Back to Journals » Risk Management and Healthcare Policy » Volume 16

The Public’s Self-Avoidance and Other-Reliance in the Reporting of Medical Insurance Fraud: A Cross-Sectional Survey in China

Authors Xu J, Tian G, He J, Deng F, Chen F, Shi Q, Liu J, Zhang H, Zhang T, Wu Q , Kang Z

Received 6 September 2023

Accepted for publication 17 December 2023

Published 22 December 2023 Volume 2023:16 Pages 2869—2881

DOI https://doi.org/10.2147/RMHP.S438854

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Gulsum Kubra Kaya

Jinpeng Xu,1 Guomei Tian,2 Jingran He,1 Fangmin Deng,1 Fangting Chen,1 Qi Shi,1 Jian Liu,1 Hongyu Zhang,1 Ting Zhang,1 Qunhong Wu,1 Zheng Kang1

1School of Health Management, Harbin Medical University, Harbin, People’s Republic of China; 2Department of Nuclear Medicine, the Fourth Hospital of Harbin Medical University, Harbin, People’s Republic of China

Correspondence: Zheng Kang, School of Health Management, Harbin Medical University, Harbin, People’s Republic of China, Email [email protected]

Purpose: To understand the public’s self-willingness to report medical insurance fraud and their expectations on others, to provide a reference for the government to do a good job in medical insurance anti-fraud.

Methods: Data were obtained from a questionnaire survey of 846 respondents in China. Descriptive statistical analyses and multinomial logistic regression were used to analyze the different subjective attitudes of the public toward different subjects when faced with medical insurance fraud and the influencing factors.

Results: 511 (60.40%) respondents were willing to report medical insurance fraud, while 739 (87.35%) respondents expected others to report it. 485 (57.33%) respondents were willing and expected others to report medical insurance fraud, followed by those who were not willing but expected others to report it (254, 30.02%). Compared to those who were unwilling to report themselves and did not want others to report, those who believe their reporting is useless (OR=3.13, 95% CI=1.15– 8.33) and those who fear for their safety after reporting (OR=2.96, 95% CI=1.66– 5.26) were more likely to expect others to report. Self-reporting willingness was stronger among the public who were satisfied with the government’s protective measures for the safety of whistleblowers (OR=4.43, 95% CI=1.38– 14.17). The public who believe that both themselves and others have responsibilities to report medical insurance fraud were willing to report and expect others to do the same.

Conclusion: The public had a “self-avoidance” and “other-reliance” mentality in medical insurance anti-fraud. The free-rider mentality, lack of empathy, concerns about own risk after reporting, and the interference of decentralized responsibility were important factors contributing to this public mentality. At this stage, the government should prevent the public’s “collective indifference” in medical insurance anti-fraud efforts. Improving the safety and protection of whistleblowers and making everyone feel more responsible and valued may be effective incentives to enhance the public’s willingness to report.

Keywords: medical insurance, anti-fraud, whistleblower, subjective attitudes

Introduction

Countries around the world are facing serious medical insurance fraud problems,1–3 which refers to the intentional deception or misrepresentation by a person or entity seeking an unauthorized benefit.4 Medical insurance fraud mainly affects developing countries with fewer resources,5 resulting in poor quality and inefficiency of health services.6 In some high-income countries, 3 to 10% of healthcare expenditures are lost due to medical insurance fraud each year, amounting to billions of dollars.7 In 2014, data from the Centers for Medicare & Medicaid Services (CMS) showed that abusive, fraudulent medical insurance in the United States accounted for about 1/3 of the $2.8 trillion in total annual US healthcare spending. From 2018 to 2020, Chinese authorities, including the National Healthcare Security Administration, succeeded in recovering a total of RMB 34.875 billion (approximately $5.396 billion) in medical insurance funds that had been used in violation of the law. Medical insurance fraud has a vicious impact on the healthcare system and the public interest, it is urgent to combat medical insurance fraud to maintain an effective healthcare system and safeguard the public interest.8

Currently, the primary method for detecting medical insurance fraud in China is manual detection by government-organized experts, supplemented by some machine learning tools.9 However, influenced by factors such as the inter-regional use of medical insurance funds and the online settlement of medical expenses, the complexity and invisibility of medical insurance fraud are also increasing, which brings tremendous pressure on the government’s anti-fraud work in medical insurance.10,11 As a quasi-public good, medical insurance funds deserve to be supervised by the public, and the value of public reporting in preventing and identifying medical insurance fraud has become commonly recognized and utilized in medical insurance anti-fraud efforts.12,13 Federal regulators in the United States take whistleblower information about medical insurance fraud seriously, with almost half of the medical insurance fraud losses recovered from 1996 to 2005 coming from lawsuits filed by whistleblowers.14 China has also taken various measures to encourage the public to report medical insurance fraud, mainly including offering financial rewards to whistleblowers and protecting their information.15,16 Public reporting is receiving increasing attention from policymakers and researchers as a medical insurance anti-fraud tool.

