Back to Journals » Journal of Multidisciplinary Healthcare » Volume 13

Effects of Financial Inclusion on Access to Emergency Funds for Healthcare in the Kingdom of Saudi Arabia

Authors Al-Hanawi MK , Chirwa GC , Kamninga TM , Manja LP

Received 17 August 2020

Accepted for publication 24 September 2020

Published 15 October 2020 Volume 2020:13 Pages 1157—1167

DOI https://doi.org/10.2147/JMDH.S277357

Checked for plagiarism Yes

Review by Single anonymous peer review

Peer reviewer comments 2

Editor who approved publication: Dr Scott Fraser

Mohammed Khaled Al-Hanawi,1 Gowokani Chijere Chirwa,2 Tony Mwenda Kamninga,3 Laston Petro Manja2

1Department of Health Services and Hospital Administration, Faculty of Economics and Administration, King Abdulaziz University, Jeddah 80200, Saudi Arabia; 2Economics Department, Chancellor College, University of Malawi, Zomba, Malawi; 3Research and Policy Department, African Institute for Development Policy, Lilongwe, Malawi

Correspondence: Mohammed Khaled Al-Hanawi

Department of Health Services and Hospital Administration, Faculty of Economics and Administration, King Abdulaziz University, Jeddah 80200, Saudi Arabia

Email [email protected]

Background: Having access to convenient and quality healthcare at all times is not only a human right but also a goal that many countries strive to achieve for their population. However, access to healthcare might face blocks in the presence of financial exclusions. Saudi Arabia has, over the years, continued to pursue policy and system reforms to enhance its population’s access to financial inclusion, as well as proper health coverage to improve health outcomes. This study seeks to estimate the effects of financial inclusion on the financial hardships in accessing healthcare in Saudi Arabia.

Methods: This study uses a nationally representative survey conducted with 1009 adults, using the 2017 World Bank Global Findex Study data. The study estimates the conditional probability of coming up with emergency funds and the conditional probability of borrowing for medical purposes to understand access to healthcare. A composite value is created for financial inclusion using several variables for individuals’ interactions with financial institutions, such as access to financial services and loans.

Results: The results revealed that financially included individuals have a higher conditional probability of both borrowing for medical purposes and coming up with emergency funds, compared to those who are financially excluded. Additionally, the study showed that individuals in low-income brackets are more likely to be financially excluded and have a reduced chance of coming up with emergency funds and borrowing for medical purposes.

Conclusion: These findings indicate that there is need for authorities to roll out a financial inclusion drive that will not only incentivise the financially excluded population to become included but that will also aim at promoting various financial products so that those who are already financially included have a wide range from which they can choose.

Keywords: access, borrow, financial inclusion, financial hardships, healthcare, Saudi Arabia

Introduction

Universal health coverage (UHC) and the ability to secure high quality healthcare and access at an affordable cost for the entire population is a principal health objective of many countries on the path to the attainment of Sustainable Development Goals (SDGs). The SDGs, also known as the Global Goals, were adopted by all United Nations Member States in 2015 as a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity by 2030.1 Hence, UHC is an integral component of achieving the SDGs and its goal is to ensure that all people have access to the healthcare they need without suffering from financial hardship, which might lead to impoverishment.2,3 In its SDGs, the United Nations has positioned health and well-being as the third goal, which requires that stakeholders promote physical and mental health and well-being with, among others, the aim to extend life expectancy.4

Precisely, SDG Number 3.8 focuses on achieving UHC, including financial risk protection, access to quality essential healthcare services and access to safe, effective, quality and affordable essential medicines and vaccines for all.4 This goal requires countries to provide everyone with access to UHC and quality healthcare for the prevention and treatment of communicable as well as non-communicable diseases. According to the World Bank Group, UHC is a way to achieve the twin goals of increasing equity and shared prosperity and ending extreme poverty.5 However, financial hardship, for instance, through lack of financial inclusion, might affect the drive towards UHC because, in order to attain UHC, people need to have both financial and health access.6

Financial hardship is one critical outcome of paying for health services and medicine out-of-pocket (OOP) at the point of use. People experience financial hardship when they make formal and informal OOP payments for healthcare services at the point of use that exceed their ability to pay.7 Consequently, this might lead to the impoverishment of individuals and households.8 Countries around the world continue to implement reforms to strengthen their health systems and provide financial protection to their populations. Comparatively, Arab countries, including the Kingdom of Saudi Arabia (KSA), are criticised for not implementing the health equity movement observed globally.9 The KSA is a high-income country, the largest country in the Middle East, and thirteenth largest in the world, with a total landmass of 2,149,690 square kilometres and a population of 30,770,375.10 The KSA’s wealth primarily comes from its vast oil revenues and these earnings have allowed the government to finance public services, including healthcare.

