Back to Journals » Risk Management and Healthcare Policy » Volume 16

Research on the Operational Efficiency of Basic Medical Insurance for Urban Employees in China–Based on Three-Stage DEA Model

Authors Peng N , Guo H, Wu Y, Liu P

Received 5 September 2023

Accepted for publication 5 December 2023

Published 18 December 2023 Volume 2023:16 Pages 2783—2803

DOI https://doi.org/10.2147/RMHP.S438721

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Haiyan Qu

Nan Peng,* Hanyang Guo,* You Wu, Pengcheng Liu

School of International Pharmaceutical Business, China Pharmaceutical University, Nanjing, Jiangsu, People’s Republic of China

*These authors contributed equally to this work

Correspondence: Pengcheng Liu, School of International Pharmaceutical Business, China Pharmaceutical University, Nanjing, Jiangsu, People’s Republic of China, Tel +86 13851619607, Email [email protected]

Purpose: To conduct a three-stage data envelopment analysis (DEA) of the operational efficiency of urban employee basic medical insurance (UEBMI) across 31 provinces in China from 2012 to 2021.

Methods: Utilized a three-stage DEA model, this study measured and evaluated the operational efficiency of urban employee basic medical insurance within China’s 31 provinces.

Results: The operational efficiency of urban employee basic medical insurance in China was notably low, displaying significant disparities across different regions and periods. Substantial room for improvement exists. Environmental factors, including urbanization level and unemployment rate, wielded a pronounced influence on the operational efficiency of China’s employee medical insurance. Conversely, the fiscal revenue and expenditure ratio hindered the enhancement of employee medical insurance efficiency.

Conclusion: This study held valuable insights for enhancing the operational efficiency of China’s urban employee basic medical insurance. To effectively improve insurance efficiency, the following recommendations are put forth: firstly, relevant departments should escalate resource investments and optimize resource utilization based on rational allocation; secondly, enhance legislation and regulations, fortify fund oversight, and ensure equitable and judicious utilization of the medical insurance fund; finally, leveraging modern high-tech advancements can comprehensively elevate the operational efficiency of the employee medical insurance fund. Ultimately, with the advent of cutting-edge technology, the operational efficiency of employee medical insurance fund can be comprehensively elevated.

Keywords: three-stage DEA, urban employee basic medical insurance, medical insurance fund, operational efficiency, technical efficiency

Introduction

The Chinese Government has proposed the enhancement of a multi-level social medical insurance system that encompasses the entire population, and integrates both urban and rural areas, ensuring fairness, uniformity, safety, standardization, and sustainability.1 Currently, China’s basic medical insurance system comprises two primary components: the basic medical insurance for urban employees and the medical insurance for urban and rural residents. As a pivotal component of China’s social security framework, urban employee medical insurance directly impacts the well-being of urban employees and the overall stability of society. Simultaneously, serving as the most well-established and comprehensive facet of China’s insurance landscape, the basic medical insurance system for urban employees has undergone varying degrees of reform since its inception. However, the primary focus of these endeavors has consistently revolved around optimizing the efficient utilization of the medical insurance fund.2

By the end of 2021, the count of participants in employees’ medical insurance surpassed 350 million, constituting around 25% of the total population covered by national medical insurance. The revenue of the employees’ medical insurance fund, inclusive of maternity insurance, exceeded 1.9 trillion yuan, with expenditures surpassing 1.4 trillion yuan. These numbers accounted for 66.15% and 61.33% of the total income and expenditure of the national medical insurance fund, respectively.3 With the expansion of medical insurance coverage and the growth in fund size, challenges and issues in managing and operating such a substantial volume of medical insurance fund have progressively surfaced. Concurrently, the outbreak of the new COVID-19 pandemic has further thrust the topic of medical insurance into the public spotlight.4 Hence, investigating the operational efficiency of the basic medical insurance fund for urban employees in China holds profound significance.

This study undertakes an analysis and assessment of the operational efficiency of the basic medical insurance fund for urban employees across 31 provinces in China. This investigation relies on China’s inter-provincial panel data spanning the years 2012 to 2021 and employs a three-stage DEA model. The primary focus of this paper centers around addressing two key inquiries: firstly, what is the operational efficiency of China’s urban employee basic medical insurance fund? Secondly, how do environmental factors, including the political economy, influence the operational efficiency of the medical insurance fund?

The research contributions of this paper are threefold. Firstly, while some scholars have delved into urban employee medical insurance, there remains a dearth of comprehensive exploration regarding the overall operational efficiency of China’s urban employee medical insurance fund.2,5–10 Secondly, although several researchers have employed the three-stage DEA methodology to gauge the operational efficiency of China’s urban and rural basic medical insurance, its basic pension insurance, and urban employees basic pension insurance, a unique gap exists wherein China’s urban employee basic medical insurance has not yet been studied using this approach.11–13 This paper pioneers the adoption of the three-stage data envelopment analysis method to scrutinize the operational efficiency of China’s urban employee basic medical insurance fund. Lastly, this paper extends its analysis to encompass the influence of political economy and other environmental factors on the operational efficiency of the employee medical insurance fund. On one hand, this study fills a gap in the research on the operational efficiency of China’s urban employee basic medical insurance by expanding the application of the three-stage DEA model in the area of health insurance efficiency assessment. This holds substantial theoretical significance. On the other hand, it furnishes pragmatic guidance and recommendations for governmental entities aiming to enhance medical insurance operational efficiency and propel the advancement of medical insurance overall, thus boasting practical significance.

Literature Review

Efficiency Analysis of Insurance Using DEA Modeling

Objectively and scientifically assessing the operational efficiency of basic medical insurance constitutes a fundamental approach to elevating the service quality of such insurance.6 Several scholars have already employed DEA to gauge insurance operational efficiency.

