Back to Journals » ClinicoEconomics and Outcomes Research » Volume 14

Predictors of Community-Based Health Insurance in Ethiopia via Multilevel Mixed-Effects Modelling: Evidence from the 2019 Ethiopia Mini Demography and Health Survey

Authors Teshome Bekele W

Received 14 April 2022

Accepted for publication 6 August 2022

Published 15 August 2022 Volume 2022:14 Pages 547—562

DOI https://doi.org/10.2147/CEOR.S368925

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Prof. Dr. Dean Smith

Wondesen Teshome Bekele

Department of Statistics, Dire Dawa University, Dire Dawa, Ethiopia

Correspondence: Wondesen Teshome Bekele, Email [email protected]

Background: The World Health Organization has endorsed a community-based health insurance scheme (CBHIS) as a shared financing plan to improve access to health services and ensure universal coverage of the healthcare delivery system. Such a contributory scheme is the most likely option to provide health insurance coverage when governments cannot offer direct health care support. Despite improvements in access to current healthcare services, Ethiopia’s healthcare delivery remained low, owing to the country’s underdeveloped healthcare finance system. As a result, the present study assessed CBHIS coverage and its predictors in Ethiopia at the individual and community level.

Methods: The availability of CBHIS was checked via a criterion: at least one of the cluster respondents had to be enrolled in CBHIS. This study was based on secondary data from the Ethiopia Mini Demography and Health Survey (EMDHS) 2019 and included 7724 respondents. The study population was described using percentage and frequency. Four multilevel mixed-effects logistic regression modelling stages were performed to control for variations due to heterogeneity across clusters, and determinant predictors of CBHIS enrollment were outplayed.

Results: The prevalence of CBHIS enrollment in Ethiopia was 33.13%. Rural residents were 3.218 times (AOR = 3.218; 95% CI: 1.521, 6.809), male household heads were 1.574 times (AOR = 1.574, 95% CI: 1.105, 2.241), getting funds from the safety net program were times 2.062 (AOR = 2.062, 95% CI: 1.297, 3.279), attending the primary educational level was 1.686 times (AOR = 1.686, 95% CI: 1.007, 2.821), bank accounts were 1.373 times (AOR = 1.373, 95% CI: 1.052, 1.792), and wealth index was 1.356 times (AOR = 1.356, 95% CI: 1.001, 1.838) more likely associated with CBHIS coverage, whereas the regions, the other religions, and women aged 20– 24 had lower odds of CBHIS coverage.

Conclusion: In Ethiopia, regional healthcare expenditure per capital, religious affiliation, women age range, residents, sex of household head, funds from the safety net program, formal educational level, and having bank accounts were associated with community-based health insurance scheme coverage.

Keywords: community-based, health insurance, Ethiopia, EMDHS-2019, multilevel

Introduction

Access to healthcare as a primary demand is limited in developing countries due to a lack of resources in healthcare systems. Policymakers have long recognized the significance of a well-functioning health system in ensuring that everyone has access to quality healthcare.1,2 The World Health Organization has supported social health insurance as a shared finance approach to enhance access to health services and guarantee universal healthcare coverage.3 However, in middle- and low-income countries, this system is rarely employed since a significant percentage of the population works in the informal sector. When governments cannot give direct healthcare assistance, a contributory plan, such as community-based health insurance programs (CBHIS), is the most likely choice.1 Due to Ethiopia’s weak healthcare financing system, healthcare delivery and population health remained low despite gains in access to current healthcare services.3

Previous local and national studies have found that factors such as demographic and socioeconomic factors, community participation, illness experience, benefit package, awareness level, previous out-of-pocket expenditure for health care services, health service status (quality, adequacy, efficiency, and coverage), premium amount, self-rated health status, and bureaucratic complexity all play a role in determining a community-based health insurance scheme enrollment.4 Furthermore, according to the theory of health insurance demand, perceived premium value, moral hazard, adverse selection, and insurance cost are all relevant determinants of people’s demand for health insurance.5

CBHIS is the most widely used approach in developing nations to achieve universal health coverage because it helps maintain a balance between population health investments and health care financing.5 Community-based health insurance, social health insurance, private health insurance, fee-waivers, and exemption are some of the most prominent health insurance types in East Africa.4,6 The lack of pre-payment financial arrangements for health care and the poor quality of healthcare services provided by public service providers were fundamental reasons for reduced healthcare consumption.7,8

In 2011, Ethiopia launched the community-based health insurance (CBHI) plan to address the vast rural agricultural sector and the small and informal urban sectors. The overall goals of insurance coverage are to provide financial security, promote social inclusion, and encourage equitable access to high-quality health care for Ethiopian families. Apart from operations connected to dentures, eyeglasses, and cosmetics, the CBHI benefit package includes all outpatient and inpatient services at the health center and hospital levels.9

