Back to Journals » Risk Management and Healthcare Policy » Volume 13

Out-Patient Service and in-Patient Service: The Impact of Health Insurance on the Healthcare Utilization of Mid-Aged and Older Residents in Urban China

Authors Han J, Zhang X , Meng Y

Received 21 July 2020

Accepted for publication 28 September 2020

Published 19 October 2020 Volume 2020:13 Pages 2199—2212

DOI https://doi.org/10.2147/RMHP.S273098

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Professor Marco Carotenuto

Junqiang Han,1 Xiaodong Zhang,2 Yingying Meng2

1School of Public Management, South-Central University for Nationalities, Wuhan 430074, People’s Republic of China; 2Centre for Social Security Studies, Wuhan University, Wuhan 430072, People’s Republic of China

Correspondence: Xiaodong Zhang; Yingying Meng

Centre for Social Security Studies, Wuhan University, Wuhan 430072, People’s Republic of China

Email [email protected]; [email protected]

Purpose: Medical insurance is a disease risk-sharing mechanism that can improve residents’ financial access to medical treatment and thus increase their utilization of health services. This paper aims to identify the impact of different kinds of medical insurances on the use of healthcare for Chinese mid-aged and older urban residents from four aspects: outpatient behaviour, outpatient costs, inpatient behaviour and inpatient costs.

Materials and Methods: The data used in this study were from 2015 China Health and Retirement Longitudinal Study (CHARLS) conducted by Peking University. Binary logit model and multiple linear regression model were used to analyse the impact of health insurance on the use of healthcare, and the PSM method was used to test the robustness of the results.

Results: Participating in either BMIUSE or BMISURR can significantly improve all kinds of healthcare utilization for mid-aged and older urban groups. However, there are huge differences on the healthcare utilization between BMISUE and BMISURR. Specifically, the probability of using inpatient care and inpatient costs of urban residents enrolled in the BMISUE are 4.2% and 45% higher, respectively, than those covered by the BMISURR, but there are no differences in outpatient care utilization and outpatient costs between these two health insurance programs.

Conclusion: This paper suggests that the large gaps between BMISUE and BMISURR only reflect on inpatient care and inpatient costs, there is no difference in outpatient services between these two health insurance programs. “Excessive demand”, “induced demand” and other moral hazard phenomena in BMISUE should be avoided when receiving hospitalization services.

Keywords: health insurance, out-patient service, in-patient service, mid-aged and older urban residents, CHARLS

Introduction

Health insurance is one disease risk-sharing mechanism that can increase individuals’ demand for healthcare and improve individuals’ utilization level of healthcare by increasing their financial accessibility to medical treatment when disease risk occurs.1–6 To improve individuals’ use level of healthcare and promote their health status, the Chinese government created different health insurance programs by different groups beginning in the 1990s. In 1998, the Chinese government established the Basic Medical Insurance System for Urban Employees (BMISUE). To expand health insurance coverage and meet all Chinese residents’ healthcare demands, the Chinese government set up the New Rural Cooperative Medical System (NRCMS) for all rural residents and the Basic Medical Insurance System for Urban Residents (BMISUR) in 2003 and 2007, respectively. In 2016, The NRCMS and BMISUR were integrated into the Basic Medical Insurance System for Urban and Rural Residents (BMISURR) to ensure that all urban and rural residents have equal access to basic healthcare and to promote social equity and justice.

To date, the Chinese government has established two health insurance systems that cover all Chinese people. According to data released by the National Bureau of Statistics, 1344.59 million people participated in health insurance programs in 2018, accounting for more than 95% of China’s total population. At the same time, from 2008 to 2017, government expenditures on health care increased from 359 billion RMB to 1.52 trillion RMB for the stable operation of the medical insurance systems. How these health insurance systems affect the healthcare utilization of the insured has become the focus of scholars.

Some scholars have explored the impact of participating in one specific health insurance programs on residents’ use of healthcare. Numerous scholars studied the impact of the NRCMS plan on the healthcare utilization of the insured. Some studies have shown that participating in the NRCMS increases the likelihood that rural residents will visit designated medical institutions and improves the use level of healthcare for the insured.7–9 However, a few scholars found that the NRCMS has no significant impact on the healthcare utilization of rural residents10–15. Similarly, some scholars have studied the impact of the BMISUR on the use of healthcare by urban residents, and found that the BMISUR significantly improves the use level of basic healthcare by urban residents, especially among vulnerable groups and low-health groups.16–19 Some scholars have discussed the impact of the BMISUE on the use of healthcare by the insured, and found that the BMISUE increases the healthcare costs of insured residents and significantly improves the use level of medical services, especially among high-level medical institutions.20,21