Willingness to report is the core prerequisite for promoting whistleblowing behavior,17,18 and research on the public’s willingness to report medical insurance fraud is an important area of current interest among scholars. In 2022, Zhang, Zhang, Shi, Liu, Xu, Zhang, Wang, Tian, Wu, Kang19 found that the public’s willingness to report medical insurance fraud was more related to whether they were direct victims. When medical insurance fraud causes a direct loss of personal benefit, the public is more likely to report it. Another study showed that the public’s lack of knowledge of whistleblowing policies has a negative impact on their whistleblowing behavior. Concerns about the consequences of whistleblowing did not inhibit the public’s whistleblowing behavior, while the inability to identify medical insurance fraud was a key barrier to converting willingness to report into behavior.20

To the best of our knowledge, existing studies have focused more on the public’s willingness to report medical insurance fraud, and no research has focused on the public’s expectation on others to report when confronted with medical insurance fraud, let alone a comprehensive analysis of the public’s self-willingness and expectation on others. Since the public lives in social contexts, when encountering social injustice events like medical insurance fraud, some people will be willing to report it themselves, while others will expect others to report it, and people tend to have different subjective attitudes toward different subjects. Not only in the area of medical insurance fraud reporting, but also in daily life, when the public is faced with smoking or queue jumping in public places and other uncivilized phenomena, they will also encounter similar problems. In such scenarios, when people are counting on having others report, social slackness arises,21 creating a free-rider problem.22,23 When people only have the will to report themselves and do not want others to report, the efficiency of the action also suffers. Therefore, it is necessary to figure out the public’s self-willingness and expectations on others when making medical insurance anti-fraud reports.

In summary, to contribute to and update the knowledge about public participation in medical insurance anti-fraud. We focus on several questions that have not been considered to date: What is the public’s willingness to report medical insurance fraud? What expectations do they have on others? Are there differences between the two? What factors influence the public’s subjective attitudes toward different subjects? The study will provide insight into the psychological decision-making of individuals facing medical insurance fraud from a microscopic perspective, and provide a reference for governmental departments to formulate relevant reporting policies and do a good job in medical insurance anti-fraud. In addition, it is reasonable to assume that the results of this study will enrich the research results of social psychology and public administration and provide ideas for public participation in the governance of other events, especially unjust events.

Numerous behavioral science theories have informed our research. The Knowing, Believing, and Acting (KAP) model proposes that people adopt certain behaviors based on three stages: knowledge acquisition, belief generation, and behavior formation.24,25 Among them, “Knowing” is the knowledge and understanding of relevant knowledge, and “Believing” is the correct belief and positive attitude. Appropriate knowledge and the right attitude can lead people to take the right action with the right inclination.26,27 The Protective Action Decision Model (PADM) proposes a role for information processing and risk perception in human response to threats.28 Perceived risks to behavior may prevent people from making rational behavioral decisions,29,30 especially in the context of medical insurance anti-fraud efforts where the public is likely to bear the risk after reporting. In addition, Triandis introduced the factor of perceived consequences in his model of behavioral decision-making, arguing that any event can have positive or negative consequences and that the perception of such consequences directly affects an individual’s willingness to act.31,32 Therefore, as shown in Figure 1, this study will build a KAP-RC model of public reporting of medical insurance fraud based on the KAP model, introducing the public’s perception of the risk of reporting behavior and the perception of the consequences of medical insurance fraud, and analyzing the different subjective attitudes of the public towards different subjects and their influencing factors when making medical insurance anti-fraud reports.

|

Figure 1 Overview of the KAP-RC framework. |

Materials and Methods

Study Population and Data Collection

A cross-sectional questionnaire was used to investigate information about respondents’ knowledge, attitudes, and willingness regarding whistleblowing medical insurance fraud. A pilot study was conducted before the formal survey in which 60 questionnaires were collected using convenience sampling to improve the design and questionnaire quality. The national survey was conducted from February 19 to September 20, 2022, through the “Questionnaire Star platform”, a widely used online questionnaire platform in China.

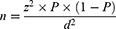

According to the National Bureau of Statistics of China, the economic region was classified into four regions: Northeast, East, Central, and West.33 Since the members of this study came from different provinces in China, to obtain a more credible sample and considering the accessibility of the participants, this study mainly collected data through the research members distributing the questionnaire links in their provinces and then collecting the data in a snowballing manner. Finally, Heilongjiang and Liaoning provinces were mainly selected as representatives in northeast China, Jiangsu and Shandong provinces in eastern China, Anhui and Shanxi provinces in central China, and Shaanxi and Guizhou provinces in western China. The public aged 18 years and older with normal cognitive abilities from four regions were selected to participate in the study on an anonymous basis. The introductory section of the questionnaire also provided written informed consent before the response. The following formula was followed in calculating the sample size for this sampling.

