Back to Journals » Psychology Research and Behavior Management » Volume 15

The Impact of Firm’s Unethical Behavior in Investment Decisions Among Young Investors in China

Received 3 August 2022

Accepted for publication 24 November 2022

Published 28 November 2022 Volume 2022:15 Pages 3427—3443

DOI https://doi.org/10.2147/PRBM.S384377

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Igor Elman

Xuelian Tang,1 Keyi Yu,2 Wenjun Yu2

1College of Science and Technology Ningbo University, Ningbo, Zhejiang, People’s Republic of China; 2Department of Psychology, Ningbo University, Ningbo, Zhejiang, People’s Republic of China

Correspondence: Wenjun Yu, 818 Fenghua Road, Ningbo, Zhejiang, People’s Republic of China, Tel +86 18868646620, Email [email protected]

Purpose: There is ample evidence that investors respond negatively to firm’s unethical behavior. However, researchers cannot explain investors’ reactions and the mechanisms of change when faced with firm’s unethical behavior. By collecting and analyzing data from questionnaires, this study investigated the effects of firm’s unethical behavior on investors’ willingness to invest and further focused on different targets involved in unethical events. Moreover, this study explored the roles of firm development stages and the moderation effect of investors’ moral support level. It aims to reveal investors’ decisions on firm’s unethical behaviors in different situations.

Methods: This study employed a 2 (behavioral ethics: unethical behavior versus normal behavior) X 2 (stages of firm development: startups versus mature firms) X 4 (targets involved in the events: employees, peers, customers, and society) mixed design. Two hundred and fifty-seven participants were finally recruited for final analysis, and then repeated-measures ANOVAs were adopted to assess the valid data collected from 257 participants.

Results: The results showed that disclosure of unethical behavior in due diligence reports significantly decreased investors’ willingness to invest. However, investor willingness was higher for startups with unethical behavior than for unethical mature firms. Investors’ willingness to invest decreased most significantly when evaluating firms with unethical behavior toward employees, followed by society and peers. Their willingness to invest decreased the least when evaluating firms exhibiting unethical behavior toward customers. The level of investors’ moral support moderated the above effects, that is, the higher the moral support, the more considerable the decrease in investment willingness in unethical firms.

Conclusion: Current results demonstrated that when facing firms with unethical behaviors, investors would make investment decisions after considering the firm’s stage of development and the stakeholder of the unethical event. This study provides a valuable theoretical basis for decision-making by government, institutional investors, and firm managers.

Keywords: unethical behavior, startups, mature firms, willingness to invest, level of moral support

Introduction

Firm’s unethical behavior occurs even while increasing number of companies attach importance to corporate ethics. The Enron accounting scandal in the United States in 2001, the exposure of fake transactions of Ruixing Coffee in China in April 2020, and the exposure of Mitsubishi Electric Corporation’s falsified inspection data in Japan in 2021 are key examples of unethical behavior. Existing studies show that when firms behave unethically, investors react negatively. This manifests as reduced willingness to invest,1 massive sell-offs,2 or even investment withdrawal.3 However, investment willingness in startups exhibiting unethical behavior has not been thoroughly investigated. Furthermore, it is important to understand whether a difference exists in investment willingness when targets of firm’s unethical behavior vary. The mechanisms of differential investors’ negative responses to firm’s unethical behavior require further exploration.

The results in current study showed that investors were less willing to invest in firms exhibiting unethical behavior than those with normal behavior. Regarding firm development stages, investors were less willing to invest in mature firms exhibiting unethical behavior than startups exhibiting unethical behavior. The degree of change in investors’ willingness to invest in firms also differed according to the targets of the unethical behavior. Besides, the level of investors’ moral support also affected their willingness to invest—the greater the moral support, the greater the decrease in investment willingness in unethical firms.

This study expanded on existing research on investor reactions to firm’s unethical behavior from management, finance, and psychological perspectives. By studying investors’ reactions to firm’s unethical behavior, management scholars suggest that firms attach importance to social responsibility and build reputational capital.4,5 Finance scholars study investor reactions to firm’s unethical behavior to assist investors in making rational decisions. Psychological studies on this issue analyze the individuals’ decision-making mechanisms in the face of ethical dilemmas. Existing business ethics research has increasingly focused on the causes of firm’s unethical behavior, whereas behavioral finance has paid more attention to investors’ reactions to firm’s unethical behavior. However, there is a lack of research on investors’ reactions to firms’ unethical behavior at different stages of development. Moreover, there is a paucity of data on investors’ willingness to invest after identifying the targets of firm’s unethical behavior. It is imperative to understand the differences in investors’ reactions to firm’s unethical behavior to help governments formulate effective policies and measures for firm supervision. Furthermore, enterprises could enhance awareness of business ethics, reduce unethical behavior, and balance multiple stakeholders’ needs, and investors could make more rational judgments and better investment decisions.

Literature Review

The Impact of Firm’s Unethical Behavior on Investment Decisions

Globally, scholars have conducted many studies on firm’s unethical behavior. Most of them define this behavior using an ethical framework. Behavior is considered unethical when a firm violates established laws, promulgated ethical principles, or social responsibility norms.6–10 From a stakeholder perspective, firms can be considered unethical when engaging in external relationships in deviation from partner relationship norms or otherwise influencing stakeholder decisions.11,12 Based on this existing literature, this study identified social institution ethical norms, norms and principles, and ethical code business conduct guidelines. Behavior that violates ethical norms and adversely affects stakeholders is considered firm’s unethical behavior.

Previous studies have confirmed that unethical behavior can negatively impact a firm’s reputation and increase investment risk.13 As investors are concerned about returns, they are sensitive to the increased likelihood of negative public reactions resulting from unethical behavior.5,14 From the viewpoint of prospect theory, people exhibit loss aversion when making choices about uncertain future events; in other words, people perceive losses more than gains.15,16 For investors, a poor firm reputation caused by unethical events may signal a potential firm crisis.17 Investors might decide to reduce or even withdraw investment to avoid the risk of damage caused by firm’s unethical behavior. In summary, this article proposes the following hypothesis.

H1: When a firm is found to have engaged in unethical behavior (compared to normal firm behavior), investors will significantly reduce their willingness to invest in that firm.

Stages of Firm Development and Willingness to Invest

The related theory states that people exhibit bounded ethicality when faced with ethical and other equally important choices.18–20 Moreover, they will show varying degrees of acquiescence or acceptance of decisions depending on the nature of the unethical behaviors.21 Thus, this study proposes that external factors, such as the stage of firm development, might influence investor perception of a firm’s unethical behavior. Ultimately, this may lead to different levels of willingness to invest.

Public information on mature firms, particularly listed ones, is very readily available. Consequently, because research conducted on firm’s unethical behavior primarily uses listed firms as samples, there is limited research on startups. There are significant differences between startups and mature firms in attracting investment. In terms of financing choices, startups are more likely to use venture capital, whereas mature firms prefer internal financing.22–24 Comparing the listing rules of China’s Growth Enterprise Market and Main Board shows that most startups’ firm performance is not as good as mature firms. China has mandated that all firms on the Main Board disclose corporate social responsibility information since 2008. Growth Enterprise Market firms are only mandated to disclose corporate social responsibility information after eight years. This enables a form of voluntary corporate social responsibility disclosure for startups not entering the Growth Enterprise Market. This shows that startups’ information disclosure constraints are not as rigorous as mature firms. Therefore, this study conducted an in-depth classification and analysis of firms’ development stages to investigate the impact of unethical behavior in firms at different development stages on investors.

