Back to Journals » Clinical Ophthalmology » Volume 12

Biosimilars in ophthalmology: “Is there a big change on the horizon?”

Authors Sharma A , Reddy P, Kuppermann BD, Bandello F , Loewenstein A

Received 16 July 2018

Accepted for publication 5 September 2018

Published 24 October 2018 Volume 2018:12 Pages 2137—2143

DOI https://doi.org/10.2147/OPTH.S180393

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Scott Fraser

Video abstract presented by Dr Ashish Sharma

Views: 620

Ashish Sharma,1 Prahalad Reddy,1 Baruch D Kuppermann,2 Bandello Francesco,3 Anat Loewenstein4

1Department of Vitreoretina, Lotus Eye Hospital and Institute, Coimbatore, Tamil Nadu, India; 2Department of Ophthalmology, Gavin Herbert Eye Institute, University of California, Irvine, CA, USA; 3Department of Ophthalmology, Scientific Institute San Raffaele, University Vita-Salute, Milano, Italy; 4Division of Ophthalmology, Tel Aviv Sourasky Medical Center, Sackler Faculty of Medicine, Tel Aviv University, Tel Aviv, Israel

Abstract: Retinal disease management has witnessed remarkable advances in posterior segment pharmacotherapy with the development of anti-VEGF molecules such as Lucentis® (ranibizumab), Eylea® (aflibercept), and off-label bevacizumab (Avastin). The US patents for ranibizumab and aflibercept will expire in 2020 (though Regeneron has indicated that it might attempt to extend its US patent to June 2023 with additional patent claims), and their European patents will expire in 2022 and 2025. Aflibercept comes off patent in 2022 in People’s Republic of China and Japan. As soon as each patent expires, biosimilar molecules could potentially come in the mainstream clinical practice as a more cost-efficient choice in the form of generic biosimilars. It is difficult to predict how significant this shift would be in terms of more cost-effective clinical management and how it will impact the care in developed and developing world. It is important for clinicians to have a clear understanding about ophthalmic biosimilars before the industry brings these molecules to the mainstream clinical use globally.

Keywords: biosimilar, Razumab®, Lucentis®, Eylea®, ophthalmology

Introduction

After the original anti-VEGF disruptor therapeutic agent, bevacizumab (Avastin, Genentech, South San Francisco, CA, USA), used with dramatic success in the management of various retinal diseases including wet age-related macular degeneration (AMD), macular edema due to retinal vein occlusion (RVO), and diabetic macular edema (DME), ophthalmology is poised for another disruptor in the form of biosimilar molecules predominantly to be used in the management of posterior segment diseases. This review will provide an understanding of biosimilar molecules, potential candidates on horizon and some which are already showing promise, and the likely impact of their entry in the developing and developed world.

What are biosimilars?

Biosimilars are molecules with similarity to existing innovator biologics (reference medicine). Biosimilars should prove comparable pharmacokinetics, pharmacodynamics, immunogenicity, safety, and efficacy to innovator biologic to establish biosimilarity.

These molecules are named differently in different countries such as follow-on biologicals, similar biologics, and similar biotherapeutic product or subsequent-entry biologics.

How does a biosimilar differ from generic?

Clinicians should clearly differentiate and understand that generic drugs and biosimilars are not the same. Generic drugs can be easily made by matching just the chemical formula and synthesis. However, biosimilar involves living cells in the process of manufacturing which could differ from the originator molecules; hence, the structure is not predefined as compared to generic drugs. Furthermore, most of the generic drugs are stable because they are generated through fixed chemical formula and synthesis. However, biosimilars need extra caution in terms of stability. Immunogenicity can be an issue with biosimilars due to different living cells and process followed by different biosimilar developers, which is not the case with generics. In a nutshell, biosimilar need not be the exact copy in terms of formulation, but it should show similar efficacy, safety, and quality.

How difficult is to manufacture a biosimilar?