The KSA has experienced significant economic and developmental progress in the last decades. However, the increased prevalence of non-communicable diseases, such as obesity, hypertension, hypercholesterolaemia, diabetes, asthma and cancer, with all the attendant risk factors, together with road traffic injuries, places significant burdens on the public healthcare of the KSA.11–17 In the KSA, health expenditure per capita has increased in the last three decades, yet such expenditure is comparatively low when compared with other high-income countries of the world. For example, the percentage of gross domestic product dedicated to health in 2017 was 5.74, which is relatively low when compared to the average percentage reported for the high-income Organisation for Economic Co-operation and Development (OECD) countries.18 Consequently, the Gulf Cooperation Council (GCC) countries, including the KSA, remain only halfway in ensuring health quality, quality care and accessibility to the needed resources in comparison with their non-GCC counterparts.19 For example, the KSA has reported significant deficiencies in the provision of safe and effective care to patients in hospital settings.20

Financial protection is not a routine part of the monitoring process in high-income countries but, nevertheless, it has received immense interest after the recent global financial crisis in the European countries. Few aspects are known in relation to financial inclusion and financial hardship in the Gulf region and KSA. Previous literature on financial inclusion in the KSA has mainly focused on its effects on levels of development and poverty,21,22 the prevalence of financial exclusion in the presence of growth in the financial sector23 and the gender differentials.24 The findings’ consensus points to the narrative that individuals with deprived backgrounds and the poor are more likely to face financial hardships and the results from the Gulf region are in tandem with estimates from Tunisia,25 Lebanon,26 the GCC,27 and in other European regions.28

There is a dearth of empirical findings from the GCC countries, including the KSA, concerning financial inclusion and financial hardships in public health.25,27 It is not known how financial inclusion might enhance borrowing for medical purposes and access to emergency funds. Financial inclusion through UHC can lead to improved population health and, therefore, accessing necessary healthcare without financial hardship is one of the key components of UHC. Financial inclusion can lead to reduced financial hardships and, hence, the current study aims to bridge the literature gap by focusing on one of the major financial hardships in the KSA, which is financial inclusion.

Given the above sentiments, it is important to understand the link between financial inclusion and financial hardships in accessing quality healthcare by focusing on the ability to borrow for health and also to have emergency funds. Therefore, the current study contributes to the literature by investigating the effects of financial inclusion on borrowing money for medical or health purposes and assessing the effects of financial inclusion on the perceived inability to access emergency funds in the KSA.

The study is motivated by a number of factors whereby the KSA provides an interesting case in point for several reasons. First, is the growth in the financial inclusion,21,22 such that over 80% of the population is financially included.29 Second, the increasing OOP burden,30,31 despite the KSA’s free at the point of use healthcare, introduces another puzzle that might undermine the potential benefits of financial inclusion. Financial inclusion enables households to access proper formal funds and insurance facilities, as well as to avoid reliance on burdensome coping strategies6 such as selling off assets like land and livestock, to mention just a few.32 To the authors’ knowledge, this is the first study to link financial inclusion to financial hardship in accessing healthcare in the KSA.

The Healthcare Accessibility Situation in the KSA

Healthcare services in the KSA are mainly publicly provided through the Ministry of Health (MOH) and people access them free at the point of use.10 Although the private sector is also involved in service provision, up to 60% of hospitals and primary healthcare centres are funded from the government budget, with the allocated percentage clearly rising, from slightly below 6% in 2006 to about 8.4% thirteen years later, which is a factor attributed to the KSA healthcare system’s apparent success.33–35 Nonetheless, rapid urbanisation in the KSA, with up to 83% of the population being urban based in 2015, has seen the health system being overwhelmed, thereby affecting access to healthcare services as well as their quality and equity.10

The KSA recognises access to health as a right for all, which is enshrined in Articles 27 and 31 of the Basic Laws of Saudi Arabia.20 In principle, the government does not segregate between genders on issues related to health. However, most inequalities in healthcare emanate from traditional, cultural and social practices.36 However, females have faced some obstacles in accessing antenatal care. For example, in a study involving 151 women, it was shown that 72.2 per cent had issues finding female healthcare. Furthermore, 25.2% required permission from their husbands and roughly 51.7% faced transportation problems since they were not permitted to drive at that time.37 Such culturally-shaped gender norms and socioeconomic restrictions hinder timely access to various services, such as quality reproductive health, preventative screening for cancer, and prevention of non-communicable diseases.38

The access issues have become even worse across the rural areas in which private hospitals’ coverage is poor. Precisely, it is reported that key challenges for rural residents in the KSA, in terms of access to primary healthcare services compared to their urban counterparts, include distance to reach the amenities and inadequate opening hours.39

The cost of healthcare provision in KSA cannot go without mention. In providing healthcare services, the government has spearheaded significant improvements to the healthcare sector, including modernisation of infrastructures such as hospitals and increasing financial commitment to the health sector. However, increased demand has seen the sector incurring huge costs for the government, which is a factor that has spurred debate for the exploration of funding alternatives.10,40,41 Between 2013 and 2017, healthcare expenditure increased by 24%.42 Furthermore, it was observed that public spending on health in KSA was higher than most high-income countries (71.3% for the KSA and 61.2% for high-income countries). Nevertheless, the cost of bed space was higher in the KSA compared to other high-income countries.42 Between 1995 and 2016, the absolute increase in health spending per capita, (in 2016 USD) was around 1257 (from 1185 USD to 1336 USD), whereas the increase in OOP spending per total health spending was 14.2% (12.4% to 16.2%).43

