Back to Journals » Risk Management and Healthcare Policy » Volume 16

Dynamics of Macroeconomy, Medicaid, and State Fiscal Conditions: A Role of Medicaid Expansion

Received 25 July 2023

Accepted for publication 20 October 2023

Published 8 November 2023 Volume 2023:16 Pages 2323—2337

DOI https://doi.org/10.2147/RMHP.S425539

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 4

Editor who approved publication: Dr Jongwha Chang

Jaeyoung Jang, Keon-Hyung Lee

Askew School of Public Administration and Policy, Florida State University, Tallahassee, FL, USA

Correspondence: Keon-Hyung Lee, Askew School of Public Administration and Policy, Florida State University, P.O. Box 3062250, 113 Collegiate Loop, Tallahassee, FL, 32306, USA, Tel +1-850-645-8210, Email [email protected]

Background: One of the main concerns of state governments about Medicaid expansion is the potential increase in state fiscal burden following the rise in enrollments. In previous literature, limited attention has been paid to the effect of macroeconomic changes, which are closely linked to Medicaid enrollments, in understanding the impact of Medicaid expansion on a state. To narrow the gap, this study establishes a synthetic model to represent the transmission channel from an unemployment shock to the Medicaid program and state expenditures.

Methods: The panel vector autoregression (VAR) model is adopted for the empirical analysis using annual data from 2010 to 2019 for 50 US states and D.C. The unit root and Granger causality tests are conducted to check the model’s appropriateness. The estimated results are analyzed by using impulse response functions.

Results: A sudden increase in the unemployment rate will raise the number of Medicaid enrollees and the state Medicaid expenditure, but the impact on the overall state budget is not clear. States that adopt Medicaid expansion will encounter surges in enrollment and increasing Medicaid expenditure during the economic recession, while the non-expansion states will only have moderate enrollment increases. However, an increased budgetary burden per new enrollees will not be significant at its level.

Conclusion: Medicaid expansion will allow more people to benefit from the public health insurance program during an economic recession while the impact on states’ fiscal burden will be moderate.

Keywords: Medicaid expansion, state government finance, unemployment shock, panel vector autoregression, Medicaid enrollments

Introduction

The United States has been spending enormous amounts of money on healthcare. In 2019, it spent approximately $3.76 trillion (17.6% of GDP) on health, and the expenditure grew by 9.7% to $4.14 trillion (19.7% of GDP) in 2020. The largest share came from the US government (50.6% in 2020) and was spent to provide public insurance through Medicaid, CHIP, and Medicare programs.1 The financial burden of healthcare costs has been one of the significant budgetary concerns for the US government, while the federal government has made continuous efforts to increase insurance coverage in the U.S.2–4

In 2010, the federal government adopted “The Affordable Care Act (ACA)”, and it expanded eligibility for Medicaid to adults with incomes up to 138% of the federal poverty level (FPL). Since January 1, 2014, each state has had the option to expand the eligibility, and until early 2022, 39 states have adopted the expansion.5 The policy has enabled many low-income adults and their children to access quality healthcare in the expanded states.6 Simultaneously, it has raised concerns regarding the increasing fiscal burden, especially for state governments, which are required to meet the balanced budget requirements by federal law.

Regardless of the expansion, state and local governments spend large amounts of their budgets on the Medicaid program every year. Medicaid expenditure accounted for approximately 27% of the state budget in 2021 and was the largest category, followed by elementary and secondary education spending, which accounted for about 18%.7 Even after considering that the federal government pays the amounts together, financing Medicaid is an important concern for state governments. Figure 1 shows the portion of each state government’s general direct expenditure spent to fund Medicaid in 2019. Medicaid spending took up about 19.81% of the expenditure for Minnesota, 19.52% for Connecticut, and 19.20% for Pennsylvania. Overall, Medicaid comprised 14.9% of states’ spending, and the amount increased by 6.8% annually from 2010 to 2019.

|

Figure 1 Medicaid’s share of state general direct expenditure (2019). Note: Author’s calculation using data from the Medicaid.gov. Available from: https://www.medicaid.gov/medicaid/financial-management/state-expenditure-reporting-for-medicaid-chip/expenditure-reports-mbescbes/index.html. |

A state’s concern regarding Medicaid expenditure extends beyond the sheer amount spent; it also encompasses the unpredictability of budget demands. Macroeconomic fluctuations can amplify the fiscal burdens associated with Medicaid, as it operates as a counter-cyclical program with increased demand during economic downturns and recessions. When economic activities slow down, the labor market contracts, resulting in higher unemployment rates and reduced incomes for many individuals. Consequently, this situation drives a surge in enrollment in the public insurance program designed for lower-income individuals, thereby impacting the state’s expenditures in the program.8–10 The escalating demands on Medicaid can precipitate substantial fiscal distress for the state, as the government concurrently contends with dwindling revenues from taxation and government services amidst an economic downturn. That is, economic changes, particularly surges in unemployment, exhibit a close association with Medicaid enrollment, ultimately influencing the fiscal health of state governments.

Previous studies have extensively investigated the impacts of Medicaid expansion on state budgets and fiscal conditions. The majority of these studies indicate that Medicaid expansion has not escalated the fiscal burdens of state governments. On the contrary, states adopting expansion have been observed to accrue fiscal advantages, primarily by augmenting federal subsidies, reducing the costs associated with uncompensated care, and enhancing tax revenues.11–13 However, it is worth noting that much of the existing literature predominantly concentrates on analyzing only the partial connection between this policy change and state budgets, with limited attention directed toward comprehending the role of macroeconomic changes in shaping this relationship.

