Back to Journals » Psychology Research and Behavior Management » Volume 16

The Interplay Between Financial Literacy, Financial Risk Tolerance, and Financial Behaviour: The Moderator Effect of Emotional Intelligence

Authors Song CL, Pan D, Ayub A , Cai B

Received 30 November 2022

Accepted for publication 1 February 2023

Published 23 February 2023 Volume 2023:16 Pages 535—548

DOI https://doi.org/10.2147/PRBM.S398450

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Igor Elman

Cui Ling Song,1 Dongfang Pan,2 Arslan Ayub,3 Binbin Cai4

1Institute of Financial Technology, Suzhou Industrial Park Institute of Services Outsourcing, Suzhou, People’s Republic of China; 2College of Art and Communication, China Jiliang University, Hangzhou, People’s Republic of China; 3National School of Management Studies, the University of Faisalabad, Faisalabad, Pakistan; 4International College, Zhejiang University of Technology, Hangzhou, People’s Republic of China

Correspondence: Binbin Cai, Email [email protected]

Aim: This study aims to examine financial literacy’s impact on individual investors’ financial behaviour while also investigating the mediating role of financial risk tolerance and the moderator effect of emotional intelligence.

Methods: The study collects time-lagged data from 389 financially independent individual investors from leading educational institutes in Pakistan. Data are analysed using SmartPLS (v 3.3.3) to test the measurement and structural models.

Results: The findings reveal that financial literacy significantly impacts the financial behaviour of individual investors. In addition, financial risk tolerance partially mediates the relationship between financial literacy and financial behaviour. Besides, the study found a significant moderating role of emotional intelligence in the direct relationship between financial literacy and financial risk tolerance and an indirect relationship between financial literacy and financial behaviour.

Discussion: The study examined a hitherto unexplored relationship between financial literacy and financial behaviour, mediated by financial risk tolerance and moderated by emotional intelligence.

Keywords: financial literacy, emotional intelligence, financial risk tolerance, financial behaviour

Introduction

Financial risk tolerance refers to “the willingness to engage in behaviours in which the outcomes remain uncertain with the possibility of an identifiable negative outcome”1 and have implications for individual investors and financial institutions.2,3 Despite burgeoning interest in financial risk tolerance, there are significant gaps in our understanding of this phenomenon.4 First, relatively less is known about the antecedents of financial risk tolerance. Although it has been theorised that a plausible assertion can be developed to associate financial literacy with financial risk tolerance, few studies have empirically examined these relationships. We answer the call of Mutlu and Özer5 to address this gap by examining financial literacy as an antecedent of financial risk tolerance. Exploring financial literacy in this context is essential because substantial evidence suggests that financial literacy/financial education level positively correlates with financial risk-taking tendencies.6–8 Furthermore, financial literacy can be practically addressed through proper financial education interventions.9 Thus, identifying financial literacy as a critical determinant of financial risk tolerance may present opportunities to expand financial risk-taking tendencies.

Second, it has been theorised that implications of financial risk tolerance extend beyond financial decision-making to assessing the financial behaviour of individual investors;10 no empirical studies have tested these relationships. Financial behaviour refers to “the ability of individuals to manage their savings, expenditures, debts and investments”.5 We anchor on the theory of planned behavior (TPB) Ajzen11,12 to examine the mediating role of financial risk tolerance in the relationship between financial literacy and financial behaviour. The TPB reflects an individual’s ‘expectancy-value’ formulation, which serves as a basis that determines attitude towards behavior.12 Our study projects that financial literacy engenders one’s behavioral beliefs that facilitates the transformation of behavior through positive attitude, ie, financial risk tolerance. By addressing this gap, we aim to provide a more comprehensive understanding of the implications of financial risk tolerance stimulated by financial literacy in predicting the financial behaviour of investors. Financial behaviour studies are of interest to researchers, business communities, and financial institutions to study the dynamics of financial behaviour. We argue that its predictions are amenable to empirical tests in behavioural finance due to the “inability of classical finance to solve financial behaviours and market abnormalities faced by individuals”.5,13,14

Third, in addition to assessing the causal mechanism, ie, financial risk tolerance, which mediates the relationship between financial literacy and financial behaviour, we outstretch the boundary conditions of financial behaviour by exploring emotional intelligence as an intervening variable that might also underpin the association between financial literacy and financial behaviour. This is in response to Mutlu and Özer’s5 call to study individual psychological factors in the financial literacy-behaviour linkage. Studying emotional intelligence in this context is essential because it allows researchers and practitioners to improve the quality of financial decisions.15,16 We predict that emotional intelligence provides “emotional stability” that might insulate individual investors against the stress typically experienced in taking a greater financial risk. In this study, we propose specifically that (1) financial risk tolerance mediates the relationship between financial literacy and financial behaviour, (2) emotional intelligence moderates the direct relationship between financial literacy and financial risk tolerance, and indirect relationship between financial literacy and financial behaviour, mediated by financial risk tolerance.

Our study contributes to the literature on financial behavior and psychology research in the following ways. First, we apply causal reasoning anchored on the TPB12 to develop and examine a model accounted for the constructive effects of financial literacy on financial behavior through the mediator effect of financial risk tolerance. In particular, it suggests that individuals possessing elevated levels of financial risk tolerance can facilitate the transformation of financial literacy in ameliorated financial behavior. Second, by examining the moderating role of emotional intelligence, this study enriches the understanding of the boundary conditions of the financial literacy–behavior link and identifies that individuals possessing superior emotional intelligence are better equipped to control their decision-making process and thus, are more likely to foster financial performance. Last but not least, our projections are amenable to empirical investigation and hence, the study extends enriching insights for practical implications. This is because the role of financial literacy coupled with emotional intelligence allows individual investors to enhance their behavioral tendency through exploiting perceived control over the opportunities. Conceptual framework is presented in Figure 1.

|

Figure 1 Conceptual model. |

The remainder of this study presents hypotheses and theoretical framework development followed by elucidating research methodology and empirical investigation of the findings. This allows the researchers to discuss the results and elaborate implications and recommendations for the future study.

