Back to Journals » Risk Management and Healthcare Policy » Volume 16

How Does Fiscal Decentralization Affect Health Outcomes? Evidence from China

Authors Chen C, Zheng M , Zhu J

Received 14 March 2023

Accepted for publication 16 June 2023

Published 16 September 2023 Volume 2023:16 Pages 1893—1903

DOI https://doi.org/10.2147/RMHP.S412547

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Professor Mecit Can Emre Simsekler

Chen Chen,1,2,* Meng Zheng,1,2,* Junli Zhu1,2,*

1School of Public Health, Capital Medical University, Beijing, People’s Republic of China; 2Research Center for Capital Health Management and Policy, Beijing, People’s Republic of China

*These authors contributed equally to this work

Correspondence: Junli Zhu, School of Public Health, Capital Medical University & Research Center for Capital Health Management and Policy, No. 10, Xitoutiao, Youanmen Wai, Fengtai District, Beijing, 100069, People’s Republic of China, Tel +86 18701515093, Fax +86 01083911578, Email [email protected]

Background: The impact of fiscal decentralization on health outcomes still has not reached a consensus, and studies conducted in the context of the new round of fiscal and taxation system reform are even less available. China’s fiscal decentralization system has its own special characteristics, so it is necessary to analyze the impact of fiscal decentralization on health outcomes before and after the new round of fiscal and taxation system reform in China.

Methods: Panel data from 2007 to 2019 were obtained through China’s Health Statistics Yearbook and China’s Statistical Yearbook. The effects of fiscal decentralization on health outcomes before and after the reform are explored separately by SYS-GMM, which introduce a dynamical model with a lag period of the explained variables. The Hansen test is used to determine excessive identification. The AR(2) is used to determine whether the residual term of the differential equation has a second-order serial correlation.

Results: Fiscal decentralization consistently had a negative impact on health outcomes, yet government health expenditures did not mediate the impact of fiscal decentralization on health outcomes. Fiscal decentralization had a positive effect on per capita government health expenditure before the new reforms, yet had a negative effect on the percentage of government health expenditures, both before and after the new reform.

Conclusion: China’s fiscal decentralization has caused local governments to pay insufficient attention to the construction of people’s livelihoods, and the problem of insufficient government investment in health has not been improved. The new round of fiscal and taxation system reform has not reversed this situation either. It is recommended to adjust the incentive system for local officials, include medical and health in the evaluation indicators of local governments, optimize the structure of government expenditure, and improve the efficiency of the use of government health expenditure.

Keywords: fiscal decentralization, government health expenditure, health outcomes, China’s new round of fiscal and tax reforms

Introduction

Along with the great economic achievements, Chinese residents’ health status has also significantly improved since the reform and opening up in 1978. According to the statistical bulletin issued by the National Health Commission, the life expectancy at birth of Chinese residents reached 77.3 years, the infant mortality rate declined to 5.6 per 1000 livebirths, and the maternal mortality rate was 17.8 per 100,000 in 2019.1 There are significant inequalities in health levels between regions and between rural and urban areas. The maternal mortality rate in underdeveloped regions like the mid-west and northeast of China is more than twice that of the developed regions like the east. The neonatal and under-five mortality rates are more than twice as high in rural areas as in urban areas. The gap also existed between China and other countries, especially those from the Organization for Economic Cooperation and Development (OECD). As of 2016, life expectancy at birth in the UK, France, Germany, and Italy exceeded 80 years, while in China it only exceeded 76.4 years. In 2018, there were fewer than 4 infant mortality rates per 1000 live births in the UK, France, Germany, and Italy, while there were 7.4 in China.