Previous studies have found that media coverage and information disclosure can effectively curb firm’s unethical behavior.14 Media coverage, in particular, can alleviate the information asymmetry between investors and firms.10,25–29 According to the political cost theory,30 firms with higher profitability and greater social impact will be under greater pressure for perceived legitimacy. Once these firms engage in unethical behavior, they will receive more media coverage and public condemnation. Government regulators are more likely to punish such firms severely. These repercussions also increase the negative impact of large firms’ unethical behavior on investment decisions. There is no institutional requirement for startups’ information disclosure in China, and the media pay less attention to them. This increases the difficulty of monitoring their unethical behavior to a certain extent, which is less likely to be disclosed. The potential risk perceived by investors for startups is less than for large firms for the same unethical behavior. In such an uncertain environment, people make decisions by weighing perceived benefits and costs.10,31–33 Making a positive investment decision is easier if the perceived cost is lower. Thus, this study hypothesized that investors would be less likely to suffer losses (ie, perceived costs) from startups’ unethical behavior than from large mature firms, that is, they would be more tolerant of startups’ unethical behavior. This led to the second hypothesis.

H2: Investors are more willing to invest in startups involved in unethical behavior than mature firms.

Targets of Firm’s Unethical Behavior and Willingness to Invest

Firm’s unethical behavior invariably infringes on its stakeholders. According to Freeman’s definition, a stakeholder is defined as “any group or individual who can affect or is affected by the achievement of the organization’s objectives.”34 Freeman and Philips have also stated that business stakeholders include individuals and groups.35 These include community consumers, shareholders, employees, competitors, distributors, government, creditors, managers, suppliers, and community members.

Previous studies have addressed the unethical behaviors of Chinese enterprises. Feng and Cai stated that unethical Chinese enterprise behaviors manifested in three aspects.36 These were a lack of credit among enterprises and a deficit of corporate responsibility to society and employees. Wei believed that Chinese enterprises’ unethical behaviors were mainly manifested on two levels.37 The first was the lack of internal morality, manifested as the owners’ disregard of Labor Law and a violation of employees’ rights and interests. The second was the enterprises’ lack of morality toward external stakeholders. This mainly referred to the breach of the rights and interests of consumers, shareholders, creditors, suppliers, competitors, government, and community, and the destruction of the natural environment in production and operation.

This study classified unethical behaviors into four categories according to the above stakeholder classification, combined with the typical manifestations of unethical behaviors in Chinese enterprises. These are (1) unethical behavior against peers, such as suppliers, distributors, and competitors; (2) unethical behavior against employees; (3) unethical behavior against society, manifested as a firm’s external problems, such as the negative impact on the government and environment; and (4) unethical behavior against customers, presenting as consumer fraud and false advertising. Because consumer-oriented unethical behavior occurs most frequently and has a wider range of influence, a separate category was created.

Stakeholder theory is meant to provide managers with guidelines on interacting with stakeholders and treating them in an ethical manner.38 Stakeholders form their perceptions of a firm by analyzing and judging the available information. If a firm’s behavior harms stakeholder interests, it can affect the firm’s financial performance.39 When an investor discovers that a firm is behaving unethically, the first reaction is that the firm presents risks. If the decision time is short, investors’ emotions dominate the decisions.40,41 Investors express displeasure with the firm’s unethical behavior, demonstrated by a decreased willingness to invest. In general, making an investment decision is accompanied by a long evaluation period. During this period, cognitive processes dominate,40,41 and investors’ negative reactions to firm’s unethical behavior vary depending on whether the affected stakeholders have a direct exchange relationship with the firm.42 If a firm’s unethical behavior affects stakeholders who have a direct exchange relationship with the firm, such as employees and consumers,43 the investor’s reaction is more negative. If the affected stakeholders do not have a direct exchange relationship with the firm, such as in a natural environment,42 the investors’ negative reactions are not significant. Based on this analysis, the hypothesis was proposed as follows.

H3: Differences in the targets of unethical behavior have different degrees of impact on investors’ willingness to invest in a firm.

Level of Personal Moral Support and Willingness to Invest

There are significant individual differences in responses to ethical issues.44–46 Ethical decision-making theory suggests that people judge an ethical issue only when they are aware of its existence, and these judgments guide their reactions.47 Awareness of an ethical issue is the key to ethical decision-making. Investors’ reactions to firm’s unethical behavior depend on whether investors notice that the behavior is unethical.48 Furthermore, the investor’s level of moral support may influence their perceptions of unethical behavior. Investors with high levels of moral character may be more likely to detect firm’s unethical behavior; however, the inverse is also true.

Blasi, a pioneer in moral identity research, argued that moral identity motivates people to behave morally.49 Individuals will behave more morally if they consistently recognize moral norms in various contexts. Further, those with higher levels of cognitive moral development are more sensitive to moral issues and more likely to make ethical judgments consistent with their morality.50–54 Kouchaki et al’s study have shown that when primed with the concept of money, individuals are more likely to engage in behaviors that violate norms to benefit themselves.55 For investors, when there is a conflict between pecuniary gain and maintaining justice, investors with high moral character will change their investment intention because they disagree with the firm’s unethical behavior. Investors with low moral character may be more willing to associate themselves with the unethical behavior.56

In summary, investors’ judgments on the losses caused by firm’s unethical behavior are influenced by personal levels of moral character. When the investors’ personal levels of moral character are high, they are more sensitive to unethical behavior. They will amplify the losses caused by such behavior, altering their willingness to invest. Individuals with low levels of moral character will diminish or ignore the negative effects caused by the unethical behavior. Based on this, the following hypothesis was proposed.

H4: The moral level of investors has a moderating effect on investment intentions—investors with higher levels of moral support are more likely to reduce their willingness to invest in firms involved in unethical behavior.

Overall, this study aims to examine changes in investors’ investment decisions in firms discovered to engage in unethical behavior. These four hypotheses highlighted firm’s ethical behavior, stages of firm development, targets involved in the ethical events (ie stakeholders), and the level of investor’s moral support, respectively. The corn concern in current study lies in the joint influence of firm’s unethical behavior and stage of development on investor’s decision.

Methodology

Experimental Design and Data Collection Routes

This study adopted a 2 (behavioral ethics: unethical behavior versus normal behavior) X 2 (stages of firm development: startups versus mature firms) X 4 (targets involved in the events: employees, peers, customers, and society) mixed design. Behavioral ethics and stages of firm development were between-subject variables. Participants were randomly assigned to these four conditions. “Targets involved in the events” was a within-subjects variable. Under the unethical behavior condition, “targets involved in the events” referred to the targets of unethical behavior. The level of moral support was a moderating variable.

This study used Tencent Survey as the sampling tool, which is an online survey platform developed by Tencent—an organization with extensive experience in questionnaires and surveys. The platform houses numerous questionnaire types and templates for client convenience. It was opened to the public in 2014, and was well-reviewed by official Chinese media. Functionally, Tencent Survey helps researchers distribute questionnaires to multiple platforms such as PC and mobile. There is no limitation on the number of users or that of questionnaires returned. The tool is an increasingly popular way to obtain data in consumer behavior fields, psychology, and other social sciences.

Material Development

Defining the Stages of Firm Development

There are two firm development classification stages as defined in previous studies. The first is based on the firm life cycle. It argues that all firms that have not yet reached the mature firm stage can be classified as startups.57,58 However, firms in different industries take different times to mature, and it is difficult to discern the stage of a firm from such an ambiguous measurement. The second classification is based on the duration of business establishment. Most scholars believe that firms established for less than eight years can be considered startups.59,60 These are further categorized by newness, size, growth and stability, and time spent overcoming barriers to entry. This approach has clear criteria for classification and was used for defining startups in the present study.