Where z determines the confidence level, and the z value is generally 1.96 corresponding to the 95% confidence level we choose. P is the percentage of a characteristic in the target population and is set to 0.5 because no prior data are available. d is the acceptable precision/accuracy level, generally, we take 0.04. Therefore, 601 samples should be investigated in this study according to the formula.

According to the IP address recorded in the questionnaire, each participant could only answer once. If a questionnaire takes more than 10 minutes to complete (which is the shortest completion time our team tested) and the two logical questions are answered correctly, it is judged as valid and included in the analysis, otherwise, it will be removed. Finally, we surveyed 900 people, and based on the inclusion exclusion criteria and the quality screening, 54 samples were excluded, resulting in a total of 846 valid samples. The flowchart of the research sample is shown in Figure 2.

|

Figure 2 The flowchart of the research sample. |

Measures

Dependent Variables

The dependent variables of the study were the subjective attitudes of the public towards different subjects when reporting medical insurance fraud, as measured by the questions “Would you like to report medical insurance fraud? (Yes/No)” and “Do you expect others to report medical insurance fraud when faced with it? (Yes/No)”. If respondents answered “Yes” to both questions, it can be assumed that the public is willing to report and expects others to report when faced with medical insurance fraud. In this way, the subjective attitudes of the public towards different subjects can be divided into four categories: Willing to report themselves and expect others to report (WRTEOR), Willing to report themselves but not expect others to report (WRTNEOR), Unwilling to report themselves but expect others to report (UWRTEOR), Unwilling to report themselves and not expect others to report (UWRTNEOR).

Independent Variables

Socio-Demographic Characteristics

The socio-demographic variables considered in this study were age, gender, marital status, education level, residency, residential economic region, and whether to be insured. Gender was defined as male and female. Marital status was dichotomized into married or single, where single included those who are unmarried, divorced, and widowed. Education levels were divided into two groups: high school or below and college or above. Following the household information of the respondents, the place of residence was divided into rural or urban areas. The economic region was classified according to the National Bureau of Statistics of China into four regions: Northeast, East, Central, and West.33 Based on their participation in basic medical insurance, respondents were classified as insured and non-insured.

Behavioral Decision Variables

Guided by behavioral science theories, we incorporated some behavioral decision-related variables to explain the factors influencing the public’s willingness to report behavior, and the names and descriptions of the variables are shown in Table 1. Knowledge (KNOW) refers to the respondents’ knowledge of public participation in medical insurance anti-fraud. Attitude towards Oneself (ATO) is the respondents’ perceptions or attitudes towards their participation in medical insurance anti-fraud, Attitude towards the Public (ATP) is the respondents’ perceptions or attitudes towards public participation in medical insurance anti-fraud, Perceived Risks (PRISK) is respondents’ perceptions of risk after reporting, and Perceived Consequences (PCONSE) is respondents’ perceptions of consequences of medical insurance fraud. Except for KNOW2, KNOW3, and KNOW4, which were dichotomous variables (No/Yes), all variables were measured by asking respondents to rate their approval of each item on a 5-point Likert scale (from 1 to 5 indicating a complete agreement to complete disagreement). Similar to other studies,34,35 scores above 3 were considered the high-level group, otherwise the low-level group.

|

Table 1 Behavioral Decision Variables |

Statistical Analysis

IBM SPSS Statistics for Windows, version 22.0 (IBM Corp., Armonk, N.Y., USA) was used for data cleaning and preprocessing. All tests were two-tailed, and the statistical significance level was set as P-value less than 0.05. Firstly, descriptive statistical analysis was used to describe the characteristics of the respondents. Secondly, we used Mann–Whitney U-test and chi-square tests to investigate the differences between the public’s different subjective attitudes towards different subjects when making medical insurance fraud reports. Thirdly, multinomial logistic regression was constructed to investigate the factors that influence different reporting propensities. Multicollinearity test showed that all independent variables satisfied TOL (tolerance value) >0.1 and VIF (variance inflation factor) <10, allowing the regression model to be built.36,37

Results

Characteristics of Respondents

Table 2 demonstrates the basic characteristics of the respondents. Among the respondents, 61.23% were female, 44.09% were married, and 71.39% had a college degree or higher. In terms of place of residence, 85.94% of the respondents lived in cities and 40.43% were from Northeast China. 89.24% of the respondents were involved in basic medical insurance. The subjective attitudes of the public towards the subject of medical insurance fraud reporting were not exactly the same in different economic regions (P=0.014). In addition to the variable PCONSE1 (respondents’ perception of the prevalence of medical insurance fraud), respondents’ knowledge of public participation in medical insurance anti-fraud (KNOW), attitude toward their own participation in medical insurance anti-fraud (ATO), attitude toward public participation in medical insurance anti-fraud (ATP), perceived risks after reporting (PRISK), and perceived consequences of medical insurance fraud (PCONSE) were all correlated with their subjective attitudes (P<0.001).

