Back to Journals » Risk Management and Healthcare Policy » Volume 17

Blockchain Adoption for Generic Drugs in the Medicine Supply Chain with Consumers’ Risk-Aversion: A Game-Theoretic Model Within Chinese Legal Framework

Authors Cui Z, Liu X, Feng Z, Huang Z

Received 10 October 2023

Accepted for publication 23 December 2023

Published 4 January 2024 Volume 2024:17 Pages 15—28

DOI https://doi.org/10.2147/RMHP.S444026

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Haiyan Qu

Zibin Cui,1,* Xiangdong Liu,2,* Zehua Feng,2 Zhengzong Huang3

1School of Management, Guangdong University of Technology, Guangzhou, People’s Republic of China; 2School of Law, Guangdong University of Technology, Guangzhou, People’s Republic of China; 3School of Marxism, Shenzhen Technology University, Shenzhen, People’s Republic of China

*These authors contributed equally to this work

Correspondence: Zehua Feng; Zhengzong Huang, Email [email protected]; [email protected]

Background: Blockchain is expected to mitigate consumers’ risk-aversion and quality uncertainty about generic drugs in medicine supply chains. This study investigates the effect of blockchain adoption for disclosing the quality information of generic drugs that compete with original drugs in the market and proposes legal measures accordingly.

Methods: We employ a game-theoretic model to analyze a medicine supply chain including a generic drug manufacturer, an original drug manufacturer, and a retailer. We examine when should the supply chain members adopt blockchain for generic drugs and how blockchain affects the medicine supply chain.

Results: Our results show that the quality information of generic drugs determines how blockchain adoption affects the price and sales quantity of generic and original drugs. Moreover, we observe that the generic drugs manufacturer and the retailer decide to adopt blockchain only if consumers’ risk-aversion degree is sufficiently low. Also, a low risk-aversion degree can lead to higher whole supply chain’s profitability with blockchain adoption, and generate a win-win-win situation of blockchain adoption for the consumers, the generic drug manufacturer, and the retailer.

Conclusion: To mitigate consumers’ risk aversion, the law should safeguard consumer rights. Blockchain adoption can benefit the medicine supply chain and consumers under certain conditions. However, it also requires the coordination of supply chain members’ benefits and the disclosure of quality information.

Keywords: generic drug, medicine supply chain, risk aversion, quality uncertainty, blockchain adoption

Introduction

Generic drugs are medicinal products that have the same active ingredients as drugs that were originally protected by chemical patents.1 Generic drugs can be trusted to have the same quality as original drugs, according to the US Food and Drug Administration (FDA), as they require generic drugs to be identical to original drugs concerning pharmacokinetic and pharmacodynamic properties.2 Also, generic drugs generally have cheaper prices because they are allowed for sale after the patents on the original drugs expire. The global generic drug market size was valued at 439.37 billion dollars in 2022 and is projected to hit around 670.82 billion dollars by 2030, expanding at a CAGR of 5.4% over the projection period from 2022 to 2030.3 In medicine supply chains, many large-scale drug retailers procure a variety of generic drugs from manufacturers such as Teva and Viatris,4 and then resell them to consumers. For example, online pharmacy AidAccess began selling generic abortion drugs to all 50 US states in 2018.5 Similar examples can be found in Pharmacy Direct, Amazon Pharmacy, and Rx Outreach.

Although generic drugs can be trusted to have the same quality as original drugs based on the FDA, consumers always have risk-aversion and quality uncertainty about generic drugs.6 According to a cross-sectional study by Idris et al,7 consumers often perceive generic drugs as inferior in quality compared to branded drugs. The scarcity of information on the manufacturing process and quality control of generic drugs contributes to this untrust. To address this challenge, blockchain is increasingly being applied in the medicine supply chain and suggested for use to enhance trust in generic drugs.8 As a publicly distributed ledger, blockchain can secure all the data recorded in it, making all information accurate and transparent. With blockchain technology, medicine supply chain members and consumers are enabled to access information about generic drugs via applications, such as Finboot’s Blockchain track and trace apps (T&T).9 In addition, blockchain also helps generic drug manufacturers address the challenge of counterfeit drug manufacturing, as counterfeit drug fraud is rampant and consumers have difficulty distinguishing between genuine generic drugs and counterfeit drugs.10 During the COVID-19 pandemic, the vaccination management system on the blockchain was considered essential to combat the proliferation of counterfeit COVID-19 vaccines. In order to enhance consumers’ trust and expand demand, some drug manufacturers (eg Pfizer and Merck) and pharmaceutical retailers (eg Walmart and JD Health) have launched collaborative initiatives that adopt blockchain technology to verify and track drug quality.