Materials of Firm’s Unethical Events

To clearly distinguish and design descriptive materials of firm’s unethical events, this study used interviews to collect the opinions of several experts from a variety of industries, but especially the financial investment industry. Fourteen paragraphs of firm’s unethical events were preliminarily summarized. Then, the summaries were transcribed into three paragraphs of unethical events involving industry peers, four paragraphs each of unethical events involving customers and those involving firm employees, and three paragraphs of unethical events involving society. Another group of experts then rated the unethicality of each event, on a 7-point Likert scale (1—not serious at all to 7—very serious), according to the following four dimensions: the degree of unethicality involving peers, customers, employees, and society. Firm codes A-N were used in place of enterprise names to minimize the influence of participants’ knowledge or experience of specific firms.

Scores from 26 experts in economics and finance fields were recorded, and those of each unethical event were averaged under each target category (ie, industry peers, customers, employees, and society). If an unethical event scored significantly higher in a particular target category out of the four, and higher than other preselected events in the same target category, that event was selected as the representative material for that category of targets. For example, the textual material of firm F was used as a preselected firm’s unethical event involving peers. The mean scores of the 26 experts showed that the event scored 6, 4.55, 4.6, and 5.25 for the unethicality of an event involving peers, customers, employees, and society, respectively. The results of the one-way ANOVA found that the unethicality of the event involving peers was significantly greater the other three targets. Compared with the other two preselected materials on firm’s unethical events involving peers, this event had the highest score for unethicality involving peers—firms E and G scored 5.9 and 5.6, respectively, on the level of unethicality involving peers. Therefore, firm F’s unethical event was selected as the formal experimental material for an unethical event involving peers. This approach was also used to select textual materials for the other three targets, and four events were ultimately selected as the materials for the “unethical event” situation in the formal experiment. While retaining the context, the unethical behaviors were modified to normal behaviors using these materials. They were presented to the participants in the “normal event” situation. (Please details in Supplementary Material)

Participants

In the experimental design, two between-subject variables were mentioned—behavioral ethics and stages of firm development. There were four between-group conditions. This study planned to collect data from at least 50 questionnaires in each between-group condition. Questionnaires were distributed to 60‒80 people at a time for each condition to ensure the adequacy and homogeneity of data. Students or community members with a background in finance studies were recruited during the formal collection process and randomly arranged in different conditions. The participants provided informed consent in accordance with the Declaration of Helsinki prior to the questionnaire, and all procedures were approved by the local institutional ethics committee of the Department of Psychology at Ningbo University.

Data were firstly collected from 282 participants. The length of time the participants took to respond was recorded to control for the quality of the participants’ data. Five participants to read the experimental materials in advance. The shortest reading time was 62 seconds. All participants with a response time of fewer than 60 seconds for all questions were presumed to have not read the questions completely, as their response time was significantly shorter than the shortest reading time. The data of these participants were excluded, and the remaining 257 participants (106 Males, 151 Females, Mage = 21.50 ± 2.31 years; Nunethical-startups = 60, Nunethical-mature firms = 65, Nnormal-startups = 54, Nnormal-mature firms = 78) served as the final population for analysis. Among them, 35.4% were undergraduate students, 56.8% with a bachelor’s degree, and 7.8% with a master’s degree. Concerning occupations, 70.8% were students majoring in finance or economics (including undergraduates and postgraduates), 14.0% were grass-roots staff in financial enterprises, and 15.2% were middle-level staff in financial enterprises.

Measurement

Introductions of Ethical Events and Willingness to Invest

At the beginning of the questionnaire, the participants were asked to read the following introductions to familiarize themselves with the scenarios that followed.

Introductions for the startup group:

You are an investor. There are four startups below (in no particular order). These companies were founded in 2018 with around 50 employees at the market development stage. After preliminary team bonding and product polishing, these firms’ products have been gradually accepted by consumers. They have a 10% market share and achieved turnarounds in 2020, showing good development. In 2020, the heads of the companies approached you to attract venture capital and accelerate the companies’ development. You found that each firm had varying degrees of corporate ethical misconduct during your due diligence on them. Please read the following due diligence report carefully and assess the relevant issues.

Introductions for the mature firm group:

You are an investor. There are four companies below (in no particular order). These companies were founded in 2002, all with 1000‒2000 employees. Their net profit exceeded 30 million RMB in the past three years, and their operating revenue exceeded 300 million RMB. They have a good social reputation and are operating stably without significant changes. In 2020, the principals of these companies contacted you to bring in venture capital to accelerate the companies’ development, so you conducted due diligence on them. Read the following due diligence report carefully and assess the relevant issues.

Participants were then asked to review the four companies’ corresponding unethical or normal events, depending on their group, and answer the questions following each event. To test the material’s operational validity, participants were asked to rate the degree of unethicality of the firm’s behavior. The question, “I consider the firm’s behavior unethical”, was rated on a Likert scale (1—strongly disagree, to 11—strongly agree). The second and most important question that the participants were asked was their willingness to invest in the firm (1—strongly disagree, to 11—strongly agree).

Measuring the Level of Moral Support

After the above questions about the operating events of the four companies were answered, the participants were required to complete an individual level of moral support measurement. This study used the Ramasamy and Yeung scale of six questions.61 The six questions reflect individuals’ support for corporate ethics and cover specific consumer behaviors that show supporting or opposing attitudes. Specifically, the following six items are included: “I believe that companies must try to operate in a socially responsible way”, “I am willing to spend more money on products from ethically-responsible companies”, “I would consider the ethical reputation of this firm when shopping”, “I would not buy products from companies that behave unethically”, “I am willing to spend more money for products from companies that care about societal well-being”, and “If the price and quality of two products were the same, I would buy the product from the firm with a good ethical reputation.” This scale has been extensively and empirically validated by scholars.62 Finally, the participants were required to fill in demographic information, including gender and age.

Results

Manipulation Check

Repeated-measures ANOVA was conducted to verify the validity of the unethical event materials in the current group of participants. Behavioral ethics was the between-group independent variable, and the target involved in the event was the within-group independent variable. Participants’ rating of the unethicality of the firm’s behavior was the dependent variable.

The results showed a significant main effect of behavioral ethics [F (1, 255) = 327.973, p < 0.001, ηp2 = 0.563], suggesting a significant difference between participants’ perceptions of unethical and normal events regarding the degree of unethicality. This was indicated by a significantly higher perception of unethicality for the firm’s unethical events (mean ± S.E., 8.156 ± 0.191) than for the normal firm events (3.324 ± 0.186). The results also showed a significant main effect of target involved in the event [F (3, 765) = 6.140, p < 0.001, ηp2 = 0.024], indicating a valid classification of targets involved in the events. Post hoc tests showed that the lowest unethicality score was related to events involving society (5.347 ± 0.158), which was significantly lower than those involving the remaining three targets, namely, the customers (5.953 ± 0.161, p<0.001), employees (5.896 ± 0.166, p<0.001), and industry peers (5.764 ± 0.172, p = 0.006). None of the latter three differed significantly (ps > 0.05). The interaction effect between the behavioral ethics and target involved in the event was significant [F (3, 765) = 14.652, p < 0.001, ηp2 = 0.054]. Simple effects analyses revealed that, under the “each target involved in the event” condition, the unethicality event scores were significantly higher than those of the corresponding normal events (ps < 0.001). This verifies that manipulation of the unethical events involving each target was effective.