Hypotheses

The Mediating Role of Financial Risk Tolerance

Numerous studies have been carried out within financial consultation and financial planning to explore the determinants of individual financial risk tolerance because of its notable effect on “financial investment decisions”.5,17,18 For instance, some preliminary investigations of the construct have examined the impact of demographic variables (eg, gender, age, income level, wealth level, education level, and marital status), behavioural factors (ie, life satisfaction level, being worried), and cultural factors on financial risk tolerance.19–24 However, only a small sample of studies have investigated the impact of financial literacy on financial risk tolerance.5

Financial literacy is “a person’s ability to understand and use financial concepts”.25 Subsequently, differences exist in financial literacy/knowledge and an individual’s education level.6,26 For instance, a person with higher education level might not possess apposite financial knowledge. In juxtaposition, a person possessing a low education level may have high financial literacy. However, substantial evidence suggests that financial knowledge can predict financial risk-taking behaviours.27–29 Studies within this stream have found a positive association between financial literacy/financial knowledge level and financial risk tolerance.30 Some other well-cited studies have endorsed that positive associations exist between financial literacy and financial risk tolerance.7,8,31,32 On the contrary, few studies have tested and found a negative correlation between financial literacy and financial risk tolerance.6 However, we draw on the TBP and predict that financial literacy offers ample capacity to predict the financial risk tolerance of individual investors. That is to say, financial experts prefer riskier alternatives as compared to people possessing low-risk perceptions, thereby, stimulating positive behavioral beliefs toward the behavior. For instance, Diacon33 found a connection between risk perceptions and financial literacy. Similarly, Wang, Keller, and Siegrist34 found high correlations between ‘knowledge-related scales’ and ‘risk-related scales’. Therefore,

H1: Financial literacy positively correlates with financial risk tolerance.

Subsequently, financial risk tolerance could predict the financial behaviour of individual investors. We predict that financial risk tolerance influences the financial behaviour of individual investors. The TPB purports that positive attitudes elicited due to augmented behavioral beliefs are more likely to culminate into action, ie, elevated financial behavior. Financial risk tolerance implies that risk can be subjective (ie, “an individual prefers to accept”) and objective (ie, “an individual is actually capable of taking it”).35 According to economists, financial risk tolerance primarily reflects an objective function of the risk that an individual is capable of taking,35 thereby leveraging behavioral control on individuals. Thus, individuals with high levels of financial risk tolerance are more capable of taking risky investments than those with low levels of financial risk tolerance.34 This corollary supports our theoretical deduction that financial risk tolerance translates into sophisticated financial behaviour. Several hosts of research in recent years have found a significant association between financial risk tolerance and financial behaviour.10,30,36 Similarly, Jacobs-Lawson and Hershey27 concluded that financial risk tolerance significantly impacts retirement saving behaviours. Therefore,

H2: Financial risk tolerance positively correlates with financial behaviour.

The combination of these hypotheses suggests a mediating role of financial risk tolerance. We predict that financial literacy influences financial behavior through a causal mechanism, ie, (i) direct association between financial literacy and financial behavior, and (ii) indirect relationship between financial literacy and financial behavior, mediated by financial risk tolerance. We anchor on the TPB and project that an individual’s risk perceptions stimulated by financial literacy transform into supreme financial behaviour because of their financial risk tolerance. For instance, Masters37 investigated the impact of financial knowledge on financial risk tolerance. The authors found that individuals with high financial knowledge about investments showed higher risk-taking tendencies than those without knowledge about investments. Similarly, another host of research has identified the impact of financial literacy on financial risk tolerance,29 ultimately leading to enhanced financial behaviour.6 Several studies have proposed a mediating role of financial risk tolerance between “demographic characteristics and financial behaviours”,38 “behavioural biases and investment decisions”,39 “urgency and financial risk-taking behaviours”,40 “financial literacy and investment performance”.41 In short, financial literacy amplifies financial risk tolerance, which ultimately culminates into preeminent financial behaviour. Therefore,

H3a: Financial literacy has a significant association with financial behavior.

H3b: Financial risk tolerance mediates the association between financial literacy and financial behaviour.

Moderator Effect of Emotional Intelligence

We expect the moderator effect of emotional intelligence, which refers to “a set of interrelated abilities possessed by individuals that permit them to accurately understand and use emotional information”.42 Although emotional intelligence has different conceptualisations, “ability-based conceptualization” is widely employed in academic research.43 Ability-based model of emotional intelligence has three dimensions, namely, ‘appraisal and expression of emotion (in self and other)’, ‘regulation of emotion (in self and other)’, and “utilisation of emotion”.43