This paper endeavors to address the aforementioned research gap by proposing an alternative synthetic model that elucidates the transmission mechanism of a macroeconomic shock to state fiscal conditions via the Medicaid program. Among the array of macroeconomic variables, our focal point is unemployment, a pivotal indicator of economic downturn closely intertwined with the Medicaid program.10 Notably, our model incorporates the dynamic feedback effect stemming from Medicaid on the broader economy—a facet that has been overlooked in prior literature. The influence of alterations in Medicaid enrollment on the state budget is transmitted to the state’s economic gross output, thereby exerting an impact on the labor market and employment levels in a reciprocal manner.14 In essence, these relationships can be depicted as a feedback loop, with Medicaid expansion introducing distinct dynamics into this loop for each state. Based on this model, our study seeks to examine whether states that have adopted Medicaid expansion encounter a heightened fiscal burden when confronted with sudden economic downturns compared to those that have not adopted this policy.

To empirically verify our model, this study employs a panel vector autoregression (PVAR) model, a widely recognized approach in macroeconomic literature. One of the primary advantages of utilizing the PVAR model lies in its capacity to treat all variables as endogenous and interrelated over time. This approach offers a comprehensive framework for our analysis. The principal contributions of this paper are twofold: firstly, it proposes a synthetic model that examines the impacts of both macroeconomic shifts and Medicaid expansion on state governments, providing a holistic perspective on these interactions. Secondly, it applies an econometric methodology that has been infrequently utilized within this particular line of research.

Background and Literature Review

Medicaid Expansion and State Budget

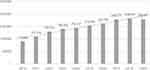

All levels of government in the United States allocate a substantial portion of their budgets to public health insurance programs. In the year 2019, the US government allocated approximately $623.9 billion toward Medicaid, with the federal government providing roughly 65% of this funding. Despite the program’s shared funding structure, it has consistently been a source of budgetary concern for state governments. As illustrated in Figure 2, the total Medicaid state share has exhibited a continuous uptrend, rising from $125.64 billion in 2010 to $254.68 billion in 2018, with an annual growth rate of approximately 8.3% observed from 2010 to 2019. In this context, fluctuations in Medicaid expenditures remain a focal point of interest for state governments striving to uphold sound fiscal conditions.

|

Figure 2 State government expenditures on Medicaid (millions of dollars). Note: Author’s calculation using data from the Medicaid.gov. Available from: https://www.medicaid.gov/medicaid/financial-management/state-expenditure-reporting-for-medicaid-chip/expenditure-reports-mbescbes/index.html. |

Since 2014, following the implementation of the Affordable Care Act (ACA), each US state has had the option to either expand Medicaid eligibility or maintain its existing stance. A primary concern for state governments regarding the expansion was the potential escalation of fiscal burdens attributed to the surging Medicaid enrollments. The federal government offered financial support to alleviate these concerns and incentivize states to adopt the expansion. For the initial three years, the federal government covered 100% of the expenditures associated with newly eligible enrollees. Subsequently, in 2017, the expanded states gradually assumed responsibility for 5% of these expenditures, with their contributions expected to increase to 10% by 2020. The anticipated increase in the state’s share of new enrollees engendered apprehension among policymakers about the potential fiscal strain resulting from the expansion.

Furthermore, states were concerned that the expansion could be demanding, even during the initial phase when the federal government fully covered the newly eligible individuals. This concern stemmed from what is commonly known as the “woodwork effect”, which signifies a surge in enrollments among adults and their children who were already eligible for Medicaid prior to the expansion. This phenomenon could manifest when individuals who were previously not enrolled in the program, due to reasons such as lack of information or administrative barriers, become more aware of the benefits and opt to apply for enrollment in response to the federal government’s promotion of the public insurance expansion.8,11,15 The increased expenditures arising from these additional enrollees were seen as potentially leading to unexpected increments in the fiscal burden of states. This was due to the fact that these costs were reimbursed at the previous matching rate by the federal government rather than being fully covered.16 Prior researchers have discovered that the reduction in uninsured rates in the expanded states was partly attributed to the “woodwork effect”.17–19

While state policymakers have hesitated to expand the eligibility for fear of potential budgetary costs, researchers have diligently sought to analyze how the expansion has impacted states’ expenditures and fiscal conditions. Their findings suggest that the budgetary effects of the “woodwork effect” were, to a large extent, moderate, and in some cases, state governments experienced fiscal savings after the expansion.12,13,20 These savings were not solely a result of increased federal government subsidies; they manifested in various ways. The expansion’s more generous eligibility and coverage contributed to a decrease in the number of uninsured patients, thereby mitigating the uncompensated care costs incurred by hospitals.21–24 Consequently, expanded states were able to save their budgets, as a substantial portion of these costs was funded by public assistance programs. In 2017, the US government allocated approximately $33.6 billion to cover uncompensated care costs, with roughly 35.4% of this amount being financed by state and local governments.25 Additionally, some programs that were previously financed by the state, such as mental health and substance abuse treatment, came under the purview of federal government funding after the expansion.20

Medicaid expansion has also exerted an influence on state budgets through their revenue streams. The expanded states received substantial amounts of federal government subsidies, which were directed toward hospitals and healthcare industries. The surge in Medicaid enrollments generated heightened demands for healthcare services, increased hospital utilization, and greater profitability, all while reducing uncompensated care costs. This, in turn, directly contributed to increased tax revenues collected by state governments.26,27 While the overall impact of Medicaid expansion on state budgets remains a topic of ongoing exploration, extant research findings suggest that the costs borne by states as a result of the expansion were relatively limited.20 However, most of the studies have been focused only on analyzing the budgetary impacts of the expansion without considering the impact of economic changes, which are directly linked to the number of Medicaid beneficiaries. In the subsequent sections, we will investigate the linkage between the economy and the Medicaid program, exploring how an unemployment shock can be transmitted to the state budget through the program.

