Back to Journals » Psychology Research and Behavior Management » Volume 11

How does cognitive dissonance influence the sunk cost effect?

Received 31 August 2017

Accepted for publication 9 January 2018

Published 1 March 2018 Volume 2018:11 Pages 37—45

DOI https://doi.org/10.2147/PRBM.S150494

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Igor Elman

Shao-Hsi Chung,1 Kuo-Chih Cheng2

1Department of Business Administration, Meiho University, Pingtung, Taiwan; 2Department of Accounting, National Changhua University of Education, Changhua City, Taiwan

Background: The sunk cost effect is the scenario when individuals are willing to continue to invest capital in a failing project. The purpose of this study was to explain such irrational behavior by exploring how sunk costs affect individuals’ willingness to continue investing in an unfavorable project and to understand the role of cognitive dissonance on the sunk cost effect.

Methods: This study used an experimental questionnaire survey on managers of firms listed on the Taiwan Stock Exchange and Over-The-Counter.

Results: The empirical results show that cognitive dissonance does not mediate the relationship between sunk costs and willingness to continue an unfavorable investment project. However, cognitive dissonance has a moderating effect, and only when the level of cognitive dissonance is high does the sunk cost have significantly positive impacts on willingness to continue on with an unfavorable investment.

Conclusion: This study offers psychological mechanisms to explain the sunk cost effect based on the theory of cognitive dissonance, and it also provides some recommendations for corporate management.

Keywords: sunk costs, sunk cost effect, cognitive dissonance, behavior, unfavorable investment

Corrigendum for this paper has been published

Introduction

Sunk costs are the costs that have occurred in the past and should be irrelevant to future decisions.1 In fact, sunk costs still affect decision-makers’ continued investment willingness in a failing project. They do not treat the sunk costs as sunk, thus producing the sunk cost effect.2 Over the past half century, research of the suck cost effect has focused on exploration of probable factors that explain the cause of the sunk cost effect. Factors including self-justification, framing effects, risk perception, escalation of commitment, mental accounting, disposition effect, anticipated regret, tendency to keep doors open, personal responsibility, agency theory, and completion effect have been identified to uncover the inherent nature of the sunk cost effect.3–13 Because the sunk cost effect is prevalent in the investment decision of modern enterprise and this effect is a possible cause of investment losses, the study of the sunk cost effect is worthy of attention.

Cognitive dissonance is a kind of cognitive bias associated with a psychologically uncomfortable state.14 Such dissonance may lead to memory errors, inaccurate judgments, and faulty logic.15 Because certain types of cognitive bias have direct impacts on the risk perceptions of entrepreneurs and influence the way they cope with risks lurking in their decisions, there is growing interest in whether and how individual cognitive bias affects the sunk cost effect.16,17 However, since cognitive dissonance is a kind of mental state and an elusive concept, it is hard to observe, record, and track.18 So, there is still no research on the influence of cognitive dissonance on the sunk cost effect.

By conceptualization and definition, cognitive dissonance includes two components, “arousal dissonance”, which is the cognitive aspect, and “discomfort dissonance”, which is the emotional aspect.19–21 The arousal dissonance is induced when a decision is taken and the cognitions direct decision-makers into different beliefs, thus arousing cognitive confliction.19 From the cognitive view of dissonance arousal, this study argues that the cognitive dissonance of decision-makers is caused by an initial investment decision on an unfavorable project, and postulates that cognitive dissonance plays an intermediary role in the relationship between sunk costs and willingness of continuing to invest. In the emotional aspect of cognitive dissonance, discomfort dissonance is a person’s psychological uncomfortable state, which comes from the changes in one’s emotions subsequent to the decision-making, often linked with anxiety and uncertainty.21 In this view, we suppose that cognitive dissonance plays a role as a moderator on the causal relationship of the sunk cost effect, where the influence of different level of cognitive dissonance will differ. The aim of the study is to confirm that cognitive dissonance has a mediating effect on the sunk cost effect, and/or a moderating effect. As a result, we hope to obtain a better understanding of the psychological mechanism of cognitive dissonance underlying the sunk cost effect.