As the cost of healthcare among individuals is on the rise and the cost of free healthcare is steadily becoming unsustainable,40 the government has put the introduction of national health insurance on the table. It has not been implemented yet, but people have shown greater willingness to contribute (69.6% of the population are willing to pay a mean of 50 Saudi Riyal (USD 13.33)).40 In light of the above-highlighted challenges and costs of healthcare, the KSA government has implemented Compulsory Employment-Based Health Insurance (CEBHI), paid by employers and covering all private-sector employees.44 However, the fact that private service providers are mainly urban-based means that access to healthcare services is still restricted, especially for rural areas. While proposed solutions include switching towards a national or social insurance-based system, or even introducing user fees, challenges in access to healthcare services have remained in the KSA.10,45

Materials and Methods

Estimation Strategy

Since this study aims to underscore financial inclusion’s effects on financial hardship in healthcare access, the econometric application requires the following modelling specification:

In Equation (1), we capture the effects of financial inclusion on financial hardship in healthcare coverage by looking at the individuals’ probability of borrowing for medical purposes. Based on literature regarding how individuals cope with health shocks,32,46,47 we hypothesise that, if an individual borrows for medical purposes, they are more likely to have financial hardships that can lead to catastrophic health expenditure. Included in the  matrix are the variables we control for, largely motivated by the literature, which are age groups, education and income quintiles.

matrix are the variables we control for, largely motivated by the literature, which are age groups, education and income quintiles.  is an error term that is assumed to be identically and independently distributed (iid). Similarly, in Equation (2), we capture financial hardships in relation to healthcare by looking at individuals’ probability of coming up with emergency funds for healthcare. We use similar control variables as in Equation (1), with

is an error term that is assumed to be identically and independently distributed (iid). Similarly, in Equation (2), we capture financial hardships in relation to healthcare by looking at individuals’ probability of coming up with emergency funds for healthcare. We use similar control variables as in Equation (1), with  representing the error term that is (iid).

representing the error term that is (iid).

In both equations, the dependent variable is a binary outcome variable. Following Cameron, Trivedi,48 Gujarati49 and Wooldridge50 to model Equations (1) and (2) above we adopt probit modelling. Concerning multicollinearity, we tested for it and the correlation ratio was not above 0.8 and, thus, multicollinearity is not an issue in the data.49 We also controlled for heteroskedasticity by employing robust standard errors.49

Data

This study uses data from the latest series of the World Bank Global Findex Study conducted in 2017.51 The World Bank launched the Global Findex database in 2011 to record the most comprehensive database regarding adult savings, borrowing, payments and management of risks. The 2017 database was compiled using nationally representative surveys in more than 150,000 adults aged 15 and above in over 144 countries.29,51 The 2017 Global Findex database includes updated indicators on access to, and use of, formal and informal financial services. The data is based on surveys conducted in collaboration with Gallup of USA. Global Findex provides data on questions about how individuals save, borrow, and make payments for about 143 countries in the world, including data for the KSA. As a series of survey rounds, the 2017 Global Findex is the third survey round, following the initial one in 2011 and the second one in 2014.

In Saudi Arabia, the interviews took place from 30th April to 20th May 2017. Landline and mobile phones were used for interviews as opposed to face-to-face interviews. The use of phone interviews is a customary procedure for all countries whose phone penetration is above 80%. All interviews were conducted in either Arabic or English. The survey employed a design effect of 1.43 with a margin of error of 3.7. The sample included Saudi nationals, Arab expatriates and non-Arabs who were able to participate in the survey in Arabic or English,51 with weighting used to ensure national representativeness. In the Saudi 2017 survey, the total sample consisted of 1009 individuals.

Variables

In this study, we used the data that was collected for the KSA. Two outcome variables for healthcare financial hardships are identified from the data. The first one is a dummy variable, taking the value of 1 if an individual borrowed for medical purposes and 0 otherwise. The second one is also a dummy variable, taking the value of 1 if individuals express that it is possible for them to obtain emergency funds and 0 if they express that it is not possible. We also constructed a financial inclusion variable from a compendium of various questions on individuals’ involvement with formal financial institutions.

Furthermore, we also categorised age into various age groups. The age group of 15 to 25 is used as a reference group or base category in the sample analysis of the results. We also organise education into categories, with the “primary or less” group being a reference category. The five income quintiles were also generated from the data to see the effects of belonging to these quintiles on financial hardships among the people of the KSA.