The Chinese government created different health insurance programs in consideration of the economic differences of different groups. Therefore, these different health insurance programs have different payment conditions and reimbursement ratios. Specifically, the BMISUE program is created for the employees of urban enterprises and the premiums are divided amongst employers and employees by a rate set by each pooling district. Both the premiums and the benefits are higher than the BMIURR program. The BMIURR program is created for all urban and rural residents who are not enrolled in the BMISUE program. The covered members pay part of the premiums, and the rest is subsidized by government through a special fund. Both the premiums and the benefits are relatively low. Theoretically, the differences between BMISUE and BMISURR may lead to the utilization differences of healthcare. Compared to BMISURR, the BMISUE plan can better improve the financial accessibility of medical treatment and further increases the utilization of healthcare. So do the differences in different health insurance programs affect the use of healthcare by the insured?

Some scholars have compared the effects of different health insurance programs on the healthcare utilization and health status of the insured. Liu X (2015) compared the impact of the BMISUE, BMISUR and NRCMS on the health status of elderly people in China and concluded that the health status of those insured under the BMISUE was significantly better than that of those insured under either the BMIUR or NRCMS.22 Pan Y (2016) studied the differences in tuberculosis medical expense reimbursements among the BMISUE, BMISUR and NRCMS and determined that the inpatient costs of patients covered by the NRCS and BMIUR were significantly lower than those covered by the BMISUE.23 Li C, Sun W and Zhang H et al (2016) found that both BMISUR and NRCMS were lower than those insured by BMISUE in health services utilization, although the utilization level of medical service of the three kinds of medical insurance increases significantly over time.24 Lin X (2017) found that different health insurance programs provide different levels of hospital care for patients with respect to three common diseases, namely, acute myocardial infarction, heart failure and pneumonia. Compared with BMISUE patients, the hospitalization mortality rate of NRCMS patients was significantly higher.25

Fan H (2019) compared the healthcare utilization of the insured between the BMISUR and NRCMS, and showed that healthcare utilization was higher among BMISUR participants than among NRCMS participants, with the BMISUR improving health to a greater extent than the NRCMS.26 Gong X (2019) studied the effects of social medical insurance (BMISUE and BMISUR) on the utilization of hospice medical services of elder adults. The study found that under the same conditions, either BMISUE or BMISUR can significantly improve the utilization level of hospice medical services for the elderly, but the total hospice expenditure of the elderly covered by BMISUE is 33.11% higher than that of BMISUR.27 Li Y and Chen B (2020) found that there were significant differences in outpatient rate and hospitalization rate among BMISUE, BMISUR and NRCMS. Specifically, participating in BMISUE and NRCMS can significantly increase the utilization of medical services for the elderly, while participation in BMISUR has no impact.28

Although these studies have examined the differences in health care among the different health insurance programs, there exist obvious and essential deficiencies. Specifically, when comparing the different health insurance programs in terms of healthcare utilization and health status level, the large gap in healthcare brought about by the “urban-rural dual structure” in China has not been considered. China’s medical and health resources are mainly concentrated in urban areas and relatively scarce in rural areas. High-tech, advanced equipment and excellent experts in the field of health services are basically concentrated in large hospitals in large cities, and the phenomena of poor conditions and limited healthcare services and medicine is widespread in rural township hospitals.29 According to figures issued by the National Bureau of Statistics in 2017, the number of health technicians, medical practitioners, registered nurses and beds in medical institutions per 10,000 people in urban areas was 109, 40, 50 and 87.54, respectively, while the number of health technicians, medical practitioners, registered nurses and beds in medical institutions per 10,000 people in rural areas was only 43, 17, 16 and 41.87, respectively. Thus, there is obviously a large gap in the availability of health resources between rural and urban residents, which will significantly affect the use of healthcare. Therefore, when comparing the BMISUE, BMISUR and NRCMS, if we do not consider the differences between rural and urban residents in terms of the accessibility of medical resources, we will not be able to accurately identify the impact of different health insurance programs on the use of healthcare by the insured, limiting the research conclusions. What’s more, with regard to the measurement of healthcare utilization, scholars have mostly either adopted simple measurement indicators (the rate of outpatient visits or hospitalization costs) or only examined healthcare utilization for specific diseases (tuberculosis, acute cerebral infarction, etc.). These single measurements cannot fully reflect the use level of healthcare by the insured.