Macroeconomic Changes and Medicaid

Medicaid During Economic Downturns

One significant reason that Medicaid expenditure stands as a notable concern for state fiscal conditions is its counter-cyclicality. The number of Medicaid enrollments tends to surge during periods of economic downturns or recessions, given the increasing demand for public health insurance.10,28,29 In these challenging economic times, the overall economy witnesses a decline or negative growth in its gross output, coupled with a rising unemployment rate as individuals lose their jobs and income. Even among those who remain employed, there’s often a need to seek Medicaid when they can no longer work full-time or when their employers reduce their insurance coverage.28 That is, changes in beneficiaries are contingent upon macroeconomic changes which states can neither control nor fully predict. The unexpected increase in the unemployment rate can lead to sudden surges in Medicaid enrollments and associated expenditures. Since state governments are mandated to maintain a balanced budget by federal law, these unforeseen increases in Medicaid costs can compel states to cut spending in other sectors, such as education and transportation.29,30

The role of Medicaid expansion during economic distress has been the subject of extensive research in recent years. Studies have consistently shown that increases in unemployment rates correspond to higher Medicaid enrollments, with the impact being particularly pronounced in states with more generous Medicaid policies.31–34 Notably, during the economic recession linked to the COVID-19 pandemic, expansion states experienced a significantly smaller increase in uninsured rates.35,36 When individuals lose their employer-sponsored insurance, they are substantially more likely to transition to public insurance, especially in expansion states, whereas individuals in non-expansion states face a higher risk of losing their insurance coverage. Consequently, expansion states enjoy a distinct advantage in securing their citizens’ access to healthcare during economic recessions. However, it’s important to recognize that this advantage can potentially result in more significant fiscal strain for expansion states than those that have not expanded Medicaid eligibility when they confront economic distress. This added burden is compounded as federal subsidies are gradually reduced, and states assume a larger share of the costs associated with newly eligible patients under the expansion.

Macroeconomic Feedback Effects of Medicaid Expansion

The effects of Medicaid expansion on a state’s budget become even more intricate when considering the dynamic feedback effects it exerts on the economy. Given that Medicaid is a large-scale public program providing significant funds to the economy annually, substantial alterations to the system inevitably bring about economic changes. Previous research has consistently identified positive impacts of the expansion on the economy, benefiting both the public and private sectors.14,37–39

Medicaid expansion yields substantial benefits for the public sector by allowing state governments to reallocate budgetary resources previously earmarked for uncompensated hospital care costs and other healthcare programs.20,40 Furthermore, the expansion exerts a significant influence on economic activities within the private sector, particularly within hospitals and healthcare industries, which draw upon this new economic resource—federal funding. Research has consistently demonstrated that the expansion has a positive impact on hospitals’ financial performance by reducing uncompensated care costs and increasing financial margins.27,40–42 This response from the healthcare industry, in turn, directly affects the public sector as it broadens the state tax base.14,38 Hospitals, benefiting from increased profits, can invest more in facilities, hire additional staff, and raise provider wages. The resultant increase in employment and labor incomes encourages citizens to spend more, driven by the consumption income effect. Overall, Medicaid expansion will expand the base of corporate, income, and sales taxes—critical sources of state revenues—while also stimulating the state’s economic production.

The dynamic economic feedback effects of Medicaid expansion are critical to estimating the costs and benefits of the expansion. However, these effects are often overlooked in the studies analyzing the impact of Medicaid expansion because they complicate the channels of impacts and causal links between the policy variables. Despite their complexity, incorporating these feedback effects remains a crucial task to understand the budgetary implications of Medicaid expansion thoroughly. In the subsequent section, we will establish a theoretical model to comprehend the dynamic impact of Medicaid expansion on the state budget. This model will be designed to incorporate the macroeconomic feedback effects, providing a more comprehensive framework for assessing the consequences of expansion.

A Synthetic Model of Unemployment, Medicaid, and State Fiscal Conditions

Prior research has revealed that Medicaid expansion exerts an impact on state fiscal conditions, both in the short and long run. States that opted for expansion have experienced budgetary savings, even after accounting for potential unexpected increases in Medicaid enrollment resulting from the “woodwork effect”.12,13,17–19 However, researchers also suggested that the expansion states should focus on the increasing fiscal burden during economic downturns. In situations where states confront a substantial negative shock to the economy, accompanied by a significant surge in unemployment, expansion states may find themselves incurring higher costs to accommodate the rising Medicaid enrollments compared to non-expansion states.31–33,35

The impact of Medicaid expansion on overall fiscal conditions during economic downturns and recessions remains elusive because the expansion exerts influence on state budgets through multiple channels, and these impacts often operate in opposing directions. When we factor in differences between regular periods and economic downturns, as well as the feedback effects that unfold over time, it becomes challenging to definitively ascertain whether the expansion would place a financial burden on states. To shed light on the intricate relationship between the macroeconomy, Medicaid, and state budgets, we have developed a model that depicts how changes in Medicaid enrollments, prompted by a sudden increase in unemployment, can lead to fluctuations in a state’s Medicaid expenditures and overall fiscal condition.

