Back to Journals » Risk Management and Healthcare Policy » Volume 13

Willingness to Enroll for Community-Based Health Insurance and Associated Factors in Simada District, North-West, Ethiopia, 2020:A Community-Based Cross-Sectional Study

Authors Yitayew MY , Adem MH , Tibebu NS

Received 6 September 2020

Accepted for publication 3 December 2020

Published 15 December 2020 Volume 2020:13 Pages 3031—3038

DOI https://doi.org/10.2147/RMHP.S280685

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Professor Marco Carotenuto

Moges Yinges Yitayew,1 Mohammed Hussien Adem,2 Nigusie Selomon Tibebu3

1Ethiopian Red Cross Society South Gondar Branch, Debre Tabor, Ethiopia; 2Department of Health Systems Management and Health Economics, School of Public Health, Bahir Dar University, Bahir Dar, Ethiopia; 3Department of Pediatrics and Child Health Nursing, College of Health Science, Debre Tabor University, Debre Tabor, Ethiopia

Correspondence: Moges Yinges Yitayew

Ethiopian Red Cross Society South Gondar Branch, Debre Tabor, Ethiopia

Tel +251920632282

Email [email protected]

Background: Community-based health insurance is a not-for-profit type of health insurance that has been used by poor people to protect themselves against the high costs of seeking medical care and treatment for illness. This study aimed to assess communities’ willingness to enroll for community-based health insurance (CBHI) and its associated factors in Simada district, Northwest, Ethiopia.

Methods: A community-based mixed cross-sectional study design was conducted. Multistage simple random and purposive sampling techniques were used for quantitative and qualitative studies, respectively. Data were coded and entered into Epi info version 7.2.0.1 and exported to SPSS 20.0 for data analysis. Inferential statistics were done to determine an association between the outcome and independent variables. Statistically significant variables in binary logistic regression analysis with p-value < 0.2 were entered for multivariable binary logistic regression analysis and P-value ≤ 0.05 was considered as statistically significant. Hosmer and Lemeshow’s goodness of fitness test was fitted and qualitative data were analyzed by using thematic analysis.

Results: Among 510 study participants, 454 (89%) [CI: (86.5%-91.6%)] were willing to enroll for community-based health insurance. Members of social capital [AOR: 7.6 (3.78– 15.5)], distance from health facilities [AOR: 10.8 (4.9– 23.5)], the experience of chronic illness in the family [AOR: 4.6 (1.88– 11.4)], medium family wealth status [AOR: 3.1 (1.3– 7.5)], and the number of family members [AOR: 2.25 (1.11– 4.6)] were significantly associated with willingness to enroll for community-based health insurance.

Conclusion: Willingness to enroll in community-based health insurance in the study area is high. Members of social capital, the experience of chronic illness in the family, distance from a health facility, the number of family members, and medium family wealth status were factors found to be associated with willingness to enroll for the scheme. Therefore, emphasizing redesigning and planning strategies for better expanding the scheme accordingly.

Keywords: CBHI, Ethiopia, willingness

Background

Community-Based Health Insurance (CBHI) is a type of insurance mean for informal sectors through contributing some amount of money, and the schemes are a not-for-profit type of health insurance that has been used by poor people to protect themselves against the high costs of seeking medical care and treatment for illness.1

Globally, 150 million people per year suffer from financial catastrophic shock, and 100 million are pushed into poverty because of direct payments for healthcare-related services.2 In the majority of African countries including Ethiopia, more than 40% of their total health expenses were constituted by out-of-pocket payment (OOP) and this resulted in the scarcity of finances for health.3 There is evidence of households being pushed into poverty or forced into deeper poverty when faced with extensive medical expenses, particularly when combined with a loss of household income due to ill-health.4

Community-Based Health Insurance refers to the pooling of prepaid funds in a way that allows for risks to be shared and particularly suitable for the rural poor and the informal sector in low- and middle- income countries that is, insurance schemes operated by organizations other than governments or private for-profit companies.5