Based on the 2015 China Health and Longitudinal Study (CHARLS), this paper, targets mid-aged and older urban residents, comparing in detail the impact of the BMISUE and BMISURR on residents’ utilization of healthcare. The main contributions of this paper is that, first, we measure healthcare utilization according to four aspects, namely, outpatient behavior, outpatient costs, inpatient behavior, and inpatient costs, and further identify in detail the impact of the different health insurance systems on the healthcare utilization of the insured, which will provide empirical evidence for more equitable reform of the medical and health system in the future. Second, in the process of examining the differences in health insurance systems on the use of healthcare by the insured, we take the huge differences between rural and urban residents in terms of the accessibility of health resources into account. Therefore, we focus on urban residents and control for the cities in which they live. This approach is conducive for effectively identifying the impact of the BMISUE and BMISURR on participants’ healthcare utilization in terms of institutional differences.

Materials and Methods

Data Source

The data used in this paper were retrieved from the 2015 CHARLS survey, which was conducted by the Chinese Social Science Research Centre at Peking University. The CHARLS is a survey that focused on Chinese families and individuals aged 45 and above and the CHARLS data defines that the individuals aged 45 and above are mid-aged and older people. The database covers 150 county-level units, 450 village-level units and 17,000 people in approximately 10,000 households. The database consists of “Demographic backgrounds”, “Health status and functioning”, “Health care and insurance”, “Work, retirement and pension”, “Income, expenditures and assets” and “Housing characteristics”, which is one of the most comprehensive and authoritative databases in mainland China.

This paper mainly chose the “Health status and functioning” and “Health care and insurance” modules of the 2015 CHARLS to analyse the impact of the different health insurance systems on the healthcare utilization of mid-aged and older urban residents. Before the empirical analysis, we processed the data in detail. First, we matched and merged all modules in the database and deleted the duplicate sample values to obtain a sample size of 18,602. Second, since the research objects of this paper are mid-aged and older urban residents, we further deleted the sample of rural households and the samples covered by NRCMS, reducing the sample size to 4201 Third, in China’s current health insurance systems, the BMISUE and BMISURR are social medical insurance programs mainly provided by the government. Additionally, there are also private health insurance and supplementary health insurance systems provided by companies in some industries for their employees as well as other types of health insurance systems. To prevent these health insurances from interfering with this study, for simplicity, we only retained the samples responses related to the BMISUE, BMIISURR or no medical insurance, for a sample size of 3980. Finally, after removing the surveys with responses such as “I don’t know”, “I refuse to answer” and those with missing values, the final sample used for our analysis was 3627.

Variables

Dependent variables

Previous studies measured residents’ use of healthcare mainly through variables such as the two-week outpatient visit rate, four-week outpatient visit rate, hospitalization rate, hospitalization days and medical expenses.16,30–32 This paper draws on these measurement methods and according to the design of the 2015 CHARLS questionnaire, uses outpatient visits (last month), outpatient costs, inpatient visits (last year) and inpatient costs to measure the healthcare utilization of mid-aged and older urban residents. The specific definitions are presented in Table 1.

|

Table 1 Definition of the Variables |

Independent Variables

The core explanatory variable of this paper is the status of health insurance participation of mid-aged and older urban residents. Based on the 2015 CHARLS questionnaire design, we used the survey question “Are you the policy holder/primary beneficiary of any of the types of health insurance listed below?” to measure the status of medical insurance participation, which is specifically divided into the BMISUE, BMISURR and no health insurance. The specific definitions are presented in Table 1.

Controlled Variables

To reduce the possible bias in the statistical model due to omitted variables, three types of variables were controlled for in the empirical analysis: individual characteristic variables, including gender, age and marital status; socioeconomic status indicators, including education level, individual income and pension insurance participation status; and health status, including self-rated health, mental health, health status before age 15 and self-rated memory. Meanwhile, considering that differences and unbalance in health resources among different provinces and cities in China may have an impact on the healthcare utilization of the insured, in the empirical analysis, we controlled for the Cities where the mid-aged and older people were located. The definitions of the variables are presented in Table 1.

Model

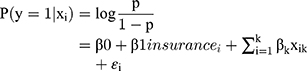

Logit model. Among the indicators measuring residents’ healthcare utilization, “outpatient visits” and “inpatient visits” are binary variables. Therefore, a logit model was used to estimate the impact of the health insurance programs on the outpatient behaviour and hospitalization behaviour of mid-aged and older urban residents. The model is as follows:

where  represents the probability of receiving outpatient visits and inpatient visits among mid-aged and older urban residents;

represents the probability of receiving outpatient visits and inpatient visits among mid-aged and older urban residents;  is the intercept term;

is the intercept term; represents the type of health insurance of the

represents the type of health insurance of the  -th individual;

-th individual;  is the correlation coefficient of the impact of the health insurance program on outpatient visits and inpatient visits;

is the correlation coefficient of the impact of the health insurance program on outpatient visits and inpatient visits;  represents a series of control variables including the individual characteristic variables, socioeconomic status indicators, and health status; and

represents a series of control variables including the individual characteristic variables, socioeconomic status indicators, and health status; and  is a random error term.

is a random error term.

