (M = 1.10). When deciding for a same-sex friend (M = 2.73), the participants were more risk-seeking than when deciding for the other recipients except for the group (not including the decision-maker), ps < 0.001, while deciding for a group (not including the decision-maker) (M = 2.37) and for a group (including the decision-maker) (M = 2.07) had a non-significant difference, p > 0.05. In the money gain domain, the risk-taking score of decided for a group (including the decision-maker) (M = 2.00) was highest and significantly higher than the other three conditions, ps < 0.001. The risk-taking score of decided for self (M = 1.60) was higher than it was for decided for a same-sex friend (M = 1.14) and for a group (not including the decision-maker) (M = 0.90). In the money loss domain, there was no significant difference among the four decision-maker role conditions, p = 0.10. In the personal safety domain, the participants who decided for self (M = 1.46) were the most risk-seeking, p < 0.001. The risk-taking score of deciding for a group (not including the decision-maker) was the lowest (M = 0.64), which was significantly lower than decided for a group (including the decision-maker) (M = 0.97), but it had no significant difference from decided for a same-sex friend (M = 0.76).

The interaction between gender and decision-making domain was significant, F(3, 672) = 4.66, p = 0.003, ηp2 = 0.02. The simple effect analysis showed that in the relationship domain, males were more risk-seeking (M = 2.36) and females were more risk-averse (M = 1.77), p < 0.001. However, there was no significant difference in the domains of money gain, money loss and personal safety (ps > 0.05).

The interaction between gender and decision-maker role was significant, F(3, 224) = 3.92, p = 0.009, ηp2 = 0.05. The simple effect analysis showed that there was no significant effect when the participants decided for self (p = 0.121). When deciding for others, including all three conditions, the males were more risk-seeking than the females (ps < 0.01).

In Experiment 3b, the self-other difference was discussed from the perspective of the number of “others”, and the findings were as follows: First, the main effect of the decision-maker role was significant. When making decisions for a group (including the decision-maker), the risk tendency was significantly higher than the other three conditions, and when making decisions for a same-sex friend, the participants were found to be more risk-seeking than when they did so for a group. This is consistent with the results of Experiment 3a that the social value of risk appetite was higher in the situation of making decisions for a single other. Second, there was a significant interaction between the decision-maker role and the decision domain. In the money gain domain, there was more risk-seeking for a group (including the decision-maker), which was not consistent with the other two experiments; however, other areas of self-other differences were consistent with this finding. No difference was found between making decisions for a group and for a single other in the various domains, which is consistent with the results of Experiment 3a.

General Discussion

In the present study, multiple experiments were conducted to investigate the influence of self-other decision-making when the “others” were distinguished by the social distance and number according to measuring the options’ social value in risk decision-making.

The findings in the three experiments suggested that there were significant differences in the domain of decision-making. People were most risk-seeking in the money loss domain and relationship domain and most risk-averse in the personal safety domain; furthermore, they demonstrated intermediate risk preference in the money gain domain. According to the social value tendency analysis, risk taking is of greater social value in the relationship domain, and risk avoidance is of greater social value in the personal safety domain. Although risk aversion was found to be more socially valuable in the money gain domain, the rate of conservative and risk taking options were just between the above domains. It can be seen that people always consider the social value of risks when making risk decisions.

There were significant gender differences in risk decision-making, and overall, males were more likely to take risks than females. Males were also found to have higher social value scores for risky options in both the pre-experiment and Experiment 3a, which is consistent with the available studies.8,9 The gender difference in risk-taking tendency was mainly manifested in the relationship domain, which is consistent with the study of Stone and Allgaier,9 which found that gender differences were greater in the relationship domain than in the financial domain.

The results of experiment 1 revealed that there was no significant difference between decision for self and for the same-sex friend, which was consistent with the results of experiment 2 and experiment 3b, in which the difference between decision for self and for new friends/same-sex friend was not significant. The reason the significant main effects of decision-making role were found in experiment 2 and 3b was the introduction of intimacy and group involving themselves, respectively.