However, whether blockchain adoption will benefit generic drug manufacturers and retailers in medicine supply chains is unclear. In practice, pharmaceutical retailers also wholesale drugs from original drug manufacturers and resell them to consumers. Moreover, based on the blockchain mechanism, the stakeholders in a supply chain need to exchange and negotiate critical information in the business, which means that blockchain adoption needs the participation of the supply chain members. Hence, it is a challenge to identify pharmaceutical retailers’ motivation for participating in blockchain since the retailers need to coordinate the benefits of selling generic and original drugs. Generic drugs that disclose quality information through blockchain may cannibalize the market share of original drugs, thereby reducing the retailer’s motivation to participate in the blockchain. Also, the coordination of the retailer’s benefits from drug sales as well as the true quality-level information of generic drugs can significantly impact the generic drug manufacturer’s profitability. Medicine supply chain members need to reach a consensus agreement on how to adopt blockchain; that is, only when retailers and generic drug manufacturers in the medicine supply chain have motivations to adopt blockchain can they share information through blockchain technology. Consequently, it is critical to examine when should the supply chain members adopt blockchain for generic drugs and how blockchain affects the medicine supply chain. Although prior studies have investigated blockchain adoption strategy in supply chains,11–17 the impact of blockchain adoption for generic drugs in medicine supply chains considering consumers’ risk-aversion has not been explored.

To address the aforementioned questions, we develop a medicine supply chain model composed of a generic drug manufacturer, an original drug manufacturer, and a retailer. The generic drug manufacturer and the original drug manufacturer compete with each other as they wholesale drugs to the retailer and then the retailer resells drugs to consumers. We assume that consumers have a risk aversion for generic drugs because they are not aware of the quality information of generic drugs. Two cases related to blockchain adoption are considered in this model. In Case N, blockchain is not adopted for generic drugs and consumers are risk-aversion and uncertain about generic drugs. In Case B, blockchain is adopted to mitigate consumers’ risk-aversion and quality untrust for generic drugs.

The rest of this paper is organized as follows: In Literature review Section, we review related literature. In Model description Section, we describe our model and parameter explanations. In Results and analysis Section, we derive the results of two cases and analyze how blockchain adoption affects the medicine supply chain. We conclude our study in Section 5.

Literature Review

This study is associated with three streams of literature: generic drugs in medicine supply chains, blockchain adoption, and risk aversion.

Our study is closely associated with the research about generic drugs in medicine supply chains. Freeman and Hill discussed the use of generic medications to treat hepatitis C, highlighting the challenges in deploying life-saving medications on a mass scale due to the monopoly pricing power of pharmaceutical patents and the potential benefits of parallel importation of generic medications.18 Gupta et al investigated the influence of critical factors on government-supported generic drug supply chains in developing economies in India and proposed a methodology for efficient governance.19 Dave et al studied the relationship between market competition levels and the variation in generic drug prices in the United States and discovered that higher levels of competition were linked to lower price changes for generic drugs over the study period.20 Aivalli et al discussed the quality of generic and branded medicines, negative attitudes towards generic medicines, and the effect on trust in public services within the local health system in Tumkur, India.21 Guerin et al examined the effect of the COVID-19 pandemic on the global supply chain of medical products with a focus on the role of Indian generics and emphasized the significance of keeping the pharmaceutical product supply chain in good shape to support the efficient operation of the healthcare delivery system.22 Kumar studied the supply chain risk management of generic medicines in India and aimed to develop a supply chain risk management framework for generic medicines in India and prioritize the risks.23 Ahlqvist et al identified the role of policymakers in applying supply chain risk management strategies (SCRMS) to mitigate generic medicine shortages in both normal and abnormal times and evaluated the strategies adopted by policymakers in managing shortage risks in the medicine supply chains of seven countries before and during the COVID-19 pandemic.24 Different from their studies, our work focuses on blockchain adoption for generic drugs in medicine supply chains considering consumers’ risk-aversion and quality uncertainty of generic drugs.

There is arising literature on blockchain adoption in the operations management area. Shen et al examined the effect of blockchain for revealing second-hand product quality in a supply chain where contributors deliver secondhand products to an online platform that resells them and competes with suppliers of new products.11 Pun et al investigated how blockchain technology can be applied to prevent counterfeiting, specifically in a market composed of a manufacturer and a counterfeiter, and discussed the use of blockchain to validate product authenticity and the effectiveness of blockchain compared to pricing strategies in alleviating post-purchase regret and enhancing social welfare.12 Zhang et al examined the effect of blockchain technology on competitive retailers’ strategic pricing, including an initial retailer and an entrant retailer both of whom can choose whether to adopt the blockchain technology.13 Li et al explored the interplay between blockchain adoption and channel selection in preventing counterfeits and analyzed how this relationship affects societal welfare and consumer surplus and developed analytical models to examine different scenarios.14 Yang et al examined the influence of brand advantage and blockchain on the mode selection of remanufacturers and manufacturers in the supply chain of remanufactured products, and found that the brand advantage has a significant impact on the manufacturer’s mode choice.15 Xu et al examined the interaction between remanufacturing and blockchain and found that higher allocated cap and higher platform-enabled power lead to higher optimal production amount and optimal collection rates in each case.16 Wang et al discussed the creation and deployment of a blockchain-enabled data-sharing marketplace for a fictitious supply chain and provided a full guide with step-by-step instructions for setting up such a data exchange prototype.17 In contrast, we explore the effect of blockchain adoption in medicine supply chains for revealing the quality level of generic drugs, which consumers are not aware of.