|

Table 2 Sample Characteristics and Prevalence of the Public’s Different Subjective Attitudes (N=846) |

Subjective Attitudes of the Public Towards Different Subjects When Making Medical Insurance Fraud Reports

Figure 3 illustrates the subjective attitudes of the public toward different subjects when making health insurance fraud reports. 511 (60.40%) respondents were willing to report medical insurance fraud, and 739 (87.35%) said they expected others to make medical insurance fraud reports. The largest number of respondents were those who were willing and expected others to report medical insurance fraud (485, 57.33%), followed by those who were not willing but expected others to report it (254, 30.02%). 81 (9.57%) respondents were neither willing themselves nor expected others to report, and 26 (3.07%) respondents were willing themselves but did not expect others to do so.

|

Figure 3 Subjective attitudes of the public toward different reporting subjects. |

Results of Multinomial Logistic Regression

Table 3 shows the results of the multinomial logistic regression. Compared with those who were unwilling to report themselves and did not expect others to report, those who believe medical insurance is linked to their interests were more likely to expect others to make medical insurance fraud reports (OR=3.47, P<0.001), and those who believe their reports are useless (OR=3.13, P=0.026) and who fear for their safety after reporting (OR=2.96, P<0.001) were also more likely to expect others to become a whistleblower. The public who followed the cases of medical insurance fraud officially disclosed had a higher willingness to self-report (OR=4.54, P=0.008), and they were also satisfied with the government’s measures to protect the safety of whistleblowers (OR=4.43, P=0.012).

|

Table 3 Multinomial Logistic Regression Analysis of the Public’s Different Subjective Attitudes (Reference = UWRTNEOR) |

The public who concerned about officially disclosed cases of medical insurance fraud (OR=2.30, P=0.026), who believe that medical insurance is highly associated with their interests (OR=4.59, P<0.001), and who perceive medical insurance fraud as egregious (OR=3.46, P=0.019) were willing to report themselves and expect others to report medical insurance fraud. Not only did they feel responsible and capable of making medical insurance fraud reports, but they also felt that it is responsible and useful for the public to do so. Even though they would be concerned about their safety after reporting (OR=2.89, P=0.001), satisfaction with government protection measures positively contributed to their willingness to report and the expectations of others (OR=2.68, P=0.010).

Discussion

Using a quantitative survey, this study innovatively explores the subjective attitudes of the public toward different subjects when facing medical insurance fraud and the influencing factors. Based on the actual situation, this study analyzed four different types of subjective attitudes of the public when reporting medical insurance fraud: Willing to report and expect others to report, Willing to report but not expect others to report, Unwilling to report but expect others to report, Unwilling to report and not expect others to report. The findings of the study will not only enrich the research results of public participation in medical insurance anti-fraud work and even in the field of public participation in social affairs governance, but also have important implications for the improvement of social psychology and public management theory.

An important contribution of this study is the detection of the “self-avoidance” and “other-reliance” psychology of the public in medical insurance anti-fraud, ie, when faced with medical insurance fraud, people are more likely to rely on others to report it than on themselves. We believe that this phenomenon may be equally applicable in other areas of social public governance, not only in the area of medical insurance anti-fraud. In the process of social public governance, people’s expectations of others’ behavior are always higher than their own behavioral willingness. For example, when someone smokes in a public place, people always expect someone to stop it, but they are often unwilling to do so themselves. When the vast majority of society is of this mentality, the phenomenon of “collective indifference” will arise. In 2021, China only recovered 0.76% of its medical insurance fund losses through public reporting.38 The psychology of “self-avoidance” and “other-reliance” may be an important reason for the failure of public participation in medical insurance anti-fraud initiatives.

The public’s free-rider mentality, lack of empathy, concerns about their risks after reporting, and interference with decentralized responsibility may be important factors in the formation of this social phenomenon. In this study, 30% of the respondents said they were reluctant to report medical insurance fraud and simply wanted to take advantage of others’ efforts to fight medical insurance fraud, even though they believed that medical insurance funds were highly relevant to their interests. Such respondents have a significant opportunistic mentality of free-riding when it comes to medical insurance fraud reporting. It needs to be acknowledged that the public’s medical insurance anti-fraud effort is a large-scale collective action, which lacks clear quantitative assessment indicators, leading to the inevitable free-rider mentality of the public.39 On the one hand, they believe that their participation in reporting is not effective, on the other hand, out of concern for their own risks after reporting, they are less likely to report.