Figure 3 delineates our theoretical model, which synthesizes various transmission channels from an unemployment shock to state budgets. These channels have been devised by the authors based on previous literature. Notably, the existing literature has only partially explored the relationships between the elements of this model. As a result, we have integrated their findings into a comprehensive and synthetic model to encompass the entire feedback loop, elucidating the intricate connections from macroeconomic changes to state budgets. This holistic approach allows us to capture the multifaceted dynamics at play in this complex relationship.

|

Figure 3 A synthetic model of macroeconomy, Medicaid, and state expenditures. |

In this comprehensive model, we expect that a sudden surge in unemployment leads individuals in each state to lose their employer-provided insurance, rendering them eligible for Medicaid.10,28,29 The resulting increase in enrollments directly drives up state Medicaid expenditures, irrespective of whether the state has adopted the Medicaid expansion, and these public funds subsequently flow into the healthcare and hospital industry.14 It is particularly noteworthy that each state experiences the shock differently as it progresses through the transmission channels, with the outcome contingent upon whether the state has adopted Medicaid expansion. The expansion can either magnify or offset the impacts of the rising unemployment on Medicaid enrollments and state expenditures, demonstrating the intricate interplay between policy choices and macroeconomic conditions.

Expansion states are expected to witness a higher influx of Medicaid applications following the economic shock, primarily due to their more generous program offerings.28,29,31–34 Consequently, there will likely be a notable rise in new enrollments in expansion states compared to non-expansion states. However, it’s important to note that the increases in Medicaid enrollments will only moderately translate into higher state expenditures. In the case of expansion states, the federal government will take charge of a substantial portion of the increasing costs through enhanced matching formulas, providing substantial assistance to these states for covering the expenditures associated with newly eligible enrollees. This means that the additional fiscal burden for the expansion states will be limited; however, they will inevitably bear more of the burden of increasing Medicaid expenditures during economic downturns.

The impact of Medicaid enrollments and cost increases on the overall fiscal condition is also expected to be moderate in expansion states. During economic downturns, low-income patients often struggle to cover their medical costs as they lose their jobs and income. A portion of these uncompensated care costs is typically covered by state governments. However, if a state has adopted Medicaid expansion and more low-income patients can be covered by Medicaid, the uncompensated care costs are reduced.27,40–42 Additionally, the budgetary savings facilitated by Medicaid expansion and the tax revenues increase will help offset the costs associated with increasing enrollees.14,38 This can preclude the states from decreasing expenditures in other sectors, such as education, transportation, and housing, to meet the balanced budget requirement or financing them by issuing debt.

Throughout each of the aforementioned stages, the responses to the unemployment shock interact with the economy, giving rise to feedback effects. In summary, the role of Medicaid expansion during periods of economic shock in a state can be hypothesized as follows:

H1. An unemployment shock will increase Medicaid enrollments in states regardless of the adoption of the Medicaid expansion. H2. An unemployment shock will increase Medicaid expenditures in state governments regardless of the adoption of the Medicaid expansion. H3. In the states that adopted Medicaid expansion, the enrollments will increase more than in the non-expanded states in response to an unemployment shock. H4. The increase in Medicaid expenditures in the expansion states will not be more significant than in the non-expansion states.

Data and Methods

Data

The main variables in the suggested dynamic synthetic model are the number of Medicaid enrollments and government expenditures on Medicaid. The number of enrollments for each state mainly came from the Medicaid Enrollment Data, which is collected through the Medicaid Budget and Expenditure System (MBSE) provided by the Center for Medicaid and CHIP Services (CMCS). CMCS collected the data from the MBSE, in which states have electrically submitted their Form CMS-64 since January 1, 2014. The enrollment data calculate an unduplicated number of individuals enrolled in the Medicaid program each month. The monthly enrollment data are collected, and the average number for each fiscal year by the state is calculated for analysis in this paper. Enrollment data before 2014 are collected from The Kaiser Family Foundation Medicaid Enrollment Snapshot for each year. As these reports only show the December snapshot, the number of enrollees at that point is used instead of the annual average for the period.

Annual government expenditures on Medicaid data are also provided by CMCS based on the MBSE. CMCS has published the Financial Management Report for each fiscal year since 1997. The reports provide detailed expenditures on Medicaid, CHIP, and the administration by each share paid by federal and state governments. For the states that adopted Medicaid expansion, enrollments and expenditure for the newly eligible adult group are specified in each dataset. Annual unemployment rate data of each state are collected from the Local Area Unemployment Statistics of the Bureau of Labor Statistics. These data measure the percentage of unemployed individuals in the labor force in each state. State gross domestic product (GDP) and population data are collected from the Bureau of Economic Analysis. The expenditures of state and local governments come from the Annual Survey of State Government Finances Datasets provided by the US Census Bureau. All variables measured in dollar amount are discounted to 2012 real value using the GDP deflator to exclude the effect of inflation. All data are collected for the period from 2010 to 2019 as annual observations for the 50 US states and the District of Columbia. Table 1 summarizes the data used in the analysis.