For instance, Liu et al measured and analyzed the operational efficiency of basic medical insurance for urban and rural residents across 31 provinces using a three-stage DEA model based on Chinese inter-provincial panel data from 2017 to 2020. Their findings revealed that the overall operational efficiency of China’s urban and rural basic medical insurance remains modest, and still evolving. Additionally, GDP and social security and employment expenditure, two environmental variables, exert a positive influence on the operation of basic medical insurance, whereas the fiscal revenue and expenditure ratio negatively affects its operation.6 Song et al utilizing data spanning 2004–2014, investigated the efficiency of the New Rural Cooperative through two-stage DEA and DEA-Malmquist methods. Their study unveiled that the first stage’s efficiency lagged the second stage, and overall efficiency was moderate. This discrepancy between stages was primarily attributed to technological advancement.7 Li et al scrutinized the expenditure efficiency of basic pension insurance for urban employees across 31 provinces using a three-stage DEA model and inter-provincial panel data from 2016 to 2020. The study revealed that the current expenditure efficiency level of employee’s basic endowment insurance fund remained suboptimal, allowing room for enhancement. Fiscal autonomy, old-age dependency ratio, and fund expenditure efficiency displayed negative correlations, while urbanization level, marketization level, and fund expenditure efficiency exhibited positive correlations.8 Hu et al drawing on China’s inter-provincial panel data from 2007 to 2016, explored the efficiency of social security expenditure across the country’s 31 provinces via a three-stage DEA model. Their findings indicated that China’s overall social security expenditure efficiency remained limited, influenced by environmental factors.9 Li et al utilizing data from 2014 to 2019, assessed the operational efficiency of basic pension insurance across 31 provinces using a three-stage DEA model. The study revealed a generally high operational efficiency of basic pension insurance in China, yet identified room for advancement. Moreover, three environmental variables—GDP, urbanization level, and government public expenditure scale—positively impacted regional basic pension insurance operational efficiency, whereas the old-age dependency ratio exerted a negative impact on efficiency.10

Impact of Income and Expenditure on the UEBMI Fund

Numerous factors can influence the income and expenditure of the urban employee basic medical insurance fund. Conducting research into the income and expenditure of the employee medical insurance fund and exploring its influencing factors will contribute to enhancing the operational efficiency of China’s urban employee basic medical insurance. Concerning the determinants of income and expenditure in the urban employee basic medical insurance fund, several scholars have undertaken a series of investigations.

Zheng et al delved into the impact of industrial structure upgrading on the income and expenditure of the urban employee basic medical insurance fund. Their analysis involved constructing a panel regression model founded on China’s provincial panel data spanning 2007 to 2018. Their findings indicated that the amalgamation of industrial structure upgrading with tertiary industry’s internal progression positively affects the income and expenditure of the urban employee basic medical insurance fund. Conversely, mere upgrading within the tertiary industry held no bearing on the fund’s income and expenditure.2 Xie et al explored the ramifications of China’s transition from a selective two-child policy to a universal two-child policy on the equilibrium of the urban employee basic medical insurance fund. Drawing from data sourced from China’s 2013 and 2015 surveys, they harnessed Poisson logarithmic bilinear models, bilinear Leslie matrices, coefficient adjustment estimation, and actuarial modeling. The study demonstrated that this policy shift led to a decrease in the fund’s current balance deficit for urban employees, ultimately resulting in a surplus.11 Yu et al predicted the prospective trajectory of Shanghai’s employee basic medical insurance fund while scrutinizing the influence of non-demographic and demographic factors on the fund’s sustainability. Constructing an actuarial model within the context of an aging population and substantial medical insurance expenditure escalation, they found that Shanghai’s employee basic medical insurance fund could achieve sustainable operation over the next 15 years. Notably, a lower growth rate of per capita medical expenses attributed to non-demographic factors correlated with better sustainable fund operation.5

To summarize, existing research on the operational efficiency of the urban employee basic medical insurance fund predominantly centers around two focal points: firstly, investigating factors influencing operational efficiency through the establishment of regression models; and secondly, prognosticating income and expenditure in China’s urban employee medical insurance fund while exploring the fund’s operational sustainability through the creation of actuarial models. However, research on measuring operational efficiency at the micro level is still lacking, and applying the three-stage DEA model to analyze the operational efficiency of the basic medical insurance fund for urban employees represents a significant area for future research.10 Consequently, this study adopted the three-stage DEA model to assess and analyze the operational efficiency of China’s urban employee basic medical insurance fund spanning the years 2012 to 2021.

Materials and Methods

There are two primary categories of general efficiency measurement methodologies: the first category is parametric, encompassing techniques like the stochastic frontier method, least squares method, and free distribution method. The second category is non-parametric, including approaches such as the data envelopment analysis method and the price index method.6 DEA was initially introduced by Charms et al12 in 1978. It stands as a versatile and objective non-parametric approach capable of employing multiple input-output indicators to evaluate efficiency. Stochastic Frontier Analysis (SFA) is a function involving inputs, outputs, and environmental factors, subject to random errors and inefficiencies. This method effectively distinguishes between inefficient and erroneous elements, finding widespread application in practical scenarios. Nevertheless, its limitation lies in its ability to assess the performance of only a single output.14 Building upon this foundation, Fried et al15 further advanced a three-stage DEA model. The three-stage DEA model, being an excellent empirical method, finds extensive application across various professional fields. It offers the advantage of efficient assessment by imposing effective boundaries.16 Given the necessity to encompass multiple input and output indicators for evaluation while accounting for the impact of environmental factors, this study opted for the three-stage DEA approach to evaluate and analyze the operational efficiency of China’s basic medical insurance for urban employees. In addition, since the purpose of this study is to investigate the operational efficiency of urban workers’ basic medical insurance funds in 31 provinces and autonomous regions in China, these 31 provinces are used as decision-making units (DMUs) in this study.

Construction of the Three-Stage DEA

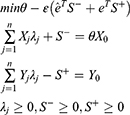

In the initial phase, the input-oriented, variable-scale DEA-BCC (Data Envelopment Analysis with Banker, Charnes, and Cooper) model was employed to gauge the inherent comprehensive technical efficiency, pure technical efficiency, and scale efficiency of China’s basic medical insurance for urban employees. The BCC model, devised by Banker et al17 in 1984, posits that comprehensive technical efficiency (TE) can be dissected into pure technical efficiency (PTE) and scale efficiency (SE), whereby TE = PTE × SE. Comprehensive technical efficiency evaluates the comprehensive adeptness of the decision-making unit (DMU) in allocating resources and managing their utilization; pure technical efficiency assesses the influence of variables like management and technology on efficiency value; scale efficiency examines the impact of scale factors on efficiency value. An integrated technical efficiency value of 1 indicates the attainment of technical efficiency by the decision-making unit. The calculation of the input-oriented BCC model is as follows:

In the formula, X and Y represent the input vector and output vector, respectively. θ denotes the efficiency value of each decision-making unit, j=(1,2,3,4,…n) denotes the DMU, λj indicates the weights of the decision-making units,  denotes the input slack variable,

denotes the input slack variable,  denotes the residual variable, e denotes a non-Archimedean infinitesimal quantity. If θ=1,

denotes the residual variable, e denotes a non-Archimedean infinitesimal quantity. If θ=1, ,

, , it means that DEA is valid. If θ=1,

, it means that DEA is valid. If θ=1, ,

, , it means that DEA is weakly valid; If θ<1, it means that DEA is invalid. Fried15 argued that the efficiency of DMUs is affected by managerial inefficiencies, environmental influences, and statistical noise, so it is necessary to separate these effects.