Ethiopia is one of the African countries with the lowest healthcare spending. In 2016, health spending accounted for 1.4% of total GDP (GDP).10 According to national health finance statistics, just 11.1% of the total government budget was dedicated to health in 2014,11 falling short of the Abuja Declaration’s 15% objective.12 Nearly 75% of hospitals are administered by the ministry of health or other government bodies, indicating that the public sector dominates the provision of health care services.13 Depending on a patient’s capacity to pay, public healthcare institutions provide healthcare services at little or no cost.11,13 However, in Ethiopia, particularly in rural regions, access to healthcare remains an obstacle to achieving UHC.14

Between 2011 and 2013, the Ethiopian government implemented CBHI in 13 Woredas to enhance progress toward UHC. The CBHI is a self-insured program. During the pilot stage, each household was given 180 Ethiopian Birr (ETB) each year (10.4 US dollars in 2011 currency). The members’ contributions varied amongst the pilot regions, ranging from 34.4 ETB to 132 ETB each year.15 All family health services and curative care (inpatient, outpatient, and acute diseases) are included in the CBHI benefit package, which is part of Ethiopia’s essential health package. Following the positive outcomes of the CBHI pilots, the government expanded the scheme to over 350 Woredas in 2017. Consequently, CBHI provided health insurance to more than 14.5 million individuals in 2017. CBHI was to be extended to 80% of Woredas and 80% of the population by 2020. Furthermore, the government forbade plans to charge copayments to lower obstacles to access.11,13,16

Only 62% of Ethiopians reported getting medical help when they became ill in 2013.16 In 2017, out-of-pocket payments (OOP) accounted for nearly 34% of overall health spending, demonstrating the significant financial burden of paying for health care on households.10,13

According to the 2019 EMDHS, 28% of households participate in the community-based health insurance program. Rural households (32%) are more likely than urban families to be enrolled (19%). Three out of ten Ethiopians (28%) are enrolled, while 72% are not.9 The 2019 EMDHS data is organized hierarchically when it comes to related predictors. The assumptions of observation independence and equal variance in the standard logistic regression model are violated. Individuals are then nested into a cluster based on the assumption that those in one cluster are more similar to those in the other. The current study’s findings give evidence for health planners, programmers, and health professionals, which examines factors associated with joining a CBHIS.9

Despite advances in access to health and care services, health service delivery and health status in Ethiopia remained low, owing to limited health-sector finance and lack of access to health insurance.4,5,7 Moving away from paying for health care out of pocket at the time of use and toward pre-payment (health insurance) is a crucial step toward avoiding the financial burden of paying for health-care services.7 However, there is a lack of large-scale information to back this claim. In addition, past regional and national research in Ethiopia focused on certain forms of insurance on a regional scale, with small sample size and a limited analytic methodology. Furthermore, no published literature examined the coverage of community-based health insurance schemes (CBHIS) at the national level, based on the recent and large sample size of the 2019 EMDHS at the individual and community levels. As a result, this study used individual and community-level data to analyze Community-Based Health Insurance schemes (CBHIS) coverage and predictors in Ethiopia. The multilevel mixed-effects generalized linear model was also used in this study. The multilevel analysis considers the hierarchical architecture of the demographic and health survey dataset.17

Methods

Data Source and Sample Design

The data set was downloaded from the Demographic and Health Survey (DHS) website (http://www.dhsprogram.com) after registering and identifying the objective of the analysis. Ethiopian Mini Demographic Health Survey (EMDHS) data were used in this study. The sample for the 2019 EMDHS was stratified and chosen in two steps. Twenty-one sampling strata in each region were divided between urban and rural regions. Enumeration Area (EA) samples were chosen in two steps, one for each stratum. 305 EAs were chosen in the first step, with a probability proportional to EA size and independent selection in each sampling stratum. A specified number of 30 homes per cluster was chosen in the selection process’s second step using an equal probability systematic selection from the newly formed household list. The survey interviewer questioned only the pre-selected households. No replacements or adjustments to the pre-selected households were allowed throughout the implementation stages to avoid bias. The survey was open to all respondents aged 15 to 49 who were regular members of the chosen households or who spent the night before the survey in the selected households. The weighted sample consisted of 8885 respondents who completed the survey.9,18

Data Management and Analysis

STATA version 16 was used for this study. Before any statistical analysis, the data were weighted using sample weight, primary sampling unit, and stratum statistical data.17,18 The study respondents are assumed to be independent of the outcome variable in standard regression models. However, when data is organized into hierarchies, units in the same category are rarely independent.19 Units from the same setting (cluster) are more comparable to one another in terms of other units or the result of interest than units from other settings. This might lead to a failure of the independence assumption, resulting in underestimating standard errors and higher Type I error rates and an increase in the false-positive rate of our results. In such cases, multilevel modeling may account for individual and community-level factors, allowing for a more thorough knowledge of CBHIS predictors.17

Study Variables

The outcome variable is being a member of community-based health insurance scheme (CBHIS) and not CBHIS. Respondents to the 2019 EMDHS were questioned if they were enrolled in a CBHIS. The coverage of the CBHIS is a binary outcome variable that was coded as one if respondents were enrolled in CBHIS and 0 if they were not. Following a review of several works in the literature,5,8,20–24 this study contained two sets of predictors or independent variables (individual and community-level). Individual and community predictors can potentially influence the decision to enroll in CBHIS.