Meanwhile, the study found that the willingness to self-report was stronger among the public who were satisfied with the government’s protective measures for the safety of whistleblowers, while the public who were concerned about their safety after reporting were more likely to expect others to report. We suggest that this may be a result of a lack of empathy on the part of the public. In many cases, people do not put themselves in the perspective of others, which is a manifestation of a lack of empathy.40,41 In the field of medical insurance anti-fraud, when people as bystanders only expect others to report, they tend to consider the benefits of this matter out of a sense of social justice and ignore the difficulty and cost of accomplishing this task. Once they become the subject of the action, their willingness to behave is influenced by many factors, including their ability, the cost of the action, the consequences of the action, the difficulty of the action, and so on.

Also, the study illustrates that the public’s concern about their own risk after reporting is an important factor influencing their subjective attitudes toward different reporting subjects, which is consistent with previous research findings.42–44 In a federal lawsuit against a US pharmaceutical manufacturer, Kesselheim, Studdert, Mello45 conducted semi-structured interviews with 26 whistleblowers, 18 of whom reported that whistleblowing “put their careers at risk”. Fleming, Humm, Wild, Mohan, Hornby, Harries, Fitzgerald, Beamish46 surveyed delegates attending the Association of Surgeons in Training (ASiT) and found that only 16% of respondents felt that National Health Service (NHS) protection for whistleblowers was adequate. As medical insurance anti-fraud is social public governance, whistleblowers often report medical insurance fraud to protect the public interest rather than their private interests, and once they realize that they cannot avoid the risks or troubles they may encounter after reporting, they are bound to hesitate. Therefore, whistleblower protection may be a necessary element for the government to consider when encouraging public participation in medical insurance anti-fraud efforts.

Finally, the study found a vague sense of public responsibility in medical insurance anti-fraud reporting. Respondents who believe that both they and others have a responsibility to report medical insurance fraud were not only willing to report medical insurance fraud themselves, but this sense of responsibility also raises public expectations of the behavior of others. It has been pointed out that when the sense of responsibility of each individual in a group is blurred, it means that a person does not have the idea and attitude of taking responsibility, which can also be said to be a lack of responsibility and can easily lead to inaction when the public is confronted with unethical behavior.47 According to the “Bystander Effect” by John Darley and Bibb Latane,48 when responsibility for medical insurance anti-fraud is apportioned to each individual, people tend to perceive themselves as less responsible and thus less likely to act. Based on this, it is essential to raise the public’s awareness of responsibility in the face of medical insurance fraud, to avoid the public’s “self-avoidance” and “other-reliance” mentality due to the interference of decentralized responsibility, and to improve the efficiency of medical insurance anti-fraud.

The study sheds some policy light on public participation in medical insurance anti-fraud efforts. Although the government has been emphasizing the importance of having the public as a significant force in medical insurance anti-fraud, it may indeed be a long process to achieve promising effects. According to our findings, Making the public feel more responsible and valued is an important means of improving the effectiveness of medical insurance anti-fraud, which is also consistent with the Pygmalion effect, causing an increase in performance by raising expectations for employees.49,50 In addition, the security protection of whistleblowers cannot be ignored.51

Our cross-sectional study provides an in-depth understanding of public participation in the supervision of medical insurance funds, but there are important aspects that we need to consider when discussing the external validity of the results. Firstly, our research object is the psychology of the general public, so the results may be generalizable. Secondly, there is a lack of research on the same subject so far, with only some studies on public participation in the governance of public affairs, such as food safety governance, environmental governance, and financial governance. Tavares, Lima, Michener52 found that in public service, women tend to report unlawful behavior less frequently than men, and that fear of retaliation reduces their willingness to engage in whistleblowing. External auditors also act in the public interest and Alleyne, Hudaib, Pike53 found that perceived responsibility for whistleblowing and the cost of whistleblowing had a direct effect on their willingness to report. Compared to their study, we observed partial similarities. However, the study identified the “self-avoidance” and “other-reliance” mentality of the public in medical insurance anti-fraud, and the external validity of this finding in these areas may require further testing.

It is also important to note that some of the design choices in our study may have implications for the external validity of the results, which are some of the limitations of this study. On the one hand, the self-reported questionnaire approach of respondents is somewhat subjective, and subsequent studies could be based on scenario experiments or situational simulations to show the public’s psychological decision-making more realistically. On the other hand, the factors influencing the willingness to report included in the study may not be comprehensive enough. In addition to the psychosocial factors already considered in this study, the effects of social trust, the influence of others, and situational judgment on willingness to report are also worth further exploration in subsequent studies.54,55 Public reporting of medical insurance fraud is still in its infancy in China, and many other topics have not been explored to date. Despite these limitations, we believe that our research framework and findings will contribute to the field of public participation in social governance.