Literature review and hypothesis development

Sunk costs and sunk cost effect

Sunk costs, the past occurred costs, which can be regarded as stimuli, provide a strong impetus to continue an investment project.2 In microeconomics, a rational individual facing a resource allocation problem will consider his or her preferences and limited resources to make an ideal choice among multiple alternatives. However, in reality, decision-makers are often affected by the amount of input sunk costs, especially when their investment project gets into an unfavorable situation, which in turn causes the sunk cost effect.17,18 Under the sunk cost effect, considering the substantial cash payout, decision-makers are unwilling to withdraw from an unfavorable project but only keep the project going for fear of instantly seeing the sunk costs turning into an immediate loss, which would finally cause serious losses.22

Cognitive dissonance and sunk cost effect

Cognitive dissonance refers to a situation involving conflicting attitudes, beliefs, and behaviors.14 If a paradoxical situation exists between belief and behavior, decision-makers would be in an uneasy and anxious mental condition, which would force them to try desperately to find an explanation for the discordance. When there is a feeling of inconsistency, decision-makers will naturally be prompted to seek resolutions to rule out the mental anguish, usually by struggling to find a way to change one or both cognitions to make them consonant.23 This process might be thought of as an individual trapped in a conflict between behavior and belief often performing a self-justification process to rationalize his or her previous actions or to psychologically protect himself or herself against a perceived error in behavior.24 In this study, we use the potential psychological mechanisms of cognitive dissonance to explore its mediation and moderation effects on the sunk cost effect and establish a relevant hypothesis.

Mediating effect of cognitive dissonance

In a review of literature addressing the sunk cost effect, the research stated that “through an effort-justification mechanism, people account for the amount of behavioral resources invested when selecting an alternative, in which case they may fall prey to purely behavioral sunk cost effects”.18 People fail to ignore prior investments mainly due to a greater motivation to minimize losses than to maximize gains.25 For this kind of value-induced motivation, they would be motivated to compromise their self-interest in order to avoid a greater loss.26 However, when decision-makers are entrapped in the sunk costs fallacy, although they are clearly aware that they should not continue to invest in a nonperforming or failing project, they constantly act otherwise and produce conflicting cognitions. In the cognitive view of arousal dissonance, cognitive dissonance is aroused by the amount of sunk costs taken in prior decision. Thus, sunk costs may bring cognitive dissonance, and the higher the fear for large loss results from immediate dropping-out, the larger the cognitive dissonance that would emerge.

Once a decision is made, for reducing cognitive dissonance, subsequent preferences will be revealed along with an increase in the attractiveness of the chosen alternative and a decrease in the attractiveness of the rejected alternatives.18,27 Although individuals and organizations may hold strong norms for rational and goal-directed behavior, their actions generally fall far short of these ideals.28 Hence, people with cognitive dissonance may continue investing in an attempt to achieve success and demonstrate that their previous decisions are not poor. Based on this rationale, since a lot of investment costs have been input into the project causing much arousal dissonance, decision-makers with a sense of increasing cognitive dissonance would frantically seek to justify their prior decisions, thus expressing stronger willingness to continue a nonperforming investment project. Briefly, decision-makers’ cognitive dissonance would be aroused by the sunk costs and they would then engage in rationalization to alleviate the conflict state. Thus, cognitive dissonance plays a pivotal and intermediary role between sunk costs and willingness to continue investing in an unfavorable project. The mediating effect of cognitive dissonance is hypothesized as follows: Hypothesis 1: Cognitive dissonance has a mediating effect on the relationship between sunk costs and willingness to continue an unfavorable investment project.

Moderating effect of cognitive dissonance

Decision-makers make irrational decisions as cognitive dissonance disturbs their rationality.29 The emotional view of discomfort dissonance holds that cognitive dissonance of a decision maker emerges due to emotional changes following the free choice decision-making.20 The emotional component of cognitive dissonance brings about an uncomfortable status that motivates dissonance reduction, as expected by dissonance theory.21 In this argument, we suggest that the uncomfortable emotional part of cognitive dissonance will interfere with the formation of the sunk cost effect. In terms of the person’s discomfort dissonance, we predicted that when a decision maker has high cognitive dissonance, in order to reduce the risk of input capital waste and disgrace caused by interrupting an investment, they are willing to continue an unfavorable investment, to justify consciously unacceptable and conflictive behaviors, thus causing the sunk cost effect. However, when the cognitive dissonance is low, they look back on the past input costs with a rational attitude and treat sunk costs as sunk, so the sunk costs have less effect on willingness to continue an investment; therefore, the sunk cost effect does not occur significantly. Accordingly, we suppose that cognitive dissonance has a moderating effect on the relationship between sunk costs and willingness to keep investing and we propose the following hypothesis: Hypothesis 2: Compared with low cognitive dissonance, when cognitive dissonance is high, the relationship between sunk costs and willingness to continue an unfavorable investment project is more positive.