Predictors at the individual-level household head sex, household size, number of children, religion, bank account, receiving cash from the safety net program, marital status, financial status, household head education level and age range, women education level, and age range were all variables. The region, resident, community-level household education, community-level poverty, and community-level women education were all community-level variables. Residence and region were non-aggregate community-level variables. Rural and urban residences were registered for the variable dwelling. The eleven administrative regions and cities from which a responder originates were defined as the variable region. Another set of community-level variables was established employing average techniques to conceptualize the neighborhood influence on CBHIS enrollment by aggregating from an individual level. These were household education at the community level, poverty at the community level, and women’s education at the community level.

Multilevel Mixed-Effects Modelling

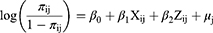

The 2019 EMDHS data showed a hierarchical structure for the predictors. The standard logistic regression model’s independence of data and equal variance assumption are violated. Individual respondents were then nested inside a cluster, assuming that individuals within a comparable cluster would be more similar to one another than individuals in the other cluster. This suggests that advanced models should account for the variability between clusters. Thus, multilevel logistic regression analysis was used since the resulting variable was binary. The primary sample unit, stratum, and individual weight were used in a complex survey design that included sampling weight.17 Multilevel models are designed to address the analytical issues when data is arranged hierarchically, and sampled data represent a sample of various stages of this hierarchical population. The first level is the individual, and the second level is the cluster (community). As a result, the record of the likelihood of CBHIS enrollment coverage was modeled using the two-level multilevel model. As follows:

where i and j are the units of level 1 (individual) and level 2 (community), respectively; X and Z apply to variables of the individual and community level, respectively;  is the likelihood of enrolling in CBHIS in the jth community for the ith individual; the

is the likelihood of enrolling in CBHIS in the jth community for the ith individual; the  s are the fixed coefficients-therefore, there is a corresponding efficiency for each one-unit increase in X|Z (a set of predictors). Whereas in the absence of control of predictors,

s are the fixed coefficients-therefore, there is a corresponding efficiency for each one-unit increase in X|Z (a set of predictors). Whereas in the absence of control of predictors,  is the intercept-The effect on the likelihood of individual on the enrollment in CBHIS; and

is the intercept-The effect on the likelihood of individual on the enrollment in CBHIS; and  indicates the random effect for the jth community (effect of the community on the decision of individual to enroll in CBHIS). The clustered data existence and the within and between community variations were taken into account by assuming that each community has a different intercept (

indicates the random effect for the jth community (effect of the community on the decision of individual to enroll in CBHIS). The clustered data existence and the within and between community variations were taken into account by assuming that each community has a different intercept ( ) and fixed coefficient (

) and fixed coefficient ( ).

).

Parameter Estimation

To estimate predictors of CBHIS enrollment coverage, four multilevel models were built. The null model was fitted without the predictor variables, model-I solely for individual-level predictors, and model-II exclusively for community-level predictors. In model-III, the outcome variable was fitted using predictors from both individual and community-level predictors. The best fit model was evaluated using the log-likelihood ratio (LLR), AIC, BIC, AU-ROC, and deviance test statistics.19 Using tau-squared, intra-class correlation (ICC),19 a proportional change in variances (PCV),19 and median odds ratio, the importance of incorporating random parameter estimates was investigated (MOR).25 Adjusted odds ratios (AOR) with a 95% confidence interval (CI) and p-value less than or equal to 0.05 were used to identify significant predictors of individual enrollment in CBHIS in Ethiopia. The intra-class correlation (ICC) is used to determine the group effect.  denotes the variance of the group level; and

denotes the variance of the group level; and  denotes the variance of the individual level that is set for the distribution of logs to π.

denotes the variance of the individual level that is set for the distribution of logs to π.

Additionally, community variation was calculated using the proportionate change in Variance (PCV) shift and the Median Odds Ratio (MOR). MOR’s goal is to transform community-level variation into the generally used odds ratio (OR) scale, which has a logical and understandable meaning. The MOR is the median value of the odds ratio between the community with the highest risk and the community with the lowest risk when two communities are randomly selected. The MOR may be considered the increased risk that (in median) have if you travel to a different place with a greater risk. It is determined by  .25

.25

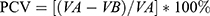

The 75th percentile of the normal distribution’s cumulative distribution function with mean 0 and variance 1 is 0.6745, where VA is the variance of the region standard.19 The proportionate variance shift, on the other hand, is calculated as19  where VA = original model variance and VB = model variance with more terms.

where VA = original model variance and VB = model variance with more terms.