Impact of Unethical Events on Willingness to Invest

For H1 and H2, this study adopted a 2×2×4 ANOVA with “willingness to invest” as the dependent variable. This was “type of behavioral ethics” (unethical behavior versus normal behavior) × “stages of firm development” (startups versus mature firms) × “targets involved in the events” (employees, peers, customers, and society). To verify that firm’s unethical behavior reduces investors’ willingness to invest in H1, this study first focused on the main effect of the type of behavioral ethics. The results of the ANOVA showed that this main effect was significant [F (1, 253) = 210.619, p < 0.001, ηp2 = 0.454]. This was demonstrated by the fact that, compared with normal events (7.549 ± 0.131), investors were significantly less willing to invest after being informed of an unethical event (4.848 ± 0.132).

The Impact of “Stage of Firm Development” and Unethical Behavior on Willingness to Invest

The study focused on the main effect of the “stage of firm development” and its interaction with the “type of behavioral ethics” in the ANOVA. This was done to verify differences in investors’ willingness to invest in firms at different stages of development when informed of the firms’ unethical behaviors in H2. The results revealed a marginal significant main effect of the “stage of firm development” [F (1, 253) = 3.404, p = 0.066, ηp2 = 0.013], suggesting that participants had a stronger willingness to invest in mature firms (6.370 ± 0.124) than startups (6.027 ± 0.139).

Interestingly, the interaction effect of the two factors was also marginal significant [F (1, 253) = 3.480, p = 0.063, ηp2 = 0.014] (see Figure 1). This was indicated by the fact that when normal events were reported in due diligence, investors were more inclined to invest in mature firms (7.894 ± 0.201) than startups (7.894 ± 0.167). Nevertheless, when both types of firms were reported to have unethical events, investors’ willingness to invest in both types of firms decreased significantly. However, the willingness to invest in mature firms (4.846 ± 0.183) decreased more than a similar level of willingness to invest in startups (4.850 ± 0.191). In other words, compared with mature firms, investors seemed to have a higher tolerance for unethical startup behavior.

The Impact of the Targets Involved in the Events on Willingness to Invest

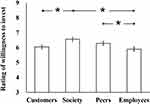

To explore H3—that different targets involved in the events can affect H1 and H2—this study isolated four target categories. The results of the 2×2×4 ANOVA [behavioral ethics (unethical behavior versus normal behavior) × stages of firm development (startups versus mature firms) × targets involved in the events (employees, peers, customers, and society)] showed a significant main effect of “targets involved in the events” [F (3, 759) = 6.917, p < 0.001, ηp2 = 0.027]. As shown in Figure 2, the post hoc tests revealed that regardless of the behavioral ethics and development stages, firms with incidents involving employees attracted the lowest willingness to invest (5.895 ± 0.133). There were significant differences compared with those involving society (6.560 ± 0.138; p < 0.001) and peers (6.287 ± 0.137; p = 0.009). Firms whose events involved customers had the next lowest willingness to invest (6.052 ± 0.125). This differed significantly from firms whose events involved society (p = 0.003). The remaining comparisons were not significantly different from each other (ps ≥ 0.074).

More importantly, the second-order interaction effect between targets involved in the events and behavioral ethics was significant [F (3, 759) = 29.266, p < 0.001, ηp2 = 0.104]. A repeated-measures ANOVA was performed in a simple effects analysis with “targets involved in the events” as the independent variable on the grouped data under both normal and unethical event conditions (see Figure 3). The results showed a significant main effect of “targets involved in the events” under the normal event condition [F (3, 393) = 24.350, p < 0.001, ηp2 = 0.157]. This was indicated by the lowest willingness to invest obtained when the “target involved in the event” was customers (6.644 ± 0.160), compared with society (7.909 ± 0.169), peers (7.894 ± 0.176), and employees (8.000 ± 0.161). The latter three were not significantly different from each other. Conversely, when a firm had an unethical event, the main effect of “targets involved in the events” remained significant [F (3, 372) = 15.826, p < 0.001, ηp2 = 0.113]. Still, the post hoc tests showed the opposite results to those under the normal event condition—firms whose unethical events involved customers had the highest willingness to invest (5.464 ± 0.190). There were significant differences among those involving peers (4.768 ± 0.212, p = 0.002) and employees (3.872 ± 0.213, p < 0.001). Firms with unethical events involving society received the second strongest willingness to invest (5.288 ± 0.225), which was also significantly different from those involving peers (p = 0.050) and employees (p < 0.001). The difference between the latter two also reached significance (p = 0.001). The above results showed that, regardless of the stage of firm development, the ethicality of events involving employees had the greatest impact on investors’ willingness to invest. Compared with normal events involving employees, unethical events reduced the investors’ willingness to invest to the greatest extent. This was followed by those involving peers and society, with those involving customers having the lowest impact on willingness to invest.

However, the second-order interaction effect of “targets involved in the events” and the “stage of firm development” was found to be non-significant [F (3, 759) = 1.641, p = 1.178, ηp2 = 0.006].

The third-order effects of targets involved in the events, behavioral ethics, and stages of firm development were also examined. It was found that the interaction effects were significant [F (3, 759) = 5.615, p = 0.001, ηp2 = 0.022]. The two line charts in Figure 4 showed the willingness to invest in mature firms and startups conditions, respectively. As we could directly observe in this figure, the significant interaction effect might be attributed to the existence of different outcome patterns under the society condition (see highlight marks in grey in Figure 4). To confirm this observation, simple effects analyses were then performed, in which a 2×2 [behavioral ethics (unethical behavior versus normal behavior) × stages of firm development (startups versus mature firms)] ANOVA was adopted for each of the four targets involved in the events. The focus was primarily on the interaction effect of the two factors. The interaction effect observed between “behavioral ethics” and “firm development stages” reached significance only in the condition where society was the target involved [F (1, 253) = 13.904, p < 0.001, ηp2 =0.052]. It was not significant in the conditions where the other three targets were involved: [customers, F (1, 253) = 0.811, p = 0.369, ηp2 = 0.003; peers, F (1, 253) = 0.458, p = 0.499, ηp2 = 0.002; employees, F (1, 253) = 2.280, p = 0.132, ηp2 = 0.009]. Another simple effects analysis was performed on the data involving society. The decrease in investors’ willingness to invest was greater when a mature firm was caught in unethical behavior (unethical events, 4.815 ± 0.271; normal events, 8.346 ± 0.248; d = 3.531) than when a startup was caught (unethical events, 5.800 ± 0.282; normal events, 7.278 ± 0.298; d = 1.478) during investment evaluation. In other words, investors might be particularly concerned about whether the unethical behavior of mature firms would harm society. Presumably, they were relatively tolerant of a startup’s unethical behavior against society.

Moderating Effect of Investors’ Levels of Moral Support

This section was designed to verify H4. This experiment used multiple items to measure the levels of moral support. Reliability analysis was conducted on the scale of moral support for the overall sample, and a Cronbach α of 0.886 was obtained. This suggests that the six measurement items from the original scale61 had a high degree of internal consistency in the current sample. The average scores of the total sample were calculated on the six measurement items. Participants with scores above the average were considered investors with high levels of moral support, while the rest were defined as those with low levels of moral support.