, it means that DEA is weakly valid; If θ<1, it means that DEA is invalid. Fried15 argued that the efficiency of DMUs is affected by managerial inefficiencies, environmental influences, and statistical noise, so it is necessary to separate these effects.

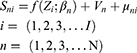

In the second stage, the slack values computed in the initial phase are disentangled into three distinct components: environmental factors, random disturbances, and managerial inefficiencies, using SFA regression. The calculation of the SFA model regression is as follows:

In the formula,  denotes the slack value of the n input variable i,

denotes the slack value of the n input variable i,  indicates environmental variables,

indicates environmental variables,  indicates coefficients of environmental variables,

indicates coefficients of environmental variables,  and

and represent the random interference term and the managerial inefficiency term, respectively, and

represent the random interference term and the managerial inefficiency term, respectively, and  is the mixed error term. The random error term

is the mixed error term. The random error term  can be expressed as the effect of random disturbances on the input slack variables. Managerial inefficiency µ is the effect of factors on the input slack variable, and suppose that μ∼

can be expressed as the effect of random disturbances on the input slack variables. Managerial inefficiency µ is the effect of factors on the input slack variable, and suppose that μ∼ is represented as a normal distribution function truncated at zero.

is represented as a normal distribution function truncated at zero.

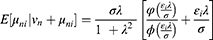

In this study, the technique introduced by Jondrow,18 known as the Decomposition  , was employed. The formula is presented as follows:

, was employed. The formula is presented as follows:

The approach developed by Dengyue L et al19 was utilized to compute  in the aforementioned equation. The formula is expressed as follows:

in the aforementioned equation. The formula is expressed as follows:

Where  ,

,  ,

,  , φ and ø are the density function and distribution function of the standard normal distribution, respectively. The formula for calculating the adjusted input value is as follows:

, φ and ø are the density function and distribution function of the standard normal distribution, respectively. The formula for calculating the adjusted input value is as follows:

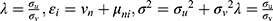

indicates the adjusted output value of the decision unit,

indicates the adjusted output value of the decision unit,  is the output value of the decision unit before adjustment, [max

is the output value of the decision unit before adjustment, [max ] is that all decision-making units are adjusted to the same environmental level, and

] is that all decision-making units are adjusted to the same environmental level, and  denotes that the random errors of all decision units are adjusted to the same level.

denotes that the random errors of all decision units are adjusted to the same level.

In the third stage, the recalibrated input indicators and the original output indicators were reintegrated into the DEA-BCC model. Subsequently, the efficiency of the decision-making unit is reevaluated. The ultimate measurement outcomes effectively eliminate the impact of environmental factors, offering a precise depiction of the actual efficiency level of the decision-making unit.

Indicator Selection

Input and Output Indicators

When assessing the efficiency of China’s urban employee medical insurance fund, the choice of indicators should adhere to the criteria of comprehensiveness, specificity, objectivity, and feasibility. Comprehensiveness demands that selected indicators holistically capture the operational dynamics of China’s basic medical insurance for urban employees. Specificity necessitates indicators capable of accurately gauging the operational efficiency of urban employee basic medical insurance. Objectivity hinges on the authenticity and reliability of data corresponding to the chosen indicators. Feasibility underscores the attainability of the selected indicators.9

Furthermore, diverse combinations of indicators yield varying results, underscoring the pivotal role of selecting input and output indicators. Guided by these principles, the assessment indicators in healthcare and medical insurance-related studies were distilled (Table 1). The analysis revealed that such studies predominantly incorporate input indicators like fund income, the count of insured individuals, and healthcare expenditures, while output indicators primarily encompass fund expenditures, participation rates, and the number of individuals compensated by healthcare insurance. Drawn from previous research and considering the unique attributes of basic medical insurance for urban employees, this study ultimately opted for fund income and number of in-service staff as input indicators, and fund expenditure, accumulated fund balance, and fund compensation rate as output indicators. The fund income refers to the various incomes obtained by the basic medical insurance fund for urban workers in the process of raising funds. The number of active employees refers to the number of people who participate in the basic medical insurance for urban workers and pay medical insurance fees. The fund expenditure refers to the expenditure on medical insurance treatment paid from the social co-ordination fund to the employees and retirees participating in the basic medical insurance in accordance with the scope and standard of expenditure stipulated in the national policy. The accumulated fund balance refers to the cumulative balance of the basic medical insurance fund for urban employees. The fund compensation rate refers to the proportion of urban workers’ basic medical insurance reimbursement costs to total medical costs.

|

Table 1 Summary of the Input and Output Indicators of Health Care Efficiency |

Environmental Variables

During the DEA analysis process, the efficiency of decision-making units undergoes a certain degree of alteration due to external environmental impacts. If left unaccounted for, these environmental variables often lead to a measure of error in the assessment of decision-making unit efficiency, yielding an efficiency value that fails to wholly encapsulate the true unit performance level. Hence, the selection of environmental variables proves pivotal in the context of the three-stage DEA. The chosen environmental variables should align with the fundamental criteria of environmental variables exerting tangible influence on efficiency, while the relevant entity is unable to exert subjective control over these factors in the short term.6

In this study, environmental variables must wield a discernible impact on the operational efficiency of China’s basic medical insurance for urban employees. As such, this paper designated the level of urbanization, the unemployment rate, and the proportion of fiscal revenues and expenditures as the chosen environmental variables.

The level of urbanization. The level of urbanization denotes the extent of urban development within a given region, typically represented as the proportion of the urban population relative to the overall population of the area. Serving as a vital metric for gauging a region’s economic advancement, urbanization usually accompanies the concentration of capital and labor, propelling socio-economic progress. Conventional wisdom holds that the economic development level primarily constrains the availability of healthcare resources within an area, with regions boasting higher economic development exhibiting augmented operational efficiency in health insurance.23 Consequently, this paper adopted the level of urbanization as an environmental variable to analyze the operation of China’s urban employee basic medical insurance.