Biosimilars are large molecules compared to generics and, as mentioned previously, they are not based on a fixed chemical formula; so, it is not easy to manufacture biosimilars. The major reason is that originator biologics do not provide complete information in terms of the process followed during the manufacturing even after expiry of their patent. Biosimilar drug makers get partial information, and most of the time they need to get cues from the original biologic drugs available in the market via reverse engineering. Furthermore, biosimilar manufacturing involves a big investment upfront compared to generic drug development. Most of the companies which are in the race for developing biosimilars are aware of this and have refined their manufacturing process to capture the next wave of a multibillion USD market. On the flip side, there is a possibility of biosimilar drugs being better (biobetter) than reference biologic because biosimilar companies use the latest technology compared to the technology used by reference biologics.

Why is there a race to develop biosimilars?

As mentioned above, it is not easy to manufacture these molecules; then why there is a race among multiple drug makers globally to bring these molecules in the market as soon as possible. The reason behind is the cost involved vs profit. The cost and time to develop a biosimilar are much less than original biologics. Typically, biologics will take 10–15 years to develop with an expenditure of USD 1,200–2,500 million. However, biosimilars can be manufactured in 8–10 years with approximately 1/10th of the cost (USD 100–200 million).1–3 The reason behind cost and time-saving in cases of biosimilars is that biosimilars need not invest heavily on clinical trials, rather they need to have robust analytical bioequivalence to prove similarity. At least one clinical study is required to compare pharmacokinetics of bio-originator and biosimilar, and at least one sufficiently large randomized controlled trial to demonstrate clinical equivalence.

In the year 2016, Lucentis® (ranibizumab, Genentech, South San Francisco, CA) clocked sales of $1.4 billion for Roche (Basel, Switzerland) in the US and $1.8 billion for Novartis (Basel, Switzerland) which commercializes it outside the US. US Eylea® (aflibercept, Regeneron, Tarrytown, NY, USA) sales rose 12% in the third quarter of 2017 to $953 million. Sales outside the US, which are booked by Bayer (Leverkusen, Germany), rose 20%. In 2016, global net sales of aflibercept were $5.2 billion.4

Diabetic retinopathy market size was valued at around USD 7 billion in 2016 and is anticipated to witness a growth of over 6.5% mean annual growth rate (CAGR) from 2017 to 2024.5 The wet AMD market is expected to be USD 8 billion+ by 2020. The global age-related macular degeneration (AMD) market size is predicted to reach $8.9 billion by 2022, growing at a CAGR of 7.6% during the forecast period.6

This time and cost factor in manufacturing biosimilars along with multibillion dollar market with growth are prompting major drug companies to get into the biosimilar market, which can give them big gains in terms of profitability.

Biosimilar approval process

Is it the same globally?

No it is not. Europe is the most experienced region regarding having a developed regulatory framework for biosimilars. The European Medical Agency (EMA) first established guidelines in 2005. Following EU, Japan (2009), Korea (2009), Canada (2010), US, and India (2012) have developed regulatory guidelines. Global guidelines through the World Health Organization were introduced in 2009.7–9

There are no fixed guidelines globally regarding their approval. Guidelines are constantly evolving as technology grows. However, fundamentals of the guidelines across the world are the following:

- Analytical studies to demonstrate high biosimilarity.

- Animal studies for toxicity assessment.

- The clinical study to assess safety, efficacy, and immunogenicity compared to the reference biologic.

There are multiple steps to assess above three described points. Each country has a committee which decides the next step of evidence on the basis of the strength of similarity in the previous step.

Does a biosimilar need to go through separate approval for each indication?

No, it can be approved for all the indications for which the reference biologic is being used provided analytical, scientific, and clinical data of similarity are robust on the tested indication.