Ethiopian government endorsed and constituted a CBHI scheme in 13 pilot districts in June 2011.6,7 According to health insurance guidelines of the Federal Ministry of health, Amhara Regional State had premeditated the regional community-based health insurance scheme which was begun in 2011 only in three pilot districts, and till 2015 it had been expanding to 98 districts.8 The Ethiopian health care system is characterized by high out-of-pocket expenditure, increased health care needs, inability to mobilize more resources for health among rural dwellers, and inability to fully recover costs of care incurred by beneficiaries.9

Community-based health insurance (CBHI) uptake was so notable in Ethiopia, in the piloting year which was raised to 41% in one year. Besides, in the next year, 48% of the scheme saw an increment of enrolment.10

Even though low and middle-income countries account for 90% of the global burden of disease, only 12% of global health spending.5 The CBHI scheme thus still has a long way to go if it wants to strongly contribute to health system performance and in many instances, risk-minimizing in health remains limited because of the small size of the CBHI member population, and going to scale remains an enormous challenge.11

Household heads’ estimation of the benefits of health insurance to themselves differs from their valuation of the benefits to other members of the household. However, this difference might be related to the economic status, gender, and other social and economic characteristics of the households.7,12

There is evidence that CBHI improves resource mobilization to improve health service utilization and provide financial protection for members in terms of reducing their OOP expenditure.13 The utilization of health care services is higher in CBHI insured households than in uninsured households.14 A study done on Ethiopia’s CBHI scheme documented that enrolment after setting up increase from 41% to 48% a year later.10 Another community-based cross-sectional study in Gojam Ethiopia revealed that 81.5% of respondents have expressed WTE the CBHI scheme.15 Furthermore, this study was aimed to assess the willingness to enroll for CBHI and associated factors in Simada District, Amhara, Ethiopia.

Methods

Study Setting

Simada district is located in South Gondar Administrative Zone, Amhara national regional state of Ethiopia. It is located 770 km far from Addis Ababa of Ethiopia, 205 km from Bahir Dar the capital of the Amhara region, and 105 km from the zonal city Debre Tabor. As the data obtained from the Simada district administration, the district had 180,485 populations by a correction factor (2019). Overall the district had 28 kebeles, and it had 41,974 households. In the district, there are 01 primary hospital, 07 health centers, 33 health posts, and 17,000 households were already enrolled for CBHI.

Study Design and Participant

A community-based mixed cross-sectional study design (Quantitative + Qualitative) was conducted from February 29/2020 to March 30/2020.

Source Population

- All households which were not a member of CBHI living in the district.

Study Population

- All households which were not a member of CBHI living in the selected kebeles of the district.

Inclusion and Exclusion Criteria

Inclusion criteria

Households which were registered as permanent residents.

Exclusion criteria

- Households which were not registered as permanent residents.

- Household heads were not able to communicate.

Sample Size Determination

The sample size was determined using single population proportion formula, with the assumptions of 5% margin of error and 95% CI; Ζα/2 = Critical value =1.96, 10% non response rate and design effect 2. n= (Z α/2)2* p (q)/d2 where as n= numbers of sample size, p= the proportion of WTE for CBHI from East Gojam 81.5%15 and q=1-p, then n=(1.96)2*0.815*0.185/(0.05)2 =232. n=232 x2 (design effect) = 464+ (464*10%) = 510.

For the qualitative method study participants were selected by their better awareness (CBHI experience) about the practice of CBHI entrance, five key informants for in-depth interviews, and sixteen participants for two focus group discussions (FGD) were employed until the information was saturated.

Sampling Methods and Procedures

The respondents for the quantitative study were selected by using two-level multistage sampling techniques. Out of a total of 28 kebeles of the district’s 8 kebeles (30%) were selected by using a simple random sampling technique.

The total respondents were assigned to each selected kebele proportionally and the data were collected from proportionally allocated households of each kebele.

For qualitative data, purposive sampling was used. Five key informants for in-depth interviews and 16 participants for 2 FGD based on educational status/better awareness about CBHI/participants were involved.

Operational Definition

WTE for CBHI

The willingness of household heads to join the proposed CBHI regardless of the amount of payment in the coming registration time (yes or no).

Social Capital

It is thus to bring out and sharing contributions to access basic health care by sharing when persons become sick or die, basically social networks of households.