When making decisions for oneself and single others, the interaction between the decision-maker role and the domain is significant, and social value theory can help to explain it. In the relationship domain, making decisions for others is more risk-seeking than for oneself; and in the personal safety domain, making decisions for others is more risk-averse than for oneself.7 According to social value theory, the social value of risk is regarded as a basis for making decisions for others. That is, when risk-seeking options are considered to have social value, making decisions for others is perceived to be more risk-seeking than doing so for oneself; when risk-averse behaviours are considered to have social value, making decisions for others is perceived to be more risk-avoiding than doing so for oneself,9 which was confirmed in the current study. In the relationship domain, the risk-seeking option is of greater social value, so individuals are more likely to make risk decisions for others in such situations. In the personal safety domain, risk avoidance could be more socially valuable, so people make more risk avoidance decisions for others in the personal safety domain. Although the results in the money loss domain and money gain domain are inconsistent with the results of previous studies,10 they can be explained by social value theory. In the money loss domain, there is no difference between the social value of risk-taking and risk aversion, so there is no significant self-other difference in this domain. In the money gain domain, risk aversion is more socially valued, so making decisions for others is more risk averse than making decisions for oneself.

One interesting finding in this study was that when “others” are divided into intimate others and strangers according to their nature, the interaction between the decision-maker role and the domain is significant. When making decisions for intimate others, the overall risk preference is not between making decisions for oneself and making decisions for strangers, as assumed by construal-level theory, but there are differences in some domains and no differences in “others”. Through the comparison of social value, it is found that in the domain where the social value of the risk-seeking option and the risk-avoiding option is significantly different (whether the social value of the risk-seeking option is higher or lower), individuals’ risk preference for intimate others and for strangers are more similar, which is consistent with social value. However, when there is little or no significant difference in the social value of the two options, the risk preference of individuals making decisions for intimate others will be in the middle between making decisions for strangers and for oneself.

When the “others” extend to multiple others by numbers, there is no significant difference in risk preference between making decisions for a group and for oneself, which is consistent with Füllbrunn and Luhan.25 However, the interaction between the domain and the decision-maker role is significant. In the domain with a high social value of the risk-seeking option, making decisions for a group is more risk-seeking than making decisions for oneself. In the domain where the social value of the risk options is low, making decisions for a group is more risk-avoiding than making decisions for oneself. Overall, making decisions for multiple others (for a group) is more risk-avoiding than making decisions for a single other. Experiment 3a showed that the social value of multiperson behaviour tended to be more risk-avoiding in different domains than that of individual behaviour.

Needless to say, a hybrid phenomenon is also possible: when making decisions for a group (including the decision-maker), people show a “compromise effect” in the nonmoney domains, where their risk appetite is between making decisions for themselves and for a group not including the decision-maker, which were not supported by the social value theory. These choices may be a combination of personal preferences and social values. Füllbrunn and Luhan28 also found that when fund managers make decisions for themselves and multiple clients, they take into account their own preferences and client preferences. However, in general, they still favour their own preferences. In the money domain, there is no such effect. The risk preference to make decisions for a group (including the decision-maker) is higher than to do so for oneself and for single others. First, there has been controversy in the past about the risk appetite in multi-person decisions involving self-interest. Lonergan and McClintock29 found that gamblers who made in a group, in which the outcome was shared by all members of the group (including the decision-maker), bet over 30% more money than when they gambled alone. Füllbrunn and Luhan28 show that fund managers are more circumspect when making decisions for multiple people involving their own interest than when they do so only for themselves. This may be related to the identity of decision-makers, social distance and other factors. In the latter study, fund managers are more responsible for clients’ investment, while the decision-makers in the former study and this study are in the same position as other group members. Second, the difference between money domains and nonmoney domains may be related to the consequences of the situation. In the nonmoney domains, the risk to each choice recipient is independent, and outcomes may differ for each person. In money domains, everyone shares the same outcome involving the risk, reducing their perception of risk. Therefore, when people make decisions for multiple people involving their own interests, they will take into account their own preferences and social values, but it will change under some conditions (for example, the choice situation changes the risk perception), which needs further research.