Studies have explored the socio-economic factors influencing health outcomes, with studies showing that gross domestic product(GDP), per capita income, urbanization rates, and levels of population aging all have impacts on health outcomes.2 It is the government’s responsibility to provide resources to the maximum extent possible to fulfill its commitment to the health and human rights of its citizens.3 So it is necessary to rationalize the increase and utilization of government health expenditure. Over the years, China has been committed to increasing fiscal investment in health, especially after the Severe Acute Respiratory Syndromes(SARS) outbreak in 2003. According to China Statistical Yearbook, the government health expenditure was 1,801,695 million yuan. Even so, China’s government health expenditure is extremely weak compared to other countries, especially OECD countries.4 The allocation fiscal expenditure by local governments depends on the country’s fiscal and taxation system. From 2019, healthcare assistance is included in the scope of common financial affairs of the central and local governments. The central share proportion is mainly according to the local financial situation and the number of protection objects and other factors. The local part relies on local own financial resources and central transfer payments. The central government to increase balanced transfer payments to promote the balance of financial resources between regions. Accordingly, it is hypothesized that fiscal decentralization, local government health expenditure, and health outcomes are closely linked.5

Since 1994, China has implemented a hierarchical tax-sharing budget management system (referred to as the “tax-sharing system”), clarifying the division of fiscal revenue and expenditure between the central and local governments, which laid the foundation for China’s modern fiscal system. The fiscal capacity of local governments plays an important role in ensuring that local governments provide adequate public health services. However, The tax-sharing system established in 1994 is asymmetric fiscal federalism and there is a serious mismatch between the financial power and administrative power of the central and local governments.6,7 Some studies have pointed out that the tax-sharing reform has brought the inequality of public services between regions and urban-rural areas.8,9 The Political Bureau of the CPC Central Committee reviewed and approved the “Overall Plan for Deepening the Reform of the Fiscal and Tax System” on June 2014, which marked the start of a new round of fiscal and taxation system reform (hereinafter referred to as the new reform). This round of reforms focuses on improving the budget and tax system and clarifying the power and expenditure responsibilities of governments at all levels. Relevant laws institutionalize the decentralization of revenue and expenditure, which promotes the legalization of the fiscal decentralization system. It is necessary to explore whether fiscal decentralization can improve local health in the context of the new reform in China.

Literature Overview

Previous studies have indicated that economic decentralization can be further implemented through two different policy options: fiscal federalism and fiscal decentralization. Fiscal federalism is the transfer of centrally centralized public health budget authorization to local governments. Following that, the local level decides how to spend the received budget.10,11 The issue of cross-regional heterogeneity arises under this system.12 The UK allocated National Health Service funding to English regions through formula funding in 1976.13 Smith(2008) refers to this way to reduce avoidable regional health inequalities by broadening the remit of the resource allocation formula.14 Diderichsen(1997) develops a new model for Stockholm in Sweden, based on the British experience, as a way to improve the equity of health care.15 Oates(1999) recommends that essential services be provided nationally across the board to deal with cross-regional heterogeneity.11 China’s tax-sharing reform drew on the basic proposition of vertical fiscal decentralization of fiscal federalism in its institutional design and implemented a centralized system of fiscal decentralization.16 Ding(2019) indicates that although the method based on the endogenous proxies of fiscal federalism is unstable and unreliable, the results of the difference-in-difference estimation show that the tax-sharing reform promoted China’s economic growth.17

Although research in many countries has shown that fiscal decentralization promotes economic development,17–19 its impact on health care is complex. Fiscal decentralization in developed countries has had mostly positive impacts on health outcomes, such as Spain, Canada, and Italy.20–22 But for developing countries, the impact of fiscal decentralization varies. In Ivory Coast, municipal revenues available for public services are higher in urban areas than in rural areas. Thus, urban local governments are more likely to have access to public health services than poorer ones.23 Mahal et al uses data from rural India and find that fiscal decentralization had a positive impact on infant mortality rates.24 Soto et al report that fiscal decentralization in Colombia has reduced infant mortality. However, the effectiveness of this improvement in health outcomes depends to a large extent on local socio-economic conditions.25 In China, both Gu (1995) and Jin (2011) suggest that fiscal decentralization had led to the collapse of village health stations and worsened healthcare services in poor areas.26,27 Uchimura (2009), on the other hand, uses data from 26 provinces in China from 1995–2001 to illustrate the positive effect of fiscal decentralization on reducing infant mortality.28 Numerous studies also demonstrate that fiscal decentralization affects health spending and that health spending affects health outcomes.20–22 In China, local government officials are not accountable to the local electorate but to higher-level government officials,29 and its’ performance appraisals are oriented towards GDP, resulting in low spending on public services which do not contribute significantly to economic growth.