Kebele

It is the lowest administrative body in Ethiopia which comprises at least 1000 households or a population of 5000 people.

Permanent Resident

Participants who were lived six months and above, and registered by the local administrative office.

Data Collection Tools and Techniques

Quantitative data were collected by using a structured interviewer-administered questionnaire. Structured interviewer-administered questionnaires were adapted from previous researches done on similar topics. The questionnaires were translated into the local language (Amharic) and then back to English for its consistency.

The data were collected by eight grade ten and twelve completed data collectors. They took the responsibility of the interview and consists of the recorded data. The supervision was made by degree health professionals. For unavailable household heads, three trials were done. Finally, the data were submitted to the investigator as scheduled.

For the qualitative approach, semi-structured interview guides were used to conduct in-depth interviews and FGD. The data were collected by the principal investigator using a tape recorder and field notes.

Data Quality Assurance

The quality of the research was maintained through training. Before the data collection, one-day training was given to data collectors and supervisors. The training was focused on the purpose, objectives of the study, and the content of the questionnaires. Data collectors were assigned out of their respective kebeles to minimize information bias. The pre-test was done in a comparable district at 10% of the actual respondents.

For qualitative data tape recorder, field note documentation, and triangulation of data collection method were used.

Data Processing and Analysis

The data were cleaned, coded, and entered in Epi info version 7.2.0.1 and transferred to SPSS version 20.0 for analysis. Descriptive and inferential statistics were used to present and analyze the data respectively. Descriptive statistics like frequency and percentage were used to summarize the socio-demographic characteristics of the study participants.

Inferential statistics like odds ratio, bi-variable, and multivariable logistic regression analysis were used to determine an association between the dependent variable (WTE for CBHI) and independent factors. The wealth status was analyzed by principal component analysis (PCA). Statistical significant variables in binary logistic regression analysis (p-value <0.2), were entered into multivariable binary logistic regression analysis, and P-value ≤ 0.05 was considered as significant at 95% CI. Hosmer and Lomshow’s goodness of fitness test was checked.

Qualitative data like pressure from CBHI officials, membership of social capital, and the presence of chronic illness were analyzed by thematic content analysis.

Results

Socio-Economic and Demographic Factors

The study was conducted among 510 study participants with a response rate of 100%. Among the total participants, 484 (94.9%) were male and 210 (41.2%) participants were in the age group of 32–45 years. The majority of the participants (38.2%) were poor (Table 1).

|

Table 1 Socioeconomic and Demographic Characteristics of Participant Simada District, Amhara Region, North West Ethiopia, July 2020. (N=510) |

Willingness to Enroll for Community-Based Health Insurance

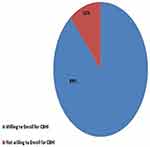

From the total participants of the study, 454 [89% (95% CI 86.5%-91.6%)] had willing to enroll for CBHI (Figure 1).

|

Figure 1 Willingness to enroll for community-based health insurance of participant Simada District, Amhara, North West Ethiopia, 2020. (N=510). |

Factors Associated with the Willingness to Enroll for Community-Based Health Insurance

Logistic regression analysis was used to determine factors affecting willingness to enroll for community-based health insurance. On bivariate analysis social capital, family size, chronic illness, borrowed money for medical service, distance from the health facility, and family wealth, were significantly associated with WTE for CBHI considering p-value< 0.2 (95% CI).

For adjusting potential confounders those variables which were significant at bivariate analysis were entered into multivariable logistic regression. As a result family wealth, social capital, presence of chronic illness, distance from the health facility, and family size were significantly associated with WTE for CBHI (Table 2).

|

Table 2 Factors Associated with WTE for CBHI Among Eligible Households of Simada District, July 2020. (N=510) |

Participants who were members of social capital had 7.6 times the odds of WTE for CBHI than participants who were not members of social capital [AOR: 7.6 (3.78–15.5)]. This result was supported by the qualitative finding. As a result, most of the participants were agreed on a member of social capital for willing to enroll for CBHI.

An individual on FGD stated that the other thing in our community, there is an association we call it Iddir for sharing ETB/birr and cooperation when persons become sick or died and so on. On this association, leaders were made an awareness. Most of the time members were willing to enroll for CBHI because they were adapted what is the use of contribution one for others. (FGD1C2).