Conclusion

In summary, our study found that when confronted with medical insurance fraud, the respondents’ willingness to expect others to report it was significantly higher than their own willingness. The public had a “self-avoidance” and “other-reliance” mentality in medical insurance anti-fraud, and the free-rider mentality, lack of empathy, concerns about their own risk after reporting, and interference with decentralized responsibility were important factors that caused the public to develop this mentality. About 30% of the public were reluctant to self-report but expected others to report, reflecting the existence of the public free-rider mentality in medical insurance anti-fraud. Publics who were satisfied with government protection measures were more willing to self-report, while public who were concerned about their safety after reporting were more likely to expect others to report, which may be the result of the public’s lack of empathy. For those who themselves were willing and expected others to report medical insurance fraud, their awareness of responsibility played an important role. At this stage, the government should prevent the public’s “collective indifference” in medical insurance anti-fraud efforts. Good protection of whistleblowers’ safety and making everyone feel more responsible and valuable may be effective incentives to increase the public’s willingness to report.

Ethics Approval and Consent to Participate

Ethics approval for the study protocol was obtained from the Ethics Committee of Harbin Medical University. A written informed consent form was provided in the introductory section of the questionnaire to explain the purpose of the questionnaire to the participants before the survey began, and informed consent was obtained from all participants through online responses.

Acknowledgments

The authors thank all participants in this study, as well as all the interviewers for data collection. We are also grateful to all the reviewers for their insightful comments and suggestions.

Funding

The research was supported by: (1) National Natural Science Foundation of China (72074064,71573068); (2) National Social Science Fund of China (19AZD013).

Disclosure

The authors report no conflicts of interest in this work.

References

1. Kang H, Hong J, Lee K, Kim S. The effects of the fraud and abuse enforcement program under the National Health Insurance program in Korea. Health Policy. 2010;95(1):41–49. doi:10.1016/j.healthpol.2009.10.003

2. Shrank WH, Rogstad TL, Parekh N. Waste in the US Health Care System: estimated Costs and Potential for Savings. JAMA J Am Med Assoc. 2019;322(15):1501–1509. doi:10.1001/jama.2019.13978

3. Villegas-Ortega J, Bellido-Boza L, Mauricio D. Fourteen years of manifestations and factors of health insurance fraud, 2006–2020: a scoping review. Health Justice. 2021;9(1):26. doi:10.1186/s40352-021-00149-3

4. Kose I, Gokturk M, Kilic K. An interactive machine-learning-based electronic fraud and abuse detection system in healthcare insurance. Appl. Soft Comput. 2015;36:283–299. doi:10.1016/j.asoc.2015.07.018

5. Perez V, Wing C. Should We Do More To Police Medicaid Fraud? Evidence on the Intended and Unintended Consequences of Expanded Enforcement. Am J Health Economics. 2019;5:1–55. doi:10.1162/ajhe_a_00130

6. Kruk ME, Gage AD, Arsenault C, et al. High-quality health systems in the Sustainable Development Goals era: time for a revolution. Lancet Glob Health. 2018;6(11):e1196–e1252. doi:10.1016/S2214-109X(18)30386-3

7. Rashidian A, Joudaki H, Vian T. No evidence of the effect of the interventions to combat health care fraud and abuse: a systematic review of literature. PLoS One. 2012;7(8):e41988. doi:10.1371/journal.pone.0041988

8. Fu HQ, Lai Y, Li YY, Zhu YS, Yip W. Understanding medical corruption in China: a mixed-methods study. Health Policy Plann. 2023;38(4):496–508. doi:10.1093/heapol/czad015

9. Lu J, Lin K, Chen R, Lin M, Chen X, Lu P. Health insurance fraud detection by using an attributed heterogeneous information network with a hierarchical attention mechanism. BMC Med. Inf. Decis. Making. 2023;23(1):62. doi:10.1186/s12911-023-02152-0

10. Zhang B, Wang H, Zhang H, et al. The influence of cross-regional medical treatment on total medical expenses, medical insurance payments, and out-of-pocket expenses of patients with malignant tumors in Chinese low-income areas. Cost Effectiveness Resource Allocation. 2022;20(1):35. doi:10.1186/s12962-022-00368-x

11. Qu Y, Liu R. Problems of China’s Legal Supervision System on the Internet Medical Care Under the Background of 5G Medical Application. Risk Management Healthcare Policy. 2022;15:2171–2176. doi:10.2147/RMHP.S386531

12. Okafor O, Adebisi F, Opara M, Okafor C. Deployment of Whistleblowing as an Accountability Mechanism to Curb Corruption and Fraud in a Developing Democracy. Accounting Auditing Accountability J. 2020;33(6):1335–1366. doi:10.1108/AAAJ-12-2018-3780

13. Kaplan SE, Lanier D Jr, Pope KR, Samuels JA. External Investigators’ Follow-Up Intentions When Whistleblowers Report Healthcare Fraud: the Effects of Report Anonymity and Previous Confrontation. Behav Res Accounting. 2020;32(2):91–101. doi:10.2308/BRIA-19-042

14. Kesselheim AS, Studdert DM. Whistleblower-initiated enforcement actions against health care fraud and abuse in the United States, 1996 to 2005. Ann Intern Med. 2008;149(5):342–349. doi:10.7326/0003-4819-149-5-200809020-00009

15. The State Council of the People’s Republic of China. Medical insurance fund use supervision and management regulations. Available from: http://www.gov.cn/gongbao/content/2021/content_5591403.htm.