Methodology

Participants and experimental questionnaire

This study adopted an experimental questionnaire survey. The Academic Ethics Committee of the Accounting Department, the Graduate Institute of Accounting, and the EMBA at the National Changhua University of Education, authorized by the Ministry of Education, have reviewed this research. The Committee confirmed that the research conforms with the ethical norms to ensure that the rights and welfare of the research participants are adequately protected. We informed the participants in the preface of the questionnaire that the research was voluntary and anonymous. Written informed consent was provided by participants confirming their agreement to participate in the research. This study did not pay any compensation to participants and has no conflicts of interest. The participants of this study are managers of companies listed on the Taiwan Stock Exchange and Over-The-Counter companies including electronic communication, transportation, manufacturing, and service industries. A total of 170 questionnaires were sent to the managers, and 134 were received back. Afterward, six invalid questionnaires were removed because the responders did not clearly understand the scenario and questions in the questionnaire or did not fill it in completely. So, the total number of valid responses was 128, resulting in an effective recovery rate of 75%. Each questionnaire consisted of three sections (Figure S1), and a narrative case was given for decision-making.30 In the experimental process, participants were randomly given one of four scenarios, each representing a different level of sunk costs. They were asked to read the scenario and then choose the level of willingness to continue an unfavorable investment project. Among 128 participants, 84 (65.6%) were male and 112 (87.5%) were educated to a bachelor’s degree level or higher. Ninety-five (74.2%) had more than 10 years work experience, and 103 (80.5%) were 31–50 years old.

Measure and analysis method

Sunk costs

Sunk costs were set as a manipulated variable. Participants were randomly assigned to one of the four levels (15%, 40%, 65%, or 90%). The numbers of valid participants in the four sunk cost levels were 33, 31, 34, and 30, respectively.

Cognitive dissonance

Cognitive dissonance is operationally defined in this study as psychologically uncomfortable states caused by cognitive conflicts given that the sunk costs have occurred. The questionnaire used to measure cognitive dissonance was developed by prior research.19 The magnitude of cognitive dissonance was gauged by the total score of the fifteen questions that were rated on a seven point Likert scale. A higher score indicated a higher level of cognitive dissonance. Cronbach’s α was 0.87 in this study.

Willingness to continue the investment project

Participants were requested to read a scenario related to four cases of sunk costs and decide their willingness to continue the investment project. The degree of willingness to continue was measured using a 0%–100% scale, with a 10% interval, where 0% indicates “definitely would not continue” and 100% denotes “definitely would continue”.

Analysis of mediation effect

To test whether sunk costs (SUNK) affect willingness to continue an unfavorable investment project (WILLINGNESS) indirectly under the mediation of cognitive dissonance (DISSONANCE), this study estimated the path coefficients using the following structural equations:

|

|

The variable DISSONANCE functions as a mediator when it meets the following requirements: 1) variations in SUNK significantly account for variations in the presumed mediator DISSONANCE, that is, γ11 is significant in equation (I), 2) variations in DISSONANCE significantly account for variations in WILLINGNESS, that is, β21 is significant in equation (II), and 3) when conditions (1) and (2) are controlled, γ21 in equation (II) is less than the correlation coefficient between SUNK and WILLINGNESS.31

Analysis of moderation effect

The moderation effect implies that the causal relation between the independent variable and dependent variable changes as a function of the moderating variable.31 Using DISSONANCE as the moderator, this study examined whether SUNK has much more influence on WILLINGNESS when the level of DISSONANCE is high. To identify whether cognitive dissonance has a moderation effect, we employ the hierarchical regression analysis and set two regression equations as follows:

|

|

To confirm cognitive dissonance having a moderation effect, the coefficient of the product term (SUNK×DISSONANCE) in equation (IV) (ie, β3 ) must be significant, and the coefficient of SUNK (ie, β1) must substantially decrease from equation (III) to equation (IV).31 Moreover, to further test the nature of the moderating effect, cognitive dissonance was dichotomized at the mean. The mean was selected as a split point to reveal a more natural division, in contrast to the median.32 A score below the mean denoted low cognitive dissonance, while a score above the mean indicated high cognitive dissonance. The full samples were thus divided into two groups, and the two further regression analyses were implemented to assess the significance of the two groups’ slope.

Results

Manipulation check

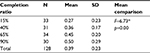

In this study, the effectiveness of manipulating the four levels of sunk costs was tested by comparing means of willingness to continue investments. The result, given in Table 1, shows that the four sunk cost levels have a significant difference (F=6.73, p<0.01). This indicates that the sunk cost scenarios have been effectively manipulated. In addition, the more the completion ratio, the higher the mean, revealing the existence of the sunk cost effect.

| Table 1 Mean comparison of willingness to continue investments based on sunk cost levels Note: *p<0.01. Abbreviation: SD, standard deviation. |

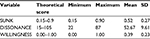

Descriptive statistics and correlation

Descriptive statistics and Pearson correlation coefficients (Pearson correlation analysis is applied for continuous variables and interval variables.33 In this study, cognitive dissonance is continuous, while sunk costs and willingness of continuing investments are interval. It is thus justified to compute Pearson correlation coefficients among these research variables.) of variables are presented in Tables 2 and 3, respectively. Except for a significant correlation between SUNK and WILLINGNESS (r=0.40, p<0.01), the correlations between SUNK and DISSONANCE and between DISSONANCE and WILLINGNESS were not significant.