The unemployment rate. The unemployment rate serves as a significant indicator of a region’s economic development; a lower unemployment rate corresponds to better economic development.24 A heightened unemployment rate often signals an economic downturn and a sluggish job market, prompting the government to place greater emphasis on social stability and welfare concerns, including medical and healthcare services, as well as medical security. In response, the government intensified healthcare investment, enhancing the distribution of healthcare resources and the expansion of medical facilities. This approach not only stimulates economic growth but also generates more employment opportunities. Moreover, an elevated unemployment rate may compel the government and pertinent authorities to accelerate healthcare reform, striving to enhance healthcare service quality and coverage, alleviate the burden of healthcare expenses, and establish a more equitable and efficient healthcare and security system. Consequently, the unemployment rate exerts a certain degree of influence on the operational efficiency of urban employee basic medical insurance.

Fiscal revenue and expenditure ratio. The fiscal revenue and expenditure ratio signifies the relationship between fiscal revenue and fiscal expenditure. This paper employed this ratio as a gauge for financial level assessment. Similar to economic development, the operation of urban employee basic medical insurance is intricately linked with government financial subsidies and support. Fiscal revenue and expenditure also wield a discernible impact on the functioning of employee medical insurance.6 Consequently, this study designated the fiscal revenue and expenditure ratio as an environmental variable for analyzing the operation of China’s urban employee basic medical insurance.

Data Source

This paper conducted a study on the operational efficiency of China’s urban employee basic medical insurance spanning the years 2012 to 2021. Therefore, all pertinent data related to input indicators, output indicators, and environmental variables used in this study were sourced from the China Statistical Yearbook and the China Health Statistics Yearbook for the years 2012 to 2021. Specifics regarding the input indicators, output indicators, and environmental variables were detailed in Table 2.

|

Table 2 Input and Output Indicators and Environmental Variables |

Results

Correlation Analysis

Before employing the three-stage DEA method for evaluating the operational efficiency of China’s urban workers’ basic medical insurance, an initial analysis of the selected input and output indicators was conducted to ascertain their interrelations. To achieve this, all indicator data were imported into SPSS 26.0 software to construct a Pearson correlation test matrix. Based on the test outcomes, it was observed that all input and output indicators displayed positive correlation coefficients, indicating a significant degree of interdependency among these indicators. The Pearson correlation test matrix for input and output indicators is presented in Table 3.

|

Table 3 Correlation Analysis of the Inputs and Outputs |

Empirical Study

The Empirical Study Analysis at Stage 1

In the first stage, the input-oriented and scale-variable DEA-BCC model was employed to gauge the comprehensive technical efficiency, pure technical efficiency, and scale efficiency of 31 Chinese provinces between 2012 and 2021. This was accomplished using the DEAP 2.1 software, and the outcomes were depicted in Table 4. The table presented the average efficiency of urban employee medical insurance in each province, along with the comprehensive technical efficiency values. The closer the value is to 1, the higher the province’s efficiency level. Specifically, an efficiency value of 1 indicates that the province has attained the efficiency frontier.

|

Table 4 Efficiency of the Basic Medical Insurance Funds in China, from 2012–2021 |

Overall, China’s urban workers’ medical insurance demonstrated favorable operational efficiency in this initial phase, registering an average technical efficiency value of 0.950, yet still harbored potential for enhancement. Table 4 revealed that two provinces, namely Tibet and Qinghai, consistently maintained an efficiency value of 1, exhibiting proficient technical efficiency performance over the course of the decade. Taking geographical dispersion into account, the eastern, central, and western regions exhibited average efficiency values of 0.955, 0.940, and 0.952, respectively. This underscored a prevailing pattern of eastern>central>western in terms of efficiency, with the comprehensive technical efficiency of the western region falling below the national average.

In general, the efficiency value is susceptible to the impact of environmental factors and random error terms. The first stage of measuring the efficiency of China’s urban employee medical insurance fund from 2012 to 2021 did not fully account for the influence of environmental variables on the efficiency value. Consequently, the obtained efficiency value carried a certain degree of bias and failed to authentically depict the actual efficiency scenario. Hence, it became imperative to eliminate the impact of environmental factors and re-evaluate the operational efficiency value of China’s urban employee medical insurance fund. This step is essential for obtaining a more objective efficiency value that genuinely mirrors the operational state of the urban employee medical insurance fund.

The Empirical Study Analysis at Stage 2

In the second stage, our focus shifted to slack variables, generally regarded as indicators of initial inefficiency. This inefficiency is primarily constituted by environmental factors, managerial inefficiency, and statistical noise. Utilizing SFA, we employed the slack variables derived from the first-stage calculation’s two input indicators – fund input and the number of active employees – as dependent variables. Simultaneously, we utilized the three environmental variables – level of urbanization, unemployment rate, and fiscal revenue and expenditure ratio – as independent variables. Through regression analysis using the SFA model and maximum likelihood estimation via FRONTIER 4.1 software, we evaluated the impact of environmental variables on efficiency value.

The results of the SFA regression (Table 5) indicated likelihood ratio test values of 191.222 and 82.289, respectively, surpassing critical values at the 1% significance level. This substantiates the appropriateness of employing the SFA model in the study’s second stage. Both the Sigma-squared and Gamma values successfully passed the significance test, signifying that the management inefficiency in the mixed error term significantly impacts the slack variable compared to the random error term.9 Moreover, the regression outcomes indicated high significance between most environmental variables and the slack variables, validating the justifiability of the selected environmental variables. Consequently, it becomes essential to further elucidate the influence of environmental factors on slack variables, enabling a comprehensive analysis of China’s urban employees’ health insurance operational efficiency. Based on the regression results of the SFA model, a positive estimated coefficient of an environmental variable suggests that the variable can escalate input slack, thereby impeding efficiency improvement. Conversely, a negative estimated coefficient implied that an environmental variable can diminish input slack, thereby fostering efficiency enhancement.

|

Table 5 Results of the SFA Model in Stage 2 |

Urbanization Level

Based on the regression results, the regression coefficient of the urbanization level and input slack variable exhibits negativity, indicating a positive impact of this environmental variable on the operational efficiency of urban employee medical insurance. Urbanization transcends mere population concentration, encompassing the aggregation of diverse public facilities, medical service resources, medical insurance resources, and other resource aspects within urban areas. This confluence effect can propel local economic development, foster augmented employment prospects for employees, and elevate workers’ income levels. This not only augments health insurance fund revenue but also amplifies health insurance coverage, thereby alleviating the residents’ healthcare burdens. Furthermore, the rapid progress of urbanization can effectively safeguard the foundation of the basic livelihood protection network and continue to meet diverse livelihood needs.25

Unemployment Rate

As per the regression outcomes, the regression coefficient of the unemployment rate and the input slack variable displayed a negative correlation, implying a positive influence of this environmental variable on the operational efficiency of urban employee medical insurance. This dynamic operated on two fronts. Firstly, an elevated unemployment rate could result in certain individuals temporarily or permanently exiting the job market. During their unemployment phase, they might become eligible for social security benefits, obviating the necessity for them to rely on urban employee medical insurance to cover medical expenses. This, in turn, lightens the burden on the urban employee basic medical insurance fund. Secondly, the unemployed may receive heightened social welfare assistance from the government, including provisions for medical insurance. Such supportive measures also contribute to relieving the burden on the urban employee basic medical insurance fund, thereby fostering enhanced medical insurance operational efficiency.