Another associated factor was the distance from health facilities. Those who lived less than 5 kilometers from health facilities had 10.8 times the odds of WTE for CBHI as compared to participants who lived more than 5 kilometers from health facilities [AOR:10.8 (4.9–23.5)]. Almost all participants believed that household heads that lived near to the health facilities were more willing to join CBHI.

An idea from the FGD stated as participants who lived far from health facilities suggested that they were not used the service equal with the nearest. People who were lived around the health facilities have a chance to got the service at any time, but people who were lived far from health facilities were not comfortable getting the service. (FGD1C1)

Participants who had chronically ill members in their families had 4.6 times the odds of willing to enroll for community-based health insurance than those who had no chronically ill members in their families [AOR: 4.6 (1.88–11.4)].

This was supported by a qualitative finding: participants on FDG stated that the CBHI program is good especially for households who have a chronic illness in their family member. On the other hand, when household members are free from the disease the scheme is not good. Household heads were enrolled in CBHI, I think because of a chronic illness in their household members and this makes repeatedly going to health facilities. They are expense high ETB/birr to get the treatment. (FGD1c4)

Participants who had medium family wealth status had 3.1 times the odds of WTE for CBHI than participants who had poor family wealth status [AOR: 3.1 (1.3–7.5)].

This was supported by a qualitative finding. A 26 years old male participant stated that when we are poor in our economical status we cannot afford the payment at a time but the rich individuals can get the health care service with payment when their family becomes sick. Most of the time households which have medium income status were willing to enroll for community-based health insurance as I sow in my experience.(IDI2)

Participants who have less than or equal to five family members had 2.25 times the odds of willing to enroll for CBHI as compared to more than five family members [AOR:2.25 (1.11–4.6)].

On the qualitative part of the study, most of the participants have complained about willing to join CBHI and few of the participants from the FGDs did not like to talk about the pressure from the CBHI officials. But an individual from the FGD stated that “I know some HHs which are a member of CBHI were enrolled by pressure from CBHI officials and CBHI agents” (FGD1C8).

The major reason the agent to apply pressure on the community is getting 2% from each household paid birr. Mechanisms to make pressure on the community were abandonments of the benefit items like birr or oil. Agents said as “canceling from safety net benefits unless being a membership”. In our Woreda/District/the communities are under the special support of the safety net program. The CBHI official at Woreda/District/level rises propagandas as you will be canceled from the SafetyNet list unless you are a member. So there is pressure from CBHI officials. Getting 2% paid ETB/birr from each household is the reason to apply their pressure. (IDI2)

Discussion

World Health Organization endorsed a resolution encouraging countries to advance toward universal health coverage by the shift from financing health care through out-of-pocket payments toward health insurance and risk pooling schemes.3

Willing To Enroll (WTE) for CBHI in the study area was 89%. This is higher as compared to a study conducted in Fogera 80%,16 East Gojam (81.5%),15 Debub bench Ethiopia 78%.17 The possible reasons might be due to the creation of awareness regarding CBHI scheme utilization becomes a wide range. This study is also higher than the study done in Nigeria at 40%. The possible reason might be variations of the study period, but this study is lower than a study conducted in one part of Nigeria 93.6%.5,18 The possible reason might be due to the presence of low awareness creation, study area (ie this study was district), and activities regarding CBHI like funding by private sectors. This study is in line with a study done in Bangladesh 86.7%19

After adjusting different factors chronic illness, family size, social capital, family wealth status, and distance from health facilities factors associated with willingness to enroll in community-based health insurance. In this study participants who have a chronic illness with their families were significantly associated with WTE for CBHI. This was congruent with a study done in low and middle-income countries.3 The possible reason might be due to the nature of the illness that needs to visit health facilities reputedly and its cost.

This study also indicates social capital was significantly associated with WTE for CBHI as compared to participants who had not social capital [AOR: 7.6 (3.77–15.5). This study was congruent with the study done in Nepal.20 The possible reason might be due to the same study design; and those social capital members have got clear awareness. But this study was different from the study done in Bench Maji zone Ethiopia.17 The difference might be due to the presence of culturally acceptable social capital activities like Iddir and Iqub.