The final stream of relevant research is about risk-aversion. Yoo investigated a scenario where a buyer determines a consumer return policy and assigns the choice of product quality to a supplier who may be risk averse or risk neutral and a penalty scheme to regulate the supplier’s covert activity and demonstrated the prerequisites for supply chain cooperation and the best possible arrangement of return policies.25 Ke et al used uncertainty theory to model the uncertain parameters to explore the choices made regarding pricing and remanufacturing in a closed-loop supply chain including two rival retailers with various risk tolerances.26 Alamdar et al investigated the choice of pricing and collection strategies in a closed-loop supply chain with a single risk-averse manufacturer, retailer, and third party under uncertain demand.27 Abbey et al examined the influence of risk preferences on consumers’ willingness to pay (WTP) for remanufactured products and found that the WTP data can be reasonably explained by a typical utility model with risk aversion and that ambiguity aversion does not play a significant role in consumers’ choices.28 Deng examined how consumers’ risk aversion affects the choice of remanufacturing models and the environmental performance of the supply chain and assessed the environmental effects of each model and examined the best choices and profits made by supply chain participants under various models.29 Adhikari et al developed a supply chain analysis model for textiles with several levels and uncertainty in demand and supply and explored various supply chain coordination agreements and investigated risk sharing as well as risk aversion effects on profitability.30 Gupta and Ivanov used a game-theoretic model to analyze how risk-averse suppliers affect the dual-sourcing strategy of a retailer who sells two substitute products in a market with demand and supply uncertainty.31 Differently, our work considers consumers’ risk-aversion to the quality level of generic drugs in medicine supply chains. Blockchain adoption helps to mitigate consumers’ risk-aversion and quality uncertainty but also affects supply chain members’ profitability.

In particular, our research is closely related to Niu et al,32 who investigated the incentive alignment opportunities and social benefits of adopting blockchain technology in OTC medicine supply chains with competing manufacturers and a common retailer. However, our study contributes to the literature on blockchain adoption in medicine supply chains in several ways. First, we extend the work of Niu et al by focusing on the supply chain that sells generic drugs,32 which face quality uncertainty and risk-aversion from consumers. We examine how blockchain adoption affects the competition and profitability of generic and original drugs in the market. Second, we employ a mean-variance utility framework to capture consumers’ risk preferences and quality perceptions of generic drugs. We show how blockchain adoption can mitigate consumers’ quality uncertainty and increase their willingness to pay for generic drugs. Third, we derive the conditions under which blockchain adoption can create a win-win-win situation for the generic drug manufacturer, the retailer, and the consumers. We also discuss the implications of our findings for supply chain coordination and legal regulation.

Model Description

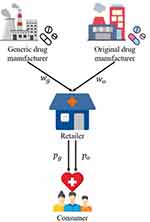

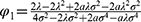

We consider a medicine supply chain consisting of a generic drug manufacturer (denoted by G), an original drug manufacturer (denoted by O), and a retailer (denoted by R). The generic drug manufacturer produces generic drugs and sells them to the retailer at a wholesale price wg, while the original drug manufacturer produces original drugs and sells them to the retailer at a wholesale price wo. The medicine supply chain structure is shown in Figure 1. Although the quality level of generic drugs is equal to that of original drugs, consumers have perception uncertainty about generic drugs’ quality because they are not aware of the manufacturing process and quality control of generic drugs.33,34 When blockchain technology is used, information about generic drugs’ quality will be effectively disclosed to consumers, thereby updating their perceptions of generic drugs’ quality and changing their purchasing decisions. In this study, we investigate two cases: (1) Case N, which is the case that without blockchain adoption, the quality information of generic drugs will not be disclosed to consumers; (2) Case B, which is the case that with blockchain adoption, the quality information of generic drugs can be known to consumers. As mentioned above, blockchain adoption requires the participation of supply chain members. Consequently, blockchain will not be adopted if the generic drug manufacturer or the retailer decides not to participate in it.

|

Figure 1 The medicine supply chain. |

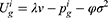

Consumers’ willingness to pay (WTP) for one unit original drug is v which is uniformly distributed in the interval [0,1] as consumers are heterogeneous.35 Moreover, consumers have a lower valuation for generic drugs than the original ones.36 Therefore, we set consumers’ WTP for a generic drug as a fraction λ(0<λ<1) of their WTP for an original drug, that is, consumers’ WTP for one unit generic drug is λv. Since consumers have a perception uncertainty about generic drugs’ quality if they do not know the quality information of generic drugs, we use a random variable θ, which has an expected value of zero and a variance of σ2, to indicate consumers’ quality uncertainty for the generic drugs.37 The consumer surplus of purchasing a generic drug at price  and an original drug at price

and an original drug at price  in Case i are:

in Case i are:

Consumers are risk-averse due to the quality uncertainty for the generic drugs, and they will make purchase decisions (no purchasing, purchasing a generic drug, or purchasing an original drug) based on their utilities. We denote the consumer’s utility of purchasing a generic drug as  while purchasing an original drug as

while purchasing an original drug as  in Case i. Since consumers have no quality uncertainty when they purchase original drugs, the utility of purchasing an original drug is

in Case i. Since consumers have no quality uncertainty when they purchase original drugs, the utility of purchasing an original drug is

However, quality uncertainty will exist when consumers consider purchasing generic drugs. Employing mean-variance utility, in Case N, the mean value and variance of consumer surplus are  and σ2 as there is no quality information of generic drugs. Therefore, the utility of purchasing a generic drug is

and σ2 as there is no quality information of generic drugs. Therefore, the utility of purchasing a generic drug is

where φ(φ>0) is consumers’ risk-aversion degree. A higher value of φ indicates that consumers are more concerned about quality uncertainty.