Potential biosimilars on the horizon

Biosimilar to ranibizumab

Razumab® (Intas Pharmaceuticals Ltd., Ahmedabad, India) – Razumab became the first and the only similar biologic to ranibizumab being clinically used at this point in time. It was approved by the regulatory body from India in 2015 based on the results of Phase 3 Clinical trial in 104 Indian patients with wet AMD (Table 1). In addition to registration clinical trial, Intas also conducted RE-ENACT study (a retrospective pooled analysis) to assess the real-world experience of razumab in 561 Indian patients with wet AMD, RVO, and DME. The subgroup analyses data from the RE-ENACT study for wet AMD (n=194) and RVO (n=160) populations have been published recently.10,11 It is a recombinant humanized IgG1 monoclonal antibody fragment designed for intraocular use. It comes in a single-use glass vial like the reference product with a concentration of 10 mg/mL in 0.05 mL. Ocular inflammation was reported with the initial three batches of the drug. However, the company took immediate action and resolved the issues by halting production for some time, and after refining the manufacturing process slowly started releasing the batches with careful monitoring. The drug has proved its safety and efficacy since then, and data have been presented at various scientific platforms such as American Society of Retina Specialists, Euretina, and American Academy of Ophthalmology regarding the same. Razumab is approved for all the indications in which ranibizumab is used (wet AMD, DME, RVO, and myopic choroidal neovascularization).12–14

| Table 1 Biosimilar of Lucentis® (ranibizumab) |

Current status – Razumab is doing well in the Indian market and expanding its user base.

- FYB 201 (Formycon AG and bioeq GmbH) – FYB 201 is the only other biosimilar to ranibizumab which will potentially be launched as soon as the ranibizumab patent expires in the US and Europe. Formycon’s development and distribution partner Bioeq is responsible for the clinical Phase 3 study. Bioeq also holds the exclusive global marketing rights for the product FYB201.

Current status – Recently, encouraging interim results of the Phase 3 trial (COLUMBUS-AMD) have been released. The drug has fullfilled the primary endpoint in terms of comparable efficacy to the reference drug (ranibizumab) in patients with neovascular (wet) AMD. Best-corrected visual acuity at 8 weeks was used as the efficacy endpoint. Safety and immunogenicity were also addressed. The last patient in the trial, in which patients are treated for a total of 48 weeks, is expected to complete treatment in the second quarter of 2018. Strong interim data from Phase 3 will help the company move forward with the marketing approval with the US Food and Drug Administration (US FDA) and the EMA.15

- Xlucane (Xbrane Biopharma) – Xbranes have their own patented technology which can have better yield compared to the standard technology used. Xlucane has shown very good in vitro characterization compared to ranibizumab. In the in vitro comparability study, in accordance with EMA and US FDA biosimilar guidelines, numerous analytical methods comparing the proteins along five key dimensions were used: primary structure (amino acid sequence), higher order structure (folding of the protein), binding characteristics (binding with the growth factor VEGFa), biological activity (activity in terms of growth inhibition on living cells), and purity. Study demonstrated similarity to the reference product on most of the tested parameters. However, purity was found to be lower compared to the reference product. The company will be doing some modifications in the manufacturing process to match the purity when they scale up the production process. Current status – Xbranes is open for global partners to go further in terms of approval and commercialization. There is the possibility of Xbrane and CR Pharma (Hong Kong, People’s Republic of China) taking it to the Chinese market. However, the timeframe is not yet confirmed.16

- PF582 (Pfenex Inc.) – Phase 1/2 study demonstrated that in terms of safety, efficacy, and immunogenicity, there are no meaningful differences compared to reference drug (ranibizumab).

Current status – Pfenex has regained full rights from Pfizer (New York, NY, USA) in August 2016, and a strategic review is on in terms of its further progress.17

- CHS3351 (Coherus BioSciences) – Website shows that the drug is in the preclinical development phase.18

- SB11 (Samsung Bioepis) – A Phase 3 randomized, double-masked, parallel-group, multicenter study to compare the efficacy, safety, pharmacokinetics, and immunogenicity between SB11 and ranibizumab in subjects with neovascular AMD is on and estimated to be completed by July 2020.19

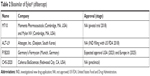

Biosimilar to aflibercept

- M710 (Momenta Pharmaceuticals and Mylan NV) – M710 is developed in collaboration with Mylan NV and Momenta Pharmaceuticals (Table 2).