|

Table 1 Summary Statistics |

Panel Vector Autoregression (PVAR)

A panel vector autoregression (PVAR) model is adopted for the empirical analysis to test the hypotheses suggested in this paper. The PVAR model is widely used in macroeconomic literature as it has the advantage of allowing all variables to be endogenous and interdependent dynamically and statically, and exogenous variables can also be included in the model.43,44 Changes in gross economic output and unemployment, Medicaid enrollments, state expenditure on Medicaid, and state fiscal conditions are all endogenous in the model and interdependent dynamically and statically. Thus, they can be best estimated using the PVAR model. Another benefit of using the PVAR model is that it enables forecasting the changes in each variable in response to another variable in the model by calculating the impulse response function (IRF). Considering that the Medicaid program is directly affected by unemployment changes, our analysis focuses on the shock in the unemployment rate and responses to it. With the IRF, changes in Medicaid enrollments and state expenditures following an unemployment shock can be estimated, and variations in impact over time can be forecasted with this econometric model.

Econometric Model

The model of the macroeconomy-Medicaid-state finance dynamic can be expressed as an econometric model as follows:

where Yi,t is a vector of endogenous variables of interests. Yi,t consists of Medicaid enrollments growth rate, the growth rate of Medicaid expenditures paid by the state, the growth rate of state and local governments general total expenditure (excludes capital outlay), the state real GDP growth rate, and the yearly state unemployment rate. The state and local government expenditure variable is used to measure the overall fiscal condition of the state.To accurately capture the impact of unexpected macroeconomic change, the amount of capital outlay is excluded from the measure. Xi,t is a vector of exogenous variable, and ui and ei,t are vectors of variable-specific panel fixed-effects and idiosyncratic errors, respectively. Xi,t includes a policy variable indicating the adoption of the Medicaid expansion. i, k, and t denote each state, lag order, and year, respectively. Ak and B are coefficient matrices to be estimated.

The order of variables in the endogenous vector is selected based on the theoretical model in Figure 1 to identify which variable precedes another. As unemployment is a lagging indicator of the business cycle, the unemployment rate is placed after the real GDP growth.45 In our model, the change in the unemployment rate is assumed to affect Medicaid enrollment with a lag. This reflects that people can remain in employer-supported insurance right after losing their jobs thanks to the Consolidated Omnibus Budget Reconciliation Act (COBRA). The increase in the number of enrollments would directly affect the expenditure on the Medicaid program, which would change the government’s spending for the year.

In estimating the PVAR model, the stationarity of each variable is critical because non-stationary time series can lead to a spurious regression problem and false implications about the statistical relationship among variables in an econometric model. To make each variable stationary, Medicaid enrollments, government expenditures, and state GDP are transformed into growth rates by taking first log-differencing, and the unemployment rates are used as a level. All transformed data are tested with the Im, Pesaran, and Shin test, which can be used for samples with fixed numbers of units and time periods.46 The test results are given in Table 2. The null hypothesis that each time series contains a unit root and non-stationary is rejected at the 1% significance level for all variables. As shown in Table 3, the optimal lag order to be included in the model is selected as the first lag based on the lag order selection criteria by Andrews and Lu.47 Results from the Granger causality test indicate the null hypothesis that all other variables in our model do not Granger-cause each variable is rejected at the 1% significance level, which confirms that their relationships should be estimated as the PVAR model. The test results are shown in Table 4. All test statistics to check the appropriateness of the data for PVAR model and the lag order selection statistics shown in the tables are calculated by authors using STATA software.

|

Table 2 Unit Root Test Results |

|

Table 3 Lag Order Selection Criteria |

|

Table 4 Granger Causality Test Results |

For a comprehensive analysis, two models are set to investigate the response of the Medicaid program and investigate government costs due to an unemployment shock. Model 1 comprises five endogenous variables and is estimated using the whole sample from 2010 to 2019. The first model aims to test whether unemployment changes significantly affect the number of Medicaid enrollments and state expenditures on Medicaid. All states are included in the sample, and both periods before and after the Medicaid expansion are covered to find general evidence on the impacts regardless of expansion. Model 2 aims to demonstrate the effects of Medicaid expansion on the state burden during an economic recession. Therefore, the PVAR model is estimated with separated state groups of early-expansion states and late- or non-expansion states. Table 5 shows the states that belong to each group. Empirical evidence of the hypotheses on the role of Medicaid expansion will be found by comparing the estimated results with each sub-sample group for the response of Medicaid expenditures to the macroeconomic shock. The PVAR model estimation is conducted using the STATA software package.44

|

Table 5 Category of Sample Groups |

Results

Model 1: Overall Impacts of an Unemployment Shock on Medicaid and State Budget

The estimation results of a PVAR model are usually analyzed with the impulse response functions (IRFs), which show how each variable will respond to a shock in another variable for multiple time periods. A shock is defined as one standard deviation change in each variable. The IRFs are calculated based on the model estimation results, and the graphs for the functions are drawn to articulate the results. The IRF graphs for Model 1 are given in Figure 4. The solid line in each graph indicates the point estimates of the variable’s forecasted responses for the 10 years after an orthogonalized unemployment rate shock.