Results

Table 1 below provides the descriptive statistics (proportions) for the full sample and across gender. The sample shows that 43.1% of the individuals are in the age group 26 to 35, followed by the age groups 15 to 25 (26.6%) and 36 to 44 (15.8%). Males have a significantly higher representation across all age groups except in the 15 to 25 age group. In terms of education, most of them have secondary education (55.2%), followed by those with tertiary education level. In the primary and secondary education categories, the number of educated males is slightly lower than females, but this difference is not statistically significant. Across all income quintiles, the differences in incomes among males and females are not significant. The largest representation in the sample, in terms of income quintiles, is quintile 5, which has a 24.4% representation, followed by quintile 4 at 20% (21.6%). The least representation is from quintile 1, with only 17.5% .

|

Table 1 Data Descriptions of Variables Used in the Study |

The sample shows that 75.5% of the sample are financially included, which is that the participants responded to at least one of the following: 1) has a bank account 2) has borrowed/has a loan from a financial institution, or 3) has saved in a financial institution. The sample shows that males (83%) are more financially included than females (62.3%) and the difference is statistically significant.

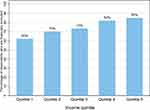

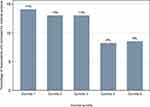

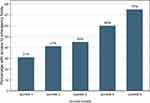

Additionally, Figures 1–3 show the distribution of the independent variable of interest (financial inclusion) and the dependent variables (borrowing for medical purposes and the possibility of coming up with emergency funds), respectively, across various income quintiles. For financial inclusion in Figure 1, the statistics show that individuals in the highest income quintile (the top 20%) are more financially included (85%), while those in the lowest income quintile are the least financially included. This distribution suggests that, as one gets financially included, there is a positive correlation between income and financial inclusion, which is to say that as one’s income increases, the possibility of also being financially included increases.

|

Figure 1 Financial inclusion by income quintiles. |

|

Figure 2 Borrowing for medical purposes by income quintiles. |

|

Figure 3 Possibility of coming up with emergency funds by income quintiles. |

Furthermore, from Figure 2, on the one hand the statistics show that individuals in income quintiles 4 and 5 borrow less for medical purposes, with a combined percentage of 17. Individuals in the bottom income quintiles (income quintiles 1 and 2) of the income quintile distribution, on the other hand, borrow more for medical purposes, with a combined percentage of 27. The highest percentage of borrowing for medical purposes comes from individuals with the lowest 10% of the income distribution. There is a generally negative correlation observed between income levels and borrowing for medical purposes.

Figure 3 shows that there is a positive correlation between income and the possibility of coming up with emergency funds. This correlation conforms with the expected results that, as individuals’ incomes increase, the chances of coming up with emergency funds also increase, partly due to the positive correlation of higher-income quintiles and financial inclusion that has been shown in Figure 1.

Regression Analysis Results

Following the study’s objective to model the effects of financial inclusion on financial hardship in healthcare access, three probit models were estimated and Table 2 below shows the regression results. The three probit models were conducted in order to check if the results are stable when a variable is included or excluded. We interpret the full model for all the estimations we have made in column C.

|

Table 2 Marginal Effects of Borrowing for Medical Purposes |

The results show that financial inclusion has a positive and statistically significant effect. This result shows that individuals with access to and involvement with financial institutions have, on average, a 7.4 percentage point increase in the probability of borrowing for medical purposes. Furthermore, the results also show that, compared to individuals in quintile 1, individuals in quintile 4 and 5 are less likely to borrow for medical purposes. The conditional probability of borrowing for medical purposes reduces by 10 percentage points for individuals in quintile 4, compared to quintile 1. Furthermore, the conditional probability of borrowing for medical purposes decreases by about eight percentage points for individuals in quintile 5, compared to individuals in the first quintile. The effects of variables such as age, gender and education on the probability of borrowing for medical purposes are statistically insignificant.

Table 3 shows the marginal effects of the possibility of coming up with emergency funds. In terms of the possibility, individuals in the age group 26 to 35 are less likely to come up with emergency funds by 10.7 percentage points, compared to those who are in the age group 15 to 25 years. The results further show that females are less likely to come up with emergency funds compared to males by 6.3 percentage points. Compared to those with primary or less education, individuals with secondary, tertiary or higher education have a greater possibility of coming up with emergency funds. For instance, the results show that those with secondary education have a 15.6 percentage point chance of coming up with emergency funds, compared to those with primary or less education.

|

Table 3 Marginal Effects for the Possibility of Coming Up with Emergency Funds |

As a robustness check, we have also shown in the Appendix that belonging to the employed group increases the conditional probability of borrowing for medical purposes by 12.7 percentage points compared to individuals in the no employment category. Furthermore, the robustness results show that the interaction of income quintiles and respondent’s age with financial inclusion has significant effects on borrowing for medical purposes. For example, compared with financial inclusion’s interaction with income quintile one, financial inclusion’s interaction with all other income quintiles has a statistically significant reducing effect in the probability of borrowing for medical purposes. The implications are that financial inclusion for individuals in low-income quintile has a higher marginal effect in improving their probability of borrowing for medical purposes. However, the interaction of age categories with financial inclusion does not make any improvement or reduction in the probability of borrowing for emergency funds.