Theoretical Implications

In summary, this study verified and expanded the utility and boundary conditions of social value theory, which could basically explain the difference of risk decision-making between self and others in different domains, including monetary, relationship and personal safety. In high impact domains (eg, personal safety domain), risk aversion was valuable, in which making decisions for others was more risk averse than making decisions for self; while in low impact domains (eg, relationship domain), the result was the opposite. Meanwhile, these results were moderated by the characteristics of “others”, such as number and intimacy. When considering the effects of number and intimacy of others, social value theory can be used to explain the self-other differences in risk decision making, however, the introduction of decision for group involving decision maker made the results of self-other differences in risk decision making inconsistent with the social value theory, which revealed that there should be boundary conditions in the application of social value theory. Therefore, when drawing on social value theory to explain the self-other differences, especially the group involving decision maker, researchers should be modest. To sum up, by changing the nature of “others” and the number of “others”, current study explored the influence of choice recipient’s identity on the domain specificity of self-others risk decision making, which enriches work on the domain specificity of self-others risk decision making, and validates and expands the utility and boundary conditions of social value theory.

Practical Implications

The results showed that in the decision-making domain where risky option had higher social value, individuals were more risk-seeking when making decisions for others, indicating that individuals made decisions for others based on whether risk-seeking was socially valuable. It suggests that in our daily lives, when we make decisions or make suggestions for others, we need to consider whether risk-seeking is more socially valuable and more in line with social norms, rather than just considering the decision-making problem itself. When general others are divided into intimate others and strangers, individuals’ decision-making will not only be affected by the difference in social value of risk options in different decision-making domains, but also by psychological distance. In daily life, when making decisions for others with different psychological distances (such as parents, lovers, and general classmates), on the one hand, it is necessary to consider whether taking risks has higher social value. On the other hand, we should consider the closeness of others to help individuals make rational decisions. When the number of others changes from single to multiple others, the inclusion of decision makers in the group is an important factor affecting individuals’ self-others risk decision-making. In daily life, when leader making decisions for the team, in addition to considering the social value of risk seeking, the leader also needs to consider the interests of the team and his/her own needs, and needs to integrate various information to make decisions.

Limitations and Future Research

Our study testified to the universality of social value theory in explaining domain specificity in self-other risk decision-making. However, it also had several weaknesses. The first was the situation setting. In the non-monetary domain, the expected value of two options were difficult to measure, which made it hard to determine whether the difference in social value evaluation and risk decision-making in various domains was due to the situation itself, or the difference in expected value between two options. Future research should generate effective paradigms to qualify the expected value of the options in non-monetary domain.

The second limitation was that the sample of college students under the background of Chinese culture was relatively simple. Social values are closely related to social culture. It is generally believed that China is a collectivist culture,30 and people are more concerned about others’ opinions when making decisions. However, in Western countries, where individualism is advocated, people pay more attention to their feelings when making decisions. Future research can consider the influence of cultural factors and systematically explore the differences between self-other decision-making in collectivist and individualistic cultures.

The third limitation was that in these scenarios, no actual decisions were made or gains/losses accrued in this study, this may be one of the factor impact on individuals’ decision-making and risk appetite. Future studies may consider setting up real decision-making situations and setting up the accumulation mechanism of gain or loss amount, so that participants can make decisions in an immersive manner to obtain results with better ecological validity.

It was found that when evaluating social value, there are situations where people prefer one option, but support for both options may be high (or low). However, in regard to making decisions, people can only choose one or the other. Future research may consider measuring the degree of preference for the two options during decision-making to further illustrate the role of social value in self-other decision-making.