Results

Socio-Demographic Features of Study Respondents

The availability of CBHIS was checked via a criterion: at least one of the cluster respondents had to be enrolled in CBHIS. Otherwise, the clusters with at least one of the respondents who enrolled in CBHIS were removed. In EMDHS 2019, the EA size in the survey is adequate for the primary sampling unit (PSU), with a sample of 30 households per EA. 305 EAs were selected with probability proportional to EA size and independent selection in each sampling stratum (EMDHS, 2021). By that, out of 305 clusters, 86 clusters were removed. These cluster numbers were 26, 28, 29, 31, 32, 33, 35, 36, 38, 39, 41, 42, 44, 47, 48, 50, 56, 81, 114, 118, 120, 122, 124, 126, 127, 128, 129, 131, 132, 134, 135, 136, 137, 141, 142, 143, 144, 145, 148, 151, 153, 156, 158, 159, 161, 162, 163, 164, 171, 181, 182, 187, 188, 195, 213, 214, 215, 216, 218, 220, 223, 227, 228, 229, 234, 238, 240, 242, 243, 262, 268, 270, 271, 273, 279, 283, 287, 288, 289, 291, 295, 296, 297, 299, 301, 302.

The number of respondents included in the study was 7724. 2559 (33.13%) respondents were engaged in the community-based health insurance scheme (CBHIS). About 5172 (67%) of CBHIS coverage were live in rural residents, and about one-third (32.2%) and about half of the respondents (48.6%) were indexed in poor and rich wealth status, respectively. The majority of respondents (44.2%) had primary education, while 37.2% were uneducated or had preschool. Most (43.7%) of the household head respondents were 45–49 age group. The larger and the minor proportion 40% and 0.30% of respondents were from Oromia regional state and Harari city of administration, respectively. Moreover, 44.7% respondents were Orthodox religious followers. About Two-thirds (59.90%) of respondents had no media access to TV or radio, and 64.2% of the respondents were married. More than half (54.60%) of respondents did not have a bank account, and 13.1% of respondents were receiving cash from the safety net program.

Other descriptive statistics showed that 44.2% of household heads attended primary school, and 19.2% of respondents have fallen in a middle index. In comparison, more than half of the community-level respondents were low in household education (53.5%), women education (52%), and poverty level (57.7%). The results further showed that 34.8% of respondents had no living children, 52.1% had below five household size, and 79.9% had male household heads (Table 1).

|  |  |

Table 1 Socio-Demographic Characteristics of Respondents in Ethiopia, EMDHS 2019 |

Across the regions, the highest prevalence was observed in Amhara (59.29%), followed by Tigray (42.58%) and Oromia (22.50%), whereas the lowest was found in Dire Dawa (8.65%) and Somali (8.75%) (Figure 1).

|

Figure 1 Community-based health insurance scheme coverage by regions. |

Predictors Associated with a Community-Based Health Insurance Scheme

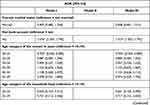

This study found a significant association between individual and community-level factors and community-based health insurance scheme (CBHIS) coverage. The ICC, LLR tests and deviance were checked in the multilevel models. Deviance, AIC, and BIC were used to compare the fitted models. Model III was the best-fitted model for the data compared to other reduced models since it has the smallest AIC, BIC, and deviance statistic. Therefore, using a multilevel mixed-effects logistic regression model was merit to get an unbiased standard error. In the multivariable multilevel analysis model, wealth level, regions, residents, sex of household head, religion, bank account, receiving cash from the safety net program, household head education level, and women age range were significantly correlated with CBHIS coverage.

Individual-Level Predictors

Respondents who had bank accounts were 1.37 (AOR = 1.37, 95% CI: 1.05, 1.79) times more likely to enroll in community-based health insurance schemes than respondents who had no bank account. Women respondents aged 20–24 years were 0.70 (AOR = 0.70, 95% CI: 0.50, 0.99) times less likely to be engaged in community-based health insurance schemes than respondents aged 15–19 years. Respondents who had a middle wealth index level were 1.36 (AOR = 2.07, 95% CI: 1.00, 1.84) times more likely to engage in community-based health insurance schemes than respondents who had poor wealth index level. Attending the primary educational level was 1.69 (AOR = 1.69, 95% CI: 1.01, 2.82) times more likely for household head to enroll in community-based health insurance schemes than not attending any formal education. Respondents who had received safety net cash for food were 2.06 (AOR = 2.06, 95% CI: 1.29, 3.28) times more likely to engage in community-based health insurance schemes than respondents who had not received safety net cash for food. The likelihood of enrolling in community-based health insurance schemes was 0.23 (AOR = 0.23, 95% CI: 0.056, 0.933) times lower among other religions than Orthodox followers.

The likelihood of being willing to enroll in community-based health insurance schemes among male household head respondents was 1.57 (AOR = 1.57, 95% CI: 1.10, 2.24) times more likely than that for female household head respondents (Table 2).

|  |  |

Table 2 Multilevel Mixed-Effects Modeling of Community-Based Health Insurance in Ethiopia, 2019 |