Multiple linear regression model. Among the indicators measuring residents’ healthcare utilization, outpatient costs and inpatient costs are continuous variables. Therefore, we adopted a multiple linear regression model to estimate the impact of the health insurance programs on the outpatient costs and inpatient costs of mid-aged and older urban residents. The model is as follows:

where  represents the logarithm of outpatient costs and inpatient costs;

represents the logarithm of outpatient costs and inpatient costs;  is the intercept term;

is the intercept term;  represents the type of health insurances of the

represents the type of health insurances of the  -th individual;

-th individual;  is the correlation coefficients of the impact of the health insurance program on outpatient costs and inpatient costs of the respondent;

is the correlation coefficients of the impact of the health insurance program on outpatient costs and inpatient costs of the respondent;  represents a series of control variables, including the individual characteristic variables, socioeconomic status indicators, and health status; and

represents a series of control variables, including the individual characteristic variables, socioeconomic status indicators, and health status; and  is a random error term.

is a random error term.

Propensity score matching method (PSM). The PSM method can eliminate selective bias caused by confounding variables and overcome any endogenous problems that may exist in the model itself. The core idea of matching estimation is to find the individuals in the control group that are as similar as possible to the individuals in the treatment group so as to obtain the anti-fact individuals of the treatment group, so that an unbiased estimator can be obtained in the case of eliminating endogenous bias.33–35

There are three steps in PSM analysis method: Firstly, calculate the propensity value using Logit model or Probit model. In this paper, we use the Logit model to predict the propensity value; Secondly, evaluate the balance after propensity score matching in which the treatment group is “BMISUE”, and the control group is “BMISURR”; Thirdly, calculate the average treatment effect (ATT). We use the k-nearest neighbour matching (one to four) to evaluate the average treatment effect of health insurance on healthcare utilization.

Results

Descriptive Analysis

Table 2 shows the results of the Chi-square test. As shown in the table, 1530 individuals are insured by BMISUE, 1759 are insured by BMISURR and 337 individuals have no insurance. There are obvious differences in healthcare utilization between the three groups, which is significant at the 5% statistical level. What’s more, the differences in individual characteristic variables (gender, age and marital status), socioeconomic status indicators (education level, individual income and pension insurance participation status) and health status (self-rated health, mental health, health status before age 15 and self-rated memory) are significant.

|

Table 2 The Chi-Square Test Results in BMISUE, BMISURR and No Insurance |

Impact of Health Insurance on Outpatient Care Utilization of Mid-Aged and Older Urban Residents

After examining the healthcare utilization differences among BMISUE, BMISURR and No insurance, Tables 3 and 4 further report the regression results for the impact of health insurance on the healthcare utilization of mid-aged urban residents. Column (1) of Table 3 suggests that compared with mid-aged and older urban residents with no health insurance, the probability of members covered by the BMISUE and BMISURR using outpatient care increased by 7.8% and 5.1%, respectively. Column (2) reports the regression results for the impact of the different health insurance programs on participants’ outpatient visits and the baseline variable is the BMISURR. The results imply that there are no significant differences in outpatient visits between the participants covered by BMISURR and BMISUE.

|

Table 3 Regression Results for the Impact of Health Insurance on Outpatient Care Utilization |

|

Table 4 Regression Results of the Impact of Health Insurance on Inpatient Care Utilization |

Columns (3) and (4) report the linear regression results of the effect of health insurance on the outpatient costs of mid-aged and older urban residents. Column (3) suggests that the outpatient costs of the participants covered by the BMISUE and BMISURR are higher than those without any health insurance by 50.0% and 30.1%, respectively. Column (4) further compares the outpatient costs between the BMISUE and BMISURR, with the baseline variable being the BMISURR. The results show that there are no significant differences in outpatient costs between the participants covered by the BMISURR and those covered by the BMISUE, implying that there are no significant differences in outpatient costs between these two health insurance programs.

Impact of Health Insurance on Inpatient Care Utilization of Mid-Aged and Older Urban Residents

Columns (1) and (2) of Table 4 report the regression results of the impact of health insurance on the inpatient care utilization of mid-aged and older urban residents. Column (1) suggests that the probability of members covered by the BMISUE and BMISURR utilizing inpatient care is 8.1% and 4.0% higher, respectively, than those who have no health insurance. Column (2) compares the impact of the BMISUE and BMISURR on participants’ inpatient visits and the baseline variable is the BMISURR. The results suggest that the probability of mid-aged and older urban residents covered by the BMISUE using inpatient care is 4.2% higher than those who have the BMISURR, and this result is significant at the 1% statistical level.