Current status – Companies have a plan to initiate a pivotal trial in early 2018. The trial is a randomized, double-blind, active-control, multicenter study in patients with DME to compare the safety, efficacy, and immunogenicity of M710 with aflibercept.20

- ALT-L9 (Alteogen, Inc.) – US-based preclinical studies are done in the monkey for safety and efficacy. Aflibercept and ALT-L9 were given four times every 4 weeks. After 13 weeks follow-up, ALT-9 demonstrated similar efficacy and safety compared to aflibercept. Alteogen states that ALT-L9 is more temperature resistant and has a longer shelf life than the originator drug. In 2014, Alteogen partnered with Kissei Pharmaceutical (Matsumoto, Japan) to develop and commercialize ALT-L9 in Japan. The Korean firm plans to launch its aflibercept biosimilar in Japan and People’s Republic of China in 2022 as soon as aflibercept goes off patent.

Current status – Company has announced that it will file Investigational New Drug application with the FDA during 2018.21

- FYB203 (Germany’s Formycon) – Formycon out-licensed FYB203 exclusively to Santo Holding GmbH in Holzkirchen, Germany in May 2015. Bioeq GmbH, a subsidiary of Santo Holding GmbH, will be responsible for the clinical development, the approval, and the global marketing and license of FYB203. Both development programs will be developed in close coordination with the US FDA, as well as the EMA, and are striving toward approval in both regions. Bioeq will guide the pharmaceutical development conducted by Formycon and also will carry out clinical development as per the terms.

Current status – The development of this biosimilar is at an early stage. The Entry of FYB203 to the market is expected in the US in 2023 and in Europe in 2025.22

- CHS-2020 (Coherus BioSciences) – Preclinical development has been initiated.23

| Table 2 Biosimilar of Eylea® (aflibercept) |

Biosimilar to Avastin® (bevacizumab)

There are biosimilars to Avastin already approved and in the pipeline. However, their use is more suited in oncology rather than ophthalmology due to the cost-effective availability of bevacizumab globally along with the faith of ophthalmologists in it. Bevacizumab biosimilars approved for clinical use in different countries are briefly mentioned in Table 3.24

Biosimilar to Humira® (adalimumab)

Bevacizumab, ranibizumab, and aflibercept have been the extensively used drugs in ophthalmology. However, there is a small segment of patients with noninfectious uveitis who might benefit with a cost-effective biosimilar to adalimumab (Humira). Table 4 lists the approved biosimilars of adalimumab.

Is there a big change around the corner?

There is a strong possibility of a shift toward biosimilar in both developing and developed world for different reasons.

Developed world

The major reason is that insurance companies will have significant savings of 15%–20% due to recurrent injections. Furthermore, it can save government expenditure on health. In the United States, biosimilars are estimated to save $44 billion from 2014 to 2024.25 Insurance and cost-saving strategies by the government might uplift the biosimilar use rather than the real clinician-based upsurge in short term. Clinicians have developed confidence over a long time use in off-label bevacizumab which is cost-effective (USD 50) over ranibizumab and aflibercept. Clinicians will take time to gain faith in new cost-effective drugs (biosimilars) when they have a cheaper drug already available.

Developing world

The equation can significantly change in developing countries where bevacizumab compounding has been an issue and bevacizumab has faced temporary ban due to regulatory agencies such as in India.26 Biosimilars have potential to fill that gap. Razumab use in India has already gone multifold in last 2 years after resolution of safety issues. Razumab is available at 30% discount compared to reference biologic ranibizumab in India and is the only similar biologic to ranibizumab being used clinically. Aflibercept has gained the market share in Europe and the US significantly in recent past. However, there are no significant financial data available from lower income countries. Cost-effective biosimilar to aflibercept might shift the momentum.

How would innovator companies protect their market share?

Innovator companies have realized that entry of biosimilars could significantly impact their sales and margins; hence, they are gearing up for the competition with strategies such as sustained drug delivery device for ranibizumab which can be a game changer for them.27 Apart from the development of newer scientific strategies, they have an option of patent extensions such as in case of aflibercept, which might extend its claims up to June 2023 rather than 2021. They can also file patent infringement suits. From the marketing perspective, they can highlight small price difference from innovator molecules and can also try to create some doubts in physicians and patients mind about the branded and biosimilar.