Community-Level Factors

Respondents who live in the rural areas were 3.218 (AOR = 3.218; 95% CI: 1.521, 6.81) times more likely to engage in community-based health insurance schemes compared to respondents who live in urban areas of Ethiopia. Respondents who live in Afar (AOR = 0.0896; 95% CI: 0.0323, 0.248), Oromia (AOR = 0.244; 95% CI: 0.124, 0.477), Somali (AOR = 0.143; 95% CI: 00.0572, 0.358), Benishangul (AOR = 0.185; 95% CI: 0.0836, 0.410), SNNP (AOR = 0.316; 95% CI: 0.133, 0.752), Gambela (AOR = 0.203; 95% CI: 0.108, 0.383), Harari (AOR = 0.156; 95% CI: 0.0725, 0.336), Addis Ababa (AOR = 0.241; 95% CI: 0.102, 0.573), Dire Dawa (AOR = 0.0833; 95% CI: 0.0380, 0.182), and regional state were less likely enroll in community-based health insurance schemes as compared to Respondents lives in Tigray region. However, respondents who live in Amhara regional state were 2.233 (AOR = 2.233; 95% CI: 1.158, 4.307) times more likely to enroll in community-based health insurance than respondents who live in Tigray region (Table 2).

Random Effect Measures of Variation

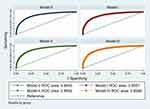

The random-effects results showed a statistically significant variation in the enrollment of community-based health insurance schemes across the clusters (Table 3). This implies that the enrollment in community-based health insurance schemes (CBHIS) was not similarly distributed across the clusters. The intra-cluster correlation coefficients (ICC) of the null model indicated that 45.685% of the total variability for community-based health insurance schemes (CBHIS) coverage was due to differences between clusters. In comparison, the remaining unexplained total variability in CBHIS coverage was attributable to the individual differences. After adjusting for individual-level and community-level factors, there was a significant variation in the CBHIS enrollment across communities or clusters. About 31.365% of CBHIS enrollment in clusters was explained in the full model. Moreover, the MOR confirmed that the CBHIS enrollment was attributed to community-level factors. The MOR for CBHIS enrollment coverage was 4.888 in the null model; this indicated that there was variation between communities (clustering) 4.888 times higher than the reference (MOR = 1). The unexplained community variation in the CBHIS enrollment coverage was reduced to MOR of 3.221 when all factors were added to the model. This indicates that when all factors are considered, the effects of clustering are still statistically significant in the full models. This indicated that when the predictors are considered, clustering effects are still statistically significant in the full models. The proportional change in variance (PCV) in the full model was 45.67% which indicated 45.67% of the community variance observed in the empty model was explained by both community- and individual-level variables (Table 3). Area Under Receiver Operating Characteristic (AU-ROC) curves of Models null, I, II and III recorded 84.93%, 85.67%, 84.92%, and 85.69%, respectively (Figure 2).

|

Table 3 Model Comparison and Random Effect Distribution of CBHIS in Ethiopia, 2019 |

|

Figure 2 Area Under Receiver Operating Characteristic (AU-ROC) curves. |

Discussion

The main goal of this study was to assess the coverage and predictors of community-based health insurance schemes (CBHIS) in Ethiopia among respondents in the 2019 Ethiopian Mini Demographic Health Survey (EMDHS) data. CBHIS is an effective method for achieving universal health coverage by increasing financial access to timely care.26,27 The total prevalence of CBHIS was found to be 33.13% in this study, with cross-region differences showing that the highest prevalence was found in Amhara (59.29%) and the lowest was found in Dire Dawa (8.65%). This disparity in CBHIS prevalence might be attributable to regional differences in domestic health expenditure as a percentage of GDP (GPD).26,28 For the development of CBHI, more resources should be mobilized if other stakeholders, in addition to the government, such as healthcare providers, lower-level policymakers, and the private sector, were involved. CBHI implementation would be aided by operational staff training and a robust information system, which would provide evidence to guide decisions.29

The Ethiopia’s plan had an average membership rate of more than 50%, although coverage varied throughout the pilot locations. The local administration’s dedication, waiting periods at the facilities, and delays in renewing CBHI were some of the issues that contributed to variances in coverage throughout the trial regions.30 Non-members expressed worry about the cost of premiums and the registration fee, with 39% expressing concern. When combined with the 16% of non-members who said they would “wait and see”, it appeared that the fees or premiums were too high to be affordable. To provide comprehensive coverage of indigents (poor and very poor individuals) by CBHI and assure the scheme’s financial viability, fiscal space for health from public sources needed to be enlarged.31 A study conducted in Vietnamese implies patients are more vulnerable to destitute than previously believed.32 Popular bypassing may worsen rural–urban inequities, given that just 5.2% of non-resident patients will be slightly harmed if they are hospitalized without major insurance coverage. The findings also show that the future of health-care providers, including hospitals, is dependent on their ability to service payments and that when prices are high, patients are in danger. The danger is heightened if a patient is ineligible for a significant percentage of the insurance package to which he or she is entitled, in theory, roughly 70%. The hospital’s image and future might be harmed if patients are left penniless following treatments due to exorbitant prices and poor insurance coverage. While the recent figures suggest that around 60% of Vietnamese people have universal coverage, the majority of insured individuals are unable to afford treatment.32 CBHI’s financial viability is determined by the government’s attempts to raise domestic income and gradually enhance risk pooling.