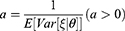

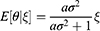

In Case B with blockade adoption, consumers can observe quality information of generic drugs that are on the blockchain. Following Ha et al,38 we denote the quality information of generic drugs observed by consumers as ξ, which is an unbiased estimator of θ (i.e., E[ξ|θ]=θ) and the absolute information accuracy as

A higher value of a indicates that the information is more abundant and accurate. According to Ericson,39

where  indicates the relative information accuracy. As E[ξ] = 0 and

indicates the relative information accuracy. As E[ξ] = 0 and  , we have

, we have

Incorporating consumers’ risk-aversion, the utility of consumers purchasing a generic drug is:

Following Orsdemir et al,40 in Case N, we denote the indifferent point between not purchasing and purchasing generic drugs as  which is the solution of

which is the solution of  . Further, the indifferent point between purchasing generic drugs and purchasing original drugs is denoted as

. Further, the indifferent point between purchasing generic drugs and purchasing original drugs is denoted as  which is the solution of

which is the solution of  . The demand for generic drugs and original drugs in Case N are

. The demand for generic drugs and original drugs in Case N are

Similarly, in Case B, the indifferent point between not purchasing and purchasing generic drugs  is the solution of

is the solution of  and the indifferent point between purchasing generic drugs and purchasing original drugs

and the indifferent point between purchasing generic drugs and purchasing original drugs  is the solution of

is the solution of  . The demand for generic drugs and original drugs in Case B are

. The demand for generic drugs and original drugs in Case B are

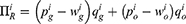

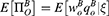

Consequently, the generic drug manufacturer, the original drug manufacturer, and the retailer’s profit in two cases are:

In Case N, since there is no accurate quality information of generic drugs, we set the expected value of supply chain members’ profit as

In Case B, the quality information of generic drugs recorded in blockchain updates consumers’ perception of generic drugs’ quality. We set the expected value of supply chain members’ profit in Case B as

The game sequence is as follows: First, the generic drug manufacturer and the retailer decide whether to adopt blockchain. Second, the generic drug manufacturer and the original drug manufacturer decide the wholesale price of generic drugs and original drugs simultaneously. Third, the retailer decides the retail price of generic drugs and original drugs. Finally, consumers make purchase decisions without or with blockchain adoption.

To guarantee positive variables in this study, we assume that  . Table 1 shows the notations used in this study.

. Table 1 shows the notations used in this study.

|

Table 1 Notations Used in This Study |

Results and Analysis

We use backward induction to solve this game. The equilibrium results are shown in Tables 2 and 3.

|

Table 2 [Equilibrium Results in Case N.] |

|

Table 3 Equilibrium Results in Case B |

In Case B, the equilibrium variable has two parts: the deterministic part which is unrelated to ξ and the randomized part which is related to ξ. We denote D[x] as the deterministic part of x and S[x] as the randomized part of x. According to Wang,41 the profit also has two parts in Case B: riskless profit and risk profit. The riskless profit is the expected value of the equilibrium profit, while the risk profit is the equilibrium profit that includes the quality information ξ. In this section, we first ignore the quality information ξ and analyze the impact of blockchain adoption on the deterministic part of the equilibrium results.

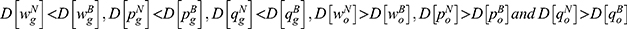

Lemma 1 shows that blockchain adoption for generic drugs leads to higher deterministic parts of the wholesale price, retail price, and sales quantity of the generic drugs while leading to lower wholesale price, retail price, and sales quantity of the original drugs. As blockchain discloses quality information of generic drugs and mitigates the negative effect of consumers’ risk-aversion, generic drugs are more popular with consumers. Therefore, both the generic drug manufacturer and the retailer choose to raise the price of generic drugs to acquire more marginal profit. Meanwhile, intensified competition between generic drugs and original drugs caused by blockchain adoption reduces the demand for original drugs and induces the original drug manufacturer and the retailer to reduce the price of original drugs.

Furthermore, we discuss the impact of the quality variance on the deterministic part of equilibrium results.