16. Fei Y, Fu Y, Yang DX, Hu CH. Research on the Formation Mechanism of Health Insurance Fraud in China: from the Perspective of the Tripartite Evolutionary Game. Front Public Health. 2022;10.

17. Ajzen I. The theory of planned behavior. Organizational Beha Human Decis Processes. 1991;50(2):179–211. doi:10.1016/0749-5978(91)90020-T

18. Gibbons FX, Gerrard M, Ouellette JA, Burzette R. Cognitive antecedents to adolescent health risk: discriminating between behavioral intention and behavioral willingness. Psychol Health. 1998;13(2):319–339. doi:10.1080/08870449808406754

19. Zhang H, Zhang T, Shi Q, et al. Who is More Likely to Report Medical Insurance Fraud in the Two Scenarios of Whether It Results in a Direct Loss of Individual Benefit? A Cross-Sectional Survey in China. Psychology Research and Behavior Management. 2022;15:2331–2341. doi:10.2147/PRBM.S375823

20. Wang D, Zhan C. Why Not Blow the Whistle on Health Care Insurance Fraud? Evidence from Jiangsu Province, China. Risk Management Healthcare Policy. 2022;15:1897–1915. doi:10.2147/RMHP.S379300

21. Hopper E What Is Social Loafing? Definition and Examples. Available from: https://www.thoughtco.com/social-loafing-4689199.

22. Abásolo I, Tsuchiya A. Blood donation as a public good: an empirical investigation of the free rider problem. Eur J Health Economics. 2014;15(3):313–321. doi:10.1007/s10198-013-0496-x

23. Wang S, Maitland E, Wang T, Nicholas S, Leng A. Student COVID-19 vaccination preferences in China: a discrete choice experiment. Front Public Health. 2022;10:997900. doi:10.3389/fpubh.2022.997900

24. Li L, Wang F, Shui X, Liang Q, He J. Knowledge, attitudes, and practices towards COVID-19 among college students in China: a systematic review and meta-analysis. PLoS One. 2022;17(6).

25. Sondakh JJS, Warastuti W, Susatia B, et al. Indonesia medical students’ knowledge, attitudes, and practices toward COVID-19. Heliyon. 2022;8(1):e08686. doi:10.1016/j.heliyon.2021.e08686

26. Ning L, Niu J, Bi X, et al. The impacts of knowledge, risk perception, emotion and information on citizens’ protective behaviors during the outbreak of COVID-19: a cross-sectional study in China. BMC Public Health. 2020;20(1):1751. doi:10.1186/s12889-020-09892-y

27. Huang A, Wang X, Tao Y, Lin L, Cheng H. Healthcare professionals’ knowledge, attitude and practice towards National Centralized Drug Procurement policy in central China: a cross-sectional study. Front Pharmacol. 2022;13:996824. doi:10.3389/fphar.2022.996824

28. Lindell MK, Perry RW. Behavioral Foundations of Community Emergency Planning. Washington, DC, US: Hemisphere Publishing Corp; 1992.

29. Caserotti M, Girardi P, Rubaltelli E, Tasso A, Lotto L, Gavaruzzi T. Associations of COVID-19 risk perception with vaccine hesitancy over time for Italian residents. Soc Sci Med. 2021;272:113688. doi:10.1016/j.socscimed.2021.113688

30. Gu J, He R, Wu X, Tao J, Ye W, Wu C. Analyzing Risk Communication, Trust, Risk Perception, Negative Emotions, and Behavioral Coping Strategies During the COVID-19 Pandemic in China Using a Structural Equation Model. Front Public Health. 2022;10:843787. doi:10.3389/fpubh.2022.843787

31. Triandis HC. Values, attitudes, and interpersonal behavior. Nebraska Symposium Motivation Nebraska Symposium on Motivation. 1980;27:195–259.

32. Karaiskos D, Drossos D, Tsiaousis A, Giaglis G, Fouskas K. Affective and social determinants of mobile data services adoption. Behaviour Inf Technol. 2012;31(3):209–219. doi:10.1080/0144929X.2011.563792

33. National Bureau of Statistics of China. East-West-Central and North-East division method. Available from: http://www.stats.gov.cn/ztjc/zthd/sjtjr/dejtjkfr/tjkp/201106/t20110613_71947.htm.