| Table 2 Descriptive statistics Abbreviations: SD, standard deviation; SUNK, sunk costs; DISSONANCE, cognitive dissonance; WILLINGNESS, willingness to continue investments. |

| Table 3 Pearson correlation Note: *p<0.01. Abbreviations: SUNK, sunk costs; DISSONANCE, cognitive dissonance; WILLINGNESS, willingness to continue investments. |

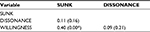

Mediating effect of cognitive dissonance

The path coefficients of equation (I) and (II) are shown in Table 4. Since γ11 and β21 are not significant, the results do not meet requirements for cognitive dissonance to be a mediator. Thus, Hypothesis 1 is not supported.

| Table 4 Results of path analysis Note: *p<0.01. Abbreviations: SUNK, sunk costs; DISSONANCE, cognitive dissonance; WILLINGNESS, willingness to continue investments. |

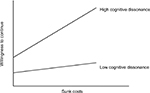

Moderating effect of cognitive dissonance

Table 5 shows the results of the regression analyses. Panel A presents the coefficients of equation (III) and (IV), where the coefficient of product term is significant (β3 =0.31, p<0.01). In addition, comparing the coefficient of SUNK in equation (III) and (IV), it reduces from β1 = 0.35 (p<0.01) to β1 = 0.19 (p<0.05). These results satisfy the requirements of cognitive dissonance to be the moderator. Panel B and Panel C present the results of high and low groups of cognitive dissonance, respectively. SUNK is significant in Panel B (β1 = 0.43, p<0.01), but not in Panel C (β1 = 0.09, p>0.1). It is clear that sunk costs only impact on willingness to continue investments in high cognitive dissonance, but not in low cognitive dissonance. Thus, Hypothesis 2 is supported. The two regression lines of high and low cognitive dissonance are depicted in Figure 1. The intercept and slope are all greater in the regression line of high cognitive dissonance, pointing out that the sunk cost effect is much more obvious when decision-makers act with high cognitive dissonance.

| Figure 1 The sunk cost effect in high/low cognitive dissonance. |

Conclusion and recommendations

The purpose of this study was to determine how cognitive dissonance affects the sunk cost effect. The findings tell us that there is only a moderating effect, but no mediating effect. The results could be explained by the psychological mechanism of the two components in cognitive dissonance, that is, arousal dissonance is not affected by sunk costs, but discomfort dissonance is attributed to sunk costs. An explanation for these results may be because the sunk cost decision was freely chosen by decision-makers, which explains why conflicting cognition was not aroused but psychological discomfort was felt internally.20 This study expounds the potential psychological mechanism of cognitive dissonance on the sunk cost effect and has made a contribution to extending the theoretical framework in this research field. In practice, we provide some management recommendations. When an investment project is likely to fail and face the problem of continuity, this study found that decision-makers are often affected by sunk costs and tend to continue with the unfavorable investment. In order to avoid the individual cognitive dissonance to deepen the negative impact of the sunk cost effect, we suggest that enterprises should build an early warning and prevention system, such as an investment stop-loss mechanism, forcing decision-makers to terminate inefficient investment cases and avoid such serious losses. In addition, a collective decision-making system can be set so as to avoid a single person from influencing major investment decisions. At the same time, the corporate management can strengthen the linkage between personal performance and investment project performance. The performance evaluation period of an investment project can also be designed to timely discover an erroneous decision. For future research, we suggest studying other psychological variables such as overconfidence and optimism to enrich the issue of explaining the sunk costs effect. In addition, researchers can extend this study further to consider how to reduce the sunk cost effect. For example, managerial incentives may reduce managers’ attempts to invest in a failing project. Besides, the organization identity and emphasis on achievement of budgetary goals are all possible factors that can affect the decision of whether to continue on with an unfavorable investment. This study has some limitations. Because each manager was requested to answer all items in the questionnaire, common method variances could exist and affect our results. However, since we efficiently manipulated the experimental scenarios, the common method variances can be minimized. In addition, the experimental study was conducted in the participants’ workplaces rather than in a fixed experimental setting, and so the researchers could not effectively control the experiment.

Acknowledgment

Special thanks to Ms Shu-Li Peng for her assistance in the research and the reviewers’ valuable comments on the improvement of this study.

Disclosure

The authors report no conflicts of interest in this work.

References

Supplementary materials

| Figure S1 An example of the experimental scenarios |

© 2018 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2018 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.