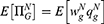

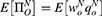

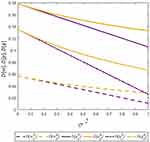

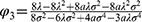

Lemma 2 shows that the deterministic parts of the wholesale price, retail price, and sales quantity of the generic drugs decrease with the quality variance, while those of the original drugs increase with the quality variance. Higher-quality variance indicates higher-quality uncertainty of generic drugs, which reduces the advantages of generic drugs in the competition. Hence, the demand for generic drugs decreases while that for original drugs increases. To mitigate the negative effect of higher-quality uncertainty, the generic drug manufacturer and the retailer decide to reduce the price of generic drugs. Further, we numerically analyze the trends of variables with respect to the quality variance to clearly illustrate our findings in Lemma 2 by assuming a=0.6, λ=0.3, and φ=0.1. The analysis is described in Figures 2 and 3.

|

Figure 2 The trends of variables of generic drugs with respect to the quality variance. |

|

Figure 3 The trends of variables of original drugs with respect to the quality variance. |

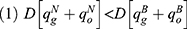

Next, we explore the impact of the quality variance on the differences of the deterministic parts of the equilibrium results.

From Lemma 3, we can observe that higher-quality variance will result in a larger difference between the two cases. The reason is that higher-quality variance will reduce consumers’ preference for generic drugs when blockchain is not adopted. Consequently, blockchain adoption can more effectively alleviate consumers’ quality uncertainty of generic drugs and thereby generate a significant effect on the price and sales quantity of generic drugs. Interestingly, we find that higher-quality variance also generates a larger positive effect of blockchain adoption on original drugs. This finding illustrates that blockchain adoption for generic drugs may bring advantages to the original drug manufacturer in high-quality variance.

We next study how blockchain adoption affects the total sales quantity and how the quality variance affects the differences of total demand.

Lemma 4 shows that blockchain adoption leads to a higher deterministic part of the quantity sum of two drugs. Also, the results indicate that the difference of the quantity sum’s deterministic parts in the two cases increases with the quality variance and consumers’ risk-aversion degree. As blockchain discloses quality information of generic drugs, some risk-averse consumers who will leave the market when blockchain is not adopted may choose to purchase the drugs. In particular, higher-quality variance and consumers’ risk-aversion degree will boost demand growth due to consumers’ quality uncertainty.

Next, we discuss how quality information affects the equilibrium results.

Lemma 5. If ξ>0, we have  and

and  ; otherwise, the above results are the opposite.

; otherwise, the above results are the opposite.

Note that ξ>0 indicates the positive quality information whereas ξ>0 indicates the negative quality information of generic drugs. When risk-averse consumers receive positive information of generic drugs, they believe that the quality level of generic drugs is higher than expected. Hence, more advantages from consumers’ preferences induce the generic drug manufacturer and the retailer to raise prices to extract more marginal profits. In contrast, positive information of generic drugs will intensify the competition between the drugs. Consequently, the original drug manufacturer and the retailer need to reduce the price of original drugs to alleviate the competition and balance the profit gains from both drugs.

We then investigate the impact of blockchain adoption on the equilibrium results considering the randomized part.

Lemma 6. If ξ>-σ2φ, we have  and

and  ; otherwise, the above results are the opposite.

; otherwise, the above results are the opposite.

Lemma 6 shows that blockchain adoption will raise the price and sales quantity of generic drugs whereas reduces those of original drugs with sufficiently positive quality information of generic drugs, and the results are the opposite with sufficiently negative quality information. Intuitively, sufficiently positive quality information results in more market advantages for generic drug manufacturers. Therefore, the demand for generic drugs increases, and the generic drug manufacturer and the retailer are more inclined to raise the price of generic drugs. Meanwhile, sufficiently positive quality information also intensifies the competition between the drugs, and thereby the original drug manufacturer and the retailer need to reduce the price of original drugs to mitigate the competition.

Next, we examine the generic drug manufacturer and the retailer’s choices for blockchain adoption by comparing their profit. In the following discussion, we denote that  ,

,  and

and  .

.

Proposition 1. Both the generic drug manufacturer and the retailer prefer blockchain adoption if and only if φ<φ1.

Proposition 1 indicates that the generic drug manufacturer and the retailer will reach a consensus on adopting blockchain when consumers’ risk-aversion degree is sufficiently low. The generic drug manufacturer’s profit consists of the price and the sales quantity of generic drugs. From Lemma 1 and 6 we know that blockchain adoption will raise the price and sales quantity of generic drugs in most cases. However, blockchain adoption will hurt the generic drug manufacturer’s profit when the risk-aversion degree is sufficiently high. The result is because of increased costs of implementation and maintenance, intensified price competition, limited increase in sales due to persistent preference for original drugs, and potential additional regulatory scrutiny. These factors could outweigh the benefits of increased sales from reduced consumer uncertainty.

Moreover, as blockchain adoption affects the retail price and sales quantity of the original drug, the retailer needs to balance the profits of the two drugs by adjusting the demand allocation. Hence, the retailer can only benefit from blockchain adoption if the risk-aversion degree is sufficiently low. Blockchain adoption increases transparency and trust in generic drugs, potentially boosting sales. However, if consumers are highly risk-averse, they may still prefer original drugs despite the increased transparency, limiting the increase in sales of generic drugs. The retailer who sells both original and generic drugs can benefit from this situation as they can maintain sales quantity by selling more original drugs to highly risk-averse consumers. Combined with the findings about the impact of blockchain adoption on the generic drug manufacturer and the retailer, we know that the generic drug manufacturer and the retailer will only adopt blockchain if consumers’ risk-aversion degree is sufficiently low.

We further examine the impact of blockchain adoption on the expected supply chain profit.