Furthermore, compared to individuals in the first quintile, all individuals in the upper-income quintiles are more likely to come up with emergency funds and the conditional probability of this happening increases as an individual moves from a lower quintile to a higher quintile. There is an 11 percentage point increase associated with being in the second quintile compared to the first quintile. This percentage point increases to 11.1 in the third quintile, to 23.9 in the fourth quintile and to 37.7 in the fifth quintile.

In terms of interaction effects, the interactions between financial inclusion and the second income quintile lead to a reduced probability (by 28.8 percentage points) of coming up with emergency funds compared to the interaction of financial inclusion with the lowest income quintile. The interaction term coefficient’s effect reduces as we go higher up in the income quintiles. An interaction of financial inclusion with higher income quintiles does not have any significant effects indicating that there is no difference in the probability of coming up with emergency funds between the poor and the rich when both these groups of people are financially included.

Discussion

The study set out to investigate financial inclusion’s effects on the financial hardships in accessing healthcare. The univariate statistics show that the proportion of people who are financially included (measured by adult ownership of an account) in the KSA is 75.5%, which is higher than the overall proportion for the Gulf region of 30%52 and higher than the statistics for global financial inclusion of 69%.51 On borrowing for medical purposes, we find the result to be lower than that for similar countries, such as Bahrain, Kuwait and the United Arab Emirates.53 Partially, this might be explained by the fact that healthcare in Saudi Arabia is largely free at the point of use.10

The result showing that the financially included are likely to have emergency funds and to be able to borrow for medical purposes comes as no surprise. According to Collard,54 it can be said that financially included people tend to be richer, live in relatively less deprived areas and have certain characteristics, such as being employed, healthier and having the skills, knowledge and understanding to make the best use of financial products and services. It is, therefore, more likely that these financially included individuals will have formed more financial connections, have access to healthy finance policy information and have the ability to pay collateral such that, when an emergency occurs, they have a higher chance of accessing emergency funds. In fact, basic ownership of a bank account (financial inclusion) was found to improve saving behaviour, reduce liquidity constraints and increase financial stability among minorities in the United States (US), which eventually benefits health.55,56

The result indicating that financially included people are more likely to borrow for medical purposes could come as a minor surprise from a different literature point of view that notes that financially included individuals are expected to be more aware of their health and to have access to health insurance policies to protect against their future unexpected expenditure.57,58 However, in this study, the focus is on the probability of borrowing for medical purposes in the event that the emergency has occurred and a financially included individual has a higher chance of borrowing to serve their medical emergencies. Nevertheless, the result might partially be related to the findings in Nigeria where it was established that financial inclusion might enable access to insurance facilities as well as helping families to avoid reliance on burdensome coping strategies.6 Because families may want to avoid reliance on burdensome coping strategies, they might want to borrow from financial institutions. In the Saudi Arabian economy, this might be much easier since loans from formal institutions do not attract interest, as prescribed by the Islamic banking principles, hence making borrowing cheaper.

Additionally, the study has also found that poorer individuals (in the lowest quintile) are more likely to borrow for medical reasons but are less likely to obtain emergency funds. This result is in parallel with what Alshamsan et al53 found while using the 2014 Global Findex study in the Arabian Gulf region. The implications from this result are that the poorer groups should be at the centre of the country’s health finance strategies in order to contribute more to the growth of the economy.

There are several issues to consider in the case of the Saudi situation, given the results. Under Saudi Labour law, all people working in the private sector should be insured by their employers, meaning that private companies and employers have to pay the health coverage costs (the insurance premiums) for all of their employees. Saudi citizens are still entitled to access public services and other citizens might also access the private sector by means of OOP payments. The primary aim of introducing private health insurance in the country was to reduce the burden on the public healthcare sector. However, a recent study proved that there was no significant reduction in the public healthcare sector.30 Twenty-six insurance companies currently offer various categories of coverage to eight million Saudi and non-Saudi residents.

Our study is not without limitations. Our construction of financial inclusion variables is limited and specific to the variables in the data and some data sets might include additional variables as the definition of financial inclusion varies from author to author. These results from this study should be interpreted with caution as there might be potential for reverse causality because the probability of borrowing for medical purposes might also affect financial inclusion. We tried to identify an instrument to control for potential reverse causality but none of the instrumental variables worked and, hence, the coefficients should not be interpreted as causal evidence. Given this, the implications for future research are that studies should consider the use of quasi-experimental methods,59,60 such as instrumental variable matching or synthetic cohort analysis,61,62 to address the potential reverse causality.

Conclusion

This study sought to understand financial inclusion’s effects on financial hardship in relation to healthcare access in the KSA in light of the principal goal of UHC, which is to ensure that all people have access to the healthcare they need without experiencing financial hardship. Financial hardship can be identified in two ways: first, through an individual’s probability of borrowing for medical purposes and, second, through an individual’s probability of coming up with emergency funds for healthcare. The financial inclusion variable was constructed from a compendium of various questions on individuals’ involvement with formal financial institutions. All univariate, bivariate and multivariate analyses made use of the latest series (2017) of the World Bank Global Findex Study data, a nationally representative survey of more than 1009 adults.