Columns (3) and (4) of Table 4 report the linear regression results of the impact of health insurance on the inpatient costs of mid-aged and older urban residents. Column (3) suggests that the inpatient costs of the mid-aged and older people covered by the BMISUE and BMISURR are higher than those without any health insurance (68.6% and 26.4%, respectively). Column (4) further compares the inpatient costs (last year) between the BMISUE and BMISURR, and the results show that the inpatient costs (last year) of the mid-aged and older urban residents covered by the BMISUE are 45% higher than those who have the BMISUE, and this result is significant at the 1% statistical level.

Robustness Test

The analysis of Tables 3 and 4 indicates that health insurance can significantly improve the utilization level of outpatient care utilization and inpatient care utilization by the insured. However, there were few differences in healthcare utilization between the different health insurance programs, ie, The inpatient care utilization level of the mid-aged and older residents covered by the BMISUE was significantly higher than that of the participants covered by the BMISURR, but we found that there were no differences in outpatient visits and outpatient costs between those insured by the BMISUE and BMISURR.

To test the robustness of the results, we further adopt use the propensity score matching (PSM) method to analyse the impact of the BMISUE and BMISURR on health services utilization by the insured. We used k-nearest neighbour matching (one to four) to evaluate the average treatment effect of health insurance on healthcare utilization. Table 4 reports the average treatment effect of the different health insurance programs on healthcare utilization.

Column (1) of Table 5 reports the impact of the health insurance programs on the use of outpatient visits by the middle-aged and elderly residents. The results show that the ATT coefficient is 0.0021 and the corresponding T-value is 0.07, which are not statistically significant. The result indicates that there is no significant effect on the use of outpatient visits by mid-aged and older urban residents between BMISUE and BMISURR. Column (2) reports the impact of the health insurance programs on the last outpatient costs of the mid-aged and older residents. The results show that the ATT coefficient is 0.1975 and the T-value is 0.17, which is not statistically significant. This result shows that the insured covered by the BMISUE and BMISURR do not have significant differences in outpatient costs. The results in Column (1) and (2) of Table 5 are consistent with the results reported in Table 3.

|

Table 5 PSM Results for the Impact of Health Insurance on the Use of Healthcare by Mid-Aged and Older Urban Residents |

Column (3) reports the impact of the different medical insurance programs on the utilization of inpatient services by mid-aged and older residents. The results show that the ATT coefficient is 0.0598 and the corresponding T-value is 1.66, which is statistically significant and prove the robustness of the results, indicating that participating in the BMISUE can significantly improve the use of inpatient care in mid-aged and older urban residents compared with those covered by the BMISURR. Column (4) reports the impact of the different health insurance programs on the last inpatient costs of the insured. The results show that the ATT coefficient is 0.6032 and the corresponding T-value is 1.96, which is statistically significant. These results indicate that compared with the mid-aged and older urban residents covered by the BMISURR, members covered by the BMISUE have higher inpatient costs, which significantly improves the use of inpatient care. The results in Column (3) and (4) are consistent with the results in Table 4.

Discussion

Participation in Health Insurance Significantly Improves the Use Level of Healthcare in Mid-Aged and Older Urban Groups

The results in Tables 3 and 4 show that compared to mid-aged and older urban residents without any health insurance, participating in both the BMISUE and BMISURR can significantly improve the utilization of healthcare. Specifically, the probability of using outpatient care among mid-aged and older urban groups covered by the BMISUE increased by 7.8%, the costs of outpatient care increased by 50%, the probability of using inpatient care increased by 8.1%, and the costs of hospitalization increased by 68.6%. The probability of using outpatient care among mid-aged and older urban groups covered by the BMISURR increased by 5.1%, the costs of outpatient care increased by 30.1%, the probability of using inpatient care increased by 4.0%, and the costs of hospitalization increased by 26.4%. This conclusion is consistent with previous studies.4,6,9,21 This paper holds that health insurance, as one risk-sharing mechanism for preventing disease risk, can disperse and transfer disease risk by giving the insured a certain amount of economic compensation when the risk of disease occurs. Such economic compensation can improve the financial accessibility of the insured when seeking medical treatment, and may even “stimulate” the insured’s demand for medical services to some extent, thus improving the utilization level of healthcare. Based on the results of this study, it can be concluded that the implementation of the BMISUE and BMISURR in China significantly improved the utilization of healthcare by the insured.