Fiscal Revenue and Expenditure Ratio

As per the regression findings, the regression coefficient of the fiscal revenue and expenditure ratio and the input slack variable exhibited positivity, signifying an adverse influence of this environmental variable on the operational efficiency of urban employee medical insurance. A heightened proportion of fiscal revenue to expenditure signified augmented fiscal revenue, contributing to an enhanced capacity for government transfer payments, heightened medical investment, superior allocation of medical resources, and an impact on public health.26 Nonetheless, a substantial ratio of fiscal revenue and expenditure ratio might diminish the government’s allocations for healthcare and medical insurance, potentially impeding the escalation of investments in basic medical insurance for urban employee and hindering enhancements in medical insurance operational efficiency.

The Empirical Study Analysis at Stage 3

In the third stage, the DEAP 2.1 software was once again employed to integrate the recalibrated input indicator data and the original output indicator data into the DEA-BCC model. This step gauged the operational efficiency of China’s urban workers’ basic medical insurance from 2012 to 2021, ultimately yielding more realistic values for comprehensive technical efficiency, pure technical efficiency, and scale efficiency. A comparison of the efficiency values from the first and third stages revealed a certain level of disparity between them, underscoring the rationale behind constructing the SFA model for regression analysis in the second stage. Table 6 presents the efficiency data from both the first and third stages. Additionally, for a more visual comparison of efficiency changes between these two stages, we generated radar charts representing integrated technical efficiency, pure technical efficiency, and scale efficiency, as depicted in Figures 1–3.

|

Table 6 Efficiency Comparison of the stage 1 and stage 3 |

|

Figure 1 Radar chart of technical efficiency. |

|

Figure 2 Radar chart of pure technical efficiency. |

|

Figure 3 Radar chart of scale efficiency. |

Technical Efficiency of the Employees’ Basic Medical Insurance Fund

The technical efficiency (TE) index is used to measure the overall efficiency of each province/municipality in the investment, use, and capital management of the UEBMI. Generally speaking, if the TE is higher, it means that the region has a high level of resource allocation and resource management. On the whole, the average comprehensive technical efficiency declined from 0.950 in the first stage to 0.701 in the third stage, representing a decrease of 26.21%. As seen in Table 6, apart from Guangdong Province’s improvement in integrated efficiency in the third stage, the remaining provinces experienced varying degrees of decline in their integrated efficiency values. Notably, Hainan, Jilin, Jiangxi, and Shanxi provinces saw more pronounced declines in integrated efficiency values, with corresponding decreases of 0.349, 0.398, 0.462, and 0.531, respectively. Particularly noteworthy was Hainan Province’s significant drop to an integrated efficiency value of 0.349, reflecting a decline of 61.65%. Following the adjustments, only Guangdong Province witnessed an increase in comprehensive efficiency from 0.980 to 1, reaching the efficiency frontier. It’s important to mention that in the first stage, Tibet and Qinghai regions exhibited a combined efficiency of 1.000, yet in the third stage, their efficiency values decreased, causing them to fall short of the efficiency frontier.

Pure Technical Efficiency of the Employees’ Basic Medical Insurance Fund

The pure technical efficiency (PTE) index reflects the distribution and management of the UEBMI in various provinces/municipalities. In general, a higher PTE means that the district is more efficient in its use of input resources given the current level of technology. In general, the pure technical efficiency in the third stage has experienced a slight decline, yet the overall change is minimal. The average pure technical efficiency value has been adjusted from 0.968 in the first stage to 0.966 in the third stage, resulting in a mere 0.21% decrease. Post-adjustment, most provinces have seen improvements in pure technical efficiency. Notably, Zhejiang, Hainan, Anhui, Guizhou, and other regions have exhibited more pronounced enhancements in pure technical efficiency. Anhui Province, in particular, witnessed a significant increase in pure technical efficiency from 0.921 to 0.999 after the adjustment, indicating a rise of 7.81%. As depicted in Figure 2, six regions—namely Beijing, Shanghai, Jiangsu, Guangdong, Tibet, and Qinghai—achieved pure technical efficiency in the first stage prior to the adjustment. However, following the adjustment, only three regions—Zhejiang, Guangdong, and Tibet—maintained pure technical efficiency. Moreover, both Guangdong and Tibet regions maintained their efficiency frontier status before and after the adjustment.

Scale Efficiency of the Employees’ Basic Medical Insurance Fund

The scale efficiency (SE) analysis reflects the gap between the current scale and the optimal scale of the UEBMI in all provinces and municipalities. Generally, if the SE is higher, it means that the gap between the actual size of the region and the optimal production size is smaller. Overall, the scale efficiency exhibited a noticeable declining trend, decreasing from 0.982 in the first stage to 0.724 in the third stage, marking a significant reduction of 26.27%. In certain instances, the decrease was even more prominent, reaching as high as 63.19%. Notably, it’s important to highlight that the scale efficiency of Qinghai Province transitioned from efficiency in the first stage to inefficiency in the third stage. However, in contrast, the scale efficiency of Jiangsu and Guangdong demonstrated improvement post-adjustment, with Guangdong attaining a scale efficiency value of 1, thus achieving optimal scale efficiency.