According to this study result, respondents 20–24 aged women were less likely to have community-based health insurance scheme engagement than the 15–19 aged women. This finding was consistent with studies that reported a direct relationship between women’s age and community-based health insurance scheme coverage.5,20–22,24 This similarity might be related to the fact that as people become older, their chances of being sick rise, and hence their chances of acquiring health insurance rise.33 According to Bayked et al,4 demographic and socioeconomic characteristics, health status, and health service-related difficulties were shown to influence the implementation of community-based health insurance in Ethiopia. Income, education, community participation, marriage, employment, and family size were significant predictors of scheme uptake and were positively associated. Concerning health status and health service-related factors, illness experience, benefit package, awareness level, previous out-of-pocket health care expenditure, and health service status (quality, adequacy, efficiency, and coverage) were significantly and positively related. Still, premium amount, self-rated health status, and bureaucratic complexity were negative predictors.

In addition, respondents who received primary education had a higher coverage of community-based health insurance schemes than those who were not educated, according to the findings of this study. The finding was in line with earlier research5,7,8,20,22,23 This implies education improves access to knowledge and leads to enhanced income, which allows people to afford the premium for community-based health insurance schemes. According to the findings of this study, respondents who have a bank account have more community-based health insurance schemes than those who do not. This outcome was consistent with findings from other studies. This result is because those who have a bank account are more likely to be able to afford the premiums and are more aware of the benefits of community-based health insurance systems.34 According to,35 both income and actual expenditure have a positive impact on improving patient satisfaction, whereas the impact of insurance reimbursement rate is negative, which could be explained by the fact that most patients may believe: “It is not worth spending time and effort for a unit of increase in insurance benefits.” Patients with resident status have a reduced likelihood of satisfaction conditional on insurance reimbursement, while patients without residency have a higher likelihood of satisfaction conditional on insurance reimbursement.

When compared to those who did not get safety net cash for food, the outcomes of this study revealed that those who got safety net cash for food had a higher coverage for community-based health insurance schemes. This conclusion was supported by research from other sources. This outcome is because those who got food stamps may be more aware of the benefits of community-based health insurance. Furthermore, the study result implies that the variable religion was significant and less likely to affect CBHIS coverage in the other region category with the reference orthodox religion category. At the same time, insignificant statistical effects were found for the categories of Protestants and Muslims.

In comparison to female household heads, men household heads had a higher coverage of community-based health insurance schemes. This result might be because male household heads tend to create more revenue than female household heads, allowing them to pay community-based health insurance premiums.36 According to this study, rural respondents were more likely than their urban counterparts to be covered by community-based health insurance systems. This conclusion is supported by research.5,8,24,26 The early focus of community-based health insurance schemes, which favored rural dwellers, might be a logical explanation for these findings. In addition, respondents from the Afar, Oromia, Somalia, Benishangul, SNNP, Gambela, Harari, Addis Ababa, and Dire Dawa areas had less likelihood of coverage of community-based health insurance schemes than their Tigray counterparts, while Amhara regional state had a higher likelihood, according to the data.

When it comes to pay for non-covered periodic generalized health tests,37 they evaluated the sensitivity of Vietnamese healthcare consumers to two types of features. The empirical data debunked detractors of regular health screening by establishing its benefit in a series of sensitivity-level assessments. According to the data, the majority of respondents were particularly unwilling to pay for a health service that cost more than USD 90. To encourage frequent general health screenings, service providers and public health officials should seek to allay customer concerns about healthcare quality, enhance public perceptions of public health, and save costs. According to statistical studies, uninsured people, who do not know if they will be covered if they have a health issue, are less price sensitive, as they seek knowledge to reduce their uncertainty about future health risks. A similar approach has been proposed in this area, calling for public health to support activities that involve little or no effort, as humans are known to be effort minimizers.38 Furthermore, because people are programmed to seek certainty in particular situations, highlight the value of a service rather than the perceived loss when selling to the risk-averse.39 Finally, the findings of this study recommend that, in the aftermath of any public health crisis, policymakers employ targeted marketing efforts to stress the importance of information, such as sickness awareness, knowledge of one’s medical issues, and knowledge of one’s community.35 Recognize that people make decisions instinctively or “heuristically.” This is the key to enhancing the success of public health programs.

Limitation of the Study

The results of this study do not produce an actual causal relationship between the variables due to the cross-sectional nature of the research design. The data was gathered based on the respondents’ self-reports, which might lead to recall bias.