Proposition 2. Blockchain adoption leads to higher expected supply chain profit if and only if φ<φ2.

Proposition 2 reveals that the whole supply chain can benefit from blockchain adoption only when consumers’ risk-aversion degree is sufficiently low. Blockchain adoption benefits the sales of generic drugs, expanding the total market demand, but it harms the sales of original drugs. Therefore, blockchain adoption is not always beneficial to the profit of the whole supply chain. The fundamental reason for this result is that blockchain adoption does not significantly alleviate consumers’ risk aversion to generic drugs at a lower risk-aversion degree and thus cannot significantly reduce the differentiation between the two types of drugs. Therefore, the total profit of the supply chain increases as the competition is mitigated by blockchain adoption. Obviously, when the risk-aversion degree is high, neither the retailer nor the original drug manufacturer is willing to adopt blockchain. Therefore, in order for the retailer to participate in the blockchain to allow consumers to realize the quality information of generic drugs, the generic drug manufacturer can coordinate the supply chain’s profit by giving subsidies to the retailer and licensing fees to the original drug manufacturer.

We next investigate the impact of blockchain adoption on consumer surplus in the medicine supply chain and explore the win-win-win situation for supply chain members and consumers. Following Qiao and Su,42 consumer surplus in Case i can be derived as:

By comparing the consumer surplus and supply chain members’ profit, we can derive the following proposition.

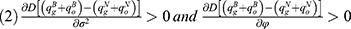

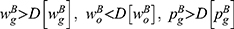

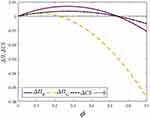

Proposition 3.

(1) Blockchain adoption leads to a higher consumer surplus if and only if φ<φ3.

(2) Blockchain adoption leads to a higher generic drug manufacturer’s profit, retailer’s profit, and consumer surplus if and only if φ<φ1.

Proposition 3 (1) indicates that when consumers’ risk-aversion degree is sufficiently low, blockchain adoption can benefit consumer surplus; otherwise, it will hurt consumer surplus. We know that blockchain adoption helps to alleviate the negative impact of customers’ risk-aversion considerations. This, in turn, expands the total demand for the two types of drugs and reduces the retail price of new products, ultimately benefiting consumer surplus. However, blockchain adoption will raise the retail price of generic drugs, which hurts the surplus of consumers who buy generic drugs. In addition, a higher risk-aversion degree leads to a larger difference in the retail price of drugs in the two cases. Therefore, consumer surplus is harmed by the higher prices brought about by blockchain adoption.

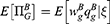

From Proposition 3 (2) we can observe that the condition of the win–win–win situation for consumers, the generic drug manufacturer, and the retailer, is the same as the condition of the win–win situation for the generic drug manufacturer and the retailer. This is because the threshold at which the generic drug manufacturer and the retailer decide to adopt blockchain is low enough that consumer surplus will benefit from blockchain adoption. When the generic drug manufacturer and the retailer decide to adopt blockchain at a lower risk-aversion degree, the retail price of drugs will not be sufficiently high. Consequently, blockchain adoption has a positive impact on consumer surplus.

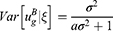

To clearly illustrate our findings in above propositions, we numerically analyze the condition of the win-win-win situation for consumers, the generic drug manufacturer, and the retailer by assuming a=0.6, λ=0.5, and σ2=0.9. Profit difference and consumer surplus difference are used to describe the comparison of the two cases. We denote  ,

,  , and

, and  . Figure 4 shows the trends of the profit difference and consumer surplus difference with respect to consumers’ risk-aversion degree.

. Figure 4 shows the trends of the profit difference and consumer surplus difference with respect to consumers’ risk-aversion degree.

|

Figure 4 Trends of ∆ΠG, ∆ΠR, and ∆CS with respect to φ. |

Conclusion

This study investigates the effect of blockchain adoption for disclosing the quality information of generic drugs that compete with original drugs in the market and proposes legal measures accordingly. We employ a game-theoretic model to analyze a medicine supply chain including a generic drug manufacturer, an original drug manufacturer, and a retailer. We examine when the supply chain members should adopt blockchain for generic drugs and how blockchain affects the medicine supply chain.

Our results show that the quality information of generic drugs determines how blockchain adoption affects the price and sales quantity of generic and original drugs. Moreover, we observed that the generic drugs manufacturer and the retailer decide to adopt blockchain only if consumers’ risk-aversion degree is sufficiently low. Also, a low risk-aversion degree can lead to higher whole supply chain’s profitability with blockchain adoption, and generate a win-win-win situation of blockchain adoption for the consumers, the generic drug manufacturer, and the retailer. Our findings suggest that blockchain adoption can benefit the medicine supply chain and the consumers under certain conditions. However, it also requires the coordination of supply chain members’ benefits and the disclosure of quality information.

Our findings provide legal implications for improving the regulation of generic drugs in China. We suggest that China should enhance the administrative procedures governing generic drug oversight to promptly safeguard consumers’ rights to life and health, thus reducing their risk-aversion. We also propose that the law should establish clear and consistent rules and standards for blockchain adoption in the medicine supply chain and balance the interests and responsibilities of different stakeholders. Blockchain adoption can provide a transparent and reliable mechanism for verifying and tracking the quality information of generic drugs, but it also poses some legal challenges, such as data privacy, data ownership, and data governance. By addressing these legal issues, China can foster a more trustworthy and efficient medicine supply chain for generic drugs.