Temporal Variation in Technical Efficiency of UEBMI Fund in China

To further compare the variability of the technical efficiency of China’s urban employee basic medical insurance fund over different years, we conducted statistical analysis on the technical efficiency values for different years in both the first and third stages. As depicted in Figure 4, the operational efficiency of China’s urban employee basic medical insurance in the first stage remained relatively stable, with the highest efficiency value of 0.964 observed in 2016 and the lowest value of 0.928 in 2014. On the other hand, the operational efficiency in the third stage experienced significant changes, showing an overall upward trend. The technical efficiency reached its peak at 0.774 in 2017 and dropped to its lowest value of 0.487 in 2012. The third-stage technical efficiency demonstrated an ascending trend from 2012 to 2017, followed by a gradual decline from 2018 to 2021. Notably, the years 2013 and 2018 marked distinct points of efficiency inflection.

|

Figure 4 Time trends in technical efficiency in phases I and III. |

Regional Distribution of Technical Efficiency of UEBMI Fund in China

To provide an intuitive comparison of the operational efficiency of the third-stage urban employee medical insurance fund across different regions of China, we have created a map illustrating the distribution of third-stage comprehensive technical efficiency based on the geographical regions of the country (Figure 5). In this map, darker colors indicate higher efficiency values (refer to Figure 5). The regional distribution of the operational efficiency of China’s urban employee basic medical insurance fund in the third stage exhibits noticeable differences. As depicted in Figure 5, well-developed areas such as Jiangsu, Zhejiang, Guangdong, Shanghai, and Beijing exhibited higher efficiency values. Similarly, inland regions like Tibet and Yunnan also demonstrated higher technical efficiency. In stark contrast, provinces like Jilin, Hainan, and Jiangxi exhibited significantly lower technical efficiency, with Hainan Province having the lowest efficiency value nationwide. Overall, the technical efficiency pattern showed a trend of higher efficiency in the western regions, followed by the eastern and central regions.

|

Figure 5 Distribution of third-stage comprehensive technical efficiency. |

Discussion

This study employed a three-stage DEA model to evaluate the comprehensive technical efficiency, pure technical efficiency, and scale efficiency of the urban employee basic medical insurance fund across 31 provinces in China during the period from 2012 to 2021. The study utilized fund revenue and the number of active employees as input indicators, while fund expenditures, medical insurance fund compensation, and cumulative fund balance serve as output indicators. The findings revealed that the overall operational efficiency of China’s urban employee basic medical insurance remained relatively low, displaying considerable temporal and regional variation, suggesting ample room for enhancement. Moreover, environmental factors exerted a significant influence on the efficiency of the medical insurance system. Consequently, accounting for the impact of environmental factors on medical insurance efficiency becomes imperative.

Analyzing the efficiency results revealed a notable contrast in the operational efficiency of China’s urban employee basic medical insurance before and after adjustments. In the first stage, the operational efficiency of China’s urban employee basic medical insurance appeared robust, with two provinces, Qinghai and Tibet, consistently achieving technical efficiency over a ten-year period. Despite being economically disadvantaged areas, these provinces demonstrated the highest operational efficiency in the employee medical insurance realm, potentially attributed to their adept utilization of limited local resources. This finding echoed the conclusions of Li et al6 who found analogous results in their study of China’s urban and rural residents’ basic medical insurance. In the third stage, the operational efficiency of China’s urban employee basic medical insurance showed a decline, with only Guangdong Province attaining comprehensive technical efficiency. This suggests that environmental factors have dampened the efficiency of medical insurance in Guangdong. Comparatively, the alteration in pure technical efficiency pre- and post-adjustment was not pronounced, signifying that the reduction in scale efficiency significance in the later stage contributes to the decline in comprehensive technical efficiency.

In terms of environmental factors, it becomes evident that these variables significantly influenced the operational efficiency of China’s urban employee basic medical insurance. Among these, urbanization level and unemployment rate emerged as pivotal determinants with a positive relationship to the operational efficiency of medical insurance. This finding underscored the potential benefits of enhancing urbanization levels and effectively managing unemployment rates, as these measures could bolster the efficiency of urban employee medical insurance. Heightened urbanization signifies a more robust economy, translating to increased government investment in medical insurance, more substantial funding in medical insurance fund, and ultimately, an upswing in the operational efficiency of urban employee basic medical insurance. This aligns with the conclusions drawn by Li10 and others who, in scrutinizing China’s basic pension insurance, similarly found that urbanization levels favor the operational efficiency of the country’s basic insurance systems. Interestingly, the rise in the unemployment rate also correlated positively with the improved efficiency of employee health insurance, thereby diverging from our initial research hypothesis. This outcome could be attributed to the fact that some unemployed individuals receive government-provided social relief following job loss, effectively lightening the load on employee health insurance fund. This phenomenon, in turn, contributed to the enhanced operational efficiency of these funds. However, it’s noteworthy that excessively high unemployment rates might have adverse societal consequences. Conversely, fiscal revenue and expenditure ratio showed a negative correlation with the operational efficiency of China’s urban employee basic medical insurance. Elevated ratios indicate heightened financial freedom for the government, but this surplus financial autonomy may disrupt fiscal balance and lead to reduced government expenditure on medical care. This, in turn, increased the medical burden on insured individuals, thus undermining the operational efficiency of urban employee medical insurance fund. This insight echoed the findings of Hu9 and other researchers who found a similar unfavorable impact of the fiscal balance ratio on the efficiency of China’s social security expenditures when evaluating the effects of environmental factors on the nation’s social security landscape.

When considering regional distribution, clear disparities exist in China’s basic medical insurance for urban workers. The distribution of efficiency in the first stage followed a distinctive pattern: eastern>western>central. In this framework, the economically developed eastern region, enriched with abundant resource inputs, exhibits the highest efficiency. While the central region boasts a higher economic level than the western region, the efficiency of the latter supersedes that of the central region. This phenomenon could stem from the country’s strategic resource allocation favoring the western region, leading to the efficient utilization of its resources. In the third stage, efficiency took on a different order: western>eastern>central. One possible explanation is that in recent years, the western part of China has received more central financial transfers for social security and people’s livelihoods. Additionally, this could also be associated with the lower economic level of the western part of the country, where greater dependence on medical insurance tends to correspond to lower income levels.10,27

Zooming in on individual provinces, Beijing, Shanghai, Jiangsu, Guangdong, and Zhejiang showcase elevated efficiency values. These provinces also represented the more economically advanced regions of China, underscoring how regional economic development fosters the effective operation of urban employee health insurance.6 Interestingly, even inland provinces like Yunnan and Tibet boasted noteworthy technical efficiencies, suggesting their pioneering resource management and utilization strategies, which could serve as valuable benchmarks for other regions. Notably, the efficiency of employee health insurance in Hainan and Jilin provinces lagged significantly behind, with Hainan Province recording the nation’s lowest efficiency. Considering this, relevant authorities should augment resource investments, implement comprehensive resource management strategies, and optimize resource utilization to enhance the operational efficiency of employee health insurance.