A repeated-measures ANOVA was then performed with “targets involved in the events” as the within-group variable and “behavioral ethics”, “stages of firm development”, and “level of moral support” (high versus low) as the between-group variables. Only results related to the levels of moral support were considered. The results suggested that there was a second-order interaction effect between behavioral ethics and moral support level [F (1, 249) = 55.683, p < 0.001, ηp2 = 0.183]. When informed of the firm’s unethical behavior (compared to normal behavior), investors with high levels of moral support with decreased willingness to invest (unethical behavior, 4.320 ± 0.166; normal behavior, 8.254 ± 0.168; d = 3.934) was significantly greater than investors with low levels of moral support (unethical behavior, 5.433 ± 0.173; normal behavior, 6.853 ± 0.167; d = 1.420). Based on this, the third-order interaction effect among “targets involved in the events”, “behavioral ethics”, and the “level of moral support” also reached significance [F (3, 747) = 5.056, p = 0.002, ηp2 = 0.020]. The interaction effect between “behavioral ethics” and “level of moral support” under the “each target involved in the event” condition was consistent with the overall second-order interaction effect. All other main effects and multi-order interaction effects were not significant.

Discussion

This study investigated the impact of firm’s unethical behavior on willingness to invest. It was found that after startups and mature firms were discovered to have engaged in unethical events, investors were substantially less willing to invest in the firms. However, there was a greater decrease in willingness to invest in mature firms. This indicates a greater investor tolerance of unethical behavior in startups. Moreover, this study found that when investors were informed of a firm’s unethical behaviors toward different targets, their willingness to invest decreased to varying degrees. The most substantial decrease in willingness to invest occurred when the unethical behavior involved employees. This was followed by unethical behavior involving peers and then society. Unethical events involving customers had the lowest impact on willingness to invest. It was also found that the third-order interaction effects of “targets involved in the events”, “behavioral ethics”, and the “types of firms” were significant. Compared with startups, when a mature firm was being evaluated, investors’ willingness to invest decreased to a greater extent when unethical behavior was detected. The investors were particularly concerned about whether the mature firm’s unethical behavior harmed society. Conversely, they were relatively tolerant of the startup’s unethical behavior against society. Further, this study found that investors’ levels of moral support moderated the abovementioned effects—investors with higher levels of moral support were less willing to invest in firms whose unethical behavior was disclosed.

This study showed that firm’s unethical behavior reduced willingness to invest, which confirmed H1 and was consistent with existing studies.63,64 Once unethical behavior is disclosed, the firm’s reputation will be negatively affected. The economic loss caused by reputational damage is influenced by several factors, such as the firm’s crisis response capability and the quality of information disclosed by the media.14 These factors, in turn, deepen investors’ perception of investment risk. To mitigate risk, investors will subjectively reduce their willingness to invest. The prospect theory may also help explain this process.16 People tend to be inclined toward loss-aversion when faced with potential gains and have a risk-chasing tendency when faced with loss in risky decision making. In the present research design, investors encountered firms’ unethical behavior during due diligence and before investment. Investors were more sensitive to losses than gains and showed a loss-aversion tendency.

In contrast, if firm’s unethical behavior occurs after venture capital has been invested, the investor becomes a primary firm stakeholder. Although the investor perceives that firm’s unethical behavior can be a potential risk, it is unknown whether it will affect them. In contrast, disinvestment will undoubtedly result in capital loss. When faced with uncertain or certain losses, investors may likely chase risk. They may be inclined to help firms conceal, or even participate in, the unethical behavior if the investment has already taken place. The results of this study provided further explanation and evidence for the risk perception process of investors prior to investment decisions are made.

Based on H1, this study explored the impact of the firm development stage with unethical behavior on investors’ decisions. In line with previous findings,1,2 results in current study showed that investors were significantly less willing to invest firms with unethical behavior, although both startups and mature firms exhibited good development and investment potential in the experimental scenario. More importantly, investors exhibited a greater decrease in willingness to invest in mature firms than startups, implying that investors might be more tolerant of unethical startup behavior, supporting H2. It is speculated that the difference between investors’ perceived benefits and costs greatly influences their decision-making process for risky investments—investors’ willingness to invest increases when perceived benefits are greater than the perceived costs. The inverse is also true. In this study’s scenario, the firm’s future growth prospects were the perceived benefits to investors; the potential risks associated with firm’s unethical behavior were the perceived costs. In a situation where firm’s unethical behavior had not been exposed to the public, it was difficult for investors to judge the extent of losses owing to unethical behavior. Under such uncertainty, the anchoring effect may influence investors’ subsequent decisions.65 The anchor value of investors’ perceived risks is influenced by the likelihood of unethical behavior being exposed by the media. In the context of China’s political economy, government regulatory regimes require mature firms to disclose information. Thus, the availability of public information on mature firms is higher than for startups, leading to a higher likelihood of unethical behavior in mature firms being exposed. This, in turn, may increase the anchor value of investors’ perceived risks of mature firms’ unethical behaviors. The media and public generally pay more attention to mature firms than to startups, increasing the visibility of news about mature firms suffering losses from unethical behavior. Thus, investors’ perception of investment risk becomes stronger, leading to an increase in the perceived anchor value of investment risk, enhancing the anchoring effect. From this perspective, results in this study provided supportive evidence for previous findings that the media plays a key role in investors’ reactions to firms’ unethical behavior.14

Because unethical events affect different groups differences in investors’ willingness to invest based on the targets of unethical events were further explored. Unethical events involving employees would significantly decrease investors’ willingness to invest, regardless of the firm development stage. This was followed by unethical events involving peers and society. Those involving customers had the lowest impact on investors’ willingness to invest. This analysis shows that the anchor value of investors’ risk perception is influenced by the probability of exposure of unethical events. From this perspective, unethical behavior against employees is most likely to be exposed. This is because employees become more aware of their rights. If their interests are violated, they file complaints to a labor arbitration institute or expose unethical behavior through news or social media. In contrast, employees may also be seen as the weaker party and companies as the stronger party. Unethical behavior against employees is labeled as bullying, triggering public discontent and leading to higher public pressure and perceived anchor value of investment risk. Under such circumstances, investors will have a strong aversion to unethical behavior against employees, leading to the greatest decrease in willingness to invest.

Unethical behavior against society involves public interest, which is more likely to receive media attention and be exposed. It is more challenging for the media to expose firm’s unethical behavior than for employees. The possibility of exposing unethical behavior against society is lower compared with unethical behavior against employees. It can be inferred from this that the anchor value of investors’ perceived risk decreases, which will lead to a decrease in investors’ willingness to invest. However, the level of reduced willingness is slightly less than for unethical behavior against employees. Interestingly, investors were more concerned when mature firms exhibited unethical behavior toward society than when startups did. This might be because mature firms are more likely to be seen as entities capable of undertaking social responsibility, resulting in higher public expectations. Companies with increased sensitivity to social responsibility are more susceptible to public pressure. Such firms pay a high price when they violate public expectations.66 This finding concurred with existing studies67,68 arguing that both the government and people pay more attention to firms with high levels of profitability and greater social influence. Thus, there are higher social responsibility expectations for such firms. Once these firms become socially irresponsible, they will receive more media coverage and public condemnation.

Moreover, unethical behavior against peers is easier to detect. The firms that have suffered a loss of interest often expose the unethical behavior of another firm through the media or by legal means. Third parties often regard this confrontation between firms as inter-firm competition, resulting in a smaller anchor value for investors’ perceived investment risk. There is a smaller decrease in their willingness to invest than in the first two types of unethical behavior.