Given the inevitable role of emotions as an essential component of personal and professional competence, emotional intelligence helps individuals to “effectively participate in multiple contexts and contribute to the overall success of their lives and the proper functioning of the society in general”.44 We further extend the implications of the TPB by hypothesizing the intervening role of emotional intelligence in the underlying linkage. According to Goleman,45 high emotional intelligence enables investors to make better decision-making strategies. That is to say individuals with superior levels of emotional intelligence are more likely to embark on behavioral control that facilitates the transformation of attitude toward behavior, ie, financial risk tolerance. Furthermore, Kunnanatt46 found that individuals with high emotional intelligence have a high chance of winning. Similarly, Dhiman and Raheja47 identified emotional intelligence as an essential skill of individual investors, which enhances the likelihood of financial risk tolerance. The authors drew on insights from Goleman’s45 conceptualisation of emotional intelligence and assessed the impact of emotional intelligence on financial risk tolerance. Their findings revealed that all five dimensions of emotional intelligence significantly influence financial risk tolerance.47 On the contrary, poor decision-making15 and deteriorated financial performance48 can be attributed to low levels of emotional intelligence. A heightened degree of financial knowledge outstretches investors’ financial risk tolerance levels, whereas the emotional intelligence competencies of investors underpin the relationship. That is to say, emotional intelligence allows individual investors to regulate negative emotions provoked due to the perception of making risky investments, vesting them cognitively decisive in managing investment portfolios. Therefore,

H4: Emotional intelligence moderates the relationship between financial literacy and financial risk tolerance such that the association is more pronounced at high levels of emotional intelligence and vice versa.

Based on these arguments, we also propose a moderated mediation such that investors’ emotional intelligence serves as a contingent factor of the indirect effect of financial literacy on investors’ financial behaviour through mediating role of financial risk tolerance. Financial risk tolerance offers more meaningful mechanisms for investors who can draw from emotional intelligence to explain why beliefs about financial literacy might translate into more responsible financial behaviour.6 In recent studies, the authors have confirmed that emotional intelligence affects financial behaviour and that emotional intelligence plays an essential role in increasing financial behaviour.15,16 Hence, anchoring on the TPB, we predict that high levels of emotional intelligence underpin the association between financial literacy and financial behaviour, mediated by financial risk tolerance (and vice versa). Therefore,

H5: Emotional intelligence moderates the relationship between financial literacy and financial behaviour such that the association is more pronounced at high levels of emotional intelligence and vice versa.

Method

Sample and Procedure

We collected time-lagged (ie, three-wave) data from financially independent individual investors from leading educational institutes in Pakistan. We employed a time interval of four weeks between each wave. We collected time-lagged data because the “effects included in the mediation analysis are causal outcomes that span a period of time”49 in order to avoid considerable bias in estimating parameters.50

We collected data through a “non-probability, purposive sampling technique”, which allowed us to get arbitrary responses.51 As the detailed information of the participants was not accessible therefore the study chose purposive sampling technique to gather responses. Several well-recognized prior studies have utilized purposive sampling technique due to its ability to generate arbitrary responses.52–54 Respondents mainly comprised managers, business people, civil servants and retirees, teachers, academics, and public and private sector employees. We distributed questionnaires along with a cover letter to the participants explaining the study’s importance and guaranteeing the confidentiality of their responses. At time 1, we distributed 500 questionnaires to collect data on the respondents’ demographic details, financial literacy, and emotional intelligence. Of these, 457 completely filled questionnaires were returned. In the second wave, we contacted those 457 respondents to gather responses on financial risk tolerance. We received 430 questionnaires, of which 412 could match the original responses. After four weeks, we gathered questionnaires on financial behaviour.

Finally, we consolidated all the responses collected in three waves with the key generated by each participant as per the directives given in the surveys. We requested participants to provide their initials followed by their birth months. Our analysis consisted of 389 completed sets of responses, leaving a response rate of 78%. The sample’s descriptive statistics represent 66% of men and 34% of women participants. Concerning education level, 36% have an undergraduate degree, 43% have a graduate degree, and 21% have a postgraduate degree. Concerning age, 20%, 32%, 28%, and 20% were in the 20–30, 31–40, 41–50, and 51–60 age ranges, respectively. Sixty-five percent of the respondents were married, and 35% were single. Concerning income level (monthly), 18% claimed an income between 30,000 and 50,000, 21% earned between 50,000 and 70,000, 25% claimed between 70,000 and 100,000, 20% responded between 100,000 and 150,000, and 18% claimed above 150,000. The study used these factors as the controlled variables and found that their impacts on the endogenous variables are insignificant.

Measures

We adapted established measures to collect data from the target respondents. Furthermore, the questionnaire was asked in English, as English is the official language and medium of instruction in schools/colleges/universities in Pakistan. Unless otherwise noted, all the items were anchored on a five-point Likert scale, ie, “1 for strongly disagree” and 5 for strongly agree. Detailed questionnaire is presented in Appendix 1.

Financial Literacy

The financial literacy questionnaire was adapted from Thung et al55 and measured on a 4-items scale. The sample items included “I know what inflation and interest rates changes mean” and “I make a price comparison when buying a product or service”.

Emotional Intelligence

The emotional intelligence questionnaire was adapted from Wong and Law42 and measured on a 16-items scale. The sample items included “I have a good sense of why I have certain feelings most of the time” and “I am a good observer of others’ emotions”.

Financial Risk Tolerance

The financial risk tolerance questionnaire was adapted from Grable and Lytton56 and measured on a 13-items scale. The sample items included “in general, how would your best friend describe you as a risk taker”? And “in terms of experience, how comfortable are you investing in stocks or stock mutual funds?”.

Financial Behaviour

The financial behaviour questionnaire was adapted from Dew and Xiao57 and measured on an 8-items scale. The sample items included “I keep my expenditures under control” and “before big purchases, I analyse my financial situation”.