Differences in the Use of Healthcare Between the BMISUE and BMISURR Among Mid-Aged and Older Urban Groups are Mainly Reflected on Inpatient Care Utilization

When comparing the effects of different health insurance programs on the utilization of healthcare among the insured, the conclusion of this study are inconsistent with those of previous studies.25,26 The existing research has found that the higher the benefits level of the health insurance system, the higher the use of the healthcare and the better health status of the insured. The results of this paper show that after controlling for the health status and socio-economic indicators of the insured, compared to mid-aged and older residents covered by the BMISURR, participating in the BMISUE can significantly improve the utilization of inpatient care by the insured, but has no impact on the utilization of outpatient care by the insured.

In China’s current health insurance systems, the BMISUE is a typical high-paying, high-reimbursing insurance system whose benefits are significantly higher than those of the BMISURR. Table 6 reports the differences between the BMISUE and BMISURR in terms of the per capita fundraising level, per capita funding expenditures, etc. It is obvious that the per capita fundraising level and per capita expenditures of the BMISUE are significantly higher than those of the BMISURR. Why does participation in the BMISUE, which has a high level of benefits, only improve the utilization of inpatient care by the insured, but has no significant effect on the use of outpatient care by the insured?

|

Table 6 Comparison of the Fundraising Levels, Fund Expenditures and Benefits Levels Between the BMISUE and BMISURR |

This paper holds that, relative to the BMISURR, although the fundraising level and overall benefits of the BMISUE are higher, from the perspective of healthcare type, the difference between these two health insurance programs for outpatient reimbursement is not significant, and the differences are mainly reflected in inpatient reimbursement levels. In terms of the reimbursement for outpatient services, according to the current provisions of the local government, the outpatient services self-payment standard of BMISUE is 1600–1800RMB, the part below the self-payment standard is paid from the individual accounts of the insured, and the reimbursement rate beyond self-payment standard is 50%-90% (the ratio varies in different provinces or prefecture-level cities) in the designated hospital. The proportion of outpatient reimbursement for the BMISURR is 50%-70% (the ratio varies in different provinces or prefecture-level cities), and the insured has a deductible of 200–400 RMB. Therefore, the differences in the reimbursement level for outpatient services between these two programs are not significant. At the same time, to prevent the excessive growth of outpatient expenses, China’s health management departments have also promulgated many stipulations (such as the unified procurement and unified pricing of drugs, that one-time outpatient treatments can only be prescribed for two weeks, the setting of outpatient reimbursement caps, etc.) in recent years, which also reduced the differences in outpatient costs between different health insurance systems.

In terms of the reimbursement rates for inpatient care, as shown in Table 6, the proportion of hospital payments within the policy scope (81.6%) and the actual hospitalization reimbursement ratio (71.8%) is much higher under the BMISUE than under the BMISURR (65.6% and 56.1%, respectively); Therefore, the BMISUE plan better improves the financial accessibility of medical treatment and further increases the utilization of inpatient care compared to BMISURR plan. Meanwhile, from the perspective of doctors, because inpatient services lack strict supervision, the doctors are motivated to take advantage of “information asymmetry” to induce excessive demand for patients according to the various health insurance types. For example, due to the high benefits level of BMISUE, doctors may give patients under BMISUE unnecessary medical examinations and prescribe drugs that the patients do not need (“large prescription”), which will also result in a huge increase in inpatient care utilization; from the perspective of the insured patients, the participants covered by BMISUE may also generate higher demand for inpatient services, leading to the moral hazard of “excessive demand” and thus improving the utilization of inpatient care compared to members covered by BMISURR.

There are some limitations in our study. First, to identify the impact of BMISUE and BMISURR on the use of healthcare by the insured, we take the large gap between rural and urban residents in terms of the accessibility of health resources into account. Therefore, we removed the sample of rural households and the samples with NRCMS. Accordingly, the representativeness of the sample may be challenged in this respect. Furthermore, there are differences and unbalance in the health resource distribution among different areas, however, due to the data limitation, we could only control for the prefecture-level cities where the mid-aged and older people located, which may cause some estimation bias when identifying the impact of health insurance on the use of healthcare in mid-aged and older groups. Although we have used the PSM method to test the reliability of the results, further studies are needed to explore the impact of various health insurance programs on the utilization of healthcare by the insured.

Conclusion

This paper compares the impact of the BMISUE and BMISURR on the use of healthcare among mid-aged and older urban people by using 2015 CHARLS data. The following research conclusions can be drawn: First, compared to mid-aged and older urban residents without any health insurance, both the BMISUE and BMISURR can reduce the economic threshold for participants to receive healthcare, remove the barrier of their medical expenses on medical treatment, and thus significantly increase the use of healthcare services. Second, under the same conditions, compared with mid-aged and older urban residents covered by the BMISURR, participating in the BMISUE can significantly improve the use of inpatient services by the insured, but has no impact on the utilization of outpatient services. After controlling for potential sample selection bias and the self-selection problem using the PSM method, the results are still robust.