Finally, in this study, the psychological distance and numbers of others were separately explored as independent variables on their influence on self-others risk decision making in different domains, but there was no interaction between the two on self-others risk decision making in different domains. Future research may consider exploring the combined effects of psychological distance and numbers of others on self-others risk decision-making in different decision-making domains.

Conclusion

The results of this study are as follows. Individuals are more risk-averse when making decisions for others than for themselves in the money gain domain and personal safety domain, while the risk preference is opposite in the relationship domain. When the others were divided into intimate others and strangers, the risk preference of making decisions for intimate others was similar to that for oneself (strangers) when the social value difference between the risk-seeking option and risk-avoiding option was small (large). When making decisions for a group, there are significant differences in domains such as the personal safety domain and the relationship domain. When making decisions for a group (including the decision-maker), people show a “compromise effect” in the non-monetary domains, where their risk appetite is between making decisions for themselves and for a group. The domain differences in self-other decision-making can be explained by the social value in these domains.

Data Sharing Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

Dawei Wang, Dong Han, and Lingchao Sun are co-first for this study. This study was supported by General Project of Education in 2021 for the 14th Five-Year Plan of the National Social Science Fund: The development, influencing factors and intervention system of middle school students’ moral shading: Based on decision-making process theory (grant no. BEA210108).

Disclosure

All authors report no conflicts of interest in this work.

References

1. Olschewski S, Dietsch M, Ludvig EA. Anti-social motives explain increased risk aversion for others in decisions from experience. Judgm Decis Mak. 2019;14(1):58–71. doi:10.1017/S1930297500002916

2. Batteux E, Ferguson E, Tunney RJ. Risk preferences in surrogate decision making. Exp Psychol. 2017;64(4):290–297. doi:10.1027/1618-3169/a000371

3. Rigoli F, Preller KH, Dolan RJ. Risk preference and choice stochasticity during decisions for other people. Cogn Affect Behav Neurosci. 2018;18(2):331–341. doi:10.3758/s13415-018-0572-x

4. Batteux E, Ferguson E, Tunney RJ. Do our risk preferences change when we make decisions for others? A meta-analysis of self-other differences in decisions involving risk. PLoS One. 2019;14(5):e0216566. doi:10.1371/journal.pone.0216566

5. Polman E, Wu K. Decision making for others involving risk: a review and meta-analysis. J Econ Psychol. 2020;77(4):102184. doi:10.1016/j.joep.2019.06.007

6. Atanasov P, Anderson BL, Cain J, Schulkin J, Dana J. Comparing physicians personal prevention practices and their recommendations to patients. J Healthcare Qual. 2015;37(3):189–198. doi:10.1111/jhq.12042

7. Mouter N, van Cranenburgh SV, van Wee BV. The consumer-citizen duality: ten reasons why citizens prefer safety and drivers desire speed. Accid Anal Prevent. 2018;121:53–63.

8. Beisswanger AH, Stone ER, Hupp JM, Allgaier L. Risk taking in relationships: differences in deciding for oneself versus for a friend. Basic Appl Soc Psych. 2003;25(2):121–135. doi:10.1207/S15324834BASP2502_3

9. Stone ER, Allgaier L. A social values analysis of self–other differences in decision making involving risk. Basic Appl Soc Psych. 2008;30(2):114–129. doi:10.1080/01973530802208832

10. Zhang XY, Chen XY, Gao Y, Liu YJ, Liu YF. Self-promotion hypothesis: the impact of self-esteem on self–other discrepancies in decision making under risk. Pers Individ Dif. 2018;127:26–30. doi:10.1016/j.paid.2018.01.031

11. Zhang XY, Li SJ, Liu YF, et al. Gain-loss situation modulates neural responses to self-other decision making under risk. Sci Rep. 2019;9(1):632. doi:10.1038/s41598-018-37236-9