Control Variables

Following the previous studi es, individual demographics,23 such as age, gender, education level, income level, and marital status, were taken as controlled variables (Table 1).

|

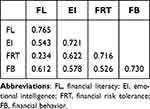

Table 1 Validity and Reliability for Constructs |

Data Analysis

The study analysed data using “partial least square structural equation modelling” (PLS-SEM) through SmartPLS (v 3.3.3). We justify the use of PLS-SEM over CB-SEM based on the following reasons: first, the study’s objective is to assess the ‘predictive capability’ of the structural paths, ie, “to maximise explained variance in the latent endogenous variables rather than theory confirmation”.58 Besides, the study assessed a complex moderated mediation model, ie, in addition to estimating the main effects, the study also assessed the moderator effect of emotional intelligence (Henseler & Fassoott, 2010).59 In light of the recommendations of Hair et al58 we utilized SmartPLS to assess the measurement model and the structural model by employing PLS algorithm and bias-corrected and accelerated (BCa) bootstrapping technique. The subsequent section presents the results of the analysis.

Results

Measurement Model

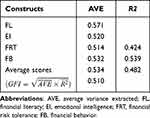

The study assessed the “measurement model” using “internal consistency”, and “convergent” and “discriminant” validity criteria.58 For evaluating ‘internal consistency’, in addition to the ‘Cronbach’s alpha’, the study measured the “composite reliability” (CR) of constructs, as recommended by Hair et al58 Table 1 indicates that all the values of ‘Cronbach’s alpha’ and CR are above the minimum acceptable value of 0.6 and 0.7,59 thus, providing evidence of ‘internal consistency’. For the ‘convergent validity’, the authors evaluated ‘outer loadings’ and AVE with the acceptable minimum threshold of 0.5 (Henseler et al, 2009).60,61 Results of the analysis show that all the values are above the minimum acceptable threshold, hence, ensuring the “convergent validity” of the study. The following items were dropped due to poor loadings (EI5, EI11, FRT8, and FB9).

|

Table 2 Fornell-Larcker Criterion |

In addition, the study assessed the “discriminant validity” that reflects the degree to which a latent variable empirically differs from other latent variables.58 For assessing discriminant validity, the study examined the Fornell-Larcker criterion and heterotrait-monotrait (HTMT) ratio.58 Table 2 shows the results of Fornell-Larcker, the square root of AVE in the construct correlation matrix, and specifies that square root values are higher for the own construct than the related inter-construct correlations. In addition, the HTMT ratio was assessed using the “bias-corrected and accelerated” (BCa) bootstrapping technique, using a resample of 5000 by employing a one-tailed t-test with a 90% significance level (in order to warrant an error probability of 95%). Table 3 presents the HTMT ratio; all the values are below the maximum threshold of HTMT.90, thus, ensuring the discriminant validity of the study.

|

Table 3 Heterotrait-Monotrait (HTMT) Ratio |

Structural Model

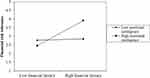

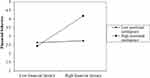

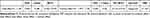

Further, we evaluated the “structural model” by analysing the path analysis to examine the study’s hypotheses. The study utilised a “non-parametric” bootstrapping procedure to get the β and corresponding t-values. In addition to the “path coefficients”, we also assessed the structural model by employing the following criteria, such as “coefficient of determination” (R2), “predictive relevance” (Q2), and the “effect sizes” (f2). The value of “cross-validated redundancy” above 0 indicates the “predictive capability” of the model. In addition, we reported the effect sizes to ensure the “predictive accuracy” of the model. The results of the structural model are presented in Table 4 and SEM is shown in Figure 2. The analysis indicates that financial literacy positively correlates with financial risk tolerance (β = 0.384, t = 5.071, p = 0.001, f2 = 0.219), supporting H1. Besides, financial risk tolerance significantly impacts financial behaviour (β = 0.463, t = 13.905, p = 0.000, f2 = 0.318), supporting H2.

|

Table 4 Effects on Endogenous Variables |

|

Figure 2 Structural equation model. |

Moreover, consistent with the recommendations of Hair et al,58 the study employed a two-stage approach to examine the moderating effect. According to Henseler and Fassott,59 the two-stage approach “exhibits a high level of statistical power” as compared to the orthogonal or product indicator approach. We measured the moderator effect size using the BCa bootstrapping approach with a resample of 5000. Table 4 shows that the interaction term (financial literacy_emotional intelligence) has a significant positive impact on financial risk tolerance (β = 0.346, t = 11.839, p = 0.000, f2 = 0.156), with medium effect size; and financial behaviour (β = 0.412, t = 12.728, p = 0.000, f2 = 0.219), with medium effect size, supporting H4 and H5.

Further, in line with Dawson’s62 recommendations, we plotted a simple slope analysis to understand the interaction effect of financial literacy_emotional intelligence on financial risk tolerance and financial behaviour (shown in Figures 3 and 4). The simple slope analysis illustrates that at high levels of emotional intelligence, the direct association between financial literacy and financial risk tolerance and the indirect relationship between financial literacy and financial behaviour, mediated by financial risk tolerance, is more robust than at low levels of emotional intelligence.

|

Figure 3 Moderating effect (1). |

|

Figure 4 Moderating effect (2). |

In addition, we also predicted the mediating role of financial risk tolerance in the relationship between financial literacy and financial behaviour. In order to evaluate the mediation analysis, we adopted Zhao et al’s mediation approach.63 We obtained point estimates of the indirect effect using the BCa bootstrapping technique with a 5000 resample.58 Table 5 shows that the direct effect of financial literacy on financial behaviour is significant, with 95% CIs (0.202, 0.410) and the indirect effect of financial literacy on financial behaviour through the mediating role of financial risk tolerance is significant, with 95% CIs (0.124, 0.318), indicating complementary mediation (Table 6). In addition, we also assess “variance accounted for” (VAF) to assess the mediation analysis. VAF value of 57.14% indicates that financial risk tolerance partially mediates the relationship between financial literacy and financial behaviour, supporting H3.