Our study has some research limitations, which can provide potential directions for future research. First, we did not consider the operational costs required to adopt blockchain technology. Considering blockchain operational costs would provide medicine supply chain managers with more valuable insights into coordinating profits. Second, there are some generic drugs on the market that are manufactured during the patent protection period of the original drugs, in which case the generic manufacturer is required to pay a license fee to the original drug manufacturer. Considering license fees and government regulation will be a challenging problem. Finally, as failure in the cold chain management process can decrease the efficacy of drugs and vaccines to the point that they are no longer effective, it would be beneficial to explore how the quality and safety of drugs can be enhanced by integrating blockchain technology with cold chain management, which involves the transportation and storage of drugs under controlled temperature conditions.

Disclosure

The authors report no conflicts of interest in this work.

References

1. Dunne SS, Dunne CP. What do people really think of generic medicines? A systematic review and critical appraisal of literature on stakeholder perceptions of generic drugs. BMC Med. 2015;13(1):1–27. doi:10.1186/s12916-015-0415-3

2. What is the difference between brand-name and generic drugs? 2021. Available from: https://www.medicalnewstoday.com/articles/brand-and-generic-drugs.

3. Generic Drugs Market; 2022. Available from: https://www.precedenceresearch.com/generic-drugs-market.

4. The top 10 generic drug makers by 2021 revenue; 2022. Available from: https://www.fiercepharma.com/pharma/top-10-generic-drugmakers-2021-revenue.

5. Our 12 Picks for Online Pharmacies of 2023; 2023. Available from: https://www.verywellhealth.com/best-online-pharmacies-4842630.

6. Carrera M, Villas-Boas S. Generic aversion and observational learning in the over-The-counter drug market. Am Econ J Appl Econ. 2023;15(3):380–410.

7. Idris IM, Hassan DN, Hassen HA, Araya RZ, Weldemariam DG. Consumers’ perception of generic medicines and evaluation of in vitro quality control parameters of locally manufactured paracetamol tablets in Asmara, Eritrea: a cross-sectional study. Biomed Res. Int. 2021;2021:1–7. doi:10.1155/2021/4014797

8. Greco C. Generic manufacturers can make big changes with blockchain technology. Blockchain Healthcare Today. 2023;6(1). doi:10.30953/bhty.v6.254

9. Disrupting Pharma Industry with Blockchain; 2023. Available from: https://www.nitorinfotech.com/blog/disrupting-pharma-industry-with-blockchain/.

10. A blockchain solution to eroding trust in the pharmaceutical model; 2022. Available from: https://www.bsvblockchain.org/news/a-blockchain-solution-to-eroding-trust-in-The-pharmaceutical-model.

11. Shen B, Xu X, Yuan Q. Selling secondhand products through an online platform with blockchain. Trans Res Part E Logistics Transport Rev. 2020;142:102066. doi:10.1016/j.tre.2020.102066

12. Pun H, Swaminathan JM, Hou P. Blockchain adoption for combating deceptive counterfeits. Prod Oper Manage. 2021;30(4):864–882. doi:10.1111/poms.13348

13. Zhang Z, Ren D, Lan Y, Yang S. Price competition and blockchain adoption in retailing markets. Eur J Oper Res. 2022;300(2):647–660. doi:10.1016/j.ejor.2021.08.027

14. Li Z, Xu X, Bai Q, Guan X, Zeng K. The interplay between blockchain adoption and channel selection in combating counterfeits. Trans Res Part E Logistics Transport Rev. 2021;155:102451. doi:10.1016/j.tre.2021.102451

15. Yang L, Gao M, Feng L. Competition versus cooperation? Which is better in a remanufacturing supply chain considering blockchain. Trans Res Part E Logistics Transport Rev. 2022;165:102855. doi:10.1016/j.tre.2022.102855

16. Xu X, Yan L, Choi TM, Cheng T. When is it wise to use blockchain for platform operations with remanufacturing? Eur J Oper Res. 2023;309(3):1073–1090. doi:10.1016/j.ejor.2023.01.063

17. Wang Z, Zheng Z, Jiang W, Tang S. Blockchain-enabled data sharing in supply chains: model, operationalization, and tutorial. Prod Oper Manage. 2021;30(7):1965–1985. doi:10.1111/poms.13356

18. Freeman JA, Hill A. The use of generic medications for hepatitis c. Liver Int. 2016;36(7):929–932. doi:10.1111/liv.13157

19. Gupta K, Dixit A, Routroy S, Dubey SK. Government supported generic drug supply chain in India: a study on critical success factors. Evid Based Manage. 2017;253.