A number of policy implications can be suggested from the study results for the KSA and similar economies. Given that being financially included increases chances of both borrowing for medical purposes and coming up with emergency funds, there is a need for monetary authorities to roll out a financial inclusion drive that will not only incentivise the excluded population to become included but will also aim at promoting various financial products so that those who are already financially included have a wide range from which they can choose. Such an initiative should be deliberately designed to attract more females, who are found to be at a higher disadvantage as far as coming up with emergency funds for healthcare is concerned.

There is also a need to provide more support programmes that aim at improving education outcomes, as the study observed a positive relationship between education and the ability to come up with emergency funds. Commercial banks should be encouraged and supported to charge more attractive interest rates for individuals to be incentivised to save funds, or even borrow. Further research should probably try to bring into account the spatial dynamics that are involved in the subject area, just to appreciate how the effects come about for the different regions in the KSA. The results from this study should be interpreted with caution as the study uses no instruments for the regressors; hence, the coefficients should not be interpreted as causal evidence.

Data Sharing Statement

The datasets is available on the World Bank website.

Ethical Approval

This paper does not require ethical approval because we used a secondary data. Furthermore, the data is de-identified. The outcomes of the analysis do not allow re-identification and the use of data cannot result in any damage or distress.

Author Contributions

All authors contributed to data analysis, drafting or revising the article, have agreed on the journal to which the article will be submitted, gave final approval of the version to be published, and agree to be accountable for all aspects of the work.

Funding

The authors received no specific funding for this work.

Disclosure

The authors declare no conflicts of interest in this work.

References

1. UNDP. United Nations development programme: sustainable development goals; 2020. Available from: https://www.undp.org/content/seoul_policy_center/en/home/sustainable-development-goals.html.

2. United Nations. Transforming our world: the 2030 agenda for sustainable development; 2015. Available from: https://sustainabledevelopment.un.org/post2015/transformingourworld.

3. WHO. Research for universal health coverage. World health organization (WHO); 2013. Available from: https://apps.who.int/medicinedocs/documents/s20294en/s20294en.pdf.

4. UN. United Nations: sustainable development goal 3: ensure healthy lives and promote well-being for all at all ages; 2017. Available from: https://sdgs.un.org/goals/goal3.

5. World Bank. Universal health coverage; 2019. Available from: https://www.worldbank.org/en/topic/universalhealthcoverage.

6. Ajefu JB, Demir A, Haghpanahan H. The impact of financial inclusion on mental health. SSM Popul Health. 2020;11:100630. doi:10.1016/j.ssmph.2020.100630

7. Moreno-Serra R, Thomson S, Xu K. Measuring and compar-ing financial protection. In: Papanicolas I, Smith P, editors. Health System Performance Comparison: An Agenda for Policy, Information and Research. Berkshire: Open University Press; 2013:223–254.

8. Wagstaff A, Flores G, Hsu J, et al. Progress on catastrophic health spending in 133 countries: a retrospective observational study. Lancet Glob Health. 2018;6(2):e169–e179.

9. Rashad H. Health equity in the Arab world: the future we want. Lancet. 2014;383(9914):286–287. doi:10.1016/S0140-6736(13)62350-8

10. Al-Hanawi MK, Alsharqi O, Almazrou S, Vaidya K. Healthcare finance in the Kingdom of Saudi Arabia: a qualitative study of householders’ attitudes. Appl Health Econ Health Policy. 2018;16(1):55–64. doi:10.1007/s40258-017-0353-7

11. Al‐Hanawi MK, Chirwa GC, Pulok MH. Socio‐economic inequalities in diabetes prevalence in the Kingdom of Saudi Arabia. Int J Health Plann Manage. 2020;35(1):233–246. doi:10.1002/hpm.2899

12. Al-Hanawi MK, Chirwa GC, Pemba LA, Qattan AM. Does prolonged television viewing affect body mass index? A case of the Kingdom of Saudi Arabia. PLoS One. 2020;15(1):e0228321. doi:10.1371/journal.pone.0228321

13. Moradi-Lakeh M, El Bcheraoui C, Daoud F, et al. Prevalence of asthma in Saudi adults: findings from a national household survey, 2013. BMC Pulm Med. 2015;15(1):77. doi:10.1186/s12890-015-0080-5

14. Basulaiman M, El Bcheraoui C, Tuffaha M, et al. Hypercholesterolemia and its associated risk factors—Kingdom of Saudi Arabia, 2013. Ann Epidemiol. 2014;24(11):801–808. doi:10.1016/j.annepidem.2014.08.001