|

Table 5 Summary of Mediating Effect Tests |

Furthermore, the study also measured the “goodness-of-fit index” (GFI) using Tenenhaus et al’s (2005) diagnostic tool.64 The authors defined GFI as ‘the geometric mean of the average communality and average R2’. GFI results are shown in Table 6 with a value of 0.510, more significant than the cutoff value of 0.36 for a large effect size of R2, ensuring a good model fit.65 Finally, we also examined Stone-Geisser’s Q2 with an “omission distance” of 5. The analysis produced a value significantly greater than 0, thus establishing the model’s “predictive relevance”.

|

Table 6 Goodness-of-Fit Index (GFI) |

Discussion and Conclusion

The objective of the current study was to investigate the impact of financial literacy on the financial behaviour of individual investors mediated by financial risk tolerance. In addition, the study also explores the boundary effects of emotional intelligence in the direct relationship between financial literacy and financial risk tolerance and the indirect effect between financial literacy and financial behaviour through the mediating role of financial risk tolerance. The study collected time-lagged data from financially independent individual investors in Pakistan for empirical evidence. The study’s findings support the following projections:

The study demonstrated that H1, which states that “financial literacy” has a significant positive influence on financial risk tolerance, is supported. The results of this study advance existing research on financial literacy,5,66,67 by projecting that financial literacy stimulates financial risk tolerance of investors, allowing them to make more robust and sound financial decisions. The results of this analysis are in harmony with previous studies.5 Similarly, the second hypothesis states that “financial risk tolerance has a significant positive association with financial behavior”. Our findings support this hypothesis and expand the implications of TPB12 by hypothesizing financial risk tolerance as the key determinant of behavior by inducing behavioral control in individuals. Furthermore, our third hypotheses state that (a) financial literacy has a significant positive relationship with financial behavior, and (b) financial risk tolerance mediates the relationship between financial literacy and financial behaviour. By investigating financial risk tolerance as the mediating mechanism, our study attempts to bridge the omission in the direct link between financial literacy and financial behavior,66,67 which turn out to be our unique contribution in this study. We come back to its theoretical implications in the subsequent section. Our next hypotheses state that emotional intelligence moderates the underlying associations such that (H4) the relationship between financial literacy and financial risk tolerance, and (H5) financial literacy and financial behaviour, mediated by financial risk tolerance, are more potent at higher levels of emotional intelligence and vice versa. By investigating the moderating role of emotional intelligence we outstretch the boundary conditions of the financial literacy–behavior nexus. Our analyses are in line with the previous studies which found the significant moderating role of emotional intelligence in the related contexts.68,69 The subsequent section presents theoretical and managerial implications.

Theoretical Implications

The study presents several critical theoretical implications to the existing body of knowledge. First, the study contributes meaningfully to the behavioural finance literature. Most earlier scientific inquiries encapsulated classical finance theories to predict financial decision-making. However, the importance of conventional finance is of paramount importance for research in financial management. However, a paradigm shift has been witnessed for the past few decades in the financial literature that builds on behavioural finance due to the “inability of classical finance to solve financial behaviours and market abnormalities faced by individuals”.5 In this regard, the present study addresses the call of Mutlu and Özer5 to investigate the impact of financial literacy on financial behaviour through the mediating role of financial risk tolerance. This turns out to be our second contribution to the extant literature. To the best of the authors’ knowledge, this is the first study investigating the mediating role of financial risk tolerance in the relationship between financial literacy and financial behaviour. For instance, prior research has investigated the mediating role of family financial socialisation,66 financial perceptions (Dewi et al, 2020),70 and attitude toward money in the relationship between financial literacy and financial behaviour.67

Drawing on the TPB, we hypothesised and tested a hitherto unexplored causal mechanism, financial risk tolerance, in the relationship between financial literacy and financial behaviour. We argue the expectancy-value formulation guides a path that provokes behavioral beliefs, which underpins behavioral controls and translate one’s attitude, ie, financial risk tolerance into behavior, ie, financial behavior. We anticipated that knowledge of financial concepts is of absolute importance that stimulates an individual’s financial behaviour as this information offers valuable insights into making financial decisions. A massive stream of research has linked financial literature as a predictor of financial behaviour.29,34,67,70 At the same time, a lack of financial literacy may leave individuals helplessly indecisive.16 This is because individuals who lack adequate financial literacy cannot evaluate investment alternatives and, hence, manifest reluctance to risky investments. Thus, the fear embedded in financial risk deleteriously affects their financial behaviours. On the contrary, individuals who capitalise on financial literacy are more likely to expand their financial risk tolerance and ultimately develop sound financial behaviour.

Third, the study investigates the boundary effects of emotional intelligence in the underlying linkage. We examined emotional intelligence in response to the call of Mutlu and Özer5 to study individual psychological factors that influence the relationship between financial literacy and financial behaviour, mediated by financial risk tolerance. Researchers have recently started scrutinising emotional intelligence in the behavioural finance literature.47 We projected that financial emotional intelligence synthesis gives rise to the ability to assess the range of possibilities and optimise decision-making. As predicted, emotional intelligence significantly moderates the direct relationship between financial literacy and financial risk tolerance and the indirect relationship between financial literacy and financial behaviour through the mediating role of financial risk tolerance.