Regarding the temporal distribution, China’s urban employee basic medical insurance operational efficiency demonstrated an improving trend during 2012–2021, reflecting the influence of ongoing medical insurance policy reforms. In the first stage, operational efficiency exhibited consistency across various periods, indicating an overall favorable performance of China’s urban employee basic medical insurance. However, in the third stage, distinctive shifts in operational efficiency became evident, with a notable inflection point in 2013. This year marked a deepening of medical and health system reforms, aligning with the comprehensive implementation of the “Twelfth Five-Year Plan” for medical and healthcare reforms, as well as the acceleration of the universal healthcare insurance system improvement.28 The years 2014–2017 observed an upward trajectory in technical efficiency, possibly attributed to policies such as the “Decision on the Implementation of the Comprehensive Two-Child Policy to Reform and Improve the Management of Family Planning Services”, along with the release of the “Circular of the General Office of the State Council on the Issuance of the Pilot Program for the Combined Implementation of Maternity Insurance and Employee Basic Medical Insurance”, which potentially contributed to enhancing technical efficiency.29,30

However, technical efficiency displayed a descending trend from 2018–2021, particularly evident in the clear downward inflection point of 2018. During this year, the establishment of China’s National Medical Insurance Bureau led to the reassignment of management responsibilities for urban employee basic medical insurance, maternity insurance, and new rural cooperative medical care under the National Healthcare Insurance Bureau (NHIB).31 Furthermore, policies like the “Guiding Opinions of the General Office of the State Council on Further Deepening the Reform of the Payment Methods of Basic Medical Insurance” and the “Key Tasks for Deepening the Reform of the Pharmaceutical and Healthcare System in the Second Half of 2018” potentially impacted the operational efficiency of the health insurance fund.32 From 2019 to 2021, the overall trend of the health insurance fund showed a decline, largely due to the repercussions of the COVID-19 pandemic. This conclusion aligns with that of Zhuo et al, who, in their study on the impact of the COVID-19 epidemic on the sustainability of China’s social healthcare system, found that the COVID-19 epidemic also influenced the cumulative balances of both the Urban Employees’ Health Insurance Fund and the Urban and Rural Residents’ Health Insurance Fund.33

The study on the efficiency of basic medical insurance for urban workers is of great significance to the development of China’s medical insurance system. The sound operation of the medical insurance fund is a fundamental prerequisite for the high-quality and sustainable development of medical insurance, and the income and expenditure of the fund is related to the health interests of almost all insured people in China. Research on the operational efficiency of China’s urban employee basic medical insurance fund efficiency, which explores the operational factors affecting medical insurance, is conducive to enhancing the strength of the medical insurance fund protection, broadening the scope of medical protection obtained by the masses, while making China’s medical protection level also continue to improve.

There are three main limitations of this study. Firstly, in terms of data, although this study uses standard data collated by the National Bureau of Statistics, there may be some bias in the results due to the adjustment of valid data during the calculation process. Secondly, in terms of methodology, although this study adopts a standard approach in the construction of the indicator system to select representative, comparable, and feasible evaluation indicators related to UEBMI, there may still be some shortcomings. Thirdly, this study has not been able to further translate efficiency into money-related changes, thus preventing readers from intuitively understanding the significance of changes in efficiency values, and thus we hope to inspire later scholars to do further exploration.

Conclusion

This study undertook an extensive analysis of the operational efficiency of urban employee basic medical insurance across 31 provinces in China, leading to the following key findings: Firstly, the operational efficiency of China’s urban employee basic medical insurance was notably below optimal levels, indicating ample room for enhancement. Secondly, substantial variations in operational efficiency existed across different regions of the country. Thirdly, recent years have witnessed an ascending trend in the operational efficiency of China’s urban employee basic medical insurance, with medical insurance policy reforms playing a pivotal role in driving this improvement. Lastly, environmental variables played a decisive role in influencing the operational efficiency of China’s urban employee basic medical insurance.

This study had significant implications for enhancing the operational efficiency of China’s urban employee basic medical insurance fund, offering valuable support for subsequent research endeavors. To uplift the operational efficiency of urban employee basic medical insurance, this study proposed the following recommendations.

To begin, government agencies should enhance resource investment in the central region and adjust resource allocation to prioritize the central and western areas, optimizing resource utilization in the central region. Secondly, thoroughly consider the influence of environmental factors such as urbanization level, fiscal revenue and expenditure ratio, and unemployment rate on the operational efficiency of urban employee basic medical insurance. Thirdly, relevant authorities must refine existing legislations and regulations, strengthen oversight of medical insurance fund, enhance transparency in fund management and utilization, and ensure equity and rationality in fund operations. Lastly, the management body of the medical insurance fund should harness modern technology to elevate the comprehensive technical efficiency of this fund.

Data Sharing Statement

The datasets supporting the conclusions of this article are available at reasonable request to the corresponding author.

Ethical Approval

All data are from the publicly available database of the Chinese Bureau of Statistics., thus no ethical approvals are required. The outcomes of the analysis do not allow re-identification and the use of data cannot result in any damage or distress.

Author Contributions

All authors made a significant contribution to the work reported, whether that is in the conception, study design, execution, acquisition of data, analysis and interpretation, or in all these areas; took part in drafting, revising or critically reviewing the article; gave final approval of the version to be published; have agreed on the journal to which the article has been submitted; and agree to be accountable for all aspects of the work.

Funding

The authors did not receive any grant from funding agencies in the public, commercial, or not-for-profit sectors for the submitted work.

Disclosure

The authors report no conflicts of interest in this work.

References

1. The Central People’s Government of the People’s Republic of China. The deputies to the 20th National Congress of the Communist Party of China hotly discussed - ensuring and improving people’s livelihood in the process of development; 2022. Available from: https://www.gov.cn/xinwen/2022-10/21/content_5720126.htm.

2. Zheng M, Zhu J. The impact of the upgrading of the industrial structure on the urban employee basic medical insurance fund: an empirical study in China. Risk Manag Healthc Policy. 2021;14:2133–2144. doi:10.2147/RMHP.S298145

3. National Healthcare Security Administration. National statistical bulletin on the development of healthcare security in 2021; 2021. Available from: http://www.nhsa.gov.cn/art/2022/6/8/art_7_8276.html?eqid=d4fa78af0003179d000000036433b153.