15. Memish ZA, Jaber S, Mokdad AH, et al. Burden of disease, injuries, and risk factors in the Kingdom of Saudi Arabia, 1990–2010. Prev Chronic Dis. 2014;11. doi:10.5888/pcd11.140176

16. El Bcheraoui C, Memish ZA, Tuffaha M, et al. Hypertension and its associated risk factors in the Kingdom of Saudi Arabia, 2013: a national survey. Int J Hypertens. 2014;2014:1–8. doi:10.1155/2014/564679

17. Mansuri FA, Al-Zalabani AH, Zalat MM, Qabshawi RI. Road safety and road traffic accidents in Saudi Arabia: a systematic review of existing evidence. Saudi Med J. 2015;36(4):418. doi:10.15537/smj.2015.4.10003

18. World Bank. World Bank open data; 2019. Available from: https://data.worldbank.org/.

19. OECD. Health for Everyone? Social inequalities in health and health systems; 2019. Available from: https://www.oecd.org/publications/health-for-everyone-3c8385d0-en.htm.

20. Al-Amoudi SM. Health empowerment and health rights in Saudi Arabia. Saudi Med J. 2017;38(8):785. doi:10.15537/smj.2017.8.19832

21. Sarma M, Pais J. Financial inclusion and development. J Int Dev. 2011;23:613–628. doi:10.1002/jid.1698

22. Neaime S, Gaysset I. Financial inclusion and stability in MENA: evidence from poverty and inequality. Fin Res Lett. 2018;24:230–237. doi:10.1016/j.frl.2017.09.007

23. Zulkhibri M. Financial inclusion, financial inclusion policy and Islamic finance. Macroecon Fin Emerg Mark Econ. 2016;9(3):303–320. doi:10.1080/17520843.2016.1173716

24. KKF. King Khalid Foundation: Financial Inclusion in Saudi Arabia; 2018.

25. Chahed MK, Arfa C. Monitoring and evaluating progress towards universal health coverage in Tunisia. PLoS Med. 2014;11(9):e1001729. doi:10.1371/journal.pmed.1001729

26. Elgazzar H, Raad F, Arfa C, et al. Who Pays? Out-Of-Pocket Health Spending and Equity Implications in the Middle East and North Africa. Washington, DC: World Bank; 2010.

27. Kruk ME, Goldmann E, Galea S. Borrowing and selling to pay for health care in low-and middle-income countries. Health Aff. 2009;28(4):1056–1066. doi:10.1377/hlthaff.28.4.1056

28. Thomson S, Evetovits T, Cylus J, Jakab M. Generating evidence for UHC: systematic monitoring of financial protection in European health systems. Eurohealth. 2016;22(2):23–27.

29. World Bank. 2017 global findex survey methodology; 2017. Available from: https://globalfindex.worldbank.org/sites/globalfindex/files/databank/Methodology2017.pdf.

30. Alkhamis A, Hassan A, Cosgrove P. Financing healthcare in Gulf Cooperation Council countries: a focus on Saudi Arabia. Int J Health Plann Manage. 2014;29(1):e64–e82. doi:10.1002/hpm.2213

31. AlBedah AM, Khalil MK, Elolemy AT, et al. The use of and out-of-pocket spending on complementary and alternative medicine in Qassim province, Saudi Arabia. Ann Saudi Med. 2013;33(3):282–289. doi:10.5144/0256-4947.2013.282

32. Flores G, Krishnakumar J, O’Donnell O, Van Doorslaer E. Coping with health-care costs: implications for the measurement of catastrophic expenditures and poverty. Health Econ. 2008;17(12):1393–1412. doi:10.1002/hec.1338

33. Alkhamis AA. Critical analysis and review of the literature on healthcare privatization and its association with access to medical care in Saudi Arabia. J Infect Public Health. 2017;10(3):258–268. doi:10.1016/j.jiph.2017.02.014

34. Health BJ. Systems of the World-Saudi Arabia. Glob Health. 2009;2(1).

35. Baranowski J. Health Systems of the World-Saudi Arabia. Global Health-an Online Journal for the Digital Age. 2009;2(1).

36. Walker L. The right to health and access to health care in Saudi Arabia with a particular focus on the women and migrants. In: The Right to Health. Springer; 2014:165–192.

37. Dhaher EA. Access to reproductive health care services for women in the southern region of Saudi Arabia. Womens Reprod Health. 2017;4(2):126–140. doi:10.1080/23293691.2017.1326255

38. Aldosari H. The Effect of Gender Norms on Women’s Health in Saudi Arabia. Washington, DC: Arab Gulf States Institute in Washington; 2017.

39. Alfaqeeh G, Cook EJ, Randhawa G, Ali N. Access and utilisation of primary health care services comparing urban and rural areas of Riyadh Providence, Kingdom of Saudi Arabia. BMC Health Serv Res. 2017;17(1):106. doi:10.1186/s12913-017-1983-z

40. Al-Hanawi MK, Vaidya K, Alsharqi O, Onwujekwe O. Investigating the willingness to pay for a contributory National Health Insurance Scheme in Saudi Arabia: a cross-sectional stated preference approach. Appl Health Econ Health Policy. 2018;16(2):259–271. doi:10.1007/s40258-017-0366-2

41. Al-Hanawi MK, Alsharqi O, Vaidya K. Willingness to pay for improved public health care services in Saudi Arabia: a contingent valuation study among heads of Saudi households. Health Econ Policy Law. 2018:1–28.

