Back to Journals » ClinicoEconomics and Outcomes Research » Volume 13

Health Insurance Coverage and Its Associated Factors Among Reproductive-Age Women in East Africa: A Multilevel Mixed-Effects Generalized Linear Model

Authors Weldesenbet AB , Kebede SA , Ayele BH , Tusa BS

Received 27 May 2021

Accepted for publication 20 July 2021

Published 28 July 2021 Volume 2021:13 Pages 693—701

DOI https://doi.org/10.2147/CEOR.S322087

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 4

Editor who approved publication: Professor Giorgio Colombo

Adisu Birhanu Weldesenbet,1 Sewnet Adem Kebede,2 Behailu Hawulte Ayele,3 Biruk Shalmeno Tusa1

1Department of Epidemiology and Biostatistics, College of Health and Medical Sciences, Haramaya University, Haramaya, Ethiopia; 2Department of Epidemiology and Biostatistics, Institute of Public Health, College of Medicine and Health Sciences, University of Gondar, Gondar, Ethiopia; 3Department of Public Health and Health Policy, College of Health and Medical Sciences, School of Public Health, Haramaya University, Harar, Ethiopia

Correspondence: Biruk Shalmeno Tusa Email [email protected]

Background: Despite improvement in access to modern healthcare services in East African countries, health-service delivery and health status of the population remained poor mainly due to the weak health-sector financing system. Therefore, the current study aimed to assess the health insurance coverage and its associated factors among reproductive-age group (RAG) women in East Africa.

Methods: The most recent (between 2010 and 2018) Demographic and Health Surveys (DHS) data of the ten East African countries (Burundi, Comoros, Ethiopia, Kenya, Malawi, Mozambique, Tanzania, Uganda, Zambia, and Zimbabwe) were included. STATA version 16.0 statistical software was used for data processing and analysis. In the multilevel mixed-effects generalized linear model, variables with a p-value ≤ 0.05 were declared as significant associated factors of health insurance coverage.

Results: The overall health insurance coverage in East Africa was 7.56% (95% CI: 7.42%, 7.77%). The odds of health insurance coverage were high among educated, currently working, and rich RAG women whereas it was low among rural residents. Besides, RAG women who have media exposure, visited by field workers, and visited health facilities have a higher chance of health insurance coverage.

Conclusion: Health insurance coverage in East Africa among RAG women was below ten percent. Educational status, working status, place of residence, wealth index, media exposure, visiting health facility within 12 months and being visited by field worker were significantly associated with health insurance coverage among RAG women in East Africa. Improving women’s access to health facilities, promoting field workers’ visit, and media exposure targeting uneducated, unemployed, and rural resident women of RAG will be a gateway to promote health insurance coverage.

Keywords: health insurance coverage, reproductive age group, Eastern Africa, DHS

Background

Globally, over 930 million people spend at least 10% of their household income on health care and about 100 million people are pushed into extreme poverty each year because of out-of-pocket spending on health.1 To provide financial protection against such catastrophes, developing countries in recent years are increasingly implementing health insurance systems to increase access to health care.2,3 Health insurance is a way of providing financial protection against health care costs with the objectives of ensuring financial sufficiency, risk pooling, and effective purchasing.4,5 Accordingly, it helps in ensuring a balance between population health investments and health care finance, and is recognized to be the prevailing method to achieve universal health coverage.5 While there are different models of health insurance, the commonly used health insurance models in eastern Africa include community-based health insurance, social health insurance, private health insurance, fee-waivers, and exemption.6

Reproductive age group women’s ability to access affordable coverage and care has important implications for society and it depends on economic benefits for women and their families.7,8 However, the coverage of healthcare services among RAG women remained Low- and middle- Income countries (LMIC) with financial constraints as a major barrier.9,10 Furthermore, poor quality of health-care services at public service providers and the absence of pre-payment financial arrangements for health care were major factors for lower utilization of health care services.11 To date, for reproductive services, health insurance is attracting more and more attention in such countries as a means of improving health care utilization and protecting against impoverishment from out-of-pocket expenditures.2,12,13