Practical Implications

Although there is a preponderance of research on classical finance,5 empirical research on behavioural finance, particularly capturing emotional intelligence to predict financial behaviour is scant, this makes our research all the more salient. The findings of this research suggest that financial literacy could be a crucial determinant of financial behaviour by exaggerating financial risk tolerance. Apposite knowledge of financial concepts translates into reasonable financial decisions that impact the financial well-being of individuals. Burgeoning international interest in enhancing the financial awareness levels of individuals has enhanced the significance of financial literacy. The robustness of individuals through financial decision-making skills and correct investment preferences elevate financial training, planning, spending, retirement planning, and control and saving behaviours. Development in information and communication technologies and globalization leverage easy access to financial information. At this point, expanding the ability to assess, interpret, and apply information is imperative. Hence, the transformation of financial behaviour through access and exploitation of financial resources is fundamental. This study is helpful for investors to better comprehend their financial behaviour by considering factors that influence their ability to make accurate financial decisions. In addition, the findings of this research extend insights to financial institutions who want to have detailed information about investor profiles and trends in the financial markets. Moreover, this research is also essential in offering insights into psychological and cognitive factors that broadly impact the financial decision-making of investors. Besides, the findings of this study extend support to the policymakers to protect investors from the financial crisis by emphasizing the importance of emotional intelligence as a sine-qua-non ability that enhances investors’ financial wisdom and well-being. Furthermore, as discussed above, a fragment of literature has found a negative correlation between financial literacy and financial behaviour.6 Thus, employing emotional intelligence as an individual factor will help investors optimise the utility of financial literacy in increasing financial risk tolerance that culminates into sound financial behaviour.

Limitations and Suggestions

The findings of this study present valuable insights into the association between financial literacy, emotional intelligence, financial risk tolerance, and financial behaviour. However, these findings should be studied with certain limitations. First, the study employed a subjective scale to measure financial literacy. However, future studies should measure subjective and objective statements to understand the phenomenon better. Second, the study measured the mediating role of financial risk tolerance and found the partial mediating role of financial risk tolerance in the relationship between financial literacy and financial behaviour. This warrants future studies examining other mediating variables that might underpin the relationship. Last but not least, the study assessed the moderating role of emotional intelligence; future research should examine the boundary effects of other psychological factors to examine the underlying linkage.

Ethical Standards

This study adheres to the guidelines of the ethical review process of the associated universities and approved by the ethics committees of these universities: Suzhou Industrial Park Institute of Services Outsourcing, China; China Jiliang University, China; The University of Faisalabad, Pakistan; and Zhejiang University of Technology, China. Further, respondents’ consent was also sought for their participation in this study.

Acknowledgment

This research will not be possible without the contributions of all the co-authors, support of institutions, active role of participants, constructive feedback of reviewers, and editors. We are indebted to all the supporting members of this research.

Author Contributions

All authors made a significant contribution to the work reported, whether that is in the conception, study design, execution, acquisition of data, analysis and interpretation, or in all these areas; took part in drafting, revising or critically reviewing the article; gave final approval of the version to be published; have agreed on the journal to which the article has been submitted; and agree to be accountable for all aspects of the work.

Funding

National key project of the 14th Five-Year Plan for Education and Scientific Research of the Ministry of Education of China in 2022; Research on high quality Employment in Vocational Colleges from the perspective of Huang Yanpei’s vocational Education theory (JKY14927); “Qinglan Project” Supported by Jiangsu Department of Education for Young and Middle-aged Academic Leaders (Su Teacher Letter [2022] No. 29).

Disclosure

The authors declare that there is no conflicts of interest regarding the publication of this article.

References

1. Irwin CE

2. Fisher PJ, Yao R. Gender differences in financial risk tolerance. J Econ Psy. 2017;61:191–202. doi:10.1016/j.joep.2017.03.006

3. Rabbani AG, Yao Z, Wang C. Does personality predict financial risk tolerance of pre-retiree baby boomers? J Behav Exp Fin. 2019;23:124–132. doi:10.1016/j.jbef.2019.06.001

4. Rahman M. Propensity toward financial risk tolerance: an analysis using behavioural factors. Rev Behav Fin. 2019;12(3):259–281. doi:10.1108/RBF-01-2019-0002

5. Mutlu U, Özer G. The moderator effect of financial literacy on the relationship between locus of control and financial behavior. Kyb. 2021;51(3):1114–1126. doi:10.1108/K-01-2021-0062

6. Aydemir SD, Aren S. Do the effects of individual factors on financial risk-taking behavior diversify with financial literacy? Kyb. 2017;46(10):1706–1734. doi:10.1108/K-10-2016-0281

7. Bannier CE, Neubert M. Gender differences in financial risk taking: the role of financial literacy and risk tolerance. Econ Lett. 2016;145:130–135. doi:10.1016/j.econlet.2016.05.033

8. Bayar Y, Sezgin HF, Öztürk ÖF, Şaşmaz MÜ. Financial Literacy and Financial Risk Tolerance of Individual Investors: multinomial Logistic Regression Approach. Sage Open. 2020;10(3):2158244020945717. doi:10.1177/2158244020945717

9. Austin P, Arnott-Hill E. Financial literacy interventions: evaluating the impact and scope of financial literacy programs on savings, retirement, and investment. J Soc Polit Econ Stud. 2014;39(3):290–314.