Conclusions

In Ethiopia, the total prevalence of community-based health insurance schemes was 28.8%, with the highest prevalence of 59.29% in Amhara and the lowest prevalence of 8.65% in Dire Dawa. Four multilevel logistic regression modeling stages were performed to control for variations due to heterogeneity across clusters, and determinant predictors of CBHIS enrollment were outplayed. Rural residents were 3.218 times, the male household head was 1.574 times, getting funds from the safety net program were times 2.062, attending the primary educational level was 1.686 times, bank account was 1.373 times, and middle wealth index was 1.356 times more likely associated with community-based health insurance scheme coverage. In contrast, the regions, the other religions, and women aged 20–24 had lower odds of community-based health insurance scheme coverage. Improving regional healthcare expenditure per capital, religious affiliation, women age range, residents, sex of household head, funds from the safety net program, formal educational level, bank accounts as a modern saving habit shall be a gateway to improve coverage of community-based health insurance schemes in Ethiopia. Particular focus should be paid to community-based intervention to attain universal health care coverage through community-based health insurance. To achieve a more significant and longer-term population coverage, the emphasis should be on improving the quality of health services and the availability of medications. More resources for the development of CBHI would be mobilized if other stakeholders, such as healthcare providers, lower-level policymakers, and the private sector, were involved. CBHI implementation would be aided by operational staff training and a robust information system, which would provide evidence to guide decisions. On the other hand, another study should be conducted to see the regional and religious effects on the CBHIS coverage as the study’s central thesis.

Abbreviation

AOR, adjusted odds ratio; CI, confidence interval; DHS, Demographic and Health Survey; ICC, intraclass correlation coefficient; PCV, proportional change in variance; MOR, median odds ratio; and LLR, log-likelihood ratio; AIC, Akaike Information Criterion; SE, standard error; BIC, Bayesian’s Information Criterion.

Data Sharing Statement

The Demographic and Health Survey measure granted data access permission by an online request from https://dhsprogram.com/Data/terms-of-use.cfm/ after all respondents were given a description of the study purpose and its procedures. Permission to access data was obtained by the demographic and health survey measure, and ICF institutional review boards.

Ethical Approval

The Dire Dawa University’s Institutional Review Boards (Protocol number DDU-IRB-2022-0127) waived the need for ethical approval and granted the ethical approval of this study.

Consent for Publication

Not applicable because secondary data analysis was used for this study.

Acknowledgments

The author wishes to express his gratitude to the Demographic and Health Surveys (DHS) Program for providing the dataset and Dire Dawa University’s Institutional Review Boards for the ethical approval.

Funding

There was no funding received for this study.

Disclosure

The author reports no conflicts of interest in this work.

References

1. Fadlallah R, El-Jardali F, Hemadi N, et al. Barriers and facilitators to implementation, uptake and sustainability of community-based health insurance schemes in low-and middle-income countries: a systematic review. Int J Equity Health. 2018;17:1–18. doi:10.1186/s12939-018-0721-4

2. Borges AP, Reis A, Anjos J. Willingness to pay for other individuals’ healthcare expenditures. Public Health. 2017;144:64–69. doi:10.1016/j.puhe.2016.11.013

3. Agago TA, Woldie M, Ololo S. Willingness to join and pay for the newly proposed social health insurance among teachers in Wolaita Sodo town, South Ethiopia. Ethiop J Health Sci. 2014;24:195–202. doi:10.4314/ejhs.v24i3.2

4. Bayked EM, Kahissay MH, Workneh BD Factors affecting community based health insurance utilization in Ethiopia: a systematic review; 2019.

5. Amu H, Seidu -A-A, Agbaglo E, et al. Mixed effects analysis of factors associated with health insurance coverage among women in sub-Saharan Africa. PLoS One. 2021;16:e0248411. doi:10.1371/journal.pone.0248411

6. Kimani JK, Ettarh R, Warren C, Bellows B. Determinants of health insurance ownership among women in Kenya: evidence from the 2008–09 Kenya demographic and health survey. Int J Equity Health. 2014;13:1–8. doi:10.1186/1475-9276-13-27

7. Demissie B, Negeri KG. Effect of community-based health insurance on utilization of outpatient health care services in Southern Ethiopia: a comparative cross-sectional study. Risk Manag Healthc Policy. 2020;13:141. doi:10.2147/RMHP.S215836

8. Amu H, Dickson KS, Kumi-Kyereme A, Darteh EKM. Understanding variations in health insurance coverage in Ghana, Kenya, Nigeria, and Tanzania: evidence from demographic and health surveys. PLoS One. 2018;13:e0201833. doi:10.1371/journal.pone.0201833

9. Ethiopian Public Health Institute (EPHI), ICF. Ethiopia Mini Demographic and Health Survey 2019: final Report; 2021. Available from: https://dhsprogram.com/pubs/pdf/FR363/FR363.pdf.

10. World Health Organization. Global Health Expenditure Database. Glob Heal Expend; 2017.

11. FMOH. Ethiopian health sector transformation plan.2015/16-2019/20. Fed Democr Repub Ethiop Minist Heal. 2015;20:50.

12. World Health Organization. The Abuja declaration: ten years on; 2010.

13. Ababa A Expenditure survey brief fifth national health; 2017.

14. Woldemichael A, Takian A, Akbari Sari A, Olyaeemanesh A. Availability and inequality in accessibility of health centre-based primary healthcare in Ethiopia. PLoS One. 2019;14:e0213896. doi:10.1371/journal.pone.0213896

15. Haile M, Ololo S, Megersa B. Willingness to join community-based health insurance among rural households of Debub Bench District, Bench Maji Zone, Southwest Ethiopia. BMC Public Health. 2014;14:1–10. doi:10.1186/1471-2458-14-591

16. Ethiopia Federal Ministry of Health AA. Ethiopia’s Fifth National Health Accounts, 2010/2011; 2014. Available from: http://hfgproject.org/wp-content/uploads/2014/04/Ethiopia-Main-NHA-Report.pdf.