Conclusion

Ophthalmology, especially retinal disease management, might see a big change in the coming few years as more and more biosimilars are approved for the clinical use in both developing and developed world. It remains to be seen how well the drugs will be priced and how the innovator companies will protect their market share.

Disclosure

None of the authors have a direct financial interest in this manuscript, though the authors below have the following financial disclosures regarding their relationships with many of the companies whose products are discussed here or alternatively with competitors of companies whose products are mentioned here:

- Baruch D Kuppermann: Clinical Research – Alcon, Alimera, Allegro, Allergan, Apellis, Clearside, Genentech, GSK, Novartis, Regeneron, ThromboGenics; Consultant – Aerpio, Alcon, Alimera, Allegro, Allergan, Ampio, Catalyst, Cell Care, Dose, Genentech, Novartis, Ophthotech, Regeneron.

- Francesco Bandello: Clinical Research – Allergan, Bayer, Boehringer Ingelheim, Hoffman La Roche, Novartis, NTC Pharma, Sifi, Sooft, ThromboGenics, Zeiss.

- Dr Anat Lowenstein acts as a consultant/advisor for the following companies: Allergan, Bayer, Beyeonics, ForSight Labs, Notal Vision, Novartis, Alcon, Almira.

- Dr Ashish Sharma acts as aconsultant/advisor for the following companies: Allergan, Bayer, Novartis, Intas.

The authors report no other conflicts of interest in this work.

References

Entine J. FDA balances costs, patient safety in the biologics and personalized medicine revolution. Forbes. 2012. Available from: https://www.forbes.com/sites/jonentine/2012/07/23/fda-balances-costs-patient-safety-in-the-biologics-and-personalized-medicine-revolution-will-it-get-it-right-or-damage-the-miracle-industry/#9b1a87a1d366. Accessed September 23, 2018. | ||

Dimasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. J Health Econ. 2016;47:20–33. | ||

Hospira.com [homepage on the Internet]. Lake Forest, IL: Hospira. Available from: https://www.hospira.com.au/en/about_hospira/biologics/developing_biosimilars. Accessed May 16, 2018. | ||

investor.regeneron.com [homepage on the Internet]. Eastview, MN: Regeneron. Available from: http://investor.regeneron.com/releasedetail.cfm?releaseid=1047691. Accessed May 16, 2018. | ||

gminsights.com [homepage on the Internet]. Ocean View, DE: Global Market Insights. Available from: https://www.gminsights.com/industry-analysis/diabetic-retinopathy-market-report. Accessed May 16, 2018. | ||

prnewswire.com [homepage on the Internet]. New York, NY: PR Newswire. Available from: https://www.psmarketresearch.com/market-analysis/age-related-macular-degeneration-market. Accessed May 16, 2018. | ||

fda.gov [homepage on the Internet]. Silver Spring, MD: US Food and Drug Administration. Available from: https://www.fda.gov/Drugs/DevelopmentApprovalProcess/HowDrugsareDevelopedandApproved/ApprovalApplications/TherapeuticBiologicApplications/Biosimilars/ucm580429.htm. Accessed September 23, 2018. | ||

Blank T, Tilonetzer WH, Vogt-Eisele A, Kaszkin-Bettag M. Safety and toxicity of biosimilars – EU versus US regulation. GaBI J. 2013;2(3):144–150. | ||

gabionline.net [homepage on the Internet]. Mol, Belgium: Generics and Biosimilars Initiative. Available from: http://www.gabionline.net/Guidelines/Global-guidelines-for-biosimilars. Accessed May 16, 2018. | ||

Sharma S, Khan MA, Chaturvedi A; RE-ENACT Study Investigators Group. Real Life Clinical Effectiveness of Razumab® (World’s First BiosimilarRanibizumab) in Wet Age-Related Macular Degeneration: A Subgroup Analysis of Pooled Retrospective RE-ENACT Study. Int J Ophthalmol Eye. 2018;6(2):368–373. | ||