In terms of outpatient services, the accessibility of healthcare among urban residents is similar. Meanwhile, there is no significant difference in the reimbursement ratio of outpatient services between the BMISUE and BMISURR; therefore, there is no significant difference in the use of outpatient services between these two health insurance programs. In terms of inpatient services, the benefits level of the BMISUE is obvious better than that of the BMISURR. Both the hospital payments within the policy scope and actual hospitalization reimbursement ratio are obviously higher for the BMISUE than for the BMISURR. Such a highly guaranteed health insurance system may lead the insured in this system to be “encouraged” to use more inpatient care services. Based on the conclusion of this paper, it should be determined how to avoid the “excessive demand”, “induced demand” and other moral hazard phenomena that may exist among mid-aged and older urban groups when receiving hospitalization services. Further, the question of how to establish a more equal and sustainable medical system on the basis of maintaining the characteristics of the system may have positive implications for future policy research.

Abbreviations

BMISUE, the Basic Medical Insurance System for Urban Employees; BMISURR, the Basic Medical Insurance System for Urban and Rural Residents; PSM, the propensity score matching; CHARLS, China Health and Retirement Longitudinal Study; NRCMS, the Chinese government set up the New Rural Cooperative Medical System; BMISUR, the Basic Medical Insurance System for Urban Residents.

Ethics Approval

Ethical approval for this study and written informed consent from the participants of the study were not required as per national legislation and institutional requirements.

Author Contributions

All authors made a significant contribution to the work reported, whether that is in the conception, study design, execution, acquisition of data, analysis and interpretation, or in all these areas; took part in drafting, revising or critically reviewing the article; gave final approval of the version to be published; have agreed on the journal to which the article has been submitted; and agree to be accountable for all aspects of the work.

Funding

This research was funded by the National Social Science Foundation (project 16CGL046), the Youth Foundation of Humanities and Social Sciences by the Ministry of Education of the People’s Republic of China (project 15YJCZH118), the Scientific Research Projects by the State Ethnic Affairs Commission (MSQ16002), and the Fundamental Research Funds for the Central Universities (projects CSY16018 and 410500076).

Disclosure

The authors report no conflicts of interest in this work.

References

1. Brindis C, Kapphahn C, Mccarter V, Wolfe AL. The impact of health insurance status on adolescents‘ utilization of school-based clinic services: implications for health care reform. J Adolescent Health. 1995;16(1):18–25. doi:10.1016/1054-139X(95)94069-K

2. Dafny L, Gruber J. Public insurance and child hospitalizations: access and efficiency effects. J Public Econ. 2005;89(1):109–129. doi:10.1016/j.jpubeco.2003.05.004

3. Lisa W, Peter F. Changes in health care expenditure associated with gaining or losing health insurance. Ann Intern Med. 2007;146(11):768.

4. Anderson M, Dobkin C, Gross T. The Effect of Health Insurance Coverage on the Use of Medical Services. Am Economic J Economic Policy. 2012;4(1):1–27.

5. Finkelstein A, Mcknight R. What did Medicare do? The initial impact of Medicare on mortality and out of pocket medical spending. J Public Econ. 2008;92(7):1644–1668.

6. Finkelstein A, Taubman S, Wright B, et al. The Oregon Health Insurance Experiment: evidence from the First Year. Quarterly J Economics. 2012;127(3):1057–1106.

7. Li X, Wang Z, Li Z. The impact of new rural cooperative medical system on medical treatment behavior and health of farmers – based on the analysis of different income levels. World Economic Papers. 2012;3:58–75.

8. Zhou J, Li Y. The influence of the new rural cooperative medicalsystem on the health status of the middle-aged and elderly people in rural China. China J Pharm Economics. 2018;4(2):34–41.

9. Chen Z, Li W, Wang H. The effect of new rural cooperative medical system on the health service utilization in rural elderly: based on analysis among elderly and younger aged people. Chin J Health Policy. 2018;11(7):34–40.