34. Xu J, Zhang H, Zhang T, et al. The “jolly fat” for the middle-aged and older adults in China, was education level considered? J Affect Disord. 2022;317:347–353. doi:10.1016/j.jad.2022.08.093

35. Zhang P, Zhang Q, Guan H, et al. Who is more likely to hesitate to accept COVID-19 vaccine: a cross-sectional survey in China. Expert Review of Vaccines. 2022;21(3):397–406. doi:10.1080/14760584.2022.2019581

36. Miles J. Tolerance and Variance Inflation Factor. Wiley StatsRef: Statistics Reference Online. 2014.

37. Stoltzfus JC. Logistic regression: a brief primer. Acad em med. 2011;18(10):1099–1104. doi:10.1111/j.1553-2712.2011.01185.x

38. Huang H. Based on a new starting point, meet new challenges, and promote new leaps in fund supervision. China Health Insurance. 2021;4:6–8.

39. Hagan CB. The Logic of Collective Action: public Goods and the Theory of Groups. By Maneur OlsonJr., (Cambridge: Harvard University Press, 1965. Pp. 175. $4.50). Am Political Sci Rev. 1966;60(1):129–130. doi:10.1017/S0003055400126917

40. Montinari N, Rancan M. Risk taking on behalf of others: the role of social distance. J Risk Uncertainty. 2018;57(1):81–109. doi:10.1007/s11166-018-9286-2

41. Polman E. Self-other decision making and loss aversion. Organizational Beha Human Decis Processes. 2012;119(2):141–150. doi:10.1016/j.obhdp.2012.06.005

42. Rauwolf P, Jones A. Exploring the utility of internal whistleblowing in healthcare via agent-based models. BMJ open. 2019;9(1):e021705. doi:10.1136/bmjopen-2018-021705

43. Latan H, Chiappetta Jabbour CJ, Ali M, Lopes de Sousa Jabbour AB, Vo-Thanh T. What Makes You a Whistleblower? A Multi-Country Field Study on the Determinants of the Intention to Report Wrongdoing. J Bus Ethics. 2022;183(3):885–905. doi:10.1007/s10551-022-05089-y

44. Jackson D, Peters K, Andrew S, et al. Trial and retribution: a qualitative study of whistleblowing and workplace relationships in nursing. Contemporary Nurse. 2010;36(1–2):34–44. doi:10.5172/conu.2010.36.1-2.034

45. Kesselheim AS, Studdert DM, Mello MM. Whistle-blowers’ experiences in fraud litigation against pharmaceutical companies. New Engl J Med. 2010;362(19):1832–1839. doi:10.1056/NEJMsr0912039

46. Fleming CA, Humm G, Wild JR, et al. Supporting doctors as healthcare quality and safety advocates: recommendations from the Association of Surgeons in Training (ASiT). Int J Surgery. 2018;52:349–354. doi:10.1016/j.ijsu.2018.02.002

47. Simha A, Parboteeah KP. The Big 5 Personality Traits and Willingness to Justify Unethical Behavior-A Cross-National Examination. J Bus Ethics. 2020;167(3):451–471. doi:10.1007/s10551-019-04142-7

48. Cieciura J. A Summary of the Bystander Effect: historical Development and Relevance in the Digital Age. Inquiries J. 2016;8.

49. Friedrich A, Flunger B, Nagengast B, Jonkmann K, Trautwein U. Pygmalion effects in the classroom: teacher expectancy effects on students’ math achievement. Contemp Educ Psychol. 2015;41:1–12. doi:10.1016/j.cedpsych.2014.10.006

50. Whiteley P, Sy T, Johnson SK. Leaders’ conceptions of followers: implications for naturally occurring Pygmalion effects. Leadership Quarterly. 2012;23(5):822–834. doi:10.1016/j.leaqua.2012.03.006

51. Demir M. The Perceived Effect of a Witness Security Program on Willingness to Testify. Int Criminal Justice Rev. 2017;28:105756771772129.

52. Tavares GM, Lima FV, Michener G. To blow the whistle in Brazil: the impact of gender and public service motivation. Regul Governance. 2021. doi:10.1111/rego.12418

53. Alleyne P, Hudaib M, Pike R. Towards a conceptual model of whistle-blowing intentions among external auditors. Br Accounting Rev. 2013;45(1):10–23. doi:10.1016/j.bar.2012.12.003

54. van Erp J, Loyens K. Why External Witnesses Report Organizational Misconduct to Inspectorates: a Comparative Case Study in Three Inspectorates. Administration & Society. 2018;52(2):265–291. doi:10.1177/0095399718787771

55. Islam MA, Saidin ZH, Ayub MA, Islam MS. Modelling behavioural intention to buy apartments in Bangladesh: an extended theory of planned behaviour (TPB). Heliyon. 2022;8(9):e10519. doi:10.1016/j.heliyon.2022.e10519

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.