Finally, unethical behavior against customers is the most difficult to detect. Once it is exposed that a firm harms customer interests to make profits, the firm will immediately lose consumer trust, and customers will buy less of its products. Therefore, the impact of such unethical behavior on a firm’s economic interests is the most direct. Firms might act covertly and even conspire with the media to suppress the truth to prevent such unethical behavior from being disclosed.69 Compared with the other three types of unethical behaviors, investors have the lowest anchor value of perceived risk against the customers and the lowest reduction in willingness to invest. These results were not contradictory to a previous finding based on a situation where firm’s unethical behavior had been exposed.42 Karpoff’s results showed that investors’ negative reactions are stronger when firm’s unethical behavior involves stakeholders who have a direct exchange relationship with the firm. Current study complemented and proved this finding.

Whether investors’ level of moral support affected their willingness to invest in firms with unethical behavior was also investigated. H4 was supported when the investors were informed of unethical behavior. The factor influenced the decisions involving every type of target. These results were generally consistent with existing studies,70,71 suggesting that individual moral level positively predicts moral judgments. Previous studies have shown that individuals respond differently to moral events.44–46 These differences stem from the individual level of cognitive moral development—individuals with higher levels of cognitive moral development are more sensitive to moral issues.51 Such individuals have a stronger perception of risk arising from unethical behaviors. This study hypothesized that investors with high levels of moral support would be more likely to regard certain firm behaviors as unethical, thereby increasing their risk perception and decreasing their willingness to invest. Conversely, investors with low levels of moral support might not regard the same unusual behaviors as unethical and ignore potential risks. Even if they were aware of these unethical behaviors, their perceived potential risk would be significantly lower compared to investors with high levels of moral support, resulting in a smaller decrease in willingness to invest in the firm.

Theoretical Implications

This study examined investment intentions from the perspective of individual investors, and provided theoretical contributions as follows.

First, this study expanded on previous discussions of the context in which firm’s unethical behavior and investment decisions occurred. Although existing research has confirmed that when firms behave unethically, the investment willingness of investors would decline, it was not clear whether the situation occurred before or after investment. The behavioral questionnaire design of this study set the investment situation as the before-investment decision, and the unethical behavior was not disclosed. Therefore, it could be more clearly demonstrated that in the before-investment stage, even if the firm’s unethical behavior had not been exposed to the public, the unethical behavior still had a negative impact on the decision-making of investors.

The findings of this study refined research on the relationship between investment decisions and different stakeholders. Previous findings42 had interpreted the relationship between investment decisions and different stakeholders from the perspective of whether stakeholders had direct transactions with the firm which engaged in unethical behavior. In contrast to the above research, the current study separated the roles of stakeholders and investors, and found that even though the stakeholders of the firm’s unethical behavior were not the investors themselves, the investors would still alter their decisions; further, the impact of unethical events on investor’s investment decision varied between different stakeholders. In this respect, current study provides a new perspective to the integration of stakeholder theory and unethical behavior.

This study enriched the understanding of firm’s unethical behavior by distinguishing the impact of unethical behavior on investment decisions between mature firms and startups. Most of existing studies ignored the research on unethical behaviors of startups, especially for comparing the differences in the impact of unethical behaviors on investment willingness between the two. This study included both startups and mature firms and confirmed that investors had a higher tolerance for unethical behavior of startups.

Practical Implications

This study analyzed investors and firm’s unethical behavior in the Chinese context, and promotes interdisciplinary communication among management, psychology, and behavioral finance and expands the analytical framework for individual investor decision-making.

For Management Practice. This study found that unethical behavior in startups and mature firms decreased investor willingness to invest. This reduction in willingness was especially pronounced for mature companies. Managers should be mindful of firm’s unethical behavior and correct it as soon as it is detected to avoid further deterioration. Investors can then see the firm can handle a crisis, which will help restore investor confidence. Although investors are more tolerant of startups’ unethical behaviors, the willingness to invest still decreases. It is already difficult for startups to raise capital, and a reduced willingness to invest can result in reduced or even withdrawn investments. Funding is as essential to business survival. If capital is scarce, startups face an existential and growth crisis. Therefore, neither startups nor mature firms should pursue economic benefits through unethical behaviors. Rather, they should balance stakeholders’ interests and pursue the maximization of overall benefits.

For investors. Stakeholders are always trying to balance business and social needs.72 If the two are in conflict, managers usually focus on the interests of shareholders and ignore the needs of specific stakeholder groups.38 This often results in firm’s unethical behavior. Investors must be aware that unethical behavior is the antithesis of firm development and may cause substantial financial and reputational damage if exposed. Prior to making investment decisions, investors should pay close attention to firm’s unethical behavior and carefully assess the investment risks. Investments should be reduced or suspended in firms exhibiting unethical behavior. Waiting for or urging them to correct their behavior helps investors build their own reputational capital and greatly reduce investment risks.

For Public Policy. As mentioned in the previous analysis, investor tolerance of startups’ unethical behavior may be attributed to the imperfection of the existing system. The costs arising from the startups’ unethical behavior are small, resulting in a low level of perceived investor risk. It is recommended that government regulatory departments establish a disclosure system and penalty regimes for unethical behavior. Regardless of whether an organization is a startup or a mature firm, unethical behaviors should be publicly disclosed to increase public pressure. Penalties for unethical behavior should be increased. This may stimulate more firms’ engagement in corporate social responsibility activities,73 acting as a deterrent to firm’s unethical behavior. It has been speculated that the likelihood of unethical behavior being exposed by the media affects the anchor value of investors’ perceived risk. This is especially true when the media clearly conveys that firms are responsible for their conduct and investors’ investment decisions are negatively predicted. Ultimately, the government should emphasize the media’s role in firm monitoring and regulation.

Conclusion and Limitations

This study has drawn some useful conclusions that complement and expand on existing research. First, this study verified that firm’s unethical behavior might lead to a significant decline in investors’ investment willingness, but investors would be more tolerant with their unethical behavior if faced with startups, showing a smaller decline in investment willingness. Meanwhile, when investors knew that there were differences in the targets involved in firm’s unethical behavior—that is, the stakeholders—their willingness to invest in the relevant firms would also change accordingly. This finding expanded the context of research on relationship between firm’s unethical behavior and investor behavior, explaining the difference in the impact of the same unethical behavior on investment willingness and decision-making between mature firms and startups; it also further revealed the impact mechanism of firm’s unethical behavior on investment willingness of different stakeholders, enriching the research on relationship between firm’s unethical behavior and investors.

Nevertheless, several limitations should be considered. In the scenarios established here, investors discovered the unethical behavior of firms during their due diligence prior to investing. At this point, they were not yet significant stakeholders. Compared with situations where an investor has already invested money, the ethical dilemma faced by the investor in this study was relatively simple, as it only requires consideration of investment risk. If the investment has already taken place, the investor has formed a symbiotic relationship with the firm. Thus, whether the investor’s perceived interest will be the dominant factor at this point in decision-making needs further exploration. Second, this study was limited to the Chinese context and did not involve other cultural contexts. When studying investment decisions, they must be understood in the context of the investor’s existing cultural background and acceptable firm ethical codes. Laws, ethical principles, and norms are constructed at the national level. Only when an investor labels firm behavior as unethical can they enter into the dilemma of economic interest versus moral choice. Thus, cross-cultural similarities in the impact of the same unethical behavior on Chinese investors require investigation. Future research on this issue could provide more valuable suggestions for the government, business operators, and investors. Third, the samples selected in this study were students or community members in financial study, but they lacked real investment experience. Future research may collect more data from actual investors in order to improve the external validity of these findings.