A sudden increase in the unemployment rate will increase the Medicaid enrollment growth rate by 0.38%p in the following year and again by 0.43%p in the second year after the shock. After the third year, the marginal impacts will be diminished, but they will remain statistically significant and positive for the periods. The responses of state Medicaid expenditure paid to the unemployment shock are forecasted to be a 0.47%p increase in its growth rate in the first year. However, the marginal change will go negative and become statistically insignificant from the second year. The impact of the shock on the overall fiscal condition seems statistically insignificant in most periods. The IRF results of Model 1 imply that a sudden negative shock in the macroeconomy will significantly increase Medicaid enrollments, and the impacts will persist rather than be transient. However, the budgetary impacts for each state are limited and only transitory. Even though the state Medicaid expenditures will increase following the surge in enrollments during the economic downturn, the costs will be small, considering the magnitude of changes in the number of enrollees. The findings confirm the first and second hypotheses about the impact of the economic shock on the Medicaid program in a general sense. Also, we do not find strong empirical evidence of the shock on the overall government budget, which indicates that Medicaid would not play a significant role in transmitting negative economic changes to state fiscal conditions.

Model 2: The Role of Medicaid Expansion

We estimated the second model using sub-sample groups to explore the role of Medicaid expansion when the state encounters sudden economic distress. The results are given in Figures 5 and 6. For the Medicaid expansion states, an unemployment rate shock will increase enrollment growth by 1.10%p in the following year, much higher than the estimates from Model 1. On the other hand, states in the other group will face only a 0.12% p increase a year after the unemployment shock. This confirms the third hypothesis that the Medicaid expansion will allow states to provide public insurance to their citizens during economic downturns.

As found in the whole sample model, the impact of the economic change on the state burden to operate the insurance program will not be that significant, even for the states that extended the eligibility. Medicaid cost for the states is forecasted to increase only by 0.3%p in the first year after the shock, and the impact will immediately diminish with time. The IRF of the Medicaid expenditure estimated with the other sample state group shows mostly statistically insignificant impacts. The impacts on the overall state public expenditures are found to be statistically insignificant for the Medicaid expansion states. These findings are consistent with the last hypothesis that the budgetary impacts will not show evident differences depending on whether each state has adopted the Medicaid expansion.

Another finding is that government expenditures in the non- or late-expansion states are forecasted to decrease in response to the unemployment shock. Considering that the extent of changes in state Medicaid expenditures is limited in spite of the surge in enrollments, we can speculate that there would be federal assistance to offset the negative impacts of the economic shock. This can be another piece of evidence for the previous literature’s findings that state governments have enjoyed budgetary benefits in multiple ways by adopting the Medicaid expansion.

Conclusion

Medicaid expansion has been a subject of substantial debate among policymakers and administrative staff, especially when considering states’ fiscal health. One of the primary concerns expressed by those opposing expansion is the potential for an unexpected increase in Medicaid expenditures by states as a result of surges in Medicaid enrollments. Over the past decade following the implementation of the Affordable Care Act (ACA), numerous researchers have undertaken efforts to examine the effects of Medicaid expansion from various angles. Many of these studies, focusing on its impacts on state budgets, have consistently suggested that expansion would not impose a significant burden on states. Instead, they have indicated that states could experience budgetary savings due to increased financial support from the federal government.

However, limited attention has been paid to the impacts of economic changes and the complicated channels that affect Medicaid and state budgets. Changes in economic conditions are inherently linked to Medicaid because a higher number of individuals tend to lose their jobs and incomes during economic downturns or recessions, which in turn increases their reliance on government-provided insurance. These increases in Medicaid enrollments directly contribute to heightened expenditures on Medicaid, and the impact can be particularly significant for states that have reduced the eligibility threshold.

Nevertheless, the overall fiscal burden of Medicaid expansion on states during economic downturns remains unclear, given the intricate interdependencies among the economy, Medicaid program, and the state budget. Taking this perspective into account, there is a compelling need for a synthesized tool that can effectively integrate the impact of macroeconomic changes on Medicaid and state governments. Such a tool would provide a more comprehensive understanding of the complex dynamics at play in this context.

In this paper, a dynamic model has been established to depict the transmission channel of the economic shock to capture the impact of Medicaid expansion. This model encompasses endogenous variables that are not only interdependent statically but also dynamically. To empirically verify this theoretical model, our study has employed the Panel Vector Autoregression (PVAR) model as the chosen econometric framework. The analysis of Impulse Response Functions (IRFs) to an unemployment shock has yielded notable results, demonstrating that the shock exerts statistically significant impacts on Medicaid programs and government expenditures.

The analysis has revealed that a sudden surge in the unemployment rate leads to a substantial increase in Medicaid enrollments and expenditures. Importantly, Medicaid expansion has been shown to magnify the impact of the shock on enrollments. However, it’s crucial to note that the state’s share of Medicaid costs experiences only a moderate increase in the expanded states. This suggests that Medicaid expansion can prove beneficial to states, allowing them to save their budget while extending the benefits of public insurance to a greater number of individuals during an economic recession. Furthermore, the findings indicate that federal funds play an essential role in mitigating the negative impact of the shock on the overall fiscal condition of states that have adopted Medicaid expansion.

This study acknowledges certain limitations in its analysis. One of these limitations is the insufficient elaboration of the transmission channel from changes in Medicaid expenditures to the state’s financial condition. Additionally, because the sample used in the empirical analysis primarily corresponds to a period when the federal government provided full coverage for the newly eligible enrollees, it’s possible that the impact of enrollment changes on Medicaid expenditures in expansion states may be underestimated.