12. Polman E. Self–other decision making and loss aversion. Organ Behav Hum Decis Process. 2012;119(2):141–150. doi:10.1016/j.obhdp.2012.06.005

13. Lu JY, Xie XF, Xu JZ. Desirability or feasibility: self–other decision-making differences. Pers Soc Psychol Bull. 2013;39(2):144–155. doi:10.1177/0146167212470146

14. Von Gunten CD, Scherer LD. Self-other differences in multiattribute decision making: compensatory versus noncompensatory decision strategies. J Behav Decis Mak. 2019;32(2):109–123. doi:10.1002/bdm.2099

15. Trope Y, Liberman N. Temporal construal. Psychol Rev. 2003;110(3):403–421. doi:10.1037/0033-295X.110.3.403

16. Trope Y, Liberman N. Construal-level theory of psychological distance. Psychol Rev. 2010;117(2):440–463. doi:10.1037/a0018963

17. Pietri ES, Fazio RH, Shook NJ. Weighting positive versus negative: the fundamental nature of valence asymmetry. J Pers. 2013;81(2):196–208. doi:10.1111/j.1467-6494.2012.00800.x

18. Zhang H, Lu JY, Xie XF. Self-other decision-making differences derived from construal level. Acta Sci Nat Univ Pekin. 2014;50(6):1124–1132.

19. Loewenstein GF, Weber EU, Hsee CK, Welch N. Risk as feelings. Psychol Bull. 2001;127(2):267–286. doi:10.1037/0033-2909.127.2.267

20. Ghassemi M, Bernecker K, Brandstätter V. ”Take care, honey!”: people are more anxious about their significant others’ risk behavior than about their own. J Exp Soc Psychol. 2019;86:103879. doi:10.1016/j.jesp.2019.103879

21. Klein W, Ferrer RA. On being more amenable to threatening risk messages concerning close others (vis-à-vis the self). Pers Soc Psychol Bull. 2018;44(10):014616721876906. doi:10.1177/0146167218769064

22. Stone ER, Choi YS, de Bruin WB, Mandel DR. I can take the risk, but you should be safe: self-other differences in situations involving physical safety. Judgm Decis Mak. 2013;8(3):250–267.

23. Menegatti M, Rubini M. Convincing Similar and Dissimilar Others: the Power of Language Abstraction in Political Communication. Pers Soc Psychol Bull. 2013;39(5):596–607. doi:10.1177/0146167213479404

24. Reynolds DB, Joseph J, Sherwood R. Risky shift versus cautious shift: determining differences in risk taking between private and public management decision-making. J Bus Econ Res. 2009;7(1):63–77.

25. Füllbrunn SC, Luhan WJ. Decision making for others: the case of loss aversion. Econ Lett. 2017;161:154–156. doi:10.1016/j.econlet.2017.09.037

26. Faul F, Erdfelder E, Lang AG, Buchner A. G*power 3: a flexible statistical power analysis program for the social, behavioral, and biomedical sciences. Behav Res Methods. 2007;39(2):175–191.

27. Aron A, Aron EN, Smollan D. Inclusion of Other in the Self Scale and the structure of interpersonal closeness. J Pers Soc Psychol. 1992;63(4):596–612. doi:10.1037/0022-3514.63.4.596

28. Füllbrunn SC, Luhan WJ. Am I My Peer’s Keeper? Social responsibility in financial decision making. NiCE Working Paper 15-03. the Netherlands: Institute for Managemenet Research, Radboud University; 2015.

29. Lonergan BG, McClintock CG. Effects of group membership on risk-taking behavior. Psychol Rep. 1961;8(3):447–455. doi:10.2466/pr0.1961.8.3.447

30. Xiao W, Sun B, Zhou H, Fan L, Sun C, Shao Y. Moral threshold model is universal? Initial evidence from China’s collectivist culture. Psychol Res Behav Manag. 2021;14:1847–1855.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.