Data Sharing Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics Statements

No animal studies are presented in this manuscript. No human studies are presented in this manuscript. No potentially identifiable human images or data is presented in this study.

Author Contributions

All authors made a significant contribution to the work reported, whether that is in the conception, study design, execution, acquisition of data, analysis and interpretation, or in all these areas; took part in drafting, revising or critically reviewing the article; gave final approval of the version to be published; have agreed on the journal to which the article has been submitted; and agree to be accountable for all aspects of the work.

Funding

This work was supported by the Zhejiang Soft Science Project (No. 2021C35057), the National Natural Science Foundation of China (No. 32100876), the Natural Science Foundation of Zhejiang Province (No. LQ19G020006), and the K. C. Wong Magna Fund in Ningbo University.

Disclosure

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

1. Lin Y, Huang C, Wei Y. Perfectionist decision-making style and ethical investment willingness: a two-factor causal mediation model, management decision. J Bus Ethics. 2018;56(3):534–549.

2. den Hond F, de Bakker F. Ideologically motivated activism: how activist groups influence corporate social change activities. Acad Manage Rev. 2007;32(3):901–924. doi:10.5465/amr.2007.25275682

3. Lewis A, Mackenzie C. Support for investor activism among UK ethical investors. J Bus Ethics. 2000;24(3):215–222. doi:10.1023/A:1006082125886

4. Mackey TB, Mackey A, Christensen LJ, Lepore JJ. Inducing corporate social responsibility: should investors reward the responsible or punish the irresponsible? J Bus Ethics. 2022;175(1):59–73. doi:10.1007/s10551-020-04669-0

5. Baker B, Derfler-Rozin R, Pitesa M, Johnson M. Stock market responses to unethical behavior in organizations: an organizational context model. Organ Sci. 2019;30(2):319–336. doi:10.1287/orsc.2018.1244

6. Baucus N. Can illegal corporate behavior be predicted? An event history analysis. Acad Manage J. 1991;34(1):9–36. doi:10.2307/256300

7. Vardi Y. The effects of organizational and ethical climates on misconduct at work. J Bus Ethics. 2001;29(4):325–337. doi:10.1023/A:1010710022834

8. Neill JD, Scott Stovall O, Jinkerson DL. A critical analysis of the accounting industry’s voluntary code of conduct. J Bus Ethics. 2005;59(1):101–108.

9. Williams G, Zinkin J. The effect of culture on consumers’ willingness to punish irresponsible corporate behaviour: applying Hofstede’s typology to the punishment aspect of corporate social responsibility. Bus Ethics. 2008;17(2):210–226. doi:10.1111/j.1467-8608.2008.00532.x

10. Greve HR, Palmer D, Pozner JE. Organizations gone wild: the causes, processes, and consequences of organizational misconduct. Acad Manag Ann. 2010;4(1):53–107. doi:10.5465/19416521003654186

11. Hill JA, Eckerd S, Wilson D, Greer B. The effect of unethical behavior on trust in a buyer-supplier relationship: the mediating role of psychological contract violation. J Oper Manag. 2009;27(4):281–293. doi:10.1016/j.jom.2008.10.002

12. Overall J. Unethical behavior in organizations: empirical findings that challenge CSR and egoism theory. Bus Ethics. 2016;25(2):113–127. doi:10.1111/beer.12110

13. Cheung MF, To WM. The effect of consumer perceptions of the ethics of retailers on purchase behavior and word-of-mouth: the moderating role of ethical beliefs. J Bus Ethics. 2021;171(4):771–788. doi:10.1007/s10551-020-04431-6

14. Carberry EJ, Engelen PJ, van Essen M. Which firms get punished for unethical behavior? Explaining variation in stock market reactions to corporate misconduct. Bus Ethics Q. 2018;28(2):119–151. doi:10.1017/beq.2017.46

15. Thaler RH. From homo economicus to homo sapiens. J Econ Perspect. 2000;14:133–141. doi:10.1257/jep.14.1.133

16. Kahneman D, Tversky A. Prospect Theory: an Analysis of Decision under Risk. Econometrica. 1979;47(2):263–292. doi:10.2307/1914185

17. Brown B. Do stock market investors reward companies with reputations for social performance? Corp Reput Rev. 1998;1(3):271–280. doi:10.1057/palgrave.crr.1540048

18. Banaji MR, Bhaskar R. Implicit stereotypes and memory: the bounded rationality of social beliefs. In: Schacter DL, Scarry E, editors. Memory, Brain, and Belief. Cambridge, MA: Harvard University Press; 2000:139–175.

19. Banaji MR, Bazerman M, Chugh D. How (Un)ethical are you? Harvard Bus Rev. 2003;81(12):56–64.

20. Chugh D, Bazerman MH, Banaji MR. Bounded ethicality as a psychological barrier to recognizing conflicts of interest. In: Moore DA, Cain DM, Loewenstein G, Bazerman MH, editors. Conflicts of Interest: Challenges and Solutions in Business, Law, Medicine and Public Policy. Cambridge: Cambridge University Press; 2005:74–95.

21. Reynolds SJ, Leavitt K, DeCelles KA. Automatic ethics: the effects of implicit assumptions and contextual cues on moral behavior. J Appl Psychol. 2010;95(4):752–760. doi:10.1037/a0019411

22. Mason C, Harrison R. Closing the regional equity gap: the role of informal venture capital. Small Bus Econ. 1995;7(2):153–172. doi:10.1007/BF01108688

23. Sohl JE, The US. Angel and venture capital market: recent trends and developments. J Priv Equity. 2003;6(2):7–17. doi:10.3905/jpe.2003.320035

24. Vanacker T, Manigart S. Pecking order and debt capacity considerations for high-growth companies seeking financing. Small Bus Econ. 2010;35(1):53–69. doi:10.1007/s11187-008-9150-x

25. Tetlock PC. Does public financial news resolve asymmetric information? Rev Financ Stud. 2010;23(9):3520–3557. doi:10.1093/rfs/hhq052

26. Jonsson S, Buhr H. The limits of media effects: field positions and cultural change in a mutual fund market. Organ Sci. 2011;22(2):464–481. doi:10.1287/orsc.1100.0553

27. Flammer C. Corporate social responsibility and shareholder reaction: the environmental awareness of investors. Acad Manage J. 2012;56(3):758–781. doi:10.5465/amj.2011.0744

28. Dai L, Parwada JT, Zhang B. The governance effect of the media’s news dissemination role: evidence from insider trading. J Account Res. 2015;53(2):331–366. doi:10.1111/1475-679X.12073

29. El Ghoul S, Guedhami O, Nash R, Patel A. New evidence on the role of the media in corporate social responsibility. J Bus Ethics. 2016;154(4):1051–1079. doi:10.1007/s10551-016-3354-9

30. Watts RL, Zimmerman JL. Positive Accounting Theory. Oxford: Prentice-Hall Press; 1986.

31. Becker GS. Crime and punishment: economic approach. J Polit Econ. 1968;76(2):169–217. doi:10.1086/259394

32. Eccles JS. Expectancies, values and academic choices: origins and changes. In: Spence JT, editor. Achievement and Achievement Motives. San Francisco: Freeman; 1983:87–134.