Sharma S, Khan MA, Chaturvedi A; RE-ENACT Study Investigators Group. Real Life Clinical Effectiveness of Razumab® (World’s First BiosimilarRanibizumab) in Retinal Vein Occlusion: A Subgroup Analysis of Pooled Retrospective RE-ENACT Study. Ophthalmologica.2018:1–8. Epub 2018 June 26. | ||

medscape.com [homepage on the Internet]. New York, NY: Medscape. Available from: https://www.medscape.com/viewarticle/867481. Accessed May 16, 2018. | ||

indianexpress.com [homepage on the Internet]. New Delhi: The Indian Express. Available from: http://indianexpress.com/article/business/companies/undertaking-detailed-analysis-patients-report-eye-inflammation-intas-recalls-its-drug-batch-4596914/. Accessed May 16, 2018. | ||

Banker A. A new biosimilar ranibizumab for retinal diseases. Paper presented at: American Society of Retina Specialists Annual Meeting; August 9–14; 2016; San Francisco, CA. | ||

formycon.com [homepage on the Internet]. Martinsried, Germany: Formycon. Available from: http://www.formycon.com/en/press-release/formycon-and-bioeq-achieve-important-milestone-biosimilar-ranibizumab-candidate-fyb201-shows-efficacy-comparable-to-the-reference-product-in-phase-iii-study/. Accessed May 16, 2018. | ||

biosimilarnews.com [homepage on the Internet]. Available from: http://www.biosimilarnews.com/2017/02/xbrane-biopharma-reports-positive-in-vitro-biosimilarity-data-on-ranibizumab-biosimilar/. Accessed May 16, 2018. | ||

ois.net [homepage on the Internet]. Raleigh, NC: OIS. Available from: https://ois.net/pfenex-moves-forward-with-lucentis-biosimilar/. Accessed May 16, 2018. | ||

coherus.com [homepage on the Internet]. Redwood City, CA: Coherus BioSciences. Available from: https://www.coherus.com/our-products/. Accessed May 16, 2018. | ||

clinicaltrials.gov [homepage on the Internet]. Bethesda, MA: US National Library of medicine. Available from: https://clinicaltrials.gov/ct2/show/NCT03150589?cond=SB11&rank=1. Accessed May 16, 2018. | ||

gabionline.net [homepage on the Internet]. Mol, Belgium: Generics and Biosimilars Initiative. Available from: http://www.gabionline.net/Biosimilars/General/Mylan-Momenta-announce-development-strategy-for-aflibercept-biosimilar. Accessed May 16, 2018. | ||

centerforbiosimilars.com [homepage on the Internet]. Available from: http://www.centerforbiosimilars.com/news/eye-on-pharma-alteogen-to-file-ind-for-proposed-aflibercept-biosimilar. Accessed May 16, 2018. | ||

bioeq.com [homepage on the Internet]. Germany: bioeq. Available from: http://www.bioeq.com/development-programs/fyb203/. Accessed May 16, 2018. | ||

adisinsight.springer.com [homepage on the Internet]. Fremont, CA: AdisInsight. Available from: https://adisinsight.springer.com/drugs/800051416. Accessed May 16, 2018. | ||

gabionline.net [homepage on the Internet]. Mol, Belgium: Generics and Biosimilars Initiative. Available from: http://gabionline.net/Biosimilars/General/Biosimilars-of-bevacizumab. Accessed May 16, 2018. | ||

Mulcahy A, Predmore Z, Mattke S. The cost savings potential of biosimilar drugs in the United States. Santa Monica, CA: Rand Corporation; 2014. Available from: https://www.rand.org/content/dam/rand/pubs/perspectives/PE100/PE127/RAND_PE127.pdf. Accessed May 16, 2018. | ||

raps.org [homepage on the Internet]. Washington, DC: Raps. Available from: https://www.raps.org/regulatory-focus%E2%84%A2/news-articles/2016/1/india%E2%80%99s-cdsco-warns-against-using-roche%E2%80%99s-avastin-as-eye-treatment\. Accessed May 16, 2018. | ||

clinicaltrials.gov [homepage on the Internet]. Bethesda, MA: US National Library of medicine. Available from: https://clinicaltrials.gov/ct2/show/NCT02510794. Accessed May 16, 2018. |

© 2018 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2018 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.