Domestic and international studies on the impact of fiscal decentralization on health outcomes have not yet reached a consensus. China’s fiscal decentralization system is unique, and the impact of fiscal decentralization on health outcomes needs to be judged in the context of the specificities of Chinese governance and the development characteristics of different periods. In addition, most of the existing literature in China takes the “tax sharing system” reform in 1994 as the background, but no research has been conducted in the context of the new era of socialism with Chinese characteristics and the new reform. All of these issues are the focus of this study, which is also the contribution of this study to the existing literature. So, the first aim of this study is to explore whether fiscal decentralization has an impact on health outcomes, and what role government health spending plays in this. The new reform in 2014 has been implemented for several years, and the impact of fiscal decentralization on health outcomes has gradually emerged. So another aim of this study is to explore whether the impact of fiscal decentralization on health outcomes differs before and after the new round of reform of China’s fiscal and taxation system.

Methods

Data Sources

Data are collected from the China Statistical Yearbook and the China Health Statistical Yearbook. Due to the reclassification of government expenditure items in 2007, the government revenue and expenditure data after 2007 are not comparable to previous data, therefore data after 2007 is chosen. The pandemic of the Coronavirus disease 2019 (COVID-19) in late 2019 had a major impact on the social and economic development of China, with a greater variety of data after 2020. So, the data is up to 2019. Since the new round of fiscal and taxation system reform was implemented in 2014, we construct panel data for two time periods, 2007 to 2013 and 2014 to 2019, respectively. Systematic generalized moment estimation method (SYS-GMM) is constructed using STATA 16.0.

Dependent Variable

In this research, health outcomes were used as the dependent variable and perinatal mortality rate (PMR) was used as an indicator for evaluating health outcomes. According to the World Health Organization (2006), perinatal mortality is both deaths in the first week of life and fetal deaths (stillbirths). It is a critical indicator of maternal care and maternal health and nutrition; it also reflects the quality of obstetric and paediatric care available.30 Most of the previous literature on the impact of fiscal decentralization on health outcomes had chosen infant mortality rate and life expectancy to measure health outcomes.20,21,27,28 In China, Hao et al indicated that PMR is a better indicator of public health than life expectancy or infant mortality.31 So PMR was chosen as an indicator of health outcomes.

Independent Variable

Fiscal decentralization was used as the independent variable in this study. In the previous literature, there were two perspectives to measure fiscal decentralization: fiscal revenue perspective32,33 and fiscal expenditure perspective.28,31 In China’s fiscal and taxation system, the central government is in a dominant position, determining the amount of revenue and how to distribute it between the central and local governments. And since the tax-sharing system reform in 1994, the revenue of most local governments had relied on transfer payments from the central government. Hao et al pointed out that the expenditure indicator can better reflect the activities of local governments in the public sector in China.31 This research chose fiscal expenditure decentralization to measure the degree of fiscal decentralization. To avoid the possible positive correlation between government expenditure scale and population size, the per capita index was used to measure the degree of fiscal expenditure decentralization.

Mediating Variable

The government health expenditure indicator is the most intuitive indicator of government investment in health, which is directly influenced by the fiscal decentralization system in China. In this study, government health expenditure was used as a mediating variable to measure government health expenditure from two perspectives: absolute quantity and relative quantity. The absolute quantity was the per capita government health expenditure, and the relative quantity was the proportion of government health expenditure to fiscal expenditure. Hao et al (2021) also chose these two indicators to explore the impact of the fiscal system on government health expenditure.29

Control Variable

Based on the previous literature, this study controlled for variables that may have an impact on health outcomes. The level of economic development may affect people’s lifestyles and medical technology development.34 The urbanization rate enhances residents’ accessibility to health resources, stimulates health demand, and thus influences health outcomes.35 The elderly population, as a health-sensitive population, is an important influential factor in stimulating health expenditures. Furthermore, an empirical study has shown a significant correlation between illiteracy rate and health resource allocation indicators.36 In summary, per capita GDP, aging population (old), urbanization rate (urban), and education level (edu) were selected as the control variables in this study. Table 1 shows the introduction and descriptive statistics of the variables.

|

Table 1 Variables and Statistics |

Estimation Framework

Panel data could provide more information and less collinearity than a separate time series or cross-sectional analysis and studies had been conducted using panel data regression models to assess the impact of fiscal decentralization on health.32,37 There may be a reverse causal relationship between the core explanatory variables and the explained variables. To address the potential endogeneity problem, this paper adopts the SYS-GMM proposed by Arellano and Bover (1995), and Blundell and Bond (1998), which introduce a dynamical model with a lag period of the explained variables.38,39 The Hansen test in the SYS-GMM was used to determine whether there were over-identification constraints in the estimation process. The null hypothesis was that the selection of instrumental variables in the model was valid, and the AR(2) was used to determine whether the residual term of the differential equation had a second-order serial correlation.

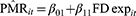

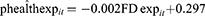

The basic mediation model was defined by three equations. First, the overall effect of FDexp (the primary predictor variable) on PMR was:

The mediation model used two regression equations to decompose the overall effect into its direct and indirect components as follows:

Where β0* is the regression intercepts in equation* and the β1*β2* terms are regression slopes in equation*. The “it” represented the data of the i-th province in the sample at time t.

Figure 1 depicted the relationship between fiscal decentralization, health outcomes, government health expenditure, and China’s new round of fiscal and tax reforms.

|

Figure 1 Conceptual path diagram of the mediation effect. |

Results

Table 2 showed the basic regression results for the mediating effect models before and after the new reform. The results of AR(2) and Hansen test for all models were higher than 0.1, indicating the instrumental variables in the estimation were effective, and there was no serial correlation in the residual term of the difference equation. The regression equations corresponding to the fiscal decentralization example before the reform were as follows:

|

Table 2 Mediating Effects Regression Models |

The β1 in Equation 4 was equal to 0.079 (p<0.05), which indicated that the fiscal decentralization increased the PMR; the β1 in (Equation 5.1 and 5.2) were equal to 0.011 and −0.001 (p<0.01) respectively, which indicated that fiscal decentralization contributed to government health expenditure per capita, but harmed the percentage of government health expenditure. The β2 in (Equation 6.1 and 6.2) were equal to −0.301 (p>0.1) and −15.671 (p>0.1) respectively, which indicated that phealthexp and healthperc did not play the mediating role before the new reform.

The regression equations corresponding to the fiscal decentralization example after the reform were as follows:

The β1 in Equation 7 was equal to 0.523 (p<0.05), which indicated that the fiscal decentralization increased the PMR. The β1 in (Equation 8.1 and 8.2) were equal to −0.002 (p>0.1) and −0.003 (p<0.1) respectively, which indicated that fiscal decentralization had no effect on government health expenditure per capita, but reduced the percentage of government health expenditure. The β2 in (Equation 9.1 and 9.2) were equal to −1.317 (p<0.05) and −21.293 (p>0.1) respectively, which indicated that phealthexp and healthperc did not play the mediating role before the new reform. But the β1 in (Equation 9.1 and 9.2) were significant, indicating that fiscal decentralization would increase PMR, but not by phealthexp and healthperc. Figure 2 illustrated the mediation regression equations in a path diagram.

Discussion

This study finds that fiscal decentralization harms health outcomes and that this negative effect has even become stronger after the new reform. One of the reasons for this situation is the lack of government attention to health care. Under the fiscal decentralization system, government health expenditure mainly comes from local government budgets. After the implementation of the new reform, local governments have less taxation rights and further shift their financial power to the central government. Kyriacou and Sagalés (2019) found that local decentralization of health spending undermines the quality of public service.40 Shih et al suggest that there is a significant relationship between the promotion of local officials and their economic performance, which leads local governments to loosen their focus on achieving basic public service goals such as health care and education and instead focus on goals such as economic growth.41 Fu (2007) points out that local governments in China do not pay enough attention to soft public services (health care and education).42 The negative impact of fiscal decentralization on the percentage of government health expenditure in our findings corroborates this view. However, Lago-Peñas et al find that centralized fiscal systems are associated with better health outcome during the COVID-19 pandemic.43 Considering the emergency of the COVID-19 global pandemic, countries around the world placed an unprecedented emphasis on health care. Fiscal decentralization at this time facilitates the uniform deployment of national resources for epidemic preparedness, while government health investments are bound to increase, both of which are beneficial to health outcomes.

The mismatch of fiscal and administrative powers between different levels of government and the principal-agent problem resulting from fiscal decentralization, and the problem of principal-agent problems between different levels of government has also had a negative impact on health outcome, which has been intensified by the further reduction of local financial powers caused by the new reform. Kyriacou et al and Nakatani et al have explored the impact of fiscal decentralization from the perspective of the quality of government governance,44,45 which is certainly an inspiration for China. Since the new reform have resulted in a greater concentration of fiscal revenue in the central government, it is suggested that the central government should emphasize the supervision of the use of transfer payment funds and improve the assessment of health and other indicators of people’s livelihood for the local government.

The percentage of government health expenditure reflects the degree of importance the government attaches to the development of health, while the per capita government health expenditure reflects the amount of government investment in health. Although neither of them plays a mediating role, the findings still reflect several problems with fiscal decentralization policies. From the results, fiscal decentralization had a significant negative impact on the percentage of health expenditure to fiscal expenditure both before and after the new reform. Hao et al, Liu et al, and Chen et al have proven that the “Province-Managing-County” reform, which is a fiscal reform of flattening local government since the first decade of this century in China, has not promoted the proportion of government health expenditure and education expenditure.29,46,47 Since the reform and opening up in China, the assessment of local officials has focused on economic development indicators such as GDP.48 Local governments are more willing to invest in productive construction that can increase GDP in a short period than in the construction of livelihood services such as education and health.49 The government investment in health is still inadequate in the context of fiscal decentralization, and the new round of fiscal and taxation system reform has yet to address this issue.

Although fiscal decentralization did not change the government’s preference for economic development, however, the total amount of government funds spent on public health increased before the new round of fiscal and taxation system reform. With the introduction of the new health care reform policy in 2009, the investment in health will increase to a certain extent in the short term. During this period, localities will concentrate on improving the total amount of regional health resources. The growth of GDP also stimulates an increase in government health expenditure.50,51 After the new health care reform policy has been implemented for a period of time, local governments have basically completed the construction of local health care system infrastructure. The investment in health may be reduced, which is one of the reasons why the fiscal decentralization after the new round of fiscal and taxation system reform did not promote the growth of total health resources. On the other hand, there is a certain lag in the effect of the new reform policies. The policy document of the new reform on the adjustment of the fiscal relationship between the central government and the local government in the health sector was introduced in 2018, and the effect of this key policy may not be visible.

The major contribution of this study is to broaden the research of fiscal decentralization on health outcomes. First of all, the fiscal expenditure decentralization in China is relatively deep, and the political power has not been delegated, which makes China’s fiscal decentralization somewhat unique in the world. Secondly, compared with previous studies, this paper has not only studied the impact of fiscal decentralization on health outcomes but also explored the relationship between fiscal decentralization, health outcome, and government health expenditure. Finally, most previous studies have used data before China’s new round of fiscal and taxation system reforms for analysis. We use two sets of panel data to explore the impact of fiscal decentralization on health outcome before and after the new reform, as well as the mediating role of government health expenditure, which tests the effect of the new reform.

This study also has some limitations on data acquisition. First, only the perinatal mortality rate has been chosen to measure health outcomes in this research. Life expectancy at birth and infant mortality are both more intuitive representations of health outcomes, but it is difficult to obtain from public information and databases. Using perinatal mortality rates alone may not accurately represent the Chinese population’s health status. Secondly, variables such as the level of population aging, changes in the spectrum of disease, and the adjustment of China’s fertility policies that may have an impact on the dependent variable were not included in the analysis due to limited data. Third, due to COVID-19, our data has only been selected up to 19 years. However, the new reform is an ongoing process, the effects of which may not yet be fully apparent, and the short data period may undermine the reliability of the results. Finally, our results indicate that government health spending does not play a mediating role. Instead, the quality of government governance seems to be a key variable. In the future, the research could extend the data period, control for other possible factors, and further explore the impact of fiscal decentralization on health outcomes.

Conclusions

Fiscal decentralization consistently had a negative impact on health outcomes, both before and after the new reforms. Government investment in health is still inadequate, and excessive competition among local governments, which arose from the GDP-centred tournament model, still exists. The new round of fiscal and taxation system reform has not reversed this situation either. It is suggested to emphasize the supervision of the use of transfer payment funds and improve the assessment of health and other indicators of people’s livelihood. There is also a need to optimize the structure of government expenditure and improve the efficiency of the use of government health expenditure.

Ethics Approval

This study was approved by the Research Ethics Committee of Capital Medical University with the Certificate of Approval ID: Z2021SY012.

Acknowledgments

The authors thank the editor and the anonymous reviewers for their helpful and constructive comments, which greatly improved the paper.

Author Contributions

All authors made a significant contribution to the work reported, whether that is in the conception, study design, execution, acquisition of data, analysis and interpretation, or in all these areas; took part in drafting, revising or critically reviewing the article; gave final approval of the version to be published; have agreed on the journal to which the article has been submitted; and agree to be accountable for all aspects of the work.

Funding

The research is supported by the National Natural Science Foundation of China (no.71974133, 71573182).

Disclosure

The authors declare no conflicts of interest in this work.

References

1. National Health Commission of the People’s Republic of China. Statistical bulletin on the development of health care in China in 2019; 2020. Available from: http://www.nhc.gov.cn/guihuaxxs/s10748/202006/ebfe31f24cc145b198dd730603ec4442.shtml.

2. House JS, Kessler RC, Herzog AR. Age, socioeconomic status, and health. Milbank Q. 1990;68(3):383–411. doi:10.2307/3350111

3. McIntyre D, Meheus F, Røttingen J-A. What level of domestic government health expenditure should we aspire to for universal health coverage? Health Econ Policy Law. 2017;12(2):125–137. doi:10.1017/S1744133116000414

4. Yu Y, Zhang L, Li F, Zheng X. Strategic interaction and the determinants of public health expenditures in China: a spatial panel perspective. Ann Reg Sci. 2013;50(1):203–221. doi:10.1007/s00168-011-0488-7

5. Wang J. Sub-provincial fiscal decentralization and health service output - an empirical study based on data from seven prefecture-level municipalities. [thesis]. Beijing: University of International Business and Economics; 2018. China.

6. Bird RM, Wong CPW. China’s fiscal system: a work in progress. Emerg Mark. 2005;2005:1. doi:10.2139/ssrn.875416

7. Jia J, Guo Q, Zhang J. Fiscal decentralization and local expenditure policy in China. Chin Econom Rev. 2014;28:107–122. doi:10.1016/j.chieco.2014.01.002

8. Zhang DY, Meng Y. Public finance investment, fiscal decentralisation and the urban-rural compulsory education gap (Chinese). J Gradu Sch Chin Acad Soc Sci. 2015;5:58–63. China.

9. Zhang X. Fiscal decentralization and political centralization in China - implications for regional Inequality. Emerg Mark. 2005;2005:1. doi:10.2139/ssrn.774206

10. Oates WE. The political economy of fiscal federalism Lexington. MA: Heath-Lexington; 1977.

11. Oates WE. An essay on fiscal federalism. J Econ Lit. 1999;37(3):1120–1149. doi:10.1257/jel.37.3.1120

12. Evans RG. Health for All or Wealth for Some?: Conflicting Goals in Health Care Reform. Centre for Health Services and Policy Research (CHSPR); 1998.

13. Party GB. Sharing resources for health report of the resource allocation working party. Lancet. 1976;308(7988):733–734. doi:10.1016/S0140-6736(76)90023-4

14. Smith PC. Resource allocation and purchasing in the health sector: the English experience. Bull World Health Organ. 2008;86(11):884–888. doi:10.2471/blt.07.049528

15. Diderichsen F, Varde E, Whitehead M. Resource allocation to health authorities: the quest for an equitable formula in Britain and Sweden. Br Med J. 1997;315(7112):875–878. doi:10.1136/bmj.315.7112.875

16. Jiang H. Finance Tutorial. Shanghai: Sanlian Bookstore Shanghai Branch; 1996. China.

17. Ding Y, McQuoid A, Karayalcin C. Fiscal decentralization, fiscal reform, and economic growth in China. Chin Econom Rev. 2019;53:152–167. doi:10.1016/j.chieco.2018.08.005

18. Akai N, Sakata M. Fiscal decentralization contributes to economic growth: evidence from state-level cross-section data for the United States. J Urban Econ. 2002;52(1):93–108. doi:10.1016/S0094-1190(02)00018-9

19. Yusuf NA. Fiscal decentralization and regional economic growth in Indonesia: a spatial econometric approach. JKAP. 2020;24(1):20–42.

20. Cantarero D, Pascual M. Analysing the impact of fiscal decentralization on health outcomes: empirical evidence from Spain. Appl Econ Lett. 2008;15(2):109–111. doi:10.1080/13504850600770913

21. Cavalieri M, Ferrante L. Does fiscal decentralization improve health outcomes? Evidence from infant mortality in Italy. Soc Sci Med. 2016;164:74–88. doi:10.1016/j.socscimed.2016.07.017

22. Rubio DJ. The impact of decentralization of health services on health outcomes: evidence from Canada. Appl Econ. 2011;43(26):3907–3917. doi:10.1080/00036841003742579

23. Sanogo T. Does fiscal decentralization enhance citizens’ access to public services and reduce poverty? Evidence from Côte d’Ivoire municipalities in a conflict setting. World Dev. 2019;113:204–221. doi:10.1016/j.worlddev.2018.09.008

24. Mahal A, Srivastava V, Sanan D. Decentralization and its impact on public service provision on health and education sectors: the case of India. In: Governance, Decentralization and Reform in China. India and Russia: Kluwer Academic Publishers and ZEF, London; 2000:77.

25. Soto VE, Farfan MI, Lorant V. Fiscal decentralisation and infant mortality rate: the Colombian case. Soc Sci Med. 2012;74(9):1426–1434. doi:10.1016/j.socscimed.2011.12.051

26. Gu XY, Tang SL, Cao SH. The financing and organization of health services in poor rural China: a case study in donglan county. Int J Health Plann Manage. 1995;10(4):265–282. doi:10.1002/hpm.4740100404

27. Jin Y, Sun R. Does fiscal decentralization improve healthcare outcomes? Empirical evidence from China. Public Money Manag. 2011;11:

28. Uchimura H, Jütting JP. Fiscal decentralization, Chinese style: good for health outcomes? World Dev. 2009;37(12):1926–1934. doi:10.1016/j.worlddev.2009.06.007

29. Hao J, Tang C, Zhu J, Jiang J. The impacts of flattening fiscal reform on health expenditure in China. Front Public Health. 2021;2021:9. doi:10.3389/fpubh.2021.614915

30. World Health Organization. Neonatal and Perinatal Mortality: Country, Regional and Global Estimates. Geneva: World Health Organization; 2006.

31. Hao Y, Liu J, Lu Z-N, Shi R, Wu H. Impact of income inequality and fiscal decentralization on public health: evidence from China. Econ Model. 2021;94:934–944. doi:10.1016/j.econmod.2020.02.034

32. Jiménez-Rubio D. The impact of fiscal decentralization on infant mortality rates: evidence from OECD countries. Soc Sci Med. 2011;73(9):1401–1407. doi:10.1016/j.socscimed.2011.07.029

33. Xiaohua N. Fiscal decentralization and local public health expenditure: empirical analysis based on different caliber indicators and provincial panel data. Int J Health Econ Policy. 2018;3(3):32–49. doi:10.11648/j.hep.20180303.12

34. Bird RM, Ebel RD. Fiscal Fragmentation in Decentralized Countries: Subsidiarity, Solidarity and Asymmetry. Edward Elgar Publishing; 2007.

35. Wang Y, Huo Y, Feng B. Definition of quasi-public goods in health services and lts significance for resources allocation. Med Philos. 2015;36:52–55.

36. Xu X, Li W, Tang L, Tian L, Xu X. Study on the efficiency of health resource allocation in China——based on three-stage DEA model. Health Econ Rec. 2021;38:23–27.

37. Yee E. The effects of fiscal decentralization on health care in China. Unive Avenue Hitotsubashi J Econ. 2001;5(1):5.

38. Arellano M, Bover O. Another look at the instrumental variable estimation of error-components models. J Econom. 1995;68(1):29–51. doi:10.1016/0304-4076(94)01642-D

39. Blundell R, Bond S. Initial conditions and moment restrictions in dynamic panel data models. J Econom. 1998;87(1):115–143. doi:10.1016/S0304-4076(98)00009-8

40. Kyriacou AP, Roca-Sagalés O. Local decentralization and the quality of public services in Europe. Soc Indic Res. 2019;145:755–776. doi:10.1007/s11205-019-02113-z

41. Shih V, Adolph C, Liu M. Getting ahead in the communist party: explaining the advancement of central committee members in China. Am Polit Sci Rev. 2012;106(1):166–187. doi:10.1017/S0003055411000566

42. Fu Y, Zhang Y. Chinese decentralization and fiscal spending structure bias: the cost of competing for growth. J Manag World. 2012;3:4–12+22.

43. Lago-Peñas S, Martinez-Vazquez J, Sacchi A. Country performance during the Covid-19 pandemic: externalities, coordination, and the role of institutions. Econ Gov. 2022;23:17–31. doi:10.1007/s10101-021-00263-w

44. Kyriacou AP, Roca-Sagalés O. Does decentralising public procurement affect the quality of governance? Evidence from local government in Europe. Local Gov Stud. 2021;47(2):208–233. doi:10.1080/03003930.2020.1729749

45. Nakatani R, Zhang Q, Garcia Valdes I. Fiscal Decentralization Improves Social Outcomes When Countries Have Good Governance. In: Fiscal Decentralization Improves Social Outcomes When Countries Have Good Governance. Washington DC: International Monetary Fund; 2022.

46. Liu ZH, LV ZY. Fiscal Decentralization and public health expenditure: experience evidence from provincial level of China. Chin Health Econom. 2014;33(10):58–60. China. doi:10.7664/che20141018

47. Chen SX, Lu SF. Does Decentralization increase the public services expenditures: a quasi-experiment of “county administrated by Province” in China. China Econ Q. 2014;13(04):1261–1282. China. doi:10.13821/j.cnki.ceq.2014.04.001

48. Zhou LA. Governing China’s local officials: an analysis of promotion tournament model. Econ Res J. 2007;07:36–50. China.

49. Keen M, Marchand M. Fiscal competition and the pattern of public spending. J Public Econ. 1997;66(1):33–53. doi:10.1016/S0047-2727(97)00035-2

50. Behera DK, Dash U. Effects of economic growth towards government health financing of Indian states: an assessment from a fiscal space perspective. J Asian Public Policy. 2019;12(2):206–227. doi:10.1080/17516234.2017.1396950

51. Liu Y, Li DX. An empirical analysis on the influencing factors of Chinese government health expenditure. J Nany Insti Technol. 2021;13(6):8. China.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.