20. Dave CV, Kesselheim AS, Fox ER, Qiu P, Hartzema A. High generic drug prices and market competition: a retrospective cohort study. Ann Internal Med. 2017;167(3):145–151. doi:10.7326/M16-1432

21. Aivalli PK, Elias MA, Pati MK, et al. Perceptions of the quality of generic medicines: implications for trust in public services within the local health system in Tumkur, India. BMJ Global Health. 2018;2(Suppl 3):e000644. doi:10.1136/bmjgh-2017-000644

22. Guerin PJ, Singh-Phulgenda S, Strub-Wourgaft N. The consequence of covid-19 on the global supply of medical products: why Indian generics matter for the world? F1000Research. 2020;9:225. doi:10.12688/f1000research.23057.1

23. Kumar D. Analysis of issues of generic medicine supply chain using fuzzy AHP: a pilot study of Indian public drug distribution scheme. Int J Pharm Healthcare Marketing. 2021;15(1):18–42. doi:10.1108/IJPHM-12-2019-0078

24. Ahlqvist V, Dube N, Jahre M, et al. Supply chain risk management strategies in normal and abnormal times: policymakers’ role in reducing generic medicine shortages. Int J Phys Distrib Logist Manage. 2023;53(2):206–230. doi:10.1108/IJPDLM-12-2021-0511

25. Yoo SH. Product quality and return policy in a supply chain under risk aversion of a supplier. Int J Prod Econ. 2014;154:146–155. doi:10.1016/j.ijpe.2014.04.012

26. Ke H, Wu Y, Huang H. Competitive pricing and remanufacturing problem in an uncertain closed-loop supply chain with risk-sensitive retailers. Asia-Pacific J Oper Res. 2018;35(01):1850003. doi:10.1142/S0217595918500033

27. Alamdar S, Rabbani M, Heydari J. Optimal decision problem in a three-level closed-loop supply chain with risk-averse players under demand uncertainty. Uncertain Supply Chain Management. 2019;7(2):351–368. doi:10.5267/j.uscm.2018.7.002

28. Abbey JD, Kleber R, Souza GC, Voigt G. Remanufacturing and consumers’ risky choices: behavioral modeling and the role of ambiguity aversion. J Oper Manage. 2019;65(1):4–21. doi:10.1002/joom.1001

29. Deng W. Sustainable development: impacts of consumers’ risk aversion on remanufacturing model selection and environmental performance. Sust Develop. 2020;28(6):1564–1574. doi:10.1002/sd.2105

30. Adhikari A, Bisi A, Avittathur B. Coordination mechanism, risk sharing, and risk aversion in a five-level textile supply chain under demand and supply uncertainty. Eur J Oper Res. 2020;282(1):93–107. doi:10.1016/j.ejor.2019.08.051

31. Gupta V, Ivanov D. Dual sourcing under supply disruption with risk-averse suppliers in the sharing economy. Int J P Res. 2020;58(1):291–307. doi:10.1080/00207543.2019.1686189

32. Niu B, Dong J, Liu Y. Incentive alignment for blockchain adoption in medicine supply chains. Trans Res Part E Logistics Transport Rev. 2021;152:102276. doi:10.1016/j.tre.2021.102276

33. Idris IM, Hassan DN, Hassen HA, Araya RZ, Weldemariam DG. Consumers’ Perception of Generic Medicines and Evaluation of In Vitro Quality Control Parameters of Locally Manufactured Paracetamol Tablets in Asmara, Eritrea: a Cross-Sectional Study. Biomed Res. Int. 2021;2021:1–7.

34. Hussar DA. Is the quality of generic drugs cause for concern? J Managed Care Specialty Pharmacy. 2020;26(5):597–599. doi:10.18553/jmcp.2020.26.5.597

35. Yang W, Zhang J, Yan H. Impacts of online consumer reviews on a dual-channel supply chain. Omega. 2021;101:102266. doi:10.1016/j.omega.2020.102266

36. Kohli E, Buller A. Factors influencing consumer purchasing patterns of generic versus brand name over-The-counter drugs. South Med J. 2013;106(2):155–160. doi:10.1097/SMJ.0b013e3182804c58

37. Wen X, Siqin T. How do product quality uncertainties affect the sharing economy platforms with risk considerations? A mean-variance analysis. Int J Prod Econ. 2020;224:107544. doi:10.1016/j.ijpe.2019.107544

38. Ha AY, Tian Q, Tong S. Information sharing in competing supply chains with production cost reduction. Manuf Serv Oper Manage. 2017;19(2):246–262. doi:10.1287/msom.2016.0607

39. Ericson WA. A note on the posterior mean of a population mean. J Royal Statistical Soc. 1969;31(2):332–334.

40. Örsdemir EA, Kemahlıoğlu‐Ziya E, Parlaktürk AK. Competitive quality choice and remanufacturing. Prod Oper Manage. 2014;23(1):48–64. doi:10.1111/poms.12040

41. Wang T, Thomas DJ, Rudi N. The effect of competition on the efficient–responsive choice. Prod Oper Manage. 2014;23(5):829–846. doi:10.1111/poms.12093

42. Qiao H, Su Q. Distribution channel and licensing strategy choice considering consumer online reviews in a closed-loop supply chain. Trans Res Part E Logistics Transport Rev. 2021;151:102338. doi:10.1016/j.tre.2021.102338

© 2024 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2024 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.