Previous local and national studies conducted elsewhere reported, factors like demographic and socioeconomic factors, community participation, illness experience, benefit package, awareness level, previous out of pocket expenditure for health care service and health service status (quality, adequacy, efficiency and coverage), premium amount, self-rated health status and bureaucratic complexity were identified to determine the utilization of health insurance.14 Besides, according to the theory of demand for health insurance, perceived value of the premium, moral hazard, adverse selection, and cost of insurance are important predictors of premium utilization.15

Despite improvement in access to modern healthcare services in East African countries, health-service delivery and health status of the the RAG remained low mainly due to the low level of health-sector financing and lack of access to health insurance by women.13,16 Moving away from out-of-pocket (OOP) payments for health care at the time of use to pre-payment (health insurance) is an important step towards averting the financial hardship associated with paying for health-care services.11 However, large scale evidences supporting this fact is lacking. Besides, previous local and national studies conducted in the region addressed specific types of insurance on small scale using small sample size and weak analysis modality. Furthermore, there are no published literatures addressed in the coverage of health insurance at the regional level (east Africa). Thus, to fill the existing gap the current study aimed to assess the coverage of health insurance and its associated factors among RAG women in East Africa using Demographic and Health Survey (DHS) data. The finding of the current study provides evidence for health planners, programmers, and health professionals to improve financial protection and service utilization of RAG women.

Methods

Data Source and Extraction

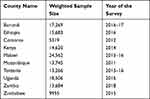

The current study used the most recent Demographic and Health Surveys (DHS) data of the ten East African countries (Burundi, Comoros, Ethiopia, Kenya, Malawi, Mozambique, Tanzania, Uganda, Zambia, and Zimbabwe). Data on all interviewed women aged 15–49 were extracted from the individual Record (IR file) data set. Ten East African countries were included, with surveys conducted between 2010 and 2018 (Table 1).

|

Table 1 List of East African Countries, Their Sample Size and Year of the Survey Included in the Analysis |

Sample Design and Sampling Weights

Demographic and Health Surveys sample designs were two-stage probability samples selected from the most recent census frame. In the first stage of selection, the primary sampling units (census enumeration areas) were drawn with probability proportional to size within each stratum. The primary sampling units formed the survey cluster. In the second stage, a complete household listing was done in each of the selected clusters (primary sampling units). Then, a fixed number of households were taken by equal probability systematic sampling in the selected cluster. In this study, individual weights for women, primary sampling unit and strata were used to achieve a national representation of women living in East Africa. Accordingly, a total weighted sample of 146,609 women aged 15–49 was included in the study.

Study Variables

The dependent variable in the present study was health insurance coverage. The DHS asked RAG women whether they are covered by health insurance and the type of health insurance by which they are covered. We, accordingly, constructed a dichotomous measure of health insurance coverage. By considering the binary nature of the outcome variable, it was coded as 1 if RAG women were covered by social security or other employer-based insurance or any of the health insurance schemes or mutual health organization or community-based insurance or privately purchased commercial insurance, otherwise it was coded as 0. After reviewing different works of literature16–23 age, marital status, educational level, currently working, place of residence, country, wealth index, sex of head of household, age of household head, media exposure, visited by a fieldworker in the last 12 months, visited a health facility in the last 12 months, and cigarette smoking were considered as independent variables.

Data Processing and Statistical Analysis

STATA version 16 statistical software was used for data processing and analysis. Before any statistical analysis, the data were weighted by sampling weight, primary sampling unit and strata. The study population was explained using cross-tabulations and summary statistics. Both fixed and mixed effects were fitted (to take into account the clustered nature of DHS data) and compared using Akaike and Bayesian Information Criteria (AIC and BIC).24 A mixed effect model (multilevel mixed-effects generalized linear model) with the lowest Information Criteria (AIC and BIC) was selected. The variances between clusters were quantified by Intra-cluster Correlation Coefficient (ICC), and it was found to be greater than 0.10. Variables with a p-value ≤0.05 were declared significant factors for health insurance coverage among RAG women.