Another factor that is significantly associated with WTE for CBHI is family wealth status which is in line with a study conducted at Fogera, Ethiopia,16 and Debub bench, Ethiopia.17 The possible reasons might be due to similar economical status, and those who had poor family wealth status may not afford the current fee.

Another factor that is significantly associated with WTE for CBHI is the distance from health facilities. This is similar to a study done in the Debub bench zone, Ethiopia.17 This similarity might be due to similar infrastructure and those near the facility have the chance to go to.

The last factor which is significantly associated with WTE for CBHI is a small family size which was contrasted with the study conducted on the evaluation of CBHI which is large in family size.21 This difference might be due to nowadays the family size increases the payment also increase or there is no constant payment (payment difference), and timely economical status.

Pressure from the CBHI officials and agents also other factors on the qualitative finding. The reasons to apply their pressure were they get 2% ETB/birr from each household paid and the mechanism was rise propagandas as “you will cancel from the SafetyNet list, abandonment from the benefit items”.

Limitations of the Study

It may have a recall, information, and social desirability bias and the study is cross-sectional it does not show a cause-effect relationship between CBHI and associated factors.

Conclusion

Willingness to enroll for community-based health insurance in the study area is high as compared to the previous study findings. Being a member of Social capital, the experience of chronic illness in the households, nearest to the health facility, less than five family members, and medium wealth status of the family were factors found to be associated with willingness to enroll CBHI scheme. Moreover, the findings of this study have significant for emphasizing redesigning and planning strategies for better expanding the scheme accordingly.

Abbreviations

CBHI, community based health insurance; CI, confidence interval; COR, crude odds ratio; EHIA, Ethiopian Health Insurance Agency; ETB, Ethiopian Birr; FGD, focus group discussion; HH, household; LMIC, low- and middle-income countries; OOP, out-of-pocket payment; OPD, out patient department; PCA, principal component analysis; PHCU, primary health care unit; SSA, Sub Saharan Africa; UHC, universal health coverage; WTE, willingness to enroll, WTP, willingness to pay.

Data Sharing Statement

Data will be available upon request from the corresponding author.

Ethical Approval and Consent to Participate

Ethical clearance was obtained from the School of Public health Ethical review board on the behalf of Bahir Dar University. Oral consent was obtained from all study participants before the interview. The verbal informed consent was acceptable and approved by the Ethical review board on the behalf of Bahir Dar University, and that this study was conducted under the declaration of Helsinki. A formal letter of cooperation was written to Simada District from Bahir Dar University and permission was obtained from respective kebele administrators. Study participants were informed about the purpose and their right to refuse the study.

Consent to Publication

Not applicable

Acknowledgment

The authors would like to thank Bahir Dar University for its technical support. Besides, we want to acknowledge data collectors and supervisors for collecting data accurately.

Author Contributions

All authors made a significant contribution to the work reported, whether that is in the conception, study design, execution, acquisition of data, analysis, and interpretation. And took part in drafting, revising, or critically reviewing the article; gave final approval of the version to be published; have agreed on the journal to which the article has been submitted, and agree to be accountable for all aspects of the work. All authors have read and approved the final manuscript.

Funding

This research didn’t receive any grant from any funding agency in the public, commercial, or not-for-profit sectors.

Disclosure

The authors report no conflicts of interest for this work.

References

1. Tabor SR. Community-based health insurance and social protection policy. World Bank, Washington: Social Protection Discussion Paper Series. 2005.

2. Uzochukwu B, Ughasoro M, Etiaba E, Okwuosa C, Envuladu E, Onwujekwe O. Health care financing in Nigeria: implications for achieving universal health coverage. Niger J Clin Pract. 2015;18(4):437–444. doi:10.4103/1119-3077.154196

3. Adebayo EF, Uthman OA, Wiysonge CS, Stern EA, Lamont KT, Ataguba JE. A systematic review of factors that affect the uptake of community-based health insurance in low-income and middle-income countries. BMC Health Serv Res. 2015;15(1):543. doi:10.1186/s12913-015-1179-3

4. McIntyre D, Thiede M, Dahlgren G, Whitehead M. What are the economic consequences for households of illness and of paying for health care in low-and middle-income country contexts? Soc Sci Med. 2006;62(4):858–865. doi:10.1016/j.socscimed.2005.07.001

5. Adebayo E. Factors That Affect the Uptake of Community-Based Health Insurance in Low-And Middle-Income Countries: A Systematic Review. University of Cape Town; 2014.