10. Feng J, Li Z. Risk Management Options for Health Care in Rural China. Economic Res J. 2009;3(4):103–115.

11. Lei X, Lin W. The New Cooperative Medical Scheme in rural China: does more coverage mean more service and better health? Health Econ. 2009;18(S2):S25–S46. doi:10.1002/hec.1501

12. Wagstaff A, Lindelow M, Jun G, Ling X, Juncheng Q. Extending health insurance to the rural population: an impact evaluation of China’s new cooperative medical scheme. J Health Econ. 2009;28(1):1–19. doi:10.1016/j.jhealeco.2008.10.007

13. Yu B, Meng Q, Collins C, et al. How does the New Cooperative Medical Scheme influence health service utilization? A study in two provinces in rural China. BMC Health Serv Res. 2010;10(1):1–9. doi:10.1186/1472-6963-10-116

14. Babiarz KS, Miller G, Yi H, Zhang L, Rozelle S. New evidence on the impact of China’s New Rural Cooperative Medical Scheme and its implications for rural primary healthcare: multivariate difference-in-difference analysis. BMJ. 2010;341(oct21 2):929. doi:10.1136/bmj.c5617

15. Liu X. The Integrated Urban and Rural Medical Insurance and the Utilization of Medical Care: evidence from China. J World Economy. 2017;40(3):169–192.

16. Hu H. Effect of basic medical insurance on health service utilization of urban residents:–policy effect and robustness test. J Zhongnan Univ Economics Law. 2012;2(5):21–28.

17. Hong L, Zhong Z An Impact Evaluation of China’s Urban Resident Basic Medical Insurance on Health Care Utilization and Expenditure.

18. Pan J, Lei X, Liu G. Does medical insurance promote health?– an empirical analysis based on China’s basic medical insurance for urban residents. Economic Res J. 2013;2(4):130–142.

19. Lu A, Dong Z, Chen B, Sun L. Equity on healthcare service utilization of China’s Urban Resident Basic Medical Insurance. Chin J Health Policy. 2015;8(6):8–12.

20. Li R, Zheng X. The Effect of Medical Insurance on the Utilization and Costs of Health Services. Chin Health Service Manag. 2006;22(8):473–475.

21. Chen H, Deng P. Health Effect Evaluation of the Urban Employee Basic Medical Insurance. Soc Security Studies. 2016;2(4):44–52.

22. Liu X, Wong H, Liu K. Outcome-based health equity across different social health insurance schemes for the elderly in China. BMC Health Serv Res. 2015;16(1):1–12. doi:10.1186/s12913-016-1261-5

23. Pan Y, Chen S, Chen M, et al. Disparity in reimbursement for tuberculosis care among different health insurance schemes: evidence from three counties in central China. Infect Dis Poverty. 2016;5(1):7. doi:10.1186/s40249-016-0102-4

24. Li C. Sun W and Zhang H. Research on the Comparison and Changing Trend of Middle-aged and Elderly People’s Health Service Utilization under Three Basic Social Medical Insurances in China. Chin Health Economics. 2016;35(07):15–18.

25. Lin X, Cai M, Tao H, et al. Insurance status, in-hospital mortality and length of stay in hospitalised patients in Shanxi, China: a cross-sectional study. BMJ Open. 2017;7(7):e015884. doi:10.1136/bmjopen-2017-015884

26. Fan H, Yan Q, Coyte PC, Yu W. Does Public Health Insurance Coverage Lead to Better Health Outcomes? Evidence From Chinese Adults. INQUIRY. 2019;56(2):004695801984200. doi:10.1177/0046958019842000

27. Xiuquan G. The Effects of Social Medical Insurance on the Utilization of Hospice Medical Services of Elder Adults Insurance Studies. Med Care. 2019;2(4):102–115.

28. Yanwen L, Bihong C. Research on the Influence of basic medical Insurance on the utilization of medical service for middle-aged and elderly population in Zhaoqing City Modern Economic Information. Med Care. 2020;2(3):9–10.

29. Xie E. On the Equalization in Health and Medical Service in Urban and Rural Areas. 2009.

30. Zhang C, Lei X, Strauss J, Zhao Y. Health Insurance and Health Care among the Mid-Aged and Older Chinese: evidence from the National Baseline Survey of CHARLS. Health Econ. 2016;26(4):431–449.

31. Brown ME, Bindman AB, Lurie N. Monitoring the consequences of uninsurance: a review of methodologies. Med Care Res Rev Formerly Med Care Rev. 1998;55(2):177–210.

32. Yu Y, Feng J. Informal Care and Health Care Utilization of the Elderly. China Economic Quarterly. 2018;17(3):56–81.

33. Rosenbaum PR, Rubin DB. Assessing Sensitivity to an Unobserved Binary Covariate in an Observational Study with Binary Outcome. J Royal Statistical Soc. 1983;45(2):212–218.

34. Cook RD, Weisberg S. The central role of the propensity score in observational studies for causal effects. Biometrika. 1983;70(1):41–55.

35. Rajeev H. Dehejia and Sadek Propensity Score-Matching Methods for Nonexperimental Causal Studies. Rev Economics Statistics. 2002;84(1):151–161.

© 2020 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2020 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.