Nevertheless, this study represents a valuable contribution in terms of providing a more accurate and comprehensive understanding of the net costs associated with Medicaid expansion. It also provides insights that can aid policymakers in forecasting budgetary burdens associated with counter-cyclical public assistance programs, allowing for more effective long-term budget management.

Data Sharing Statement

All data used in this study can be publicly accessed. Detailed explanation on the data sources can be found in Data of this article. The datasets are available from the corresponding author on reasonable request.

Ethics Approval and Informed Consent

As the data in this study were complied using the publicly available information at the state-level, the Florida State University (FSU) IRB staff determined on July 6, 2023 that the proposed activity is not research involving human subjects as defined by DHHS and/or FDA regulations. Because of the above, IRB review and approval by FSU is not required. The authors declare the data accessed complied with relevant data protection and privacy regulations.

Disclosure

The authors declare no conflicts of interest in this study.

References

1. National Health Expenditure Data. Centers for Medicare & Medicaid Services (CMS); 2021. Available from: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData.

2. Kennedy EM. The role of the federal government in eliminating health disparities. Health Aff. 2005;24(2):452–458. doi:10.1377/hlthaff.24.2.452

3. Mahiben M, Ologunde R, Gunarajasingam A. Is health care a right? Health reforms in the USA and their impact upon the concept of care. Ann Med Surg. 2013;2(1):15–17. doi:10.1016/S2049-0801(13)70021-9

4. Barack O. United States health care reform: progress to date and next steps. JAMA. 2016;316(5):525–532. doi:10.1001/jama.2016.9797

5. Status of State Medicaid Expansion Decisions: interactive map. KFF; 2023. Available from: https://www.kff.org/medicaid/issue-brief/status-of-state-medicaid-expansion-decisions-interactive-map/.

6. Li L, Cuerden MS, Liu B, Shariff S, Jain AK, Mazumdar M. Three statistical approaches for assessment of intervention effects: a primer for practitioners. Risk Manag Healthc Policy. 2021;14:757–770. doi:10.2147/RMHP.S275831

7. Peter G. How do states pay for Medicaid? Peterson Foundation; 2022. Available from: https://www.pgpf.org/budget-basics/budget-explainer-how-do-states-pay-for-medicaid.

8. Sommers BD, Epstein AM. Why states are so miffed about Medicaid—economics, politics, and the “woodwork effect”. N Engl J Med. 2011;365(2):100–102. doi:10.1056/NEJMp1104948

9. Clemens J, Ippolito B. Implications of Medicaid financing reform for state government budgets. Tax Policy Econ. 2018;32(1):135–172. doi:10.1086/697140

10. Benitez J, Perez V, Seiber E. Medicaid access during economic distress: lessons learned from the great recession. Med Care Res Rev. 2021;78(5):490–501. doi:10.1177/1077558720909237

11. Sommers BD, Gruber J. Federal funding insulated state budgets from increased spending related to Medicaid expansion. Health Aff. 2017;36(5):938–944. doi:10.1377/hlthaff.2016.1666

12. Cross-Call J. Medicaid Expansion continues to benefit state budgets, contrary to critics’ claims. Center on Budget and Policy Priorities; 2018:9.

13. Gruber J, Sommers BD. Fiscal Federalism and the Budget Impacts of the Affordable Care Act’s Medicaid Expansion. No. w26862. National Bureau of Economic Research; 2020.

14. Levy H, Ayanian JZ, Buchmueller TC, Grimes DR, Ehrlich G. Macroeconomic feedback effects of Medicaid expansion: evidence from Michigan. J Health Polit Policy Law. 2020;45(1):5–48. doi:10.1215/03616878-7893555

15. Sommers BD, Arntson E, Kenney GM, Epstein AM. Lessons from early Medicaid expansions under health reform: interviews with Medicaid officials. Medicare Medicaid Res Rev. 2013;3(4):E1–E23. doi:10.5600/mmrr.003.04.a02

16. Sonier J, Boudreaux MH, Blewett LA. Medicaid’ welcome-mat’ effect of Affordable Care Act implementation could be substantial. Health Aff. 2013;32(7):1319–1325. doi:10.1377/hlthaff.2013.0360

17. Sommers BD, Kenney GM, Epstein AM. New evidence on the Affordable Care Act: coverage impacts of early Medicaid expansions. Health Aff. 2014;33(1):78–87. doi:10.1377/hlthaff.2013.1087

18. Frean M, Gruber J, Sommers BD. Premium subsidies, the mandate, and Medicaid expansion: coverage effects of the Affordable Care Act. J Health Econ. 2017;53:72–86. doi:10.1016/j.jhealeco.2017.02.004

19. Hudson JL, Moriya AS. Medicaid expansion for adults had measurable ‘welcome mat’effects on their children. Health Aff. 2017;36(9):1643–1651. doi:10.1377/hlthaff.2017.0347

20. Ward B; Commonwealth Fund. The Impact of Medicaid Expansion on States’ Budgets. Commonwealth Fund; 2020.

21. Dranove D, Garthwaite C, Ody C. Uncompensated care decreased at hospitals in Medicaid expansion states but not at hospitals in nonexpansion states. Health Aff. 2016;35(8):1471–1479. doi:10.1377/hlthaff.2015.1344

22. Kaufman BG, Reiter KL, Pink GH, Holmes GM. Medicaid expansion affects rural and urban hospitals differently. Health Aff. 2016;35(9):1665–1672. doi:10.1377/hlthaff.2016.0357

23. Nikpay S, Buchmueller T, Levy HG. Affordable Care Act Medicaid expansion reduced uninsured hospital stays in 2014. Health Aff. 2016;35(1):106–110. doi:10.1377/hlthaff.2015.1144

24. Camilleri S. The ACA Medicaid expansion, disproportionate share hospitals, and uncompensated care. Health Serv Res. 2018;53(3):1562–1580. doi:10.1111/1475-6773.12702

25. Coughlin TA, Samuel-Jakubos H, Garfield R. Sources of Payment for Uncompensated Care for the Uninsured. Kaiser Family Foundation; 2021.