Results

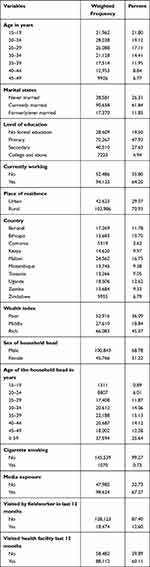

A total of 146,609 RAG women from 10 East African countries were included in the analysis. More than one-fifth (21.8%) of the participants were in the age group of 15–19 years. More than three-fifths of them were married (61.8%) and were currently working (64.2%). Regarding educational status and place of residence, 19.50% and 70.93% of the study participants were uneducated and from rural areas, respectively.

Malawi is a country with the highest proportion of study participants (16.75%) followed by Uganda (12.62%), and Burundi (11.78%), whereas Comoros has the lowest proportion of the study participants (3.63%). More than two-thirds (67.27%) of the women reported that they had media exposure and 36.09% are poor. Regarding cigarette smoking behavior, almost all, 99.27% were non-smokers. About 60.11% of the participants have visited health facilities and 12.6% were visited by field workers (Table 2).

|

Table 2 Characteristics of Respondents for the Study on Health Insurance Coverage Among Reproductive-Age Group Women in East Africa Countries, 2021 |

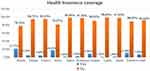

Health Insurance Coverage

As indicated in Figure 1 below, the overall prevalence of health insurance coverage in East Africa was 7.56% (95% CI: 7.42%, 7.77%). The highest prevalence was from Burundi (21.77%) and Kenya (18.13%), whereas the lowest was from Uganda (1.38%) and Malawi (1.55%).

|

Figure 1 Health insurance coverage among women of reproductive aged group in East African countries, 2021. |

Factors Associated with Health Insurance Coverage

From the total of 13 variables considered in the multivariable analysis model, age of mother, marital status, educational status, working status, place of residence, country of residence, wealth index, sex of the household head, media exposure, visiting a health facility in the last 12 months, and being visited by a field worker were significantly associated with health insurance coverage among RAG women in East Africa (Table 3).

|

Table 3 Bi-Variable and Multivariable Analysis of Health Insurance Coverage Among Reproductive-Age Group Women in East Africa, 2021 |

The odds of health insurance coverage decreased by 37% among women aged 20–24 years as compared to those aged 15–19 years (AOR = 0.63, 95% CI: 0.57, 0.69). On the other hand, the odds of health insurance coverage were 1.38, 1.54, 1.79 and 1.76 times higher among women aged 30–34, 35–39, 40–44 and 45–49 years compared to women of the age group of 15–19 years (AOR = 1.38, 95% CI: 1.24, 1.54), (AOR = 1.54, 95% CI: 1.37, 1.74), (AOR = 1.79, 95% CI: 1.58, 2.03), and (AOR = 1.76, 95% CI: 1.54, 2.02), respectively.

Health insurance coverage was lower by 45% and 48%, respectively among never married and formerly married women of RAG in East Africa (AOR =0.55, 95% CI: 0.50, 0.60) and (AOR = 0.52, 95% CI: 0.47, 0.56) compared to those married during the time of the survey. The odds of health insurance coverage were 1.23, 2.71, and 12.56 times higher among women who attended primary, secondary, and higher (tertiary) level of education (AOR = 1.23, 95% CI: 1.13, 1.33), (AOR = 2.71, 95% CI: 2.47, 2.97), and (AOR = 12.56, 95% CI: 11.18, 14.12) as compared to participants with no formal education, respectively.

Working status at the time of the survey was another variable which was significantly associated with health insurance coverage among RAG women. Accordingly, women who are working were 1.34 times more likely to have health insurance as compared to those who are not working at the time of the survey (AOR = 1.34, 95% CI: 1.26, 1.43). The odds of health insurance coverage were lower by 13% among women from rural areas (AOR = 0.87, 95% CI: 0.79, 0.96) as compared to those residing in an urban area.

The odds of health insurance coverage were lower by 95% (AOR = 0.05, 95% CI: 0.04, 0.07), 93% (AOR = 0.07, 95% CI: 0.06, 0.09), 70% (AOR = 0.30, 95% CI: 0.27, 0.35), 99% (AOR = 0.01, 95% CI: 0.01, 0.02), 95% (AOR = 0.05, 95% CI: 0.04, 0.06], 83% (AOR = 0.17, 95 CI: 0.14, 0.20), 99% (AOR = 0.01, 95% CI: 0.01, 0.02), 98% (AOR = 0.02, 95% CI: 0.01, 0.03) and 88% (AOR = 0.12, 95% CI 0.10, 0.14) among women from Ethiopia, Comoros, Kenya, Malawi, Mozambique, Tanzania, Uganda, Zambia and Zimbabwe respectively as compared to women from Burundi.