42. Alatawi AD, Niessen LW, Khan JA. Efficiency evaluation of public hospitals in Saudi Arabia: an application of data envelopment analysis. BMJ Open. 2020;10(1):e031924. doi:10.1136/bmjopen-2019-031924

43. Chang AY, Cowling K, Micah AE, et al. Past, present, and future of global health financing: a review of development assistance, government, out-of-pocket, and other private spending on health for 195 countries, 1995–2050. Lancet. 2019;393(10187):2233–2260. doi:10.1016/S0140-6736(19)30841-4

44. Almalki M, FitzGerald G, Clark M. Health care system in Saudi Arabia: an overview. East Mediterr Health J. 2011;17(10):784–793. doi:10.26719/2011.17.10.784

45. Mufti MH. A case for user charges in public hospitals. Saudi Med J. 2000;21(1):5–7.

46. Xu K, Evans DB, Carrin G, Aguilar-Rivera AM, Musgrove P, Evans T. Protecting households from catastrophic health spending. Health Aff. 2007;26(4):972–983. doi:10.1377/hlthaff.26.4.972

47. Murphy A, McGowan C, McKee M, Suhrcke M, Hanson K. Coping with healthcare costs for chronic illness in low-income and middle-income countries: a systematic literature review. BMJ Glob Health. 2019;4(4):e001475. doi:10.1136/bmjgh-2019-001475

48. Cameron AC, Trivedi PK. Microeconometrics: Methods and Applications. Cambridge university press; 2005.

49. Gujarati DN. Basic Econometrics. Tata McGraw-Hill Education; 2009.

50. Wooldridge JM. Introductory Econometrics: A Modern Approach. Nelson Education; 2016.

51. Demirguc-Kunt A, Klapper L, Singer D, Ansar S, Hess J. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. The World Bank; 2018.

52. Chehade N, Navarro A, Barnieh Y, Attia H Financial inclusion measurement in the Arab World. Working Paper prepared by the Consultative Group to Assist the Poor (CGAP) and the Arab Monetary Fund; 2017.

53. Alshamsan R, Leslie H, Majeed A, Kruk M. Financial hardship on the path to Universal Health Coverage in the Gulf States. Health Policy. 2017;121(3):315–320. doi:10.1016/j.healthpol.2016.12.012

54. Collard S. Toward financial inclusion in the UK: progress and challenges. Public Money Manage. 2007;27(1):13–20. doi:10.1111/j.1467-9302.2007.00550.x

55. Aguila E, Angrisani M, Blanco LR. Ownership of a bank account and health of older Hispanics. Econ Lett. 2016;144:41–44. doi:10.1016/j.econlet.2016.04.013

56. Thaler RH. Mental accounting matters. J Behav Decis Mak. 1999;12(3):183–206. doi:10.1002/(SICI)1099-0771(199909)12:3<183::AID-BDM318>3.0.CO;2-F

57. Gyasi RM, Adam AM, Phillips DR. Financial inclusion, Health-Seeking behavior, and health outcomes among older adults in Ghana. Res Aging. 2019;41(8):794–820. doi:10.1177/0164027519846604

58. Luciano E, Rossi M, Sansone D Financial inclusion and life insurance demand; Evidence from Italian households; 2016.

59. Kim Y, Steiner P. Quasi-experimental designs for causal inference. Educ Psychol. 2016;51(3–4):395–405. doi:10.1080/00461520.2016.1207177

60. Maciejewski ML. Quasi-experimental design. Biostat Epidemiol. 2020;4(1):38–47. doi:10.1080/24709360.2018.1477468

61. Kreif N, Grieve R, Hangartner D, Turner AJ, Nikolova S, Sutton M. Examination of the synthetic control method for evaluating health policies with multiple treated units. Health Econ. 2016;25(12):1514–1528. doi:10.1002/hec.3258

62. O’Neill S, Kreif N, Grieve R, Sutton M, Sekhon JS. Estimating causal effects: considering three alternatives to difference-in-differences estimation. Health Serv Outcomes Res Methodol. 2016;16(1–2):1–21. doi:10.1007/s10742-016-0146-8

© 2020 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.

© 2020 The Author(s). This work is published and licensed by Dove Medical Press Limited. The full terms of this license are available at https://www.dovepress.com/terms.php and incorporate the Creative Commons Attribution - Non Commercial (unported, v3.0) License.

By accessing the work you hereby accept the Terms. Non-commercial uses of the work are permitted without any further permission from Dove Medical Press Limited, provided the work is properly attributed. For permission for commercial use of this work, please see paragraphs 4.2 and 5 of our Terms.