10. Pinjisakikool T. The influence of personality traits on households’ financial risk tolerance and financial behaviour. J Interdisciplin Econ. 2018;30(1):32–54. doi:10.1177/0260107917731034

11. Ajzen I. The theory of planned behavior. Organ Behav Hum Decis Process. 1991;50(2):179–211. doi:10.1016/0749-5978(91)90020-T

12. Ajzen I. The theory of planned behavior: frequently asked questions. Hum Behav Emerg Technol. 2020;2(4):314–324. doi:10.1002/hbe2.195

13. Nwagwu U. A SWOT Analysis on the Use of Blockchain in Supply Chains. Masters Dissertation; 2015.

14. Nwagwu U. Impact of COVID-19 on the supply chain of the food industry: a literature analysis. Int J Adv Res Stat, Manag Fin. 2021;8(2):37–44.

15. Bouzguenda K. Emotional intelligence and financial decision making: are we talking about a paradigmatic shift or a change in practices? Res Inter Bus Fin. 2018;44:273–284. doi:10.1016/j.ribaf.2017.07.096

16. Sullivan RN. Deploying financial emotional intelligence. Financial Analysts Journal. 2011;67(6):4–10. doi:10.2469/faj.v67.n6.6

17. Shah NH, Khalid W, Khan S, et al. An empirical analysis of financial risk tolerance and demographic factors of business graduates in Pakistan. Inter J Econ Fin Iss. 2020;10(4):220.

18. Zeb R, Shah NH, Arif M. Fostering the social capital: the effect of financial risk tolerance and family income on entrepreneurial intention in higher education sector of District Swabi. Glob Econ Rev. 2021;VI.

19. Anbar A, Melek E. An empirical investigation for determining of the relation between personal financial risk tolerance and demographic characteristic. Ege Acad Rev. 2020;10(2):503–522.

20. Grable JE, Joo SH. Environmental and biophysical factors associated with financial risk tolerance. J Fin Counsel Plan. 2004;15(1):73–82.

21. Kannadhasan M. Retail investors’ financial risk tolerance and their risk-taking behaviour: the role of demographics as differentiating and classifying factors. IIMB Manag Rev. 2015;27(3):175–184. doi:10.1016/j.iimb.2015.06.004

22. Larkin C, Lucey BM, Mulholland M. Risk tolerance and demographic characteristics: preliminary Irish evidence. Financial Services Rev. 2013;22(1):548.

23. Sulaiman EK. An empirical analysis of financial risk tolerance and demographic features of individual investors. Proc Econ Fin. 2012;2:109–115.

24. Thanki H, Baser N. Interactive impact of demographic variables and personality type on risk tolerance. Emerg Econ Stud. 2019;5(1):42–54.

25. Servon LJ, Kaestner R. Consumer financial literacy and the impact of online banking on the financial behavior of lower‐income bank customers. J Con Affair. 2008;42(2):271–305. doi:10.1111/j.1745-6606.2008.00108.x

26. Khan MD, Waqas M, Arif M, Shah NH. Impact of Personality Traits on Investment Behavior: the Moderating Role of Financial Literacy. J Finance Economics Res. 2020;1–14.

27. Jacobs-Lawson JM, Hershey DA. Influence of future time perspective, financial knowledge, and financial risk tolerance on retirement saving behaviors. Fin Ser Rev. 2005;14(4):331.

28. Tang N, Baker A. Self-esteem, financial knowledge and financial behavior. J Econ Psy. 2016;54:164–176. doi:10.1016/j.joep.2016.04.005

29. Wang A. Interplay of investors’ financial knowledge and risk taking. J Behav Fin. 2009;10(4):204–213. doi:10.1080/15427560903369292

30. Saurabh K, Nandan T. Role of financial knowledge, financial socialisation and financial risk attitude in financial satisfaction of Indian individuals. Inter J Ind Cul Bus Manag. 2019;18(1):104–122.

31. Chatterjee S, Fan L, Jacobs B, Haas R. Risk tolerance and goals-based savings behavior of households: the role of financial literacy. J Person Fin. 2017;1:548.

32. Yong HNA, Tan KL. The influence of financial literacy towards risk tolerance. Inter J Bus Soc. 2017;18(3):469–484. doi:10.33736/ijbs.3139.2017

33. Diacon S. Investment risk perceptions: do consumers and advisers agree? Int J Bank Marketing. 2004;22(3):180–199. doi:10.1108/02652320410530304

34. Wang M, Keller C, Siegrist M. The less You know, the more You are afraid of—A survey on risk perceptions of investment products. J Behav Fin. 2011;12(1):9–19. doi:10.1080/15427560.2011.548760

35. Van de Venter G, Michayluk D, Davey G. A longitudinal study of financial risk tolerance. J Econ Psy. 2012;33(4):794–800. doi:10.1016/j.joep.2012.03.001

36. Kubilay B, Bayrakdaroglu A. An empirical research on investor biases in financial decision-making, financial risk tolerance and financial personality. Inter J Fin Res. 2016;7(2):171–182.

37. Masters R. STUDY EXAMINES INVESTORS’RISK-TAKING PROPENSITIES. J Fin Plan. 1989;2(3):658.

38. Heo W, Nobre LHN, Grable JE, Ruiz-Menjivar J. What role does financial risk tolerance play in mediating investing behavior? J Fin Ser Prof. 2016;70(5):42–52.

39. Raheja S, Dhiman B. Relationship between behavioral biases and investment decisions: the mediating role of risk tolerance. DLSU Bus Econ Rev. 2019;29(1):31–39.

40. Hemrajani P, Sharma SK. Influence of urgency on financial risk-taking behavior of individual investors: the role of financial risk tolerance as a mediating factor. IUP J App Fin. 2018;24(1):30–43.

41. Kanagasabai B, Aggarwal V. The Mediating Role of Risk Tolerance in the Relationship between Financial Literacy and Investment Performance. Colombo Bus J. 2020;11(1):83–104.