The odds of health insurance coverage were 1.76 and 3.47 times more likely among RAG women in middle and rich wealth index quintiles (AOR = 1.76, 95% CI: 1.61, 1.92) and (AOR = 3.47, 95% CI: 3.20, 3.77) compared to those in poor wealth index quintiles, respectively. The likelihoods of health insurance coverage were 1.14 times higher in a situation where females are household heads (AOR = 1.14, 95% CI: 1.07, 1.21) compared to where males are household heads.

Women who had media exposure were 1.44 times more likely (AOR = 1.44, 95% CI: 1.34, 1.55) to have health insurance as compared to those who had no media exposure. The odds of health insurance were 1.14 times higher among women visited by field workers in 12 months preceding the survey (AOR= 1.14, 95% CI: 1.04, 1.24] compared to those not visited by field workers. Women who visited health facilities in 12 months preceding the survey were 1.38 times more likely (AOR = 1.38, 95% CI: 1.31, 1.47) to have health insurance compared to those who did not visit health facilities within 12 months preceding the survey.

Discussion

Health insurance coverage among RAG women provides greater financial access to timely care and is a key strategy to achieve universal health coverage.25 In the current study, we examined the prevalence and factors associated with health insurance coverage among RAG women in East African countries.

The results of our study showed that the overall prevalence of health insurance coverage among RAG in East Africa was 7.56%, with cross-country variations where the highest prevalence was observed in Burundi (21.77%) and the lowest was found in Uganda (1.38%). The possible reason for this discrepancy might be due to the difference in domestic health expenditure per Gross Domestic Product (GPD) and premium payment method.26

The findings of this study revealed that RAG women who are single had low health insurance coverage as compared to married ones. This finding was consistent with studies conducted elsewhere.16–18 This is because single women may not afford the premiums, deductibles, and have low perceived illness. According to the current study, participants who engaged in some types of job were positively associated with better coverage of health insurance. This finding was similar to studies done in Ethiopia19 and Kenya.18,20 This is because employed participants can able to pay the regular contribution for health insurance premium required for enrolment.

In this study, relatively older RAG women were more likely to have health insurance as compared to the youngers. Other studies have also reported a direct relationship between maternal age and health insurance coverage.16,18,19,21 This similarity might be due to the fact that as age increases the risk of getting illness increases; thus, the chance of health insurance coverage will increase.27 Consistent with previous studies,16,19,20,22,23 there is a positive relationship between educational status and health insurance coverage among RAG women. This positive association might have occurred because education enhances access to information and high-income, occupations tend to offer insurance and income provides the means to pay insurance premiums.

The current study documented that the odds of health insurance coverage among RAG women in middle and rich wealth index were higher compared to poor wealth index. These findings were similar to a study done at national level in Ethiopia.19 This might be due to the association of income with the utilization of health insurance premium.28 Other studies,6 however, recorded lower odds of health insurance coverage among women from wealthier households (SSA). This might be explained by wealthier women are likely to use private health facilities, due to the quality of healthcare provided.29

Besides, our findings revealed that health insurance coverage was lower among RAG women from rural areas compared to their urban counterparts. This finding is in line with the different studies conducted elsewhere.16,21,23 A plausible explanation for these findings could be that less information access and media exposure about health insurance among rural dweller RAG women. Furthermore, the present study recorded that RAG women who had media exposure were more likely to utilize the health insurance as compared to their counterparts. This finding is similar to a study done in Ghana,18 Ethiopia,19 Kenya,18 and Sub-Saharan Africa.16 The possible explanation could be media exposure play a crucial role in disseminating information and increasing awareness about the importance of health insurance. Besides, the current study identified a strong association between health insurance coverage and health facility visits and being visited by field workers. Thus, media is another getaway to create awareness about health insurance for RAG women.