17. Elkasabi M, Ren R, Pullum TW. Multilevel Modeling Using DHS Surveys: A Framework to Approximate Level-Weights. ICF; 2020.

18. Croft TN, Marshall AMJ, Allen CK, et al. Guide to DHS statistics. ICF. 2018;645:1

19. Goldstein H. Multilevel Statistical Models. John Wiley & Sons; 2011.

20. Weldesenbet AB, Kebede SA, Ayele BH, Tusa BS. Health Insurance coverage and its associated factors among reproductive-age women in East Africa: a multilevel mixed-effects generalized linear model. Clin Outcomes Res CEOR. 2021;13:693.

21. Kazungu JS, Barasa EW. Examining levels, distribution and correlates of health insurance coverage in Kenya. Trop Med Int Heal. 2017;22:1175–1185. doi:10.1111/tmi.12912

22. Nageso D, Tefera K, Gutema K. Enrollment in community based health insurance program and the associated factors among households in Boricha district, Sidama Zone, Southern Ethiopia; a cross-sectional study. PLoS One. 2020;15:e0234028. doi:10.1371/journal.pone.0234028

23. Otieno PO, Wambiya EOA, Mohamed SF, et al. Prevalence and factors associated with health insurance coverage in resource-poor urban settings in Nairobi, Kenya: a cross-sectional study. BMJ Open. 2019;9:e031543. doi:10.1136/bmjopen-2019-031543

24. Van Der Wielen N, Falkingham J, Channon AA. Determinants of national health insurance enrolment in Ghana across the life course: are the results consistent between surveys? Int J Equity Health. 2018;17:1–14. doi:10.1186/s12939-018-0760-x

25. Merlo J, Chaix B, Yang M, et al. A brief conceptual tutorial of multilevel analysis in social epidemiology: linking the statistical concept of clustering to the idea of contextual phenomenon. J Epidemiol Community Heal. 2005;59:443–449. doi:10.1136/jech.2004.023473

26. Wells WA, Stallworthy G, Balsara Z. How tuberculosis programs can navigate the world of social health insurance. Int J Tuberc Lung Dis. 2019;23:26–37. doi:10.5588/ijtld.18.0289

27. Kozhimannil KB, Abraham JM, Virnig BA. National trends in health insurance coverage of pregnant and reproductive-age women, 2000 to 2009. Women Heal Issues. 2012;22:e135–e141. doi:10.1016/j.whi.2011.12.002

28. Stepovic M, Rancic N, Vekic B, et al. Gross domestic product and health expenditure growth in Balkan and East European countries—three-decade horizon. Front Public Heal. 2020:492. doi:10.3389/fpubh.2020.00492

29. Mulat AK, Mao W, Bharali I, et al. Scaling up community-based health insurance in Ethiopia: a qualitative study of the benefits and challenges. BMC Health Serv Res. 2022;22:1–12. doi:10.1186/s12913-022-07889-4

30. Feleke S, Mitiku W, Zelelew H, Ashagari D Ethiopia’s community-based health insurance: a step on the road to universal health coverage.[Case study]. Heal Financ Gov Proj Washington, DC Abt Assoc USAID; 2015.

31. Agency EHI. Evaluation of community-based health insurance pilot schemes in Ethiopia; 2015.

32. Vuong QH. Be rich or don’t be sick: estimating Vietnamese patients’ risk of falling into destitution. Springerplus. 2015;4:1–31. doi:10.1186/s40064-015-1279-x

33. Li J. Effects of age and income on individual health insurance premiums. Undergrad Econ Rev. 2011;7:14.

34. Baloul I, Dahlui M. Determinants of health insurance enrolment in Sudan: evidence from health utilisation and expenditure household survey 2009. BMC Health Serv Res. 2014;14:1. doi:10.1186/1472-6963-14-S2-O17

35. Vuong Q-H. Sociodemographic factors influencing Vietnamese patient satisfaction with healthcare services and some meaningful empirical thresholds. Iran J Public Health. 2018;47:119.

36. Ginde AA, Lowe RA, Wiler JL. Health insurance status change and emergency department use among US adults. Arch Intern Med. 2012;172:642–647. doi:10.1001/archinternmed.2012.34

37. Vuong Q-H, Ho T-M, Nguyen H-K, Vuong -T-T. Healthcare consumers’ sensitivity to costs: a reflection on behavioural economics from an emerging market. Palgrave Commun. 2018;4:1–10. doi:10.1057/s41599-018-0127-3

38. Hallsworth M. Rethinking public health using behavioural science. Nat Hum Behav. 2017;1:612. doi:10.1038/s41562-017-0188-0

39. Editorial. The rise of behavioural economics. Nat Hum Behav. 2017;1:767. doi:10.1038/s41562-017-0252-9

© 2022 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2022 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.