6. Mebratie AD, Sparrow R, Yilma Z, Alemu G, Bedi AS. Enrollment in Ethiopia’s community-based health insurance scheme. World Dev. 2015;74:58–76. doi:10.1016/j.worlddev.2015.04.011

7. Asfaw A, Von Braun J. Can community health insurance schemes shield the poor against the downside health effects of economic reforms? The case of rural Ethiopia. Health Policy. 2004;70(1):97–108. doi:10.1016/j.healthpol.2004.02.005

8. Amhara Regional Health Bureau. Community-Based Health Insurance Finance and Audit Manual. 2018.

9. Mariam DH. Exploring alternatives for financing health care in Ethiopia: an introductory review article. Ethiopian J Health Development. 2001;15(3):153–163.

10. Mebratie AD, Sparrow R, Yilma Z, Alemu G, Bedi AS. Dropping out of Ethiopia’s community-based health insurance scheme. Health Policy Plan. 2015;30(10):1296–1306. doi:10.1093/heapol/czu142

11. Carrin G, Waelkens MP, Criel B. Community‐based health insurance in developing countries: a study of its contribution to the performance of health financing systems. Tropical Med Int Health. 2005;10(8):799–811. doi:10.1111/j.1365-3156.2005.01455.x

12. Dong H, Kouyate B, Cairns J, Sauerborn R. Differential willingness of household heads to pay community-based health insurance premia for themselves and other household members. Health Policy Plan. 2004;19(2):120–126. doi:10.1093/heapol/czh014

13. Bodhisane S, Pongpanich S. The impact of community-based health insurance in enhancing better accessibility and lowering the chance of having financial catastrophe due to health service utilization: a case study of Savannakhet province, Laos. Int J Health Services. 2017;47(3):504–518. doi:10.1177/0020731415595609

14. Atnafu DD, Tilahun H, Alemu YM. Community-based health insurance and healthcare service utilization, North-West, Ethiopia: a comparative, cross-sectional study. BMJ Open. 2018;8(8):e019613. doi:10.1136/bmjopen-2017-019613

15. Kibret GD, et al. Willingness to join community-based health insurance and its determinants in East Gojjam zone, Northwest Ethiopia. BMC Res Notes. 2019;12(1):

16. Kebede A, Gebrselassie M, Yitayal M. Willingness to pay for community-based health insurance among households in the rural community of Fogera District, North West Ethiopia. Int J Economics, Finance, Management Sci. 2014;2(4):263–269. doi:10.11648/j.ijefm.20140204.15

17. Haile M, Ololo S, Megersa B. Willingness to join community-based health insurance among rural households of Debub Bench District, Bench Maji Zone, Southwest Ethiopia. BMC Public Health. 2014;14(1):591. doi:10.1186/1471-2458-14-591

18. Banwat M, Agbo H, Hassan Z, et al. Community based health insurance knowledge and willingness to pay; A survey of a rural community in North Central zone of Nigeria. Jos J Med. 2012;6(1):54–59.

19. Ahmed S, Hoque ME, Sarker AR, et al. Willingness-to-pay for community-based health insurance among informal Workers in Urban Bangladesh. PLoS One. 2016;11(2):e0148211. doi:10.1371/journal.pone.0148211

20. Ko H, Kim H, Yoon C-G, Kim C-Y. Social capital as a key determinant of willingness to join community-based health insurance: a household survey in Nepal. Public Health. 2018;160:52–61. doi:10.1016/j.puhe.2018.03.033

21. Agency (EHIA) EHI. Evaluation of community-based health insurance pilot schemes in ethiopia: final report. Addis Ababa, Ethiopia; May 2015. Available from: https://www.hfgproject.org/wp-content/uploads/2015/05/CBHI-Evaluation–5–2015.

© 2020 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2020 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.