As a strength, the current study used nationally representative data of ten East Africa countries and an advanced model that considered the clustered nature of that data. However, some East African countries were not included in this study because of the absence of DHS data or data related to health insurance. This might be a limit to conclude our finding for all East African counties. Since the present study used secondary data, some important variables such as perceived need for health care, the presence of degenerative diseases and other special health conditions that can affect health insurance coverage were included in this study.

Conclusion

Health insurance coverage in East Africa among RAG women was below ten percent. The highest prevalence was from Burundi and the lowest was from Uganda. The odds of health insurance was higher among old aged (30–49 years), educated, currently working and rich RAG women, but it was low among rural residents. Besides, RAG women who have media exposure, were visited by field workers, and have visited health facilities have a higher chance of utilizing health insurance. Improving women’s access to health facilities, promoting field workers’ visits, and media exposure targeting young, unemployed, poor, and rural RAG women will be a gateway to improve the coverage of health insurance among RAG women in East Africa.

Abbreviations

AIC, Akaike Information Criteria; AOR, adjusted odds ratio; BIC, Bayesian Information Criteria; CBHI, Community Based Health Insurance; CI, confidence interval; DHS, Demography health survey; GLMM, Generalized Linear Mixed Models; ICC, Intra-cluster Correlation Coefficient; IR, Individual Record; LMIC, Low and Middle Income; RAG, Reproductive Aged group; SSA, Sub-Saharan Africa.

Data Sharing Statement

All necessary informations were included with the manuscript.

Ethics Approval and Consent to Participate

Up on our request to DHS Program, permission was approved by 153701 reference number to download and use the data for this study from http://www.dhsprogram.com. There are no individual identifiers reported in any part of this manuscript. All the data management and analysis were conducted according to the manuals of DHS.

Acknowledgment

We would like to thank DHS for giving us this data.

Author Contributions

All authors made substantial contributions to conception and design, acquisition of data, or analysis and interpretation of data; took part in drafting the article or revising it critically for important intellectual content; agreed to submit to the current journal; gave final approval of the version to be published; and agree to be accountable for all aspects of the work.

Funding

No fund was received for this work.

Disclosure

All authors declared no conflicts of interest for this work.

References

1. WHO. Universal Health Coverage (UHC) [Web]. Geneva:World Health Organization;2021 [updated April 01, 2021]. Available from https://www.who.int/news-room/fact-sheets/detail/universal-health-coverage-(uhc).

2. Spaan E, Mathijssen J, Tromp N, McBain F, Have AT, Baltussen R. The impact of health insurance in Africa and Asia: a systematic review. Bull World Health Organ. 2012;90(9):685–692. doi:10.2471/BLT.12.102301

3. Domapielle MK. Health insurance and access to health care services in developing countries. J Gov Polit. 2014;5(1):30964.

4. Conn CP, Walford V. An Introduction to Health Insurance for Low Income Countries. UK Department for International Development by the Institute for Health Sector Development; 1998.

5. Criel B, van Ginneken W, Kawabata K, Mechbal A, Perrot J, Villar W. Community Based Health Insurance Schemes in Developing Countries: Facts, Problems and Perspectives. Department of Health System Financing Earaf, Editor. Geneva: WHO; 2003.

6. WHO. Health Finincing. Geneva:World Helath Organization;2020 [updated April 14; cited April 18, 2021]. Available from https://www.who.int/health-topics/health-financing#tab=tab_1.

7. Finkelstein A, Taubman S, Wright B, et al. The oregon health insurance experiment: evidence from the first year. Q J Econ. 2012;127(3):1057–1106. doi:10.1093/qje/qjs020

8. Bailey MJ, Lindo JM. Access and Use of Contraception and Its Effects on Women’s Outcomes in the US. National Bureau of Economic Research; 2017.

9. Shudura E, Yoseph A, Tamiso A. Utilization and predictors of maternal health care services among women of reproductive age in Hawassa University health and demographic surveillance system site, South Ethiopia: a Cross-Sectional Study. Adv Public Health. 2020;2020:1–10. doi:10.1155/2020/5865928

10. Kimani JK, Ettarh R, Warren C, Bellows B. Determinants of health insurance ownership among women in Kenya: evidence from the 2008–09 Kenya demographic and health survey. Int J Equity Health. 2014;13(1):1–8. doi:10.1186/1475-9276-13-27

11. Demissie B, Negeri KG. Effect of community-based health insurance on utilization of outpatient health care services in Southern Ethiopia: a comparative cross-sectional study. Risk Manag Healthc Policy. 2020;13:141.