4. Feng QQ, Ao YB, Chen SZ, Martek I. Evaluation of the allocation efficiency of medical and health resources in China’s rural three-tier healthcare system. Public Health. 2023;218:39–44. doi:10.1016/j.puhe.2023.02.009

5. Yu ZQ, Chen LP, Qu JQ, Wu WZ, Zeng Y. A study on the sustainability assessment of China’s basic medical insurance fund under the background of population aging–evidence from Shanghai. Front Public Health. 2023;11:1170782. doi:10.3389/fpubh.2023.1170782

6. Liu T, Gao Y, Li H, Zhang L, Sun J. Analysis of the operational efficiency of basic medical insurance for urban and rural residents: based on a three-stage DEA model. Int J Environ Res Public Health. 2022;19(21):13831. doi:10.3390/ijerph192113831

7. Song K, Liu WB, Qing Y, Tian MN, Pan WT. Efficiency analysis of new rural cooperative medical system in China:implications for the COVID-19 era. Front Psychol. 2021;12:686954. doi:10.3389/fpsyg.2021.686954

8. Li L, Li D. Efficiency evaluation of urban employee’s basic endowment insurance expenditure in China based on a three-stage DEA model. PLoS One. 2023;18(3):e0279226. doi:10.1371/journal.pone.0279226

9. Hu Y, Wu Y, Zhou W, Li T, Li L. A three-stage DEA-based efficiency evaluation of social security expenditure in China. PLoS One. 2020;15(2):e0226046. doi:10.1371/journal.pone.0226046

10. Li Z, Si X, Ding Z, et al. Measurement and evaluation of the operating efficiency of china’s basic pension insurance: based on three-stage DEA model. Risk Manag Healthc Policy. 2021;14:3333–3348. doi:10.2147/RMHP.S320479

11. Xie Y, Yu H, Lei X, Lin AJ. The impact of fertility policy on the actuarial balance of China’s urban employee basic medical insurance fund–The selective two-child policy vs. the universal two-child policy. Nor Am J Eco Fin. 2020;53:101212. doi:10.1016/j.najef.2020.101212

12. Charnes A, Cooper WW, Rhodes E. Measuring the efficiency of decision making units. Eur J Oper Res. 1978;2(6):429–444. doi:10.1016/0377-2217(78)90138-8

13. Barber RM, Fullman N, Sorensen RJD, et al. Healthcare access and quality index based on mortality from causes amenable to personal health care in 195 countries and territories, 1990–2015: a novel analysis from the global burden of disease study 2015. Lancet. 2017;390(10091):231–266. doi:10.1016/S0140-6736(17)30818-8

14. Aigner D, Lovell CAK, Schmidt P. Formulation and estimation of stochastic frontier production function models. J Econom. 1977;6(1):21–37. doi:10.1016/0304-4076(77)90052-5

15. Fried HO, Lovell CA, Schmidt SS, Yaisawarng S. Accounting for environmental effects and statistical noise in data envelopment analysis. J Product Anal. 2002;17(1–2):157–174. doi:10.1023/A:1013548723393

16. Zhao C, Zhang H, Zeng Y, et al. Total-factor energy efficiency in BRI countries: an estimation based on three-stage DEA model. Sustainability. 2018;10(2):278. doi:10.3390/su10010278

17. Banker RD, Charnes A, Cooper WW. Some models for estimating technical and scale inefficiencies in Data Envelopment Analysis. Manag Sci. 1984;30(9):1078–1092. doi:10.1287/mnsc.30.9.1078

18. Jondrow J, Knox Lovell CA, Materov IS, Schmidt P. On the estimation of technical inefficiency in the stochastic frontier production function model. J Econom. 1982;19(2–3):233–238. doi:10.1016/0304-4076(82)90004-5

19. Luo D. A note on estimating managerial inefficiency of three-stage DEA model. Statis Res. 2012;29(4):104–107.

20. Chiu CM, Chen MS, Lin CS, Lin WY, Lang HC. Evaluating the comparative efficiency of medical centers in Taiwan: a dynamic data envelopment analysis application. BMC Health Serv Res. 2022;22(1):435. doi:10.1186/s12913-022-07869-8

21. Yan-ling W Analysis on efficiency of Chinese new rural cooperative medical insurance system based on DEA method. In:

22. Ngobeni V, Breitenbach MC, Aye GC. Technical efficiency of provincial public healthcare in South Africa. Cost Eff Resour Alloc. 2020;18(1):3. doi:10.1186/s12962-020-0199-y

23. Yang Y, Zhang L, Zhang X, Yang M, Zou W. Efficiency measurement and spatial spillover effect of provincial health systems in China: based on the two-stage network DEA model. Front Public Health. 2022;10:952975. doi:10.3389/fpubh.2022.952975

24. Chai KC, Li Q, Bao XL, Zhu J, He XX. An empirical study of economic cycle, air quality, and national health since reform and opening up. Front Public Health. 2021;9:706955. doi:10.3389/fpubh.2021.706955

25. Liu H, Wu W, Yao P. Assessing the financial efficiency of healthcare services and its influencing factors of financial development: fresh evidences from three-stage DEA model based on Chinese provincial level data. Environ Sci Pollut Res. 2022;29(15):21955–21967. doi:10.1007/s11356-021-17005-4

26. Zhong M, Wang P, Ji M, Zeng XH, Wei HX. Promote or inhibit: economic goal pressure and residents’ health. Front Public Health. 2021;9:725957. doi:10.3389/fpubh.2021.725957

27. Xu X, Wang Q, Li C. The impact of dependency burden on urban household health expenditure and its regional heterogeneity in China: based on quantile regression method. Front Public Health. 2022;10:876088. doi:10.3389/fpubh.2022.876088

28. General Office of the State Council. Circular of the general office of the state council on the issuance of the main working arrangements for deepening the reform of the medical and health care system in 2013; 2013. Available from: https://www.gov.cn/zwgk/2013-07/24/content_2454676.htm.

29. The Central People’s Government of the People’s Republic of China. Decision of the central committee of the communist party of China and the state council on the implementation of the comprehensive two-child policy to reform and improve the management of family planning services; 2015. Available from: https://www.gov.cn/gongbao/content/2016/content_5033853.htm.

30. General Office of the State Council. Notice of the general office of the state council on the issuance of the pilot program on the merger of maternity insurance and employee basic medical insurance; 2017. Available from: http://www.nhsa.gov.cn/art/2017/1/19/art_104_6431.html.

31. General Office of the State Council. Guiding opinions of the general office of the state council on further deepening the reform of basic medical insurance payment methods; 2017. Available from: http://www.nhsa.gov.cn/art/2017/6/20/art_104_6432.html.

32. General Office of the State Council. Notice of the general office of the state council on the issuance of key tasks for deepening the reform of the medical and health system in the second half of 2018; 2018. Available from: http://www.nhsa.gov.cn/art/2018/8/28/art_104_6437.html.

33. Zuo F, Zhai S. The influence of China’s COVID-19 treatment policy on the sustainability of its social health insurance system. Risk Manag Healthc Policy. 2021;14:4243–4252. doi:10.2147/RMHP.S322040

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.