42. Wong CS, Law KS. Wong and Law Emotional Intelligence Scale. Lead Quar. 2002. doi:10.1037/t07398-000

43. Salovey P, Mayer JD. Emotional intelligence. Imagin, Cog Person. 1989;9(3):185–211. doi:10.2190/DUGG-P24E-52WK-6CDG

44. Gendron B. Quelles compétences émotionnelles du leadership éthique, de l’enseignant au manager, pour une dynamique de réussite et de socialisation professionnelle. Actes du colloque. 2007;7(8):325.

45. Goleman D. The socially intelligent. Educ Lead. 2006;64(1):76–81.

46. Kunnanatt JT. Emotional intelligence: the new science of interpersonal effectiveness. Hum Res Dev Quar. 2004;15(4):489. doi:10.1002/hrdq.1117

47. Dhiman RS. Do personality traits and emotional intelligence of investors determine their risk tolerance? Manag Lab Stud. 2018;43(1–2):88–99. doi:10.1177/0258042X17745184

48. Ameriks J, Wranik T, Salovey P, et al. Emotional Intelligence and Investor Behavior. Charlottesville, VA: Research Foundation of CFA Institute; 2009.

49. Maxwell SE, Cole DA. Bias in cross-sectional analyses of longitudinal mediation. Psychol Methods. 2007;12(1):23. doi:10.1037/1082-989X.12.1.23

50. Cole DA, Maxwell SE. Testing mediational models with longitudinal data: questions and tips in the use of structural equation modeling. J Abnorm Psy. 2003;112(4):558. doi:10.1037/0021-843X.112.4.558

51. Saunders M, Lewis P, Thornhill A. Research Methods for Business Students. Pearson education; 2009.

52. Hassan MU, Ayub A. Women’s experience of perceived uncertainty: insights from emotional intelligence. Gender Manag. 2019;34(5):366–383. doi:10.1108/GM-02-2019-0016

53. Sahabuddin M, Qingmei T, Ayub A, et al. Workplace ostracism and employee silence: an identity-based perspective. Kyb. 2021. doi:10.1108/K-04-2021-0306

54. Yao L, Ayub A, Ishaq M, et al. Workplace ostracism and employee silence in service organizations: the moderating role of negative reciprocity beliefs. Inter J Man. 2022;43(6):1378–1404. doi:10.1108/IJM-04-2021-0261

55. Thung CM, Kai CY, Nie FS, et al. Determinants of saving behaviour among the university students in Malaysia. RMP TIG3 Conferences. 2012;15–126.

56. Grable J, Lytton R. Assessing financial risk tolerance: do demographic, socioeconomic, and attitudinal factors work. Fam Rel Hum Dev. 1999;3(1):80–88.

57. Dew J, Xiao JJ. The financial management behavior scale: development and validation. J Fin Couns Plan. 2011;22(1):43–59.

58. Hair JF, Sarstedt M, Ringle CM, Gudergan SP. Advanced Issues in Partial Least Squares Structural Equation Modeling. Sage publications; 2017.

59. Henseler J, Fassot G. Testing moderating effects in PLS models: an illustration of available procedures. In: Vinzi VE, Chin WW, Henseler J, Wang H, editors. Handbook of Partial Least Squares: Concepts, Methods and Applications in Marketing and Related Fields. Springer; 2010:195–218.

60. Henseler J, Ringle CM, Sinkovics RR. The use of partial least squares path modeling in international marketing. In: New Challenges to International Marketing. Emerald Group Publishing Limited; 2009.

61. Henseler J, Ringle CM, Sarstedt M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Market Sci. 2015;43(1):115–135. doi:10.1007/s11747-014-0403-8

62. Dawson JF. Moderation in management research: what, why, when, and how. J Bus Psychol. 2014;29(1):1–19. doi:10.1007/s10869-013-9308-7

63. Zhao X, Lynch JG, Chen Q. Reconsidering Baron and Kenny: myths and truths about mediation analysis. J Con Res. 2010;37(2):197–206. doi:10.1086/651257

64. Tenenhaus M, Vinzi VE, Chatelin YM, Lauro C. PLS path modeling. Comput Stat Data Analys. 2005;48(1):159–205. doi:10.1016/j.csda.2004.03.005

65. Hoffmann A, Birnbrich C. The impact of fraud prevention on bank-customer relationships: an empirical investigation in retail banking. Inter J Bank Market. 2012;30(5):390–407. doi:10.1108/02652321211247435

66. Khawar S, Sarwar A. Financial literacy and financial behavior with the mediating effect of family financial socialisation in the financial institutions of Lahore, Pakistan. Fut Bus J. 2021;7(1):1–11.

67. Susilowati N, Kardiyem K, Latifah L. The Mediating Role of Attitude Toward Money on Students’ Financial Literacy and Financial Behavior. J Account Bus Edu. 2020;4(2):58–68.

68. Asad ASS, Yezhuang T, Muhammad SA, et al. Fear of terror and psychological well-being: the moderating role of emotional intelligence. Int J Environ Res Public Health. 2018;15(11):2554. doi:10.3390/ijerph15112554

69. Ayub A, Sultana F, Iqbal S, et al. Coping with workplace ostracism through ability-based emotional intelligence. J Organ Chang Manag. 2021;34(5):969–989. doi:10.1108/JOCM-11-2020-0359

70. Dewi VI, Febrian E, Effendi N, Anwar M. Does financial perception mediating the financial literacy on financial behavior? A study of academic community in central Java Island, Indonesia. Mont J Econ. 2020;16(2):33–48.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.