12. Garg CC, Karan AK. Reducing out-of-pocket expenditures to reduce poverty: a disaggregated analysis at rural-urban and state level in India. Health Policy Plan. 2009;24(2):116–128.

13. Organization WH. Extending Social Protection in Health; Developing Countries’ Experiences, Lessons Learnt and Recommendations; 2007.

14. Bayked E, Kahissay M, Workneh B. Factors affecting community based health insurance utilization in Ethiopia: a systematic review. 2019.

15. Kelman S, Woodward A. John Nyman and the economics of health care moral hazard. Int Sch Res Notices. 2013;2013:Article ID 603973. doi:10.1155/2013/603973

16. Amu H, Seidu -A-A, Agbaglo E, et al. Mixed effects analysis of factors associated with health insurance coverage among women in sub-Saharan Africa. PLoS One. 2021;16(3):e0248411.

17. Bernstein AB, Brett KM, Bush MA, Cohen RA. Marital status is associated with health insurance coverage for working-age women at all income levels, 2007. 2008.

18. Kazungu JS, Barasa EW. Examining levels, distribution and correlates of health insurance coverage in Kenya. Trop Med Int Health. 2017;22(9):1175–1185.

19. Kebede SA, Liyew AM, Tesema GA, et al. Spatial distribution and associated factors of health insurance coverage in Ethiopia: further analysis of Ethiopia demographic and health survey, 2016. Arch Public Health. 2020;78(1):1–10.

20. Otieno PO, Wambiya EO, Mohamed SF, Donfouet HPP, Mutua MK. Prevalence and factors associated with health insurance coverage in resource-poor urban settings in Nairobi, Kenya: a cross-sectional study. BMJ Open. 2019;9(12):e031543.

21. Van Der Wielen N, Falkingham J, Channon AA. Determinants of National Health Insurance enrolment in Ghana across the life course: are the results consistent between surveys? Int J Equity Health. 2018;17(1):1–14.

22. Nageso D, Tefera K, Gutema K. Enrollment in community based health insurance program and the associated factors among households in Boricha district, Sidama Zone, Southern Ethiopia; a cross-sectional study. PLoS One. 2020;15(6):e0234028.

23. Amu H, Dickson KS, Kumi-Kyereme A, Darteh EK. Understanding variations in health insurance coverage in Ghana, Kenya, Nigeria, and Tanzania: evidence from demographic and health surveys. PLoS One. 2018;13(8):e0201833.

24. Snijders TA, Bosker RJ. Multilevel Analysis: An Introduction to Basic and Advanced Multilevel Modeling. Sage; 2011.

25. Kozhimannil KB, Abraham JM, Virnig BA. National trends in health insurance coverage of pregnant and reproductive-age women, 2000 to 2009. Womens Health Issues. 2012;22(2):e135–e141.

26. Stepovic M, Rancic N, Vekic B, et al. Gross domestic product and health expenditure growth in Balkan and East European countries—three-decade horizon. Front Public Health. 2020;8:492.

27. Li J. Effects of age and income on individual health insurance premiums. Undergraduate Econ Rev. 2011;7(1):14.

28. Yaya S. Wealth Status, health insurance, and maternal health care utilization in Africa: evidence from Gabon. Biomed Res Int. 2020;2020:4036830.

29. Baloul I, Dahlui M. Determinants of health insurance enrolment in Sudan: evidence from health utilisation and expenditure household survey 2009. BMC Health Serv. 2014;14(2):1.

© 2021 The Author(s). This work is published and licensed by Dove Medical Press Limited. The

full terms of this license are available at https://www.dovepress.com/terms.php

and incorporate the Creative Commons Attribution

- Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted

without any further permission from Dove Medical Press Limited, provided the work is properly

attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2021 The Author(s). This work is published and licensed by Dove Medical Press Limited. The

full terms of this license are available at https://www.dovepress.com/terms.php

and incorporate the Creative Commons Attribution

- Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted

without any further permission from Dove Medical Press Limited, provided the work is properly

attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.