33. Wigfield A, Eccles JS. The development of achievement task values: a theoretical analysis. Dev Rev. 1992;12(3):265–310. doi:10.1016/0273-2297(92)90011-P

34. Freeman RE. Strategic management: a stakeholder theory. J Manage Stud. 1984;39(1):1–21.

35. Freeman RE, Philips RA. Stakeholder theory: a libertarian defense. Bus Ethics Q. 2002;12(3):331–349. doi:10.2307/3858020

36. Feng W, Cai J. The lack and reconstruction of enterprise morality in China. Econ Res Guide. 2011;14:34–36. Chinese.

37. Wei X. The summary of domestic corporate moral studies (in Chinese). Enterpriseviality. 2010;2:77–82.

38. Tashman P, Raelin J. Who and what really matters to the firm: moving stakeholder salience beyond managerial perceptions. Bus Ethics Q. 2013;23(4):591–616. doi:10.5840/beq201323441

39. Lange D, Lee PM, Dai Y. Organizational reputation: a review. J Manag. 2011;37(1):153–184.

40. Greene JD. Why are VMPFC patients more utilitarian? A dual-process theory of moral judgment explains. Trends Cogn Sci. 2007;11(8):322–323. doi:10.1016/j.tics.2007.06.004

41. Suter RS, Hertwig R. Time and moral judgment. Cognition. 2011;119(3):454–458. doi:10.1016/j.cognition.2011.01.018

42. Karpoff JM. Does reputation work to discipline corporate misconduct? In: Pollock TG, Barnett ML, editors. Oxford Handbook of Corporate Reputation. Oxford: Oxford University Press; 2012:361–382.

43. King BG, Soule SA. Social movements as extra-institutional entrepreneurs: the effect of protests on stock price returns. Admin Sci Quart. 2007;52(3):413–442. doi:10.2189/asqu.52.3.413

44. Reynolds SJ. Moral attentiveness: who pays attention to the moral aspects of life? J Appl Psychol. 2008;93(5):1027–1041. doi:10.1037/0021-9010.93.5.1027

45. Jordan J. A social cognition framework for examining moral awareness in managers and academics. J Bus Ethics. 2009;84(2):237–258. doi:10.1007/s10551-008-9706-3

46. Schmocker D, Tanner C, Katsarov J, Christen M. An advanced measure of moral sensitivity in business. Eur J Psychol Assess. 2019;36(5):864–873. doi:10.1027/1015-5759/a000564

47. Jones TM. Ethical decision making by individuals in organizations: an issue-contingent model. Acad Manag Rev. 1991;16(2):366–395. doi:10.2307/258867

48. Barnett ML. Why stakeholders ignore firm misconduct: a cognitive view. J Manage. 2014;40(3):676–702.

49. Blasi A. Moral functioning: moral understanding and personality. Moral Dev. 2004;1:335–347.

50. Trevino LK, Youngblood SA. Bad apples in bad barrels: a causal analysis of ethical decision-making behavior. J Appl Psychol. 1990;75(4):378–385. doi:10.1037/0021-9010.75.4.378

51. Reynolds SJ, Ceranic TL. The effects of moral judgment and moral identity on moral behavior: an empirical examination of the moral individual. J Appl Psychol. 2007;92(6):1610–1624. doi:10.1037/0021-9010.92.6.1610

52. Monga M. Managers’ moral reasoning: evidence from large Indian manufacturing organisations. J Bus Ethics. 2007;71(2):179–194. doi:10.1007/s10551-006-9133-2

53. Zakaria M, Haron H, Ismail I. Knowledge of ethics, perceived ethical problems and ethical judgments. J Financ Report Acco. 2010;8(1):50–64. doi:10.1108/19852511011055934

54. Martinov-Bennie N, Mladenovic R. Investigation of the impact of an ethical framework and an integrated ethics education on accounting students’ ethical sensitivity and judgment. J Bus Ethics. 2015;127(1):189–203. doi:10.1007/s10551-013-2007-5

55. Kouchaki M, Smith-Crowe K, Brief AP, Sousa C. Seeing green: mere exposure to money triggers a business decision frame and unethical outcomes. Organ Behav Hum. 2013;l21(1):53–61. doi:10.1016/j.obhdp.2012.12.002

56. Abdolmohammadi MJ, Ariail DL. A test of the selection-socialization theory in moral reasoning of CPAs in industry practice. Behav Res Account. 2009;21(2):1–12. doi:10.2308/bria.2009.21.2.1

57. Kazanjian RK, Drazin R. A stage-contingent model of design and growth for technology based new ventures. J Bus Venturing. 1990;5(3):137–150. doi:10.1016/0883-9026(90)90028-R

58. Klotz AC, Hmieleski KM, Bradley BH, Busenitz LW. New venture teams: a review of the literature and roadmap for future research. J Manag. 2014;40(1):226–255.

59. Zahra SA, Bogner WC. Technology strategy and software new ventures’ performance: exploring the moderating effect of the competitive environment. J Bus Venturing. 2000;15(2):135–173. doi:10.1016/S0883-9026(98)00009-3

60. Kumar S, Das S. Integrated framework of strategic orientation, value offerings and new venture performance. Decision. 2020;47(1):3–17. doi:10.1007/s40622-020-00232-y

61. Ramasamy B, Yeung M. Chinese consumers’ perception of corporate social responsibility (CSR). J Bus Ethics. 2009;88(1):119–132. doi:10.1007/s10551-008-9825-x

62. Arli DI, Lasmono HK. Consumers’ perception of corporate social responsibility in a developing country. Int J Consum Stud. 2010;34(1):46–51. doi:10.1111/j.1470-6431.2009.00824.x

63. Erikson R, Goldthorpe JH. Intergenerational inequality: a sociological perspective. J Econ Perspect. 2002;16(3):31–44. doi:10.1257/089533002760278695

64. Fang L, Yasuda A. The effectiveness of reputation as a disciplinary mechanism in sell-side research. Rev Financ Stud. 2009;22(9):3735–3777. doi:10.1093/rfs/hhn116

65. Silwal PP, Bajracharya S. Behavioral factors influencing stock investment decision of individuals. Int Res J Manag Sci. 2021;6(1):53–73. doi:10.3126/irjms.v6i1.42339

66. Patten DM. Exposure, legitimacy, and social disclosure. J Account Public Pol. 1991;10(4):297–308. doi:10.1016/0278-4254(91)90003-3

67. Core JE, Guay W, Larcker DF. The power of the pen and executive compensation. J Financ Econ. 2008;88(1):1–25. doi:10.1016/j.jfineco.2007.05.001

68. Christensen DM. Corporate accountability reporting and high-profile misconduct. Account Rev. 2016;91(2):377–399. doi:10.2308/accr-51200

69. Gurun UG, Butler AW. Don’t believe the hype: local media slant, local advertising, and firm value. J Financ. 2012;67(2):561–598. doi:10.1111/j.1540-6261.2012.01725.x

70. Culiberg B, Mihelič KK. Three ethical frames of reference: insights into M illennials’ ethical judgements and intentions in the workplace. Bus Ethics. 2016;25(1):94–111. doi:10.1111/beer.12106

71. Jhamb S, Stephenson T, Bibelhauser S. Ethical quandaries in business: a study of ethical judgment and ethical intentions through the Lens of Rest’s (1979) ethical reasoning process. J Leadersh Account Ethics. 2021;18(5):59–75.

72. Bowen HR. Social Responsibilities of the Businessman. Iowa City: University of Iowa Press; 2013.

73. Bonnefon JF, Landier A, Sastry PR, Thesmar D. The moral preferences of investors: experimental evidence. NBER Working Papers. 2022;w29647:1–43.

© 2022 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2022 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.