26. Bazzoli GJ. Effects of expanded California health coverage on hospitals: implications for ACA Medicaid expansions. Health Serv Res. 2016;51(4):1368–1387. doi:10.1111/1475-6773.12414

27. Blavin F. Association between the 2014 Medicaid expansion and U.S. hospital finances. JAMA. 2016;316(14):1475–1483. doi:10.1001/jama.2016.14765

28. Rowland D. Health care and Medicaid—weathering the recession. N Engl J Med. 2009;360(13):1273–1276. doi:10.1056/NEJMp0901072

29. Clemens J, Ippolito B, Veuger S. Medicaid and fiscal federalism during the COVID‐19 pandemic. Public Budget Finance. 2021;41(4):94–109. doi:10.1111/pbaf.12287

30. Hoadley JF, Cunningham P, McHugh M. Popular Medicaid programs do battle with state budget pressures: perspectives from twelve states. Health Aff. 2004;23(2):143–154. doi:10.1377/hlthaff.23.2.143

31. Jacobs PD, Hill SC, Abdus S. Adults are more likely to become eligible for Medicaid during future recessions if their state expanded Medicaid. Health Aff. 2017;36(1):32–39. doi:10.1377/hlthaff.2016.1076

32. Benitez J, Williams T, Goldstein E, Seiber E. The relationship between unemployment and health insurance coverage: before and after the Affordable Care Act’s coverage expansions. Med Care. 2021;59(9):768–777. doi:10.1097/MLR.0000000000001603

33. Gangopadhyaya A, Garrett AB. Unemployment, health insurance, and the COVID-19 recession. Health Insurance, and the COVID-19 Recession; 2020.

34. Huberfeld N, Gordon SH, Jones DK. Federalism complicates the response to the COVID-19 health and economic crisis: what can be done? J Health Polit Policy Law. 2020;45(6):951–965. doi:10.1215/03616878-8641493

35. Garrett AB, Gangopadhyaya A “How the COVID-19 recession could affect health insurance coverage.” Available at SSRN 3598558. 2020.

36. Karpman M, Zuckerman S, Peterson G. Adults in Families Losing Jobs During the Pandemic Also Lost Employer-Sponsored Health Insurance. Washington, DC: Urban Institute; 2020:1–14.

37. Bachrach D, Boozang P, Herring A, Reyneri DG. States Expanding Medicaid See Significant Budget Savings and Revenue Gains. Princeton, NJ: Robert Wood Johnson Foundation; 2016.

38. Ayanian JZ, Ehrlich GM, Grimes DR, Levy H. Economic effects of Medicaid expansion in Michigan. Obstet Gynecol Surv. 2017;72(6):326–328. doi:10.1097/01.ogx.0000520208.62105.8e

39. Buchmueller TC, Cliff BQ, Levy H. The benefits of Medicaid expansion. In: JAMA Health Forum. Vol. 1. American Medical Association; 2020.

40. Gruber J, Sommers BD. The Affordable Care Act’s effects on patients, providers, and the economy: what we’ve learned so far. J Policy Anal Manage. 2019;38(4):1028–1052. doi:10.1002/pam.22158

41. Lindrooth RC, Perraillon MC, Hardy RY, Tung GJ. Understanding the relationship between Medicaid expansions and hospital closures. Health Aff. 2018;37(1):111–120. doi:10.1377/hlthaff.2017.0976

42. Blavin F, Ramos C. Medicaid expansion: effects on hospital finances and implications For hospitals facing COVID-19 challenges: study examines Medicaid expansion effects on hospital finances and implications for hospitals facing COVID-19 challenges. Health Aff. 2021;40(1):82–90. doi:10.1377/hlthaff.2020.00502

43. Canova F, Ciccarelli M. Panel vector autoregressive models: a survey☆ the views expressed in this article are those of the authors and do not necessarily reflect those of the ECB or the eurosystem. In: VAR Models in Macroeconomics–New Developments and Applications: Essays in Honor of Christopher A. Sims. Vol. 32. Emerald Group Publishing Limited; 2013:205–246.

44. Abrigo MRM, Love I. Estimation of panel vector autoregression in Stata. Stata J. 2016;16(3):778–804. doi:10.1177/1536867X1601600314

45. Shigeru F, Garey R. The cyclicality of separation and job finding rates. Int Econ Rev. 2009;50(2):415–430. doi:10.1111/j.1468-2354.2009.00535.x

46. Im KS, Pesaran MH, Shin YC. Testing for unit roots in heterogeneous panels. J Econom. 2003;115(1):53–74. doi:10.1016/S0304-4076(03)00092-7

47. Andrews DWK, Lu B. Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J Econom. 2001;101(1):123–164. doi:10.1016/S0304-4076